24 July 2024 : Daily Current Affairs

1. FM revises personal income tax slabs

(Source – The Hindu, International Edition – Page No. – 2)

| Topic: GS3 – Indian Economy |

| Context |

|

Analysis of the news:

- Finance Minister Nirmalsa Sitharaman revised the income tax slabs under the new regime, maintaining the existing tax rates but increasing standard deductions.

- The tax slab of ₹3-6 lakh has been revised to ₹3-7 lakh, with the 5% tax rate unchanged.

- No changes were made for incomes below ₹3 lakh, the ₹12-15 lakh slab, or incomes exceeding ₹15 lakh.

- The changes are expected to save a salaried employee up to ₹17,500 in income taxes.

Standard Deduction

- The standard deduction for salaried employees under the new tax regime increased from ₹50,000 to ₹75,000.

- Deduction on family pension for pensioners increased from ₹15,000 to ₹25,000.

- These measures aim to provide relief to around 4 crore salaried individuals and pensioners.

- The revision in tax slabs and the increase in standard deductions benefit salaried employees, facilitating savings of about ₹17,500 on an income of ₹15 lakh, thus increasing disposable income.

Points to Remember:

- Taxpayers in the new tax regime cannot claim exemptions like house rent allowance (HRA), limiting incentivisation avenues, hence the revision in tax slabs and standard deduction.

- The FM proposed that not reporting movable assets up to ₹20 lakh would not incur penalties, addressing issues faced by Indian professionals with foreign assets like ESOPs and social security schemes.

2. A pathway to inclusive growth

(Source – The Hindu, International Edition – Page No. – 2)

| Topic: GS3 – Indian Economy |

| Context |

|

Analysis of the news:

- The Union Budget 2024, presented by Finance Minister Nirmala Sitharaman, emphasizes inclusive growth and economic resilience.

- Focus areas include job creation, infrastructure development, support for MSMEs, and affordable housing while reducing the fiscal deficit to 4.9%.

A New DBT Scheme

- A Direct Benefit Transfer (DBT) scheme provides ₹15,000 to new workers registered with EPFO, benefiting 210 lakh youth, with eligibility for salaries up to ₹1 lakh per month.

- Aim: to boost job creation in the manufacturing sector, targeting first-time workers with EPFO contribution incentives for four years.

- Expected benefits of the scheme include employment for 3 million young people across various sectors and reimbursement of up to ₹3,000 per month for two years for each additional employee’s EPFO contributions.

- The goal is to create employment opportunities for 5 million additional people.

- Employment-linked skilling schemes are part of the PM’s comprehensive package.

Other Schemes:

- A new credit guarantee scheme for MSMEs aims to facilitate term loans for machinery and equipment without collateral.

- The Budget allocates ₹10 lakh crore to the PM Awas Yojana Urban 2.0 for the housing needs of the urban poor and middle class, with an additional ₹2.2 lakh crore initiative to make housing more affordable.

- Emphasis on energy security and sustainable development.

- Removing angel tax boosts start-up morale, and simplified rules and recognition for FDIs aim to facilitate inflow and promote the Rupee for overseas investments.

- Angel Tax: It was introduced in 2013 Budget. It taxed the the difference between amount received and fair market value of an asset. This was done to curb money laundering.

- Tax law reforms simplify the process for taxpayers and rationalise tax rates, ensuring a straightforward system and controlling inflation.

- The market is expected to handle slight increases in long-term and short-term capital gains taxes and the Securities Transaction Tax (STT) on Futures and Options (F&Os).

- The government’s balanced and inclusive approach aims to steer India towards economic resilience and equitable growth.

