3 October 2024 : PIB Summary For UPSC

1. Insolvency and Bankruptcy Board of India celebrates its Eighth Annual Day

(Source – https://pib.gov.in/PressReleseDetail.aspx?PRID=2060974®=3&lang=1 )

| Context |

|

Insolvency and Bankruptcy Board of India (IBBI)

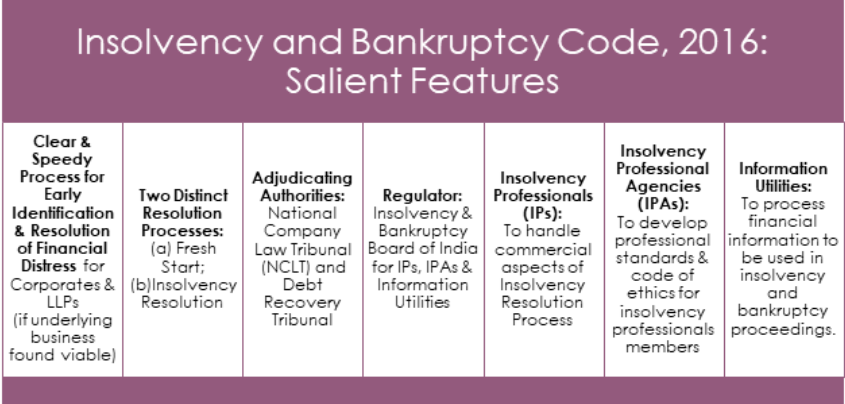

- The Insolvency and Bankruptcy Board of India (IBBI) was established in October 2016 under the Insolvency and Bankruptcy Code (IBC), 2016, to regulate and oversee insolvency proceedings in India.

- IBBI is responsible for ensuring the effective implementation of the IBC and promoting a transparent and efficient insolvency regime.

- The board aims to protect the interests of stakeholders, including creditors, debtors, and other entities involved in insolvency processes.

- IBBI develops and enforces regulations governing insolvency professionals, professional agencies, and information utilities.

- It conducts research and analysis on insolvency law, facilitating informed policy decisions and enhancing the insolvency framework.

- The board plays a crucial role in enhancing the Ease of Doing Business in India by providing a robust framework for corporate insolvency resolutions.

- It promotes awareness and education regarding insolvency processes among stakeholders through various initiatives and publications.

- IBBI collaborates with various regulatory bodies and stakeholders to strengthen the insolvency ecosystem.

- It has initiated capacity-building programs for insolvency professionals to ensure the quality and consistency of services in the field.

- The board regularly publishes annual reports and research studies to assess the effectiveness of the IBC and its impact on the economy.

| Practice Question: Discuss the role of the Insolvency and Bankruptcy Board of India (IBBI) in enhancing the corporate insolvency framework in India. Analyse its impact on the Ease of Doing Business and the resolution of non-performing assets (NPAs). (250 Words /15 marks) |