State of the Economy Report 2022-23: RBI

Challenges Facing the Global Economy

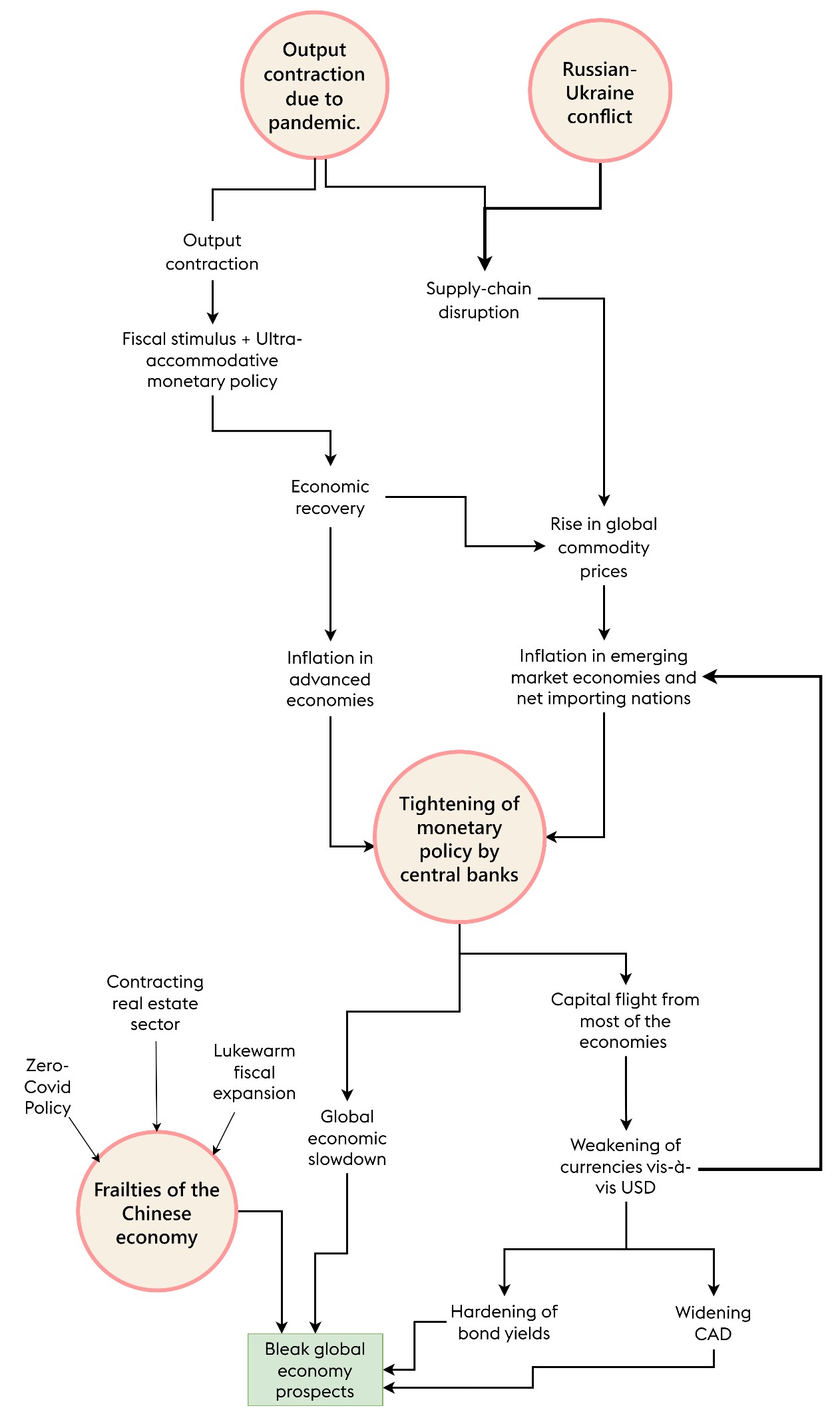

The global economy is facing a unique set of challenges that are simultaneous and, therefore, unprecedented. The challenges are:

- Global output contraction following the Covid-19 pandemic.