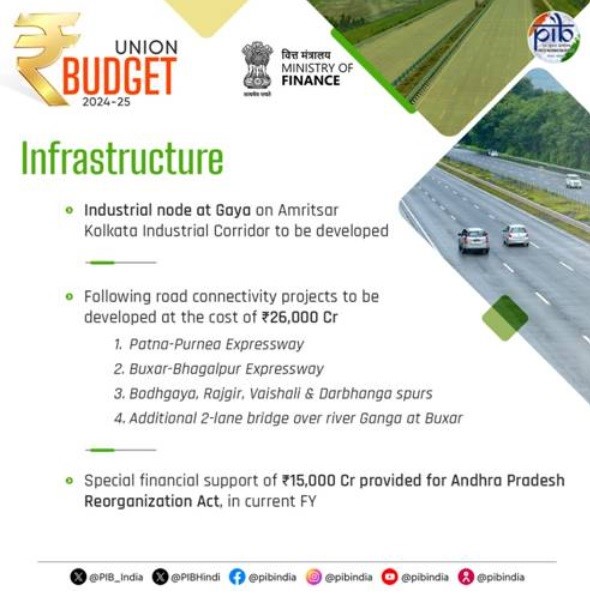

3. Placing thrust on infrastructure

(Source – The Hindu, International Edition – Page No. – 3)

| Topic: GS3 – Indian Economy |

| Context |

|

Analysis of the news:

- Finance Minister Nirmala Sitharaman emphasized the crucial infrastructure sector in her seventh Budget presentation and the first of PM Modi’s third term.

- Major initiatives include a massive urban housing expansion with a ₹10 lakh crore investment and a rural roads programme worth ₹26,000 crore.

- The capex budget for FY25 is retained at ₹11.1 lakh crore, or 3.4% of GDP.

- Announcements include a new power plant for Bihar and investments in expressways, medical colleges, airports, and tourist circuits in the State.

- Andhra Pradesh will receive a new capital with ₹15,000 crore Central assistance in the first year and industrial corridors connecting Chennai-Vizag and Bengaluru-Hyderabad.

- The Indian economy’s revival from COVID and its status as the world’s fastest-growing major economy are partly due to infrastructure investments.

- Government spending on infrastructure has had a multiplier effect, enhancing productivity, connectivity, and ease of travel.

- The government’s continued focus on infrastructure has led to a doubling of spending from 1.7% of GDP to 3.4% in three years.

- The Budget offers India Inc. a significant opportunity to participate in nation-building, improving quality of life and ease of living.

- With a target of $5 trillion GDP by the end of the decade and aiming to be a developed economy by 2047, the private sector has a unique opportunity.

- Large business groups have already proposed multi-billion dollar investments in infrastructure, and smaller companies are expected to follow.

- Capital markets are buoyant, and banks have healthy balance sheets, easing the financing of large projects.

- The government’s response to the COVID-induced slowdown was to accelerate infrastructure spending, and the 2024 Budget builds on this progress.

- The Budget demonstrates the government’s long-term focus and commitment to transforming India into a developed economy by 2047.

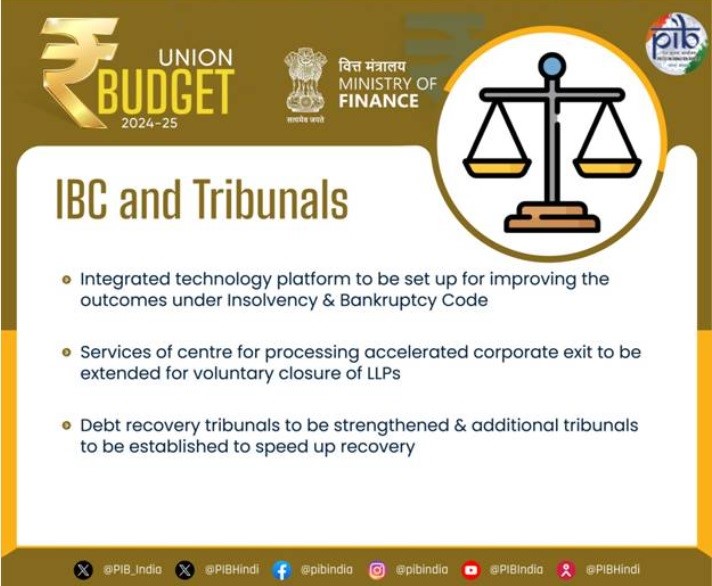

4. Budget proposes tech platform to boost IBC, more NCLTs

(Source – The Hindu, International Edition – Page No. – 3)

| Topic: GS3 – Indian Economy |

| Context |

|

Analysis of the news:

- Finance Minister Nirmala Sitharaman proposed an integrated technology platform to improve outcomes under the Insolvency & Bankruptcy Code (IBC) for transparency, consistency, timely settlement, and better oversight of resolution cases.

