Income-tax Bill, 2025 Introduced

(Source – Indian Express, Section – Explained – Page No. – 19)

|

Topic: GS3 – Indian Economy |

|

Context |

|

Analysis of the news:

A Move Towards Simplicity

-

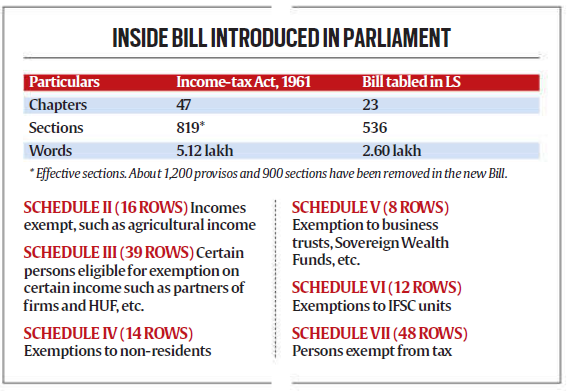

The Income-tax Bill, 2025, introduced in Lok Sabha, aims to replace the six-decade-old Income-tax Act, 1961, by streamlining tax provisions, eliminating redundant sections, and introducing a more structured and comprehensible legal framework.

-

The bill focuses on clarity and ease of compliance for taxpayers, ensuring continuity without major structural changes in direct taxation.

Key Structural Changes: Shorter and More Organised

-

The new bill is 24% shorter than the current Act, with fewer chapters (23 vs. 47) and sections (536 vs. 819).

-

The complex numbering system used in the past has been eliminated, making navigation easier.

-

All tax-related deductions, exemptions, and TDS/TCS rates have been presented in tabular formats for better accessibility.

Shifting to ‘Tax Year’ from ‘Assessment Year’

-

A significant change is the replacement of the Assessment Year (AY) with the Tax Year, simplifying the process by aligning tax assessment with economic activity in the same financial year.

-

This eliminates confusion caused by tracking different periods for taxation.

Social Media and Crypto Regulation

-

The bill expands tax authorities’ access to digital assets and online spaces, including social media accounts, cloud servers, and online investments, enhancing scrutiny in surveys and searches.

-

Furthermore, cryptocurrencies have been formally classified as capital assets, reinforcing their taxability under capital gains.

Reforming Dispute Resolution

-

The bill introduces greater clarity in Dispute Resolution Panel (DRP) decisions by explicitly stating points of determination and reasoning, addressing past ambiguities that led to litigation.

Capital Gains and Deductions: Streamlining Exemptions

-

Outdated provisions such as Section 54E, which covered exemptions for capital gains before April 1992, have been removed.

-

The standard deduction, gratuity, and leave encashment provisions have been reorganized into a structured format for better comprehension.

Taxation Framework and Income Scope

-

While the income tax structure remains largely unchanged, the bill expands the definition of income to incorporate emerging sources.

-

Tax slabs for the new tax regime are clearly listed, but old tax regime slabs are not explicitly detailed, indicating a possible shift in focus towards the new structure.

The Road Ahead: Legislative Process and Implementation

-

The bill, following its Interim Budget 2024 announcement, is expected to undergo Parliamentary review before final approval.

-

Once passed, it will come into effect on April 1, 2026.

-

Despite its simplifications, tax experts note that compliance provisions remain largely unchanged, focusing primarily on reducing redundancy rather than introducing major policy shifts.

Conclusion: Towards a More Transparent Tax System

-

The Income-tax Bill, 2025, marks a major step toward simplification and transparency in India’s direct taxation system.

-

By reducing legal complexity, introducing structured formats, and eliminating obsolete provisions, the bill aims to enhance tax certainty, reduce litigation, and create a modernized and taxpayer-friendly framework.

|

Practice Question: Discuss the key features of the Income-tax Bill, 2025 and analyze its impact on India’s taxation system. How does it aim to simplify compliance and enhance tax transparency? (150 Words /10 marks) |