- Russia-Ukarine conflict.

- Monetary tightening to rein in inflation.

- Trade protectionism.

- A slowdown in China.

- Effects of loss of education and earning opportunities during the pandemic.

- The global economic recovery post-pandemic was well on track before the Russian-Ukraine conflict broke out. However, the conflict disrupted the supply chain of critical commodities such as crude oil, natural gas, fertilisers, and wheat to soar, which made the inflation situation worse. Already, inflation was at record levels in advanced economies due to the fiscal stimulus and ultra-accommodative monetary policies meant to revive economies in 2020. Additionally, rising commodity prices increased inflation in emerging market economies (EMEs).

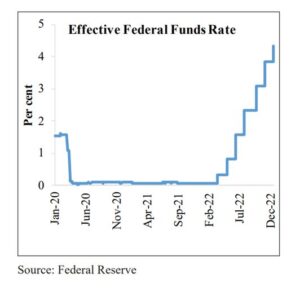

- The central banks had to step in when they realised that the inflation level was not transient but persistent and stubbornly high. A synchronous hike in policy rates by the banks followed, and the tightening cycle has been distinctly rapid, significantly impacting the global output.

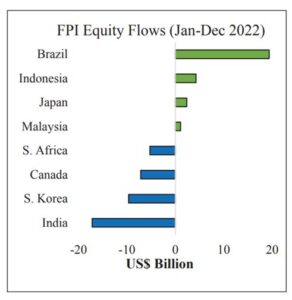

- Inflation and monetary tightening led to a hardening of bond yields across economies and an outflow of equity capital from most economies, notably from the advanced economies of Europe. An outcome of this was the strengthening of US dollars against other currencies, which widened the CAD and increased the inflationary pressures in the net importing economies.

- In its 2022 update World Economic Outlook (WEO), the IMF lowered the growth forecasts, considering further prospects of rising inflation, monetary policy tightening and a further increase in borrowing costs. Global economic challenges led to a downward revision in growth forecast across countries.

- Risk of financial contagion:

- Further tightening of monetary policy may aggravate fragilities built up in the financial system over the years, such as private and government debt structures, the effects of which could trigger financial contagion.

- Recently, there have been positive signs in the developed world, such as a reduced pace of interest rate hikes, strong employment data, sharply lower headline inflation, and warmer winter weather in Europe (neutralising the risk of a near-term energy crisis). But downside risks to the global economic outlook continue to persist, as evident from weaker earnings growth, mass layoffs by US-tech companies, geopolitical frictions, persisting inflationary pressures, and subdued demand.

- India has withstood the above challenges better than most economies.

Macroeconomic And Growth Challenges in the Indian Economy

- India oversaw a rapid economic recovery post the pandemic, due to several enabling factors like:

- Localised lockdowns, rapid vaccination coverage, mild symptoms and quick recovery have sustained mobility.

- Domestic demand remained buoyant.

- Strong demand revival in advanced economies enabled by the proactive fiscal stimulus of their governments has facilitated global trade and hence the Indian exports through 2021.

- The economy recovery from the pandemic has been hampered by the recent events such as the Russia-Ukraine conflict, and the aggressive and synchronized tightening monetary policy. As a result following challenges are faced by Indian economy:

- Widening CAD.

- High levels of retail inflation due to persisting high international commodities prices and weather conditions like excessive heat and unseasonal rains.

- Depreciated Indian currency.

- Plateauing of exports due to geopolitical frictions, persiting inflationary pressures, and subdued demand. This is likely to continue through FY24.

- Systemic risks of a financial breakdown are concentrated in other parts of the world, but the increase in general debt burden in India has attracted much attention.Baltic Dry Index: The London-based Baltic Exchange publishes a daily shipping freight-cost index called the Baltic Dry Index (BDI). It is widely regarded as a stand-in for dry bulk shipping stock and a leading indicator of the global shipping market.