Additional NCLTs

- The government will set up additional National Company Law Tribunals (NCLTs) to expedite case resolutions under the IBC. Additional tribunals will be dedicated to resolving cases exclusively under the Companies Act.

- Benefit: These measures will benefit the banking sector by enhancing the speed of recovery processes.

C-PACE to be extended to LLPs:

- The Centre for Processing Accelerated Corporate Exit (C-PACE) will extend its services for the voluntary closure of LLPs.

- The integration of the IBC ecosystem through a tech platform will increase the utility and efficiency of the Corporate Insolvency Resolution (CIR) process.

- Improvements in the legislative framework and increased tribunal strength are expected to enhance process efficiency.

- Technological integration will help identify sources of delay and implement corrective measures to improve efficiency.

5. Five new schemes to aid job creation

(Source – The Hindu, International Edition – Page No. – 4)

| Topic: GS3 – Indian Economy |

| Context |

|

Analysis of the news:

- The first Budget of the third Narendra Modi government prioritises employment and skilling amid rising unemployment and job losses, proposing five schemes with a ₹2 lakh crore outlay to generate jobs for youth.

- Three schemes under the Prime Minister’s package focus on “employment-linked incentive” based on EPFO enrolment, targeting first-time employees and providing support to employees and employers.

The Five Schemes:

- One scheme offers a direct benefit transfer of one-month salary in three instalments to newly employed workers registered in the EPFO, up to ₹15,000, benefiting 210 lakh youth with a salary eligibility limit of ₹1 lakh per month.

- The Ministry of Textiles’ 2016 special package for the apparel sector aimed to generate one crore jobs in three years, with the government covering the entire 12% EPFO contribution for new employees earning less than ₹15,000 per month for the first three years.

- S.K. Sundararaman, Chairman of the Southern India Mills’ Association, emphasised the need for consistency and long-term implementation of such schemes for success.

- The second scheme incentivizes additional employment in the manufacturing sector, linked to first-time employees’ EPFO contributions in the first four years, benefiting 30 lakh youth and their employers.

- The third scheme covers additional employment in all sectors, with the government reimbursing employers up to ₹3,000 per month for two years towards EPFO contributions for each additional employee.

- The fourth scheme aims to skill 20 lakh youth over five years by upgrading 1,000 Industrial Training Institutes in hub-and-spoke arrangements with outcome orientation.

- The fifth scheme offers internship opportunities for one crore youth in 500 top companies over five years, providing an internship allowance of ₹5,000 per month and a one-time assistance of ₹6,000.

- Trade union leader Amarjeet Kaur critiqued the proposals as focusing on ease of doing business and benefiting corporate houses, while emphasising skilling over job creation for the already skilled but unemployed.

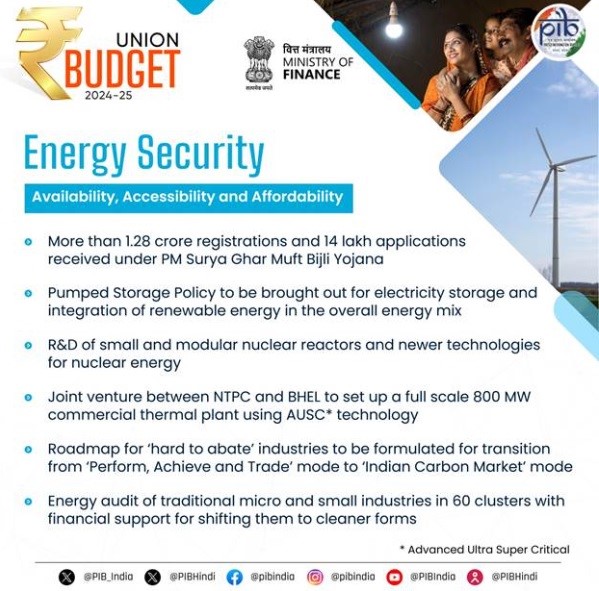

6. Budget gives fresh impetus to clean energy schemes

(Source – The Hindu, International Edition – Page No. – 6)

| Topic: GS3 – Indian Economy |

| Context |

|

Pradhan Mantri Surya Ghar Muft Bijli Yojna:

- Finance Minister Nirmala Sitharaman’s Budget address emphasised clean energy commitments but did not introduce new schemes.

