Article 270- Taxes levied and distributed between the Union and the States.

Article 270 of Indian Constitution

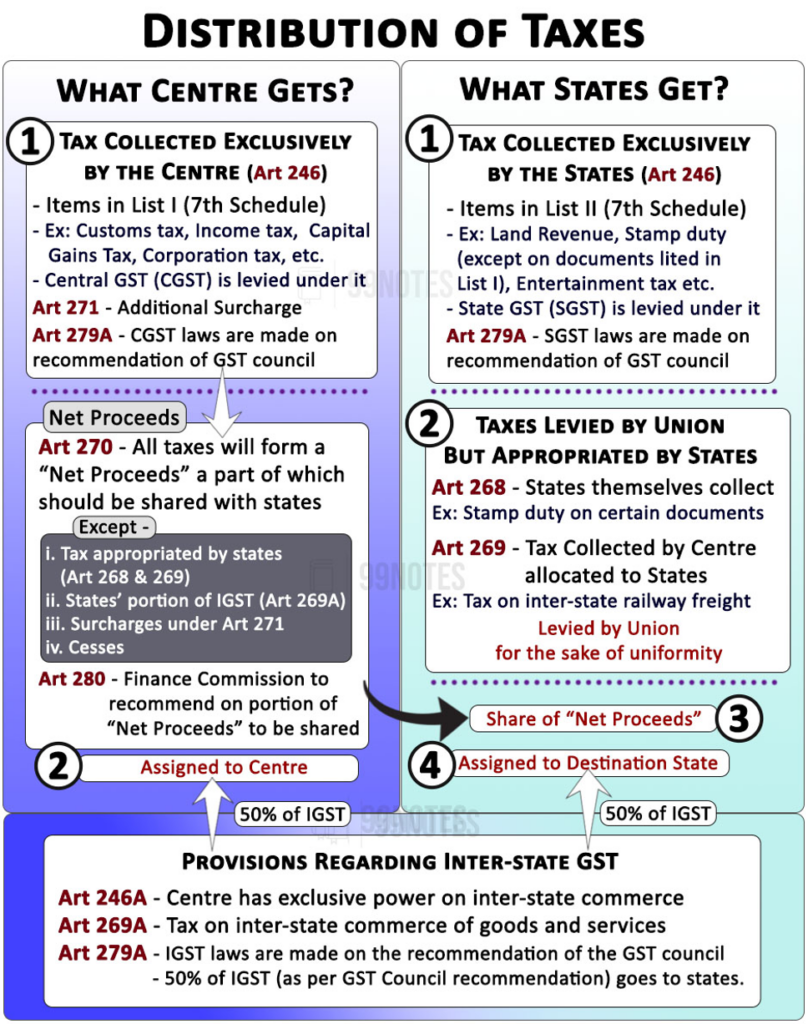

Intro: Article 270 of Indian Constitution outlines the distribution of revenues between the union and the states from taxes levied and collected by the Union. It Mandates that a certain percentage of the net proceeds of taxes is to be shared with the states. This mechanism ensures a fair division of financial resources, aiding in the equitable economic development across all states. The specific allocation and distribution are determined by the recommendations of the Finance Commission.

Original Text of Article 270 of Indian Constitution

(1) All taxes and duties referred to in the Union List, except the duties and taxes referred to in [articles 268, 269 and 269A], respectively, surcharge on taxes and duties referred to in article 271 and any cess levied for specific purposes under any law made by Parliament shall be levied and collected by the Government of India and shall be distributed between the Union and the States in the manner provided in clause (2).

(1A) The tax collected by the Union under clause (1) of article 246A shall also be distributed between the Union and the States in the manner provided in clause (2).

(1B) The tax levied and collected by the Union under clause (2) of article 246A and article 269A, which has been used for payment of the tax levied by the Union under clause (1) of article 246A, and the amount apportioned to the Union under clause (1) of article 269A, shall also be distributed between the Union and the States in the manner provided in clause (2).

(2) Such percentage, as may be prescribed, of the net proceeds of any such tax or duty in any financial year shall not form part of the Consolidated Fund of India, but shall be assigned to the States within which that tax or duty is leviable in that year, and shall be distributed among those States in such manner and from such time as may be prescribed in the manner provided in clause (3).

(3) In this article, “prescribed” means, —

- until a Finance Commission has been constituted, prescribed by the President by order, and

- after a Finance Commission has been constituted, prescribed by the President by order after considering the recommendations of the Finance Commission.

Commentary on Article 270 of Indian Constitution:

As we have understood from the above discussion that the Centre is fiscally much stronger than the states, the constitution makers felt a need for the Union to be constitutionally mandated to share a portion of its tax revenue with the states under Article 270.

