RBI slashes rate by 0.25% to revive growth

(Source – The Hindu, International Edition – Page No. – 1)

| Topic: GS3 – Indian Economy |

| Context |

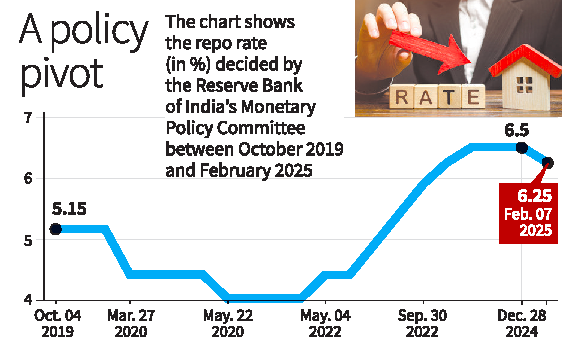

| ● The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) has reduced the repo rate by 25 basis points to 6.25%, marking the first cut since May 2020. |

Repo Rate Cut After 57 Months

- This decision aims to boost economic growth amid expectations of inflation easing to 4.4% in this quarter and averaging 2% in 2025-26.

- The reduction in the repo rate may lead to lower borrowing costs for home, car, and other loans.

| What is Repo Rate? |

| ● The Repo Rate is the interest rate at which the Reserve Bank of India (RBI) lends money to commercial banks in exchange for government securities.

● It is a key monetary policy tool used to control inflation and liquidity in the economy. ●A higher repo rate makes borrowing costlier, reducing inflation, while a lower repo rate boosts lending and economic growth by making loans cheaper for businesses and consumers. |

| Monetary Policy Committee (MPC) |

| ● The Monetary Policy Committee (MPC) is a six-member body of the Reserve Bank of India (RBI) responsible for setting the repo rate to control inflation and economic growth.

● It was established in 2016 under the amended RBI Act, 1934, and follows an inflation-targeting framework. ● The MPC has six members. Three members are from the RBI, including the Governor, and three are external members appointed by the government ● The MPC meets at least four times a year, and decisions are made by majority vote, with the RBI Governor having a casting vote in case of a tie. |

Economic Growth and Inflation Projections

- The RBI has projected real GDP growth at 6.7% for 2025-26, an increase from the 4% estimated for this year.

- Assuming a normal monsoon, inflation is expected to decline further and gradually align with the 4% target.

Mixed Demand Trends

- Rural demand is improving, while urban consumption remains weak.

- Higher employment, tax benefits from the budget, and lower inflation are expected to support household consumption.

Currency and External Sector Stability

- The RBI does not target a specific exchange rate but intervenes to reduce excessive market volatility.

- India’s foreign exchange reserves are at $630.6 billion (as of January 31, 2025), covering over 10 months of imports.

- The current account deficit is expected to remain at a sustainable level.

| PYQ:

Which of the following statements is/are correct regarding the Monetary Policy Committee (MPC)? (UPSC civil services prelims 2017) 1.It decides the RBI’s benchmark interest rates. 2.It is a 12-member body including the Governor of RBI and is reconstituted every year. 3.It functions under the chairmanship of the Union Finance Minister. Select the correct answer using the code given below: (a) 1 only Ans: Option (a) |

| Practice Question: Explain the role of the Monetary Policy Committee (MPC) in maintaining price stability and fostering economic growth in India. How does the repo rate influence inflation and liquidity in the economy? (250 Words /15 marks) |

For more such UPSC related Current Affairs, Check Out – On the appointment of ad-hoc judges to High

Courts