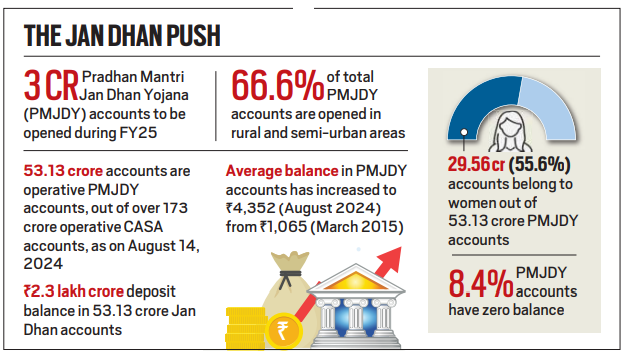

Government Aims to Open Over 3 Crore New Jan Dhan Accounts in 2024-25 as Scheme Marks 10 Years

(Source: Indian Express; Section: Economy; Page: 13)

| Topic: GS2 – Governance – Government Policies |

| Context: |

|

Analysis of News:

What is Pradhan Mantri Jan Dhan Yojana?

- PMJDY creates a platform for universal access to banking facilities with at least one basic banking account for every household, financial literacy, and access to credit, insurance, and pension facilities.

Features of PMJDY:

-

- It aims to expand banking services through branches and Banking Correspondents (BCs).

-

-

- It covers both urban and rural areas and those who open an account would get indigenous Debit Card (RuPay card).

-

-

-

- There is no requirement to maintain any minimum balance in PMJDY accounts.

-

-

- Accident Insurance Cover of Rs.1 lakh (enhanced to Rs. 2 lakh to new PMJDY accounts opened after 28.8.2018) is available with RuPay card issued to the PMJDY account holders.

-

- It provides an overdraft facility of Rs. 10,000 to every eligible adult.

-

- PMJDY accounts are eligible for Direct Benefit Transfer (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Atal Pension Yojana (APY).

Achievements Over the Decade

- Since its launch on August 28, 2014, by Prime Minister Narendra Modi, the number of PMJDY accounts has grown nearly fourfold, reaching 53.13 crore by August 16, 2024, compared to 14.72 crore in March 2015.

- Total deposits under the scheme have surged to over Rs 2.31 lakh crore, up from Rs 15,670 crore in March 2015.

Focus on Reaching the Unbanked

- Finance Minister Nirmala Sitharaman highlighted that most adults in the country now have bank accounts, with a focus on covering the remaining unbanked adults and new adults (neo-adults).

- The average balance in PMJDY accounts has increased significantly, with 80% of accounts being active.

Impact of PMJDY

- The PMJDY has been foundational for people-centric economic initiatives, enabling direct benefit transfers, COVID-19 financial assistance, and schemes like PM-KISAN.

- The JAM Trinity (Jan Dhan, Aadhaar, Mobile) has expanded the Direct Benefit Transfer (DBT) program, particularly in rural and semi-urban areas, where 66.6% of PMJDY accounts are held. Additionally, 55.6% of accounts belong to women.

Accessibility and Features

- As of now, 99.95% of inhabited villages have access to banking facilities within a 5-km radius.

- PMJDY accounts offer various benefits, including no charges for opening, maintaining, or minimum balances, a free RuPay debit card with Rs 2 lakh accident insurance, and an overdraft facility of up to Rs 10,000.

| Significance |

|

| PYQ: ‘Pradhan Mantri Jan-Dhan Yojana’ has been launched for (2015)

(a) providing housing loan to poor people at cheaper interest rates Ans: (c) |

| Practice Question: Examine the role of the Pradhan Mantri Jan Dhan Yojana (PMJDY) in promoting financial inclusion in India over the last decade. Discuss the challenges and opportunities associated with the expansion of the scheme in the coming years. (250 words/15 m) |