Net Proceeds

Article 270 states that all taxes and duties collected by the Union on the items given in the Union List and the IGST (Article 246A) will form part of a “Net Proceeds” of taxes, a percentage of which should be shared with the States.

However, there are following exceptions that will not form part of “Net Proceeds”:

- Duties and taxes that are mandated to be appropriated by the states under Articles 268 and 269.

- Surcharge on taxes and duties mentioned in 271 Article (mentioned below); and

- Any cess levied for specific purposes.

- Further, duties and taxes collected as Inter-state Goods and services tax under 269-A are to be first shared with the State as per the recommendation of the GST Council. (IGST is currently shared half by the Centre and the State.) The remaining amount will become a part of the “Net Proceeds”.

Division of Net Proceeds of taxes

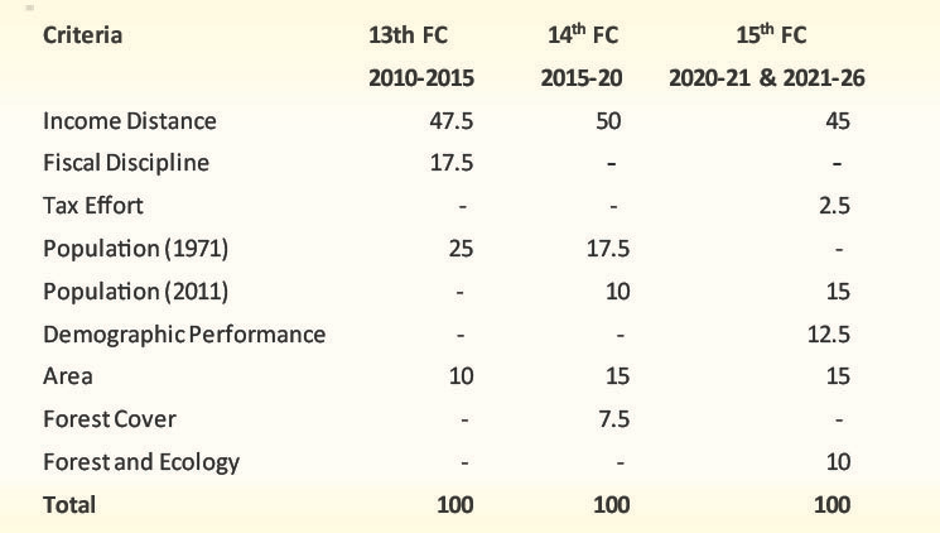

The centre has to devolve a certain share of these net proceeds to the states on the basis of a formula, which is given by the finance commission.

The Finance Commission (Article 280) recommends the percentage of the “Net Proceed” of taxes that should be shared with the states. This is, therefore, also known as the Divisible pool of taxes. Currently, 41% of the “Net Proceeds” of taxes go to the states, according to the 15th Finance Commission formula.

The rest of the amount will then form a part of the Consolidated Fund of India. This is the amount on which the Union government can then have complete control.

| 80th Constitutional Amendment, 2000 |

| On the recommendation of the 10th Finance Commission, corporate tax and customs duty were included in the divisible pool. |

| Shrinking Share of States in Divisible Pool |

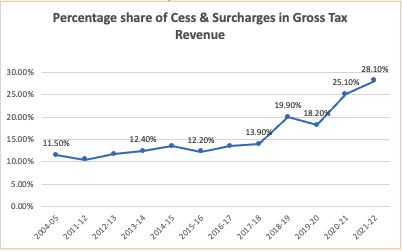

In recent times, the chief ministers of states have been complaining about dwindling state revenues due to the shrinking of the Centre’s divisible pool. Reason: The Centre has been raising its revenue by levying new cesses and surcharges and increasing rates of existing cesses. Cess and surcharges are intended for specific purposes and do not form a part of a Divisible pool of taxes. As a result,per the report of the 15th Finance Commission, the Centre’s share in total resources raised by the Centre and states is 62.7%.  Source: 15th Finance Commission report & Rajya Sabha Question no.136 (2022). Source: 15th Finance Commission report & Rajya Sabha Question no.136 (2022). |

Current formula for division of taxes

List of Amendments in Article 270 of Indian Constitution

| Amendments | Description |

| 80th Constitutional Amendment Act, 2000 | On the recommendation of the 10th Finance Commission, corporate tax and customs duty were included in the divisible pool. |

| 88th Constitutional Amendment Act, 2003 | Amended Article 268 and added Article 268A, which gives Parliament the power to make laws on taxes on certain services. |

| 101st Constitutional Amendment Act, 2016 | It amended articles 268 269 and omitted 268A. |

For further reference:

Read the constitution of India.

Read the centre state relations article.