- India oversaw a rapid economic recovery post the pandemic, due to several enabling factors like:

- Some positive signs:

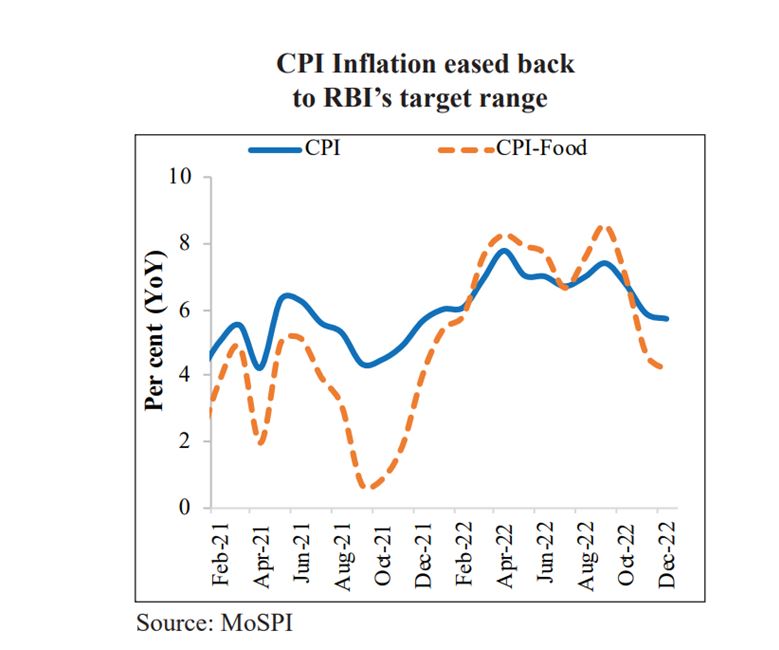

- Retail inflation has returned to back to tolerance levels after breaching this limit for over 10 months. This is largely due to lowering of food prices.

- Indian Rupee performed well compared to other EMEs.

- India has enough foreign exchange reserves to fund the CAD and to intervene in the foreign exchange market to control rupee volatility.

- India’s stock markets bounced back unfazed by withdrawals by foreign portfolio investors.

India’s Economic Resilience and Growth Drivers

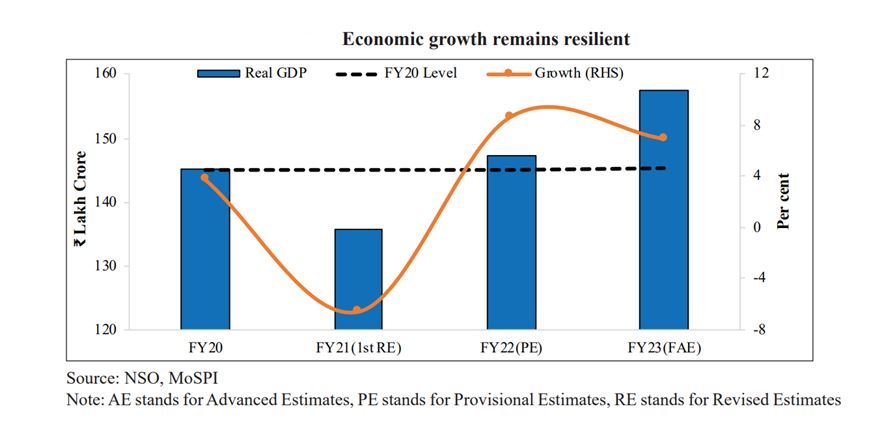

- Even as strong global headwinds and tighter domestic monetary policy continue, the IMF’s growth forecast for India has been relatively favourable, with India being the only major economy featuring a 6+ % projected growth rate for the year 2023, and that too without the base effect advantage. This demonstrates the economy’s inherent resilience and ability to recover, renew, and re-energize the growth drivers.

