Understanding the Rupee’s Depreciation: Causes, Dynamics, and Implications

(Source: Indian Express; Section: Explained; Page: 17)

| Topic: GS3 – Indian Economy |

| Context: |

|

Analysis of News:

Understanding the Exchange Rate

- The exchange rate refers to the price of one currency in terms of another.

- For example, the current exchange rate of the Indian rupee against the US dollar stands at Rs 85 per dollar, compared to Rs 83 in April and Rs 61 a decade ago.

- This rate reflects the relative value of currencies and fluctuates based on the dynamics of demand and supply in the currency market.

- A depreciating rupee means it takes more rupees to buy one US dollar.

Factors Influencing Exchange Rates

Trade of Goods

- The trade balance significantly affects currency demand. If India imports more goods from the US than it exports, the demand for US dollars increases while demand for the rupee decreases.

- This imbalance weakens the rupee relative to the dollar.

Trade in Services

- A similar dynamic occurs in services trade. If Indians purchase more US services, such as tourism, than Americans consume Indian services, the rupee loses value as demand for dollars grows.

Investments

- Investment flows also play a critical role. If Americans invest more in India, the rupee appreciates due to higher demand.

- Conversely, reduced or negative investments, such as capital outflows during global uncertainty, weaken the rupee.

Underlying Drivers of Demand Shifts

Trade Policies

- Protectionist measures, such as US-imposed tariffs or import restrictions on Indian goods, reduce the demand for rupees, causing depreciation.

Inflation Differential

- Higher inflation in India relative to the US diminishes the rupee’s value. Inflation erodes purchasing power and makes Indian investments less attractive to foreign investors, leading to reduced inflows and weakening of the currency.

Investor Behavior

- Economic uncertainty, policy shifts, or better returns in US markets prompt foreign investors to withdraw capital from India, reducing rupee demand and pushing its value down further.

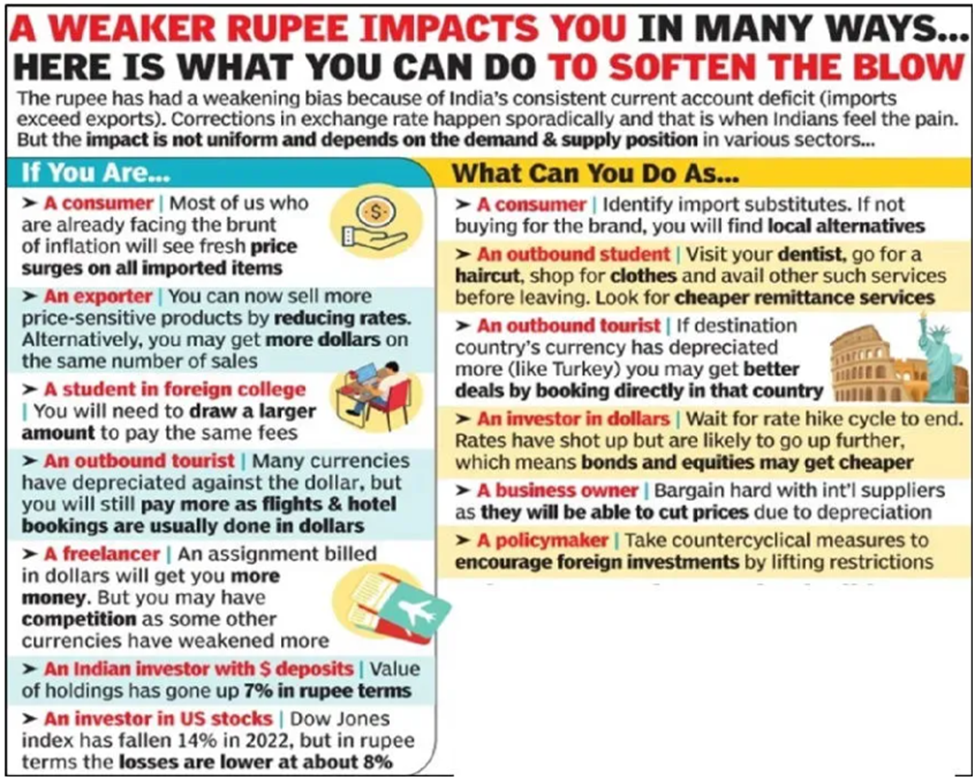

Implications of Rupee Depreciation

- A weakening rupee makes imports like crude oil and foreign goods more expensive, leading to higher inflation domestically.

- It also increases the burden of servicing external debt. However, it can benefit exporters, as Indian goods become cheaper and more competitive globally.

In conclusion, the exchange rate dynamics hinge on the interplay of trade, investments, inflation, and policies. Addressing these factors systematically is crucial to stabilizing the rupee and minimizing the adverse economic impact of currency fluctuations.

| Reasons for falling rupee |

|

| PYQ: Consider the following statements: The effect of devaluation of a currency is that it necessarily 1) improves the competitiveness of the domestic exports in the foreign markets 2) increases the foreign value of domestic currency 3) improves the trade balance Which of the above statements is/are correct? (a) 1 only (b) 1 and 2 (c) 3 only (d) 2 and 3 Ans: (a) |

| Practice Question: Discuss the factors contributing to the depreciation of the Indian rupee against the US dollar. Analyze its economic implications and suggest measures to stabilize the exchange rate. (250 words/15 m) |