- News: The Pradhan Mantri Surya Ghar Muft Bijli Yojna received an allocation of nearly ₹10,000 crore for the current year, doubling the previous year’s expenditure on solar power.

- Aim of the Scheme: to provide subsidised rooftop solar installations to one crore households, offering 300 units of free electricity.

- Households must pay a minimum of ₹20,000 for the system, which can be financed through a low-interest, collateral-free loan. Eligibility requires a suitable roof and an existing grid connection.

- Over 1.28 crore registrations for the scheme have been reported.

Investment in small modular nuclear reactors (SMRs)

- Investment in small modular nuclear reactors (SMRs) was highlighted, with plans to partner with the private sector for setting up Bharat Small Reactors and advancing nuclear energy technologies.

- SMRs, which offer up to 300MW of power, are seen as a significant component of India’s future energy mix.

- The Budget also restated a 2018 proposal to develop an Advanced Ultra Supercritical (AUSC) thermal power plant through collaboration with NTPC and BHEL, but no specific budget was allocated for this project.

7. New scheme to focus on upliftment of tribal villages

(Source – The Hindu, International Edition – Page No. – 8)

| Topic: GS3 – Indian Economy |

| Context |

|

PM Janjatiya Unnat Gram Abhiyaan (PM-JANMAN):

- Finance Minister Nirmala Sitharaman announced the launch of the PM Janjatiya Unnat Gram Abhiyaan, aiming for full saturation of basic facilities for five crore Scheduled Tribe families across 63,000 villages in tribal-majority areas and aspirational districts.

- The scheme, modelled after PM-JANMAN, will focus on Scheduled Tribe populations but lacks details on funds, implementation, or oversight.

- Tribal Affairs Minister Jual Oram welcomed the scheme, calling it transformative and a step towards improving tribal communities’ socio-economic conditions.

Ministry Budget this year

- The Budget allocated ₹13,000 crore for the Ministry of Tribal Affairs for FY 2024-25, a 4.31% increase from the previous year’s Budget Estimate. This is up from the ₹7,605 crore Revised Estimate for FY 2023-24 and the ₹7,273.53 crore spent in FY 2022-23.

- Of this allocation, ₹6,399 crore is designated for Eklavya Model Residential Schools for tribal students.

- The Ministry of Social Justice and Empowerment received a Budget Estimate of ₹14,225.47 crore for FY 2024-25, a 1.08% increase from the previous year’s estimate.

- The National Fellowship for OBC students’ allocation decreased to ₹55 crore from ₹57 crore in the previous Budget Estimate, despite a higher Revised Estimate of ₹90 crore for FY 2023-24.

8. Agriculture gets more; food subsidies cut

(Source – The Hindu, International Edition – Page No. – 4)

| Topic: GS3 – Indian Economy |

| Context |

|

Analysis of the news:

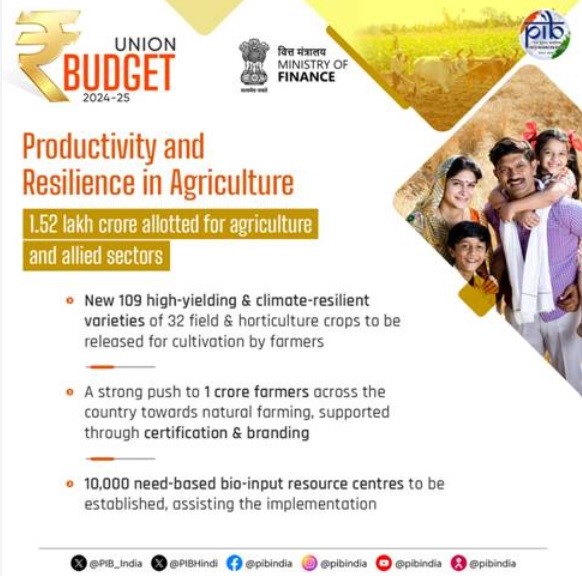

- Finance Minister Nirmala Sitharaman allocated ₹1.52 lakh crore for agriculture and allied sectors in the first Budget of Narendra Modi’s third term, prioritising productivity and resilience in farming.