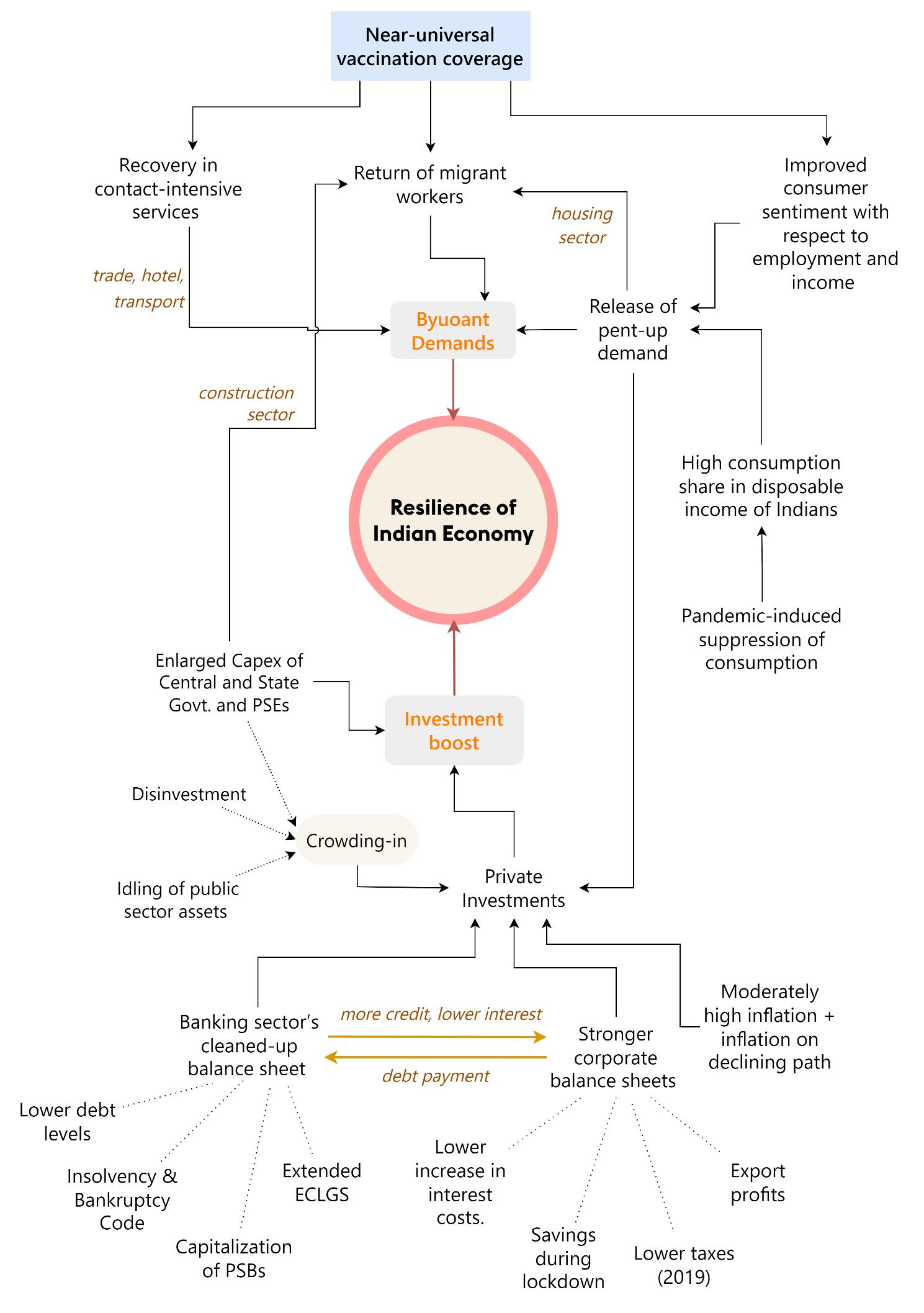

- Internal growth stimuli are seamlessly taking the place of external ones, which is driving the resilience of the Indian economy.

