How would a carbon market function?

(Source – The Hindu, International Edition – Page No. – 10)

| Topic: GS3 – Environment – Environmental pollution and degradation |

| Context |

| ● COP29 in Baku approved standards for establishing an international carbon market, emphasizing its potential to reduce global emissions.

● Carbon markets enable trading carbon credits to internalize environmental costs and curb pollution. ● However, challenges like governmental manipulation and corporate misuse persist. |

COP29 and Carbon Markets

- COP29, held in Baku, Azerbaijan, has approved standards to establish an international carbon market, potentially operational by next year.

- This step highlights the role of carbon markets in curbing carbon emissions and addressing climate change challenges.

| What is a Carbon Market? |

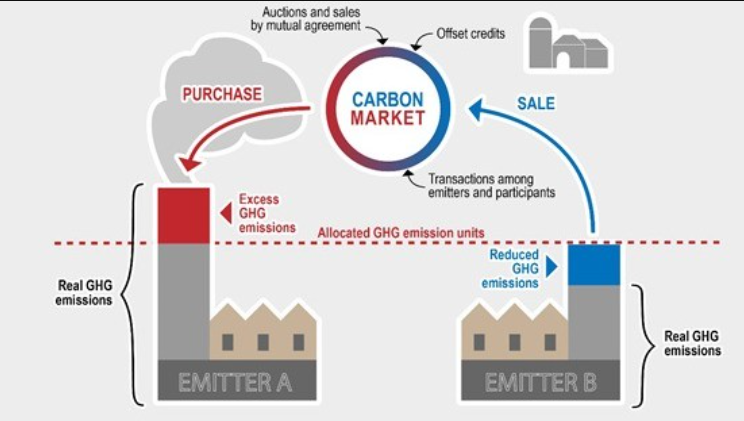

| ● A carbon market allows buying and selling of rights to emit carbon dioxide.

● Governments issue carbon credits, each equivalent to 1,000 kilograms of carbon dioxide, to limit emissions. ● Entities without carbon credits are prohibited from emitting carbon. ● The market price for carbon credits is determined by supply and demand dynamics. ● Carbon offsets involve businesses purchasing credits from environmental organizations that commit to carbon reduction activities like tree planting. |

Benefits of Carbon Markets

- Carbon markets address the problem of externalities, where the environmental cost of economic activities is not internalized in market prices.

- They impose financial costs on firms for carbon emissions, encouraging them to reduce pollution.

- Standardized accounting frameworks and technological advancements have enhanced corporations’ ability to monitor emissions and report accurately.

- Voluntary reporting systems like the Carbon Disclosure Project are preferred by corporations, while they oppose government interventions.

- Firms advocate free trading of carbon credits, which they claim ensures efficient allocation of resources.

Challenges of Carbon Markets

- Governments may manipulate the supply of carbon credits, either oversupplying them to reduce prices or allowing firms to bypass regulations.

- Firms purchasing carbon offsets may engage in virtue signaling, with limited actual impact on reducing emissions.

- Critics question governments’ ability to determine the optimal supply of carbon credits, as political interests may lead to restrictive or overly lenient policies.

- Restrictive policies may hinder economic growth, while lax regulations may fail to achieve meaningful emission reductions.

The Way Forward

- The effectiveness of carbon markets depends on transparent governance, strict enforcement, and incentivized participation by firms and governments.

- Ensuring accountability in carbon offset mechanisms and maintaining optimal credit supply are critical for achieving environmental goals.

- Collaboration between governments, corporations, and international bodies is essential to balance economic growth and climate commitments.

| PYQ: Should the pursuit of carbon credit and the clean development mechanism set up under UNFCCC be maintained even though there has been a massive slide in the value of carbon credit? Discuss with respect to India’s energy needs for economic growth. (200 words/12.5m) (UPSC CSE (M) GS-3 2014) |

| Practice Question: Discuss the role of carbon markets in mitigating climate change. Highlight the challenges associated with their implementation and suggest measures to enhance their effectiveness. (150 Words /10 marks) |