14 February 2025 : Daily Current Affairs

1. Only Parliament can constitutionally remove HC judge: Jagdeep Dhankhar

- 1. Only Parliament can constitutionally remove HC judge: Jagdeep Dhankhar

- 2. Income-tax Bill, 2025 Introduced

- Prelims Facts

- 1. What is happening in the DRC?

- 2. Aborting moon rocket to test Musk’s power

- 3. Deep-Sea Detector Captures Most Energetic Neutrino Ever, Possibly from Beyond the Milky Way

- 4. FAME PHASE-II SCHEME

- 5. PROJECT ASIATIC LION

(Source – The Hindu, International Edition – Page No. – 4)

| Topic: GS2 – Indian Polity |

| Context |

|

Analysis of the news:

- Rajya Sabha Chairman Jagdeep Dhankhar stated that only Parliament has the authority to constitutionally remove a High Court judge.

- A notice for the removal of Justice Shekhar Yadav of the Allahabad High Court is pending with him.

- The Supreme Court had summoned Justice Yadav over his alleged communal remarks and sought a report from the Allahabad High Court Chief Justice.

- Dhankhar emphasized that the matter falls exclusively under his jurisdiction and, ultimately, Parliament and the President.

- A notice signed by 55 Rajya Sabha members seeking Justice Yadav’s removal was submitted on December 13, 2024.

- Opposition members accused Justice Yadav of making hate speech at a VHP event.

| Procedure for removal of Supreme Court / High Court Judge |

|

Constitutional Provision

Grounds for Removal

Initiation of Removal

Inquiry Committee

Parliamentary Approval

Presidential Decision

|

| Practice Question: Explain the procedure for the removal of Supreme Court and High Court judges in India. How does this process uphold judicial accountability? (150 Words /10 marks) |

2. Income-tax Bill, 2025 Introduced

(Source – Indian Express, Section – Explained – Page No. – 19)

| Topic: GS3 – Indian Economy |

| Context |

|

Analysis of the news:

A Move Towards Simplicity

- The Income-tax Bill, 2025, introduced in Lok Sabha, aims to replace the six-decade-old Income-tax Act, 1961, by streamlining tax provisions, eliminating redundant sections, and introducing a more structured and comprehensible legal framework.

- The bill focuses on clarity and ease of compliance for taxpayers, ensuring continuity without major structural changes in direct taxation.

Key Structural Changes: Shorter and More Organised

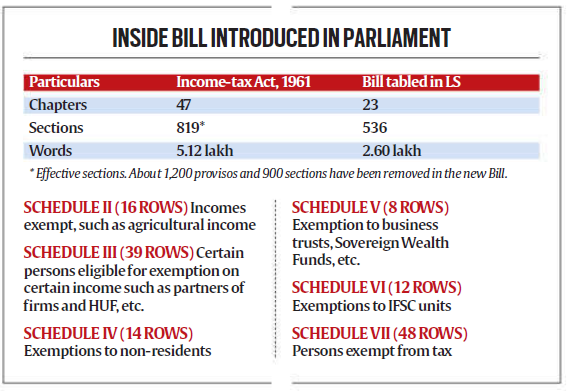

- The new bill is 24% shorter than the current Act, with fewer chapters (23 vs. 47) and sections (536 vs. 819).

- The complex numbering system used in the past has been eliminated, making navigation easier.

- All tax-related deductions, exemptions, and TDS/TCS rates have been presented in tabular formats for better accessibility.

Shifting to ‘Tax Year’ from ‘Assessment Year’

- A significant change is the replacement of the Assessment Year (AY) with the Tax Year, simplifying the process by aligning tax assessment with economic activity in the same financial year.

- This eliminates confusion caused by tracking different periods for taxation.

Social Media and Crypto Regulation

- The bill expands tax authorities’ access to digital assets and online spaces, including social media accounts, cloud servers, and online investments, enhancing scrutiny in surveys and searches.

- Furthermore, cryptocurrencies have been formally classified as capital assets, reinforcing their taxability under capital gains.

Reforming Dispute Resolution

- The bill introduces greater clarity in Dispute Resolution Panel (DRP) decisions by explicitly stating points of determination and reasoning, addressing past ambiguities that led to litigation.

Capital Gains and Deductions: Streamlining Exemptions

- Outdated provisions such as Section 54E, which covered exemptions for capital gains before April 1992, have been removed.

- The standard deduction, gratuity, and leave encashment provisions have been reorganized into a structured format for better comprehension.