- Fertiliser and food subsidies were decreased, leading to criticism from farmer organisations.

- The budget includes plans to review agriculture research to focus on productivity and climate-resilient crop varieties, with 109 new high-yielding varieties of 32 field and horticulture crops to be introduced.

- One crore farmers will be initiated into natural farming over the next two years, supported by certification and branding.

- Efforts will be made to strengthen pulses and oilseeds production, develop large-scale vegetable production clusters near major consumption centres, and promote Farmer-Producer Organisations (FPOs), cooperatives, and start-ups for vegetable supply chains.

- The implementation of Digital Public Infrastructure for Agriculture and a digital crop survey of kharif crops in 400 districts are also announced.

- Financial support will be provided for establishing a network of Nucleus Breeding Centres for shrimp broodstocks through NABARD.

Budgetary Allocations:

- The total allocation for the Department of Agriculture and Farmers Welfare is ₹1,22,528.77 crore, up from ₹1,16,788.96 crore in Revised Estimates for 2023-24.

- Allocation for the Ministry of Fisheries, Animal Husbandry and Dairying increased to ₹7,137.68 crore from ₹5,614.93 crore.

- Allocation for fertilisers was reduced to ₹1,64,150.81 crore from ₹1,88,947.29 crore in Revised Estimates, a 34.7% cut compared to the 2022-23 actuals.

- ₹10,000 crore is allocated to the Price Stabilisation Fund to manage essential commodity prices.

- No allocation was made to the Integrated Scheme on Agriculture Cooperation, which had received ₹300 crore in the revised Budget for 2023-24

9. ₹1,000-crore venture capital fund to be set up for space technology start-ups

(Source – The Hindu, International Edition – Page No. – 5)

| Context |

|

Analysis of the news:

- The Department of Space received a marginal increase in allocation in the 2024-25 Union Budget compared to FY24 Revised Estimates.

- The rise mainly supports space technology development, with increased funding for space applications, decrease for space sciences, and a significant cut for INSAT satellite systems.

- A ₹1,000 crore ($120 million) venture capital pool was announced for space start-ups, aimed at expanding the space economy by five times in the next decade.

- Reactions to the pool were mixed, with some viewing it as insufficient compared to global standards.

- Experts noted the need for more substantial government backing to foster a thriving space start-up ecosystem.

- The government also proposed removing angel tax, which space industry members welcomed as a step to reduce investment friction.

- Recent policies allow up to 100% FDI in satellite component manufacturing and ground segments, with lower limits in other areas.

10. Rs. 6.22 lakh crore allocated to MoD, highest among Ministries, in Regular Union Budget 2024-25; 4.79% higher than FY 2023-24

(Source – https://pib.gov.in/PressReleseDetail.aspx?PRID=2035748 )

| Topic: GS3 – Indian Economy |

| Context |

|

Budgetary Allocation:

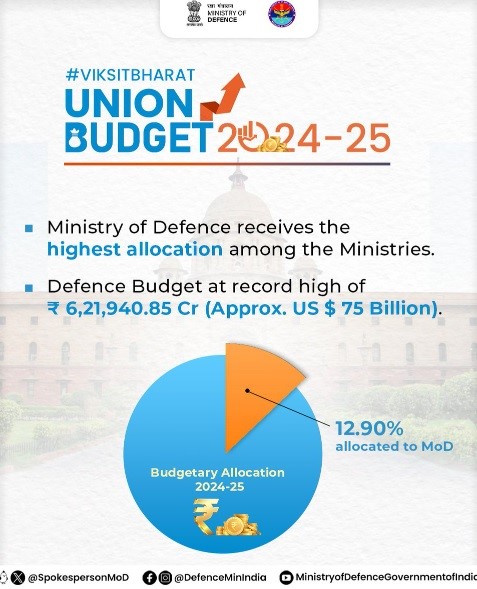

- The Union Budget 2024-25 allocated Rs 6,21,940.85 crore to the Ministry of Defence (MoD), the highest among ministries.

