Farm fire in China-US trade

(Source – Indian Express, Section –Explained, Page – 09)

|

Topic: GS3 – Economy |

|

Context |

|

Analysis of the news:

US Trade Actions

-

The U.S. imposed a 25% tariff on most Canadian and Mexican imports but exempted goods under USMCA, sparing 50% of Mexican and 38% of Canadian imports.

-

Canadian energy products and potash fertilizers from both nations face only a 10% tariff.

-

In contrast, China faces harsher trade measures, with tariffs escalating from 10% (Feb 4) to 20% (March 4), with no exclusions or pauses.

China’s Retaliation

-

China imposed 10-15% tariffs on U.S. agricultural products such as soybeans, wheat, corn, and meat.

-

In 2024, China’s total agricultural imports from the U.S. stood at $27.29 billion, with soybeans ($12.76 billion) being the largest component.

Shift in China’s Strategy

-

China aims to reduce dependence on U.S. agricultural imports and boost domestic production for food security.

-

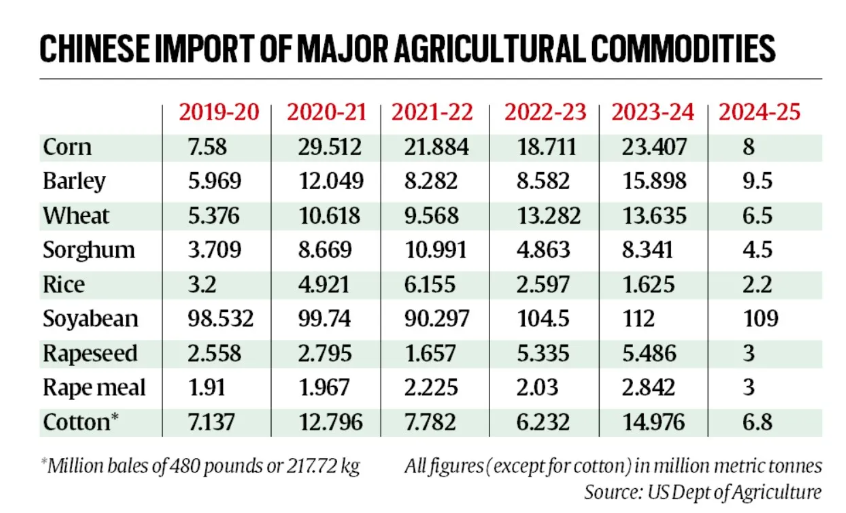

In 2023-24, China was the world’s largest importer of soybean, rapeseed, wheat, barley, sorghum, oats, and cotton.

-

COFCO and Sinograin, China’s state-owned firms, play a key role in securing food supply and reducing reliance on Western agri-commodity traders.

-

Following the 2008 food crisis and recent global disruptions, China ramped up strategic stockpiling through imports.

Emphasis on Self-Reliance

-

In April 2023, China’s Ministry of Agriculture projected an increase in domestic grain production from 694 MT to 767 MT by 2032, with imports reducing from 148 MT to 122 MT.

-

China is shifting towards Brazilian and Argentinian grain suppliers, reducing U.S. soybean market share from 30% (2017-18) to 22% (2023-24).

-

The U.S. share of China’s agricultural imports is declining, with China increasingly relying on alternative sources.

Future Implications

-

The U.S.-China trade war may escalate, impacting global trade dynamics.

-

There could be pressure on India to open its markets to U.S. agricultural products.

-

China’s push for agricultural self-sufficiency aligns with India’s Atmanirbhar Bharat strategy, highlighting a global shift towards food security.

|

Practice Question: The ongoing U.S.-China trade war has led to significant shifts in global agricultural trade and food security strategies. Discuss how China’s emphasis on self-reliance in agriculture could impact global trade dynamics and India’s agricultural sector. (250 words) |