Is consumption enough to drive growth?

(Source – The Hindu, International Edition – Page No. – 10)

| Topic: GS3 – Indian Economy |

| Context |

|

Understanding Economic Growth: Supply and Demand Balance

- Economic growth depends on supply (production of goods and services) and demand (expenditure to purchase these goods and services).

- If supply grows slower than demand, inflation occurs. If demand lags, firms accumulate unsold goods, leading to reduced production, job losses, and economic slowdown.

Sources of Demand in the Economy

- Private consumption: Individuals spending on food, clothing, and personal goods.

- Private investment: Firms and households investing in machinery, factories, and residences.

- Government expenditure: Includes spending on salaries, infrastructure, and development projects.

- Net exports: The balance of exports and imports in foreign trade.

Investment and Its Multiplier Effect

- Investment has a stronger impact on GDP growth than consumption.

- Example: A ₹100 investment can generate more than ₹100 in overall economic growth due to the multiplier effect.

- Investments in infrastructure (like highways) lead to job creation, business expansion, and overall economic growth.

- The multiplier effect varies depending on the type of investment and regional development.

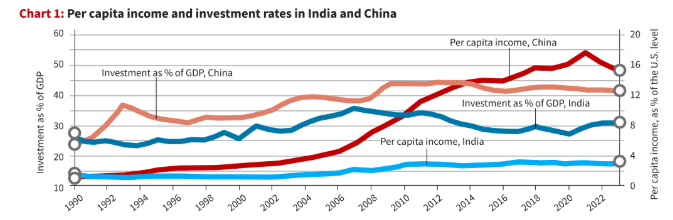

Comparison of Economic Growth Between India and China

- In the early 1990s, India and China had similar per capita incomes.

- By 2023, China’s per capita income was five times higher than India’s (2.4 times after adjusting for purchasing power).

- China’s economic growth was investment-led, whereas India’s growth was driven by domestic consumption.

Investment Trends Over Time

- In 1992, China’s investment rate was 1% of GDP, while India’s was 27.4%.

- By 2007, the investment gap narrowed, but after the 2008 financial crisis, both countries responded differently.

- China increased investment in infrastructure, manufacturing, and technology, while India’s investment rate fell sharply after 2012.

- By 2023, China’s investment rate was 3%, and India’s was 30.8%.

Challenges in Investment-Led Growth

- Over the last decade, India’s economic growth has been consumption-driven, while China’s growth has been investment-driven.

- In 2023, consumption as a share of GDP was 60.3% in India compared to 39.1% in China.

- Weak investment, low government spending, and trade deficits contribute to slower economic expansion in India.

- Investment-led growth creates more jobs and reduces income inequality, whereas consumption-driven growth worsens income inequality.

Government’s Role in Investment

- Investment by households and private firms in India has stagnated in recent years, except for residential real estate in the early 2010s.

- Private firms in India are reluctant to invest due to weak business confidence (low animal spirits).

- The Indian government needs to increase spending in critical sectors to stimulate private investment.

Concerns Over Government’s Policy Approach

- The Indian government has not significantly increased investments in the latest budget.

- Instead, policies have favored tax concessions and a low-growth path dependent on consumption, benefiting primarily middle and upper-class consumers.

- Without a strong public investment push, India’s economic growth will remain slow, and inequalities may worsen.

| Practice Question: How does investment-led growth compare to consumption-driven growth in terms of economic development and income distribution? Analyze its implications for India’s growth strategy. (150 Words /10 marks) |