Taxation Framework and Income Scope

- While the income tax structure remains largely unchanged, the bill expands the definition of income to incorporate emerging sources.

- Tax slabs for the new tax regime are clearly listed, but old tax regime slabs are not explicitly detailed, indicating a possible shift in focus towards the new structure.

The Road Ahead: Legislative Process and Implementation

- The bill, following its Interim Budget 2024 announcement, is expected to undergo Parliamentary review before final approval.

- Once passed, it will come into effect on April 1, 2026.

- Despite its simplifications, tax experts note that compliance provisions remain largely unchanged, focusing primarily on reducing redundancy rather than introducing major policy shifts.

Conclusion: Towards a More Transparent Tax System

- The Income-tax Bill, 2025, marks a major step toward simplification and transparency in India’s direct taxation system.

- By reducing legal complexity, introducing structured formats, and eliminating obsolete provisions, the bill aims to enhance tax certainty, reduce litigation, and create a modernized and taxpayer-friendly framework.

| Practice Question: Discuss the key features of the Income-tax Bill, 2025 and analyze its impact on India’s taxation system. How does it aim to simplify compliance and enhance tax transparency? (150 Words /10 marks) |

Prelims Facts

1. What is happening in the DRC?

(Source – The Hindu, International Edition – Page No. – 10)

| Context |

|

Historical Background of the Conflict

- The region has faced ethnic conflicts between Hutus and Tutsis since colonial times.

- During colonial rule, administrative roles were given to the Tutsis, leading to resentment among Hutus.

- After independence in 1962, the Hutus came to power, leading to the migration of Tutsis to neighboring countries.

Rwandan Genocide and Its Impact

- A civil war began in 1990 between the Tutsi-led rebel group and the Hutu-led government.

- In 1994, the assassination of two Hutu leaders triggered mass killings, leading to the deaths of around 800,000 Tutsis and some Hutus.

- After the genocide, millions of Hutus fled to eastern DRC, including those responsible for the killings.

Wars and Instability in DRC

- Rwandan forces invaded DRC twice, in 1996 and 1998.

- These conflicts, called the First and Second Congo Wars, led to massive casualties and political instability.

- The Second Congo War involved multiple African nations and resulted in about five million deaths.

Economic Factors Behind the Conflict

- The conflict is not just about ethnic tensions but also about mineral resources.

- DRC has large reserves of Coltan, a crucial metal used in electronic devices.

- Goma’s capture gives M23 control over trade and transport in this mineral-rich region.

Regional Reactions

- The DRC government has called the M23’s actions an act of war.

- Rwanda supports including M23 in peace discussions while denying direct involvement.

- Burundi has warned that the conflict may spread further if not controlled.

- Uganda is maintaining a neutral stance but is involved in military operations targeting militants linked to extremist groups.

2. Aborting moon rocket to test Musk’s power

(Source – The Hindu, International Edition – Page No. – 13)

| Context |

|

SLS Moon Rocket Program

- Overview: The Space Launch System (SLS) is NASA’s most powerful rocket, designed for deep space missions, including Artemis missions to the Moon and future Mars explorations.

- Power & Capability: It can produce 8.8 million pounds of thrust, surpassing the Saturn V rocket.

- Launch Cost: Each launch costs $2 billion to $4 billion, making it significantly more expensive than commercial alternatives.

- The first SLS mission, Artemis I, successfully launched an uncrewed Orion spacecraft around the Moon in November 2022.

- Future Plans: NASA plans to use SLS for sustained lunar exploration and eventual Mars missions under the Artemis program.

- Future Uncertainty: There are discussions about canceling or phasing out SLS due to high costs and delays.

- Alternatives: SpaceX’s Falcon Heavy, a cheaper but less powerful rocket, costs around $250 million per launch.

3. Deep-Sea Detector Captures Most Energetic Neutrino Ever, Possibly from Beyond the Milky Way

(Source – Indian Express, Section – Explained- Page No. – 19)

| Context |

|

Analysis of the news:

Neutrinos: The ‘Ghost Particles’

- Neutrinos are near-massless subatomic particles produced by various cosmic events like supernovae, cosmic rays, and radioactive decay.

- They are called ‘ghost particles’ because they rarely interact with matter—trillions pass through the human body every second without any effect.

Challenges in Neutrino Detection

- Due to their elusive nature, neutrinos are extremely difficult to detect. Scientists use underwater, underground, and polar ice detectors to capture the rare instances when neutrinos collide with matter.