- Capital acquisition funding is Rs 1.72 lakh crore, a 20.33% increase from FY 2022-23 and 9.40% more than FY 2023-24.

- Rs 92,088 crore is allocated for sustenance and operational readiness, up 48% from FY 2022-23.

- Defence pensions have been allocated Rs 1.41 lakh crore, a 2.17% increase from the previous year.

- Rs 6,500 crore is designated for border roads development, and Rs 7,651 crore for coastal security.

- The iDEX budget is raised to Rs 518 crore from Rs 115 crore to foster defence innovation.

- The budget includes Rs 6,968 crore for the Ex-Servicemen Contributory Health Scheme (ECHS), a 28% increase from last year.

- Border Roads Organisation receives Rs 6,500 crore, a 30% increase from FY 2023-24.

- Indian Coast Guard’s allocation is Rs 7,651.80 crore, 6.31% higher than last year.

- DRDO’s budget is increased to Rs 23,855 crore, with a focus on capital expenditure and private sector partnerships.

- The allocation for Technology Development Fund (TDF) is Rs 60 crore to support start-ups and innovation.

- Raksha Mantri Rajnath Singh praised the budget for strengthening armed forces and promoting self-reliance in defence.

11. SUMMARY OF THE UNION BUDGET 2024-2025

(Source – https://pib.gov.in/PressReleseDetail.aspx?PRID=2035618 )

| Topic: GS3 – Indian Economy |

| Context |

|

Summary of the Union Budget 2024:

- Economic Performance:

- India’s inflation is currently low and stable, approaching the 4% target set by the government. Core inflation, excluding food and fuel, is at 3.1%. The government is working on ensuring the effective supply of perishable goods to stabilise prices.

- Prime Minister’s Package:

- The government announced a ₹2 lakh crore package for 5 major schemes aimed at providing employment, skill development, and other opportunities to 4.1 crore youth over the next 5 years. An allocation of ₹1.48 lakh crore has been made this year for education, employment, and skilling initiatives.

- Budget Focus Areas:

- The budget emphasises nine key priorities:

- Productivity and resilience in agriculture

- Employment and skilling

- Inclusive human resource development and social justice

- Manufacturing and services

- Urban development

- Energy security

- Infrastructure

- Innovation and research

- Next-generation reforms

- The budget emphasises nine key priorities:

- Agriculture:

- Introduction of 109 new high-yielding, climate-resilient varieties of 32 field and horticulture crops.

- Over the next two years, 1 crore farmers will be trained in natural farming, supported by certification and branding.

- Establishment of 10,000 bio-input resource centers.

- Strengthening production, storage, and marketing of pulses and oilseeds.

- Implementation of Digital Public Infrastructure (DPI) in agriculture, with a ₹1.52 lakh crore provision for agriculture and allied sectors.

- Employment and Skilling:

- Implementation of three new schemes under the ‘Employment Linked Incentive’ program focusing on EPFO enrolment, recognition of first-time employees, and support for both employees and employers.

- Upgrading 1,000 Industrial Training Institutes with a hub-and-spoke model.

- Revised Model Skill Loan Scheme to provide loans up to ₹7.5 lakh, benefiting 25,000 students annually.

- Financial support for higher education loans up to ₹10 lakh, with e-vouchers for 1 lakh students, including an annual interest subvention of 3%.

- Inclusive Human Resource Development:

- Enhanced implementation of schemes supporting craftsmen, artisans, self-help groups, and entrepreneurs, including PM Vishwakarma, PM SVANidhi, National Livelihood Missions, and Stand-Up India.

- The ‘Purvodaya’ plan for the all-round development of the Eastern states of Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh.