- Internal factors driving the resilience of the Indian economy:

-

-

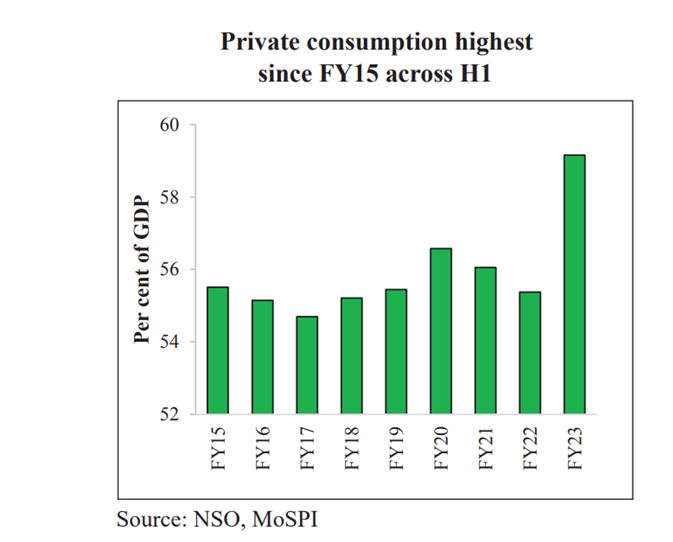

- Buoyant domestic Demand: Domestic demand has sufficiently matured to drive economic growth in the light of sluggish exports.

- Private Consumption stood at 58.4% of the GDP in Q2 of FY23.

- The remarkable rebound of the domestic demand in India enabled a rise in domestic capacity utilisation.

- Factors fuelling demand:

- Near-universal coverage of vaccination in India overseen by the government.

- This led to recovery in contact-intensive services like trade, hospitality, and transportation.

- It also served as a health stimulant to raise consumer sentiments and thus the recovery and growth of the economy.

- “Release of pent-up demand”

- This is due to an increased consumption share in disposable income of Indians from a pandemic-induced suppression of consumption. Another reason is an improved consumer sentiment with respect to current and prospective employment and income conditions.

- This recoil of demands also covers the housing sector, indicated by the rise in housing loans, decline in housing inventories, and firming up of the prices. The movement in housing market and the near-universal vaccination coverage facilitated return of the migrant workers.

- The boost in construction sector from the housing sector and much-enlarged capital budget (Capex) of the central government and its public sector enterprises stimulated the innumerable backward and forward linkages associated with it.