- The latest discovery was made by a detector still under construction, highlighting advancements in neutrino research.

Scientific Significance

- Studying neutrinos helps scientists understand the fundamental structure of the universe, including its formation and the highest-energy cosmic processes.

- According to experts, this discovery is crucial for unraveling the most extreme astrophysical events.

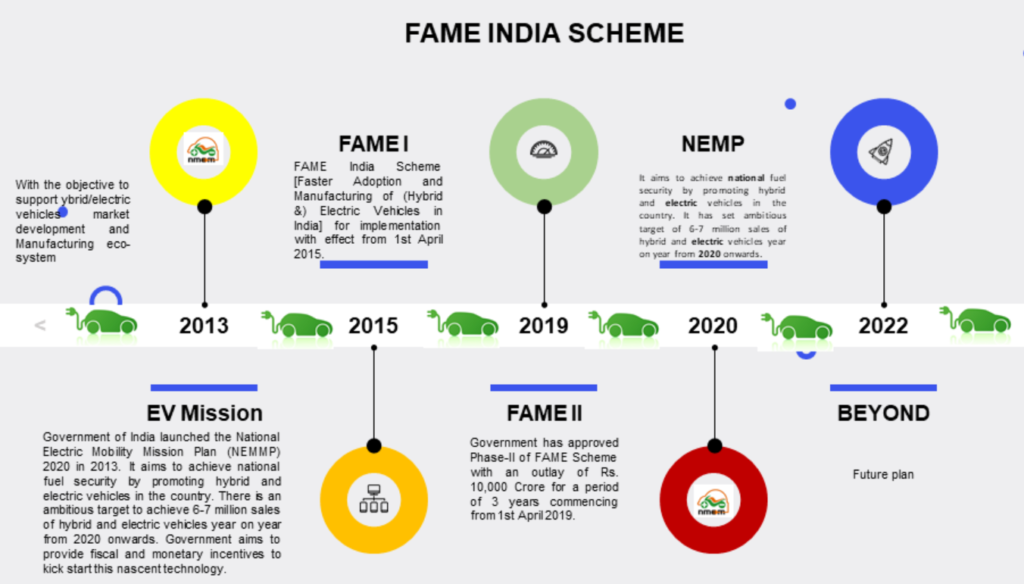

4. FAME PHASE-II SCHEME

(Source – https://pib.gov.in/PressReleasePage.aspx?PRID=2102782 )

| Context |

|

FAME Phase-II Scheme:

- The FAME India Scheme Phase-II was launched on April 1, 2019, with a budget of ₹11,500 crore to promote electric vehicles (EVs).

- As of December 31, 2024, it has supported 16,14,737 EVs, including 14,28,009 two-wheelers, 1,64,180 three-wheelers, and 22,548 four-wheelers.

- The PLI-Auto Scheme (₹25,938 crore) encourages domestic manufacturing of Advanced Automotive Technology (AAT) products with 50% Domestic Value Addition (DVA).

- The PLI-ACC Scheme (₹18,100 crore) promotes the production of 50 GWh of Advanced Chemistry Cell (ACC) batteries.

- The PM E-DRIVE Scheme (₹10,900 crore) supports various EVs and charging infrastructure for two years.

- The PM e-Bus Sewa-PSM Scheme (₹3,435.33 crore) aims to deploy 38,000 electric buses with payment security for operators.

- The SPMEPCI Scheme (March 2024) promotes electric car manufacturing, requiring a minimum ₹4,150 crore investment with phased DVA targets.

5. PROJECT ASIATIC LION

(Source – https://pib.gov.in/PressReleasePage.aspx?PRID=2102700 )

| Context |

|

Project Asiatic Lion:

- Project Lion is being implemented in the Gir landscape, Gujarat, to conserve the Asiatic Lion using a landscape ecology-based approach.

- The project integrates conservation and eco-development while ensuring the protection of the growing lion population.

- The ‘Lion @ 47: Vision for Amritkal’ document outlines key objectives, including securing and restoring lion habitats and enhancing community participation.

- It aims to make India a global hub for big cat disease diagnostics and treatment.

- The Asiatic Lion population has increased from 411 in 2010 to 674 in 2020 due to conservation efforts.

- The species is classified as Endangered by the IUCN Red List, upgraded from Critically Endangered in 2008.

check more – 13 February 2025 : Daily Current Affairs