- Launch of ‘Pradhan Mantri Janjatiya Unnat Gram Abhiyan’ to improve socio-economic conditions in tribal-majority villages and aspirational districts, benefitting 5 crore tribal people.

- Establishment of more than 100 branches of India Post Payment Bank in the North East region to expand banking services.

- Allocation of ₹2.66 lakh crore for rural development, including infrastructure.

- Manufacturing and MSMEs:

- Special attention to MSMEs, with a self-financing guarantee fund offering guarantee cover up to ₹100 crore per applicant. Public sector banks will enhance their credit assessment capabilities for MSMEs.

- Enhanced Mudra loan limit to ₹20 lakh for entrepreneurs with previous successful loans.

- Financial support for setting up 50 multi-product food irradiation units and 100 food safety testing labs with NABL accreditation.

- Establishment of E-Commerce Export Hubs to help MSMEs and traditional artisans access international markets.

- Launch of a comprehensive internship scheme for 1 crore youth in 500 top companies over 5 years.

- Urban Development:

- PM Awas Yojana Urban 2.0 aims to address the housing needs of 1 crore urban poor and middle-class families with an investment of ₹10 lakh crore, including ₹2.2 lakh crore central assistance over 5 years.

- Water supply, sewage treatment, and solid waste management projects for 100 large cities in partnership with state governments and multilateral development banks.

- Development of 100 weekly ‘haats’ or street food hubs to support street vendors.

- Energy Security:

- Launch of PM Surya Ghar Muft Bijli Yojana to install rooftop solar plants, providing free electricity up to 300 units for 1 crore households. The scheme has received over 1.28 crore registrations.

- Increased focus on nuclear energy as part of the energy mix for Viksit Bharat.

- Infrastructure:

- Allocation of ₹11.11 lakh crore for capital expenditure, representing 3.4% of GDP.

- Launch of Phase IV of PMGSY to provide all-weather connectivity to 25,000 rural habitations.

- Financial support for irrigation and flood management projects in Bihar, Assam, Himachal Pradesh, Uttarakhand, and Sikkim.

- Innovation and Research:

- Operationalization of the Anusandhan National Research Fund with ₹1 lakh crore to support basic research and prototype development.

- Expansion of the space economy with a ₹1,000 crore venture capital fund.

- Next Generation Reforms:

- Formulation of an Economic Policy Framework to guide future reforms and employment generation.

- Integration of e-shram portal with other services and enhancement of compliance portals for labor.

- Simplification of Foreign Direct Investment and overseas investment regulations.

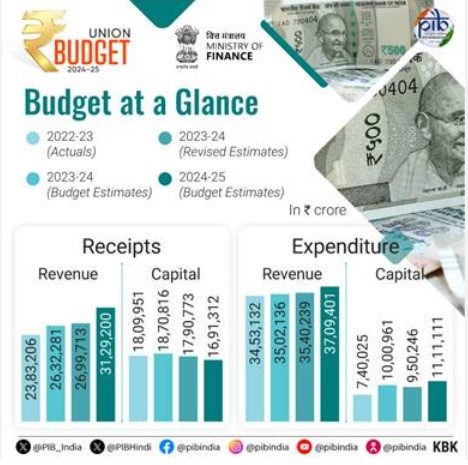

- Fiscal Estimates:

- Estimated total receipts (excluding borrowings) are ₹32.07 lakh crore, with total expenditure at ₹48.21 lakh crore. Fiscal deficit is projected at 4.9% of GDP.

- Gross and net market borrowings are estimated at ₹14.01 lakh crore and ₹11.63 lakh crore, respectively.

- The government aims to achieve a fiscal deficit below 4.5% next year.

- Tax Reforms:

- Increased standard deduction for salaried individuals to ₹75,000 and enhanced family pension deduction to ₹25,000.

- Abolition of angel tax, reduced corporate tax for foreign companies, and simplified TDS rates.

- Increase in capital gains exemption limit to ₹1.25 lakh per year and other provisions to enhance ease of doing business.