- Investment boost

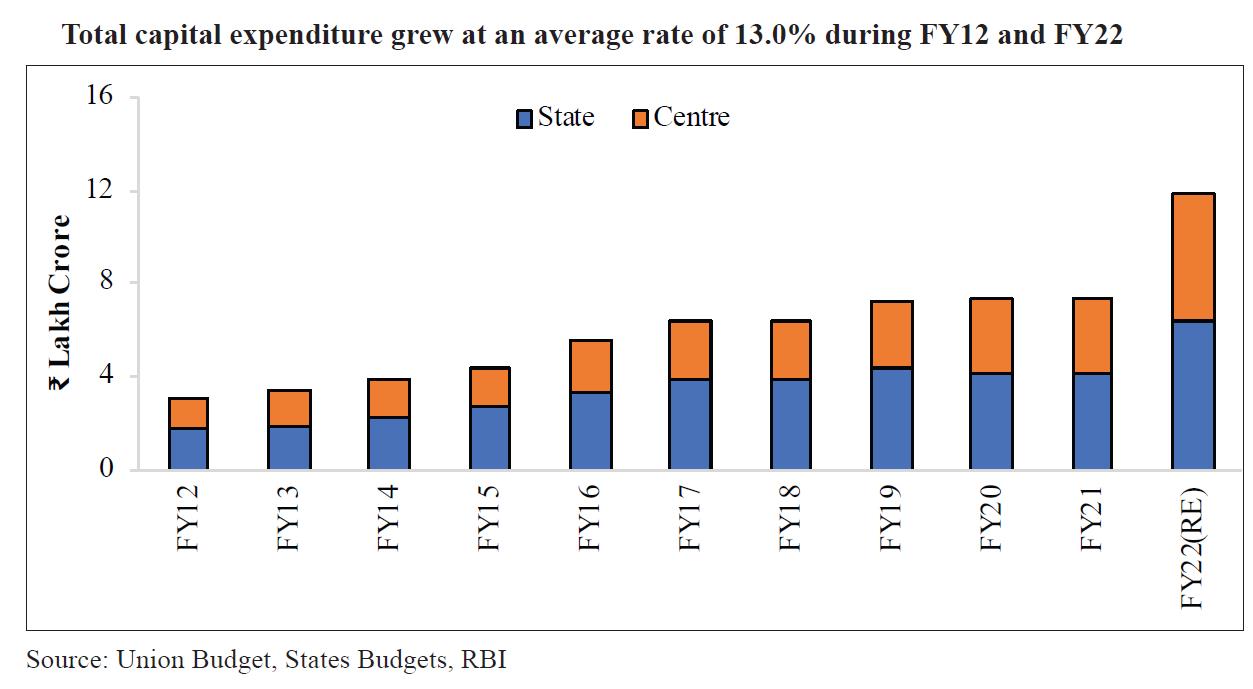

- Much-enlarged capital budget (Capex) of the central government and state governments and the public sector enterprises over the last two years has started bearing results.

- Going by the Capex multiplier estimated for the country, the economic output of the country is set to increase by at least 4 times the amount of Capex.

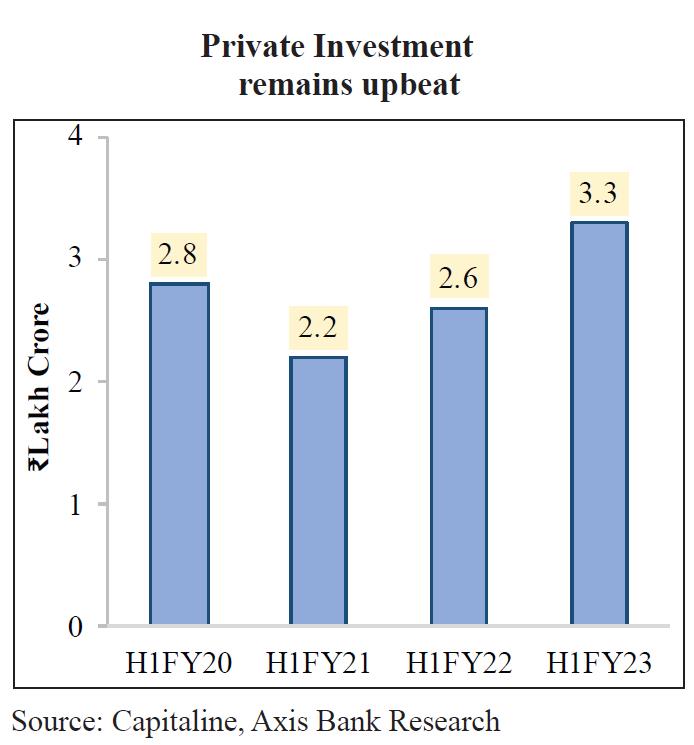

- Increased Capex budget of government, disinvestment and idling of public sector assets over the last few years were strategically packaged with an aim to boost crowding-in of private investments.

- Following developments support the stimulation in private and public investments:

-

- Significant increase in the Capex budget in FY23, as well as its high rate of spending.

- Highly buoyant direct taxes and GST collections, but muted growth in revenue expenditure to contain the widening of fiscal deficit from increased Capex.

- Increasing trend in announced projects and capex spending by the private players.

- Other factors that have aided increased private investments and manufacturing activities are:

- The banking sector’s cleaned-up balance sheet has led to a decline in debt burden, even as most economies saw a rising debt burden. This enabled banks to expand their credit portfolios and lower the interest rates.

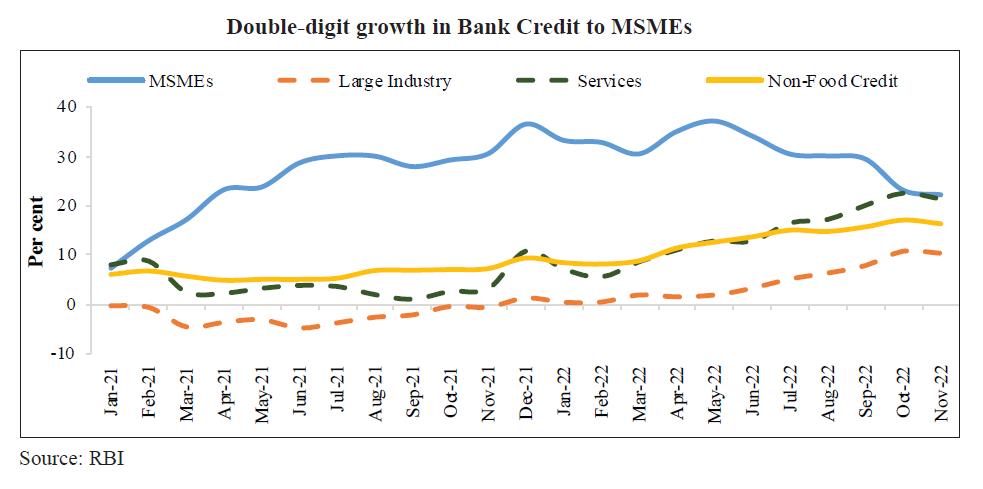

- The credit growth to the MSME sector has been remarkably high, over 30.5%, on average, during Jan-Nov 2022, supported by the extended ECLGS of the central government.

- The banking sector’s cleaned-up balance sheet has led to a decline in debt burden, even as most economies saw a rising debt burden. This enabled banks to expand their credit portfolios and lower the interest rates.

- Deleveraging over the last decade has strengthened the corporate balance sheets.

- Ex: Over the last decade, Indian non-financial private sector debt and non-financial corporate debt as a share of GDP declined by nearly 30% points.

- Increased profits from surge in exports, the lower taxes announced in 2019, possible savings on overheads during lockdowns, and lower interest costs.

- Rebound in consumption.

- Moderately high inflation has further ensured the anchoring of inflationary expectations preventing prices from weakening demand and growth, and hence private sector investments in India.

- Additionally, with inflation on the declining path, the interest cost of domestic credit will likely decline, inducing a further increase in demand for credit by corporates and retail borrowers.

- Improved financial sector health.

- Factors responsible for improved financial sector health:

- Improved financial health of the corporates.

- Their Non-Performing Assets (NPAs) being fast-tracked for quicker resolution/liquidation by the Insolvency and Bankruptcy Board of India (IBBI).

- The government has been providing adequate budgetary support for keeping the PSBs well-capitalized, ensuring that their Capital Risk-Weighted Adjusted Ratio (CRAR) remains comfortably above the threshold levels of adequacy.

- Following testify the strength of the financial sector:

- Bank profits are being booked at regular intervals.

- Banks have successful passed the macro tests being conducted at regular intervals.

- Banks have negligible cross-border claims currently when there is high currency risk involved.

- A strong financial sector has helped meet the credit needs of the corporate sector in a scenario where the corporate bond yields have gone up and there are higher interest/hedging costs on External Commercial Borrowings (ECBs).

-

India’s Inclusive Growth

Inclusive growth involves growth with job creation. Employment levels have risen in the current financial year.

- Periodic Labour Force Survey (PLFS) shows around 10% decline in urban unemployment rate for people aged 15 years and above.

- There is improvement in the labour force participation rate (LFPR) as well.

- Factors that have helped the job creation:

- Initial surge in exports

- A strong release of the “pent-up” demand

- A swift rollout of the capex

- Capex must continue to sustain the job creation, as the life for export growth and “pent-up” demands are finite. A strong private sector with good internal resource generation, high-capacity utilisation, and improving demand outlook, can do the capex heavy lifting.

- Emphasis on MNREGS.

- Emergency Credit Line Guarantee Scheme that boosted job growth in the MSME sector.

- PM Garib Kalyan Anna Yojana have significantly contributed to lessening impoverishment in the country.

Conclusion

Strong consumption rebound, robust revenue collections, sustained capex in both the public and the private sector, growing employment levels in the urban as well as the rural areas, and targeted social security measures further underpin the prospects for economic and social stability and sustained growth.

-

- Much-enlarged capital budget (Capex) of the central government and state governments and the public sector enterprises over the last two years has started bearing results.

- Near-universal coverage of vaccination in India overseen by the government.

-

-