12. Union Budget 2024-25: Strategic Shift Towards Collaborative Governance and Economic Resilience

(Source: Indian Express; Section: Explained; Page: 18)

| Topic: GS3 – Indian Economy – Government Budgeting |

| Context: |

|

Analysis of News:

Budget Objectives and Economic Management

Dual Purposes of Budgets: Budgets serve two main functions:

- Detail government finances, including earnings, expenditures, and borrowings for the past and upcoming financial years.

- Act as a critical tool for economic management by determining taxation, spending priorities, and shaping the economic landscape.

Fiscal Prudence: Excessive borrowing (fiscal deficit) increases national debt, burdening taxpayers. Prudential norms advocate reducing deficits to lower the debt-to-GDP ratio, promoting long-term economic stability.

Economic Philosophy Since 2014

- Single-Party Majority Impact: With a majority in Lok Sabha, the BJP could implement its economic philosophy without coalition constraints. This allowed for:

- Minimal Government Interference: Emphasizing private sector-led growth.

- Tax Reforms: Lowering tax rates while broadening the tax base and encouraging compliance.

- Prudential Fiscal Management: Reducing government borrowing to leave more funds for private sector growth.

- Digitalization and Formalization: Enhanced monitoring of the economy through digitalization and formalization, aiming to raise resources efficiently and reduce bureaucratic inefficiencies.

Challenges and Responses

- Limited Success of Initial Strategies: Despite high expectations for second-generation reforms, the past decade saw limited success. Major reforms like GST restructuring, the Insolvency and Bankruptcy Code, and corporate tax cuts faced implementation and timing issues, leading to economic stagnation and rising unemployment.

- Impact of COVID-19: The pandemic exacerbated economic challenges, leading to income destruction and low consumption levels. The government’s growth strategy unraveled, highlighting the need for a course correction.

Course-Correction in the Budget

- Coalition Budget: Significant allocations for states like Bihar and Andhra Pradesh indicate a coalition-friendly budget, emphasizing infrastructure development and regional growth.

- Agrarian and Rural Focus: With a priority on agriculture, the budget addresses agrarian distress through initiatives aimed at boosting farm income, promoting natural farming, and enhancing research and development.

- Employment and Skills Development: Shifting focus from Production-Linked Incentive (PLI) schemes to Employment-Linked Incentive (ELI) schemes to boost job creation and address unemployability through extensive skilling programs.

- Support for MSMEs: Recognizing the importance of small businesses, the budget includes measures to alleviate stress in the MSME sector, emphasizing their role in manufacturing output, exports, and employment.

- Collaborative Governance: Acknowledging the need for cooperation with states, the budget promotes competitive federalism and incentivizes state-level reforms, particularly in land and labor policies.

Conclusion

- The Union Budget for 2024-25 marks a strategic shift, acknowledging economic distress and emphasizing collaborative governance, regional development, and employment generation.

- The proposed economic policy framework aims to guide future reforms, fostering sustainable growth and addressing pressing economic challenges.

| Practice Question: Examine the key shifts in the Union Budget 2024-25 and discuss its implications for fiscal consolidation, employment, and collaboration with states. (250 words/15 m) |

13. Supreme Court Upholds NEET-UG 2024 Results, Orders Revision for Marking Error

(Source: Indian Express; Section: Express Network; Page: 25)

| Topic: GS2 – Governance – Government policies – Interventions for development in various sectors |

| Context: |

|

Analysis of News:

What is the National Eligibility Entrance Test (NEET-UG)?

- NEET (UG) is one of the toughest medical entrance examinations conducted in India. National Eligibility cum Entrance Test (NEET) is conducted by the National Testing Agency (NTA) for admission to undergraduate (MBBS/BDS/Ayush Courses) every year.

- The single national level undergraduate medical entrance exam, NEET, is held every year for admission to medical, dental, AYUSH, and BVSc (Bachelor of Veterinary Science) and AH (Animal Husbandry) colleges in India.

- The NEET exam is conducted online and in 11 languages — English, Hindi, Marathi, Odia, Tamil, Marathi, Urdu Bengali, Telugu, Kannada, and Assamese.

- Before the NTA, the test was conducted by the Central Board of Secondary Education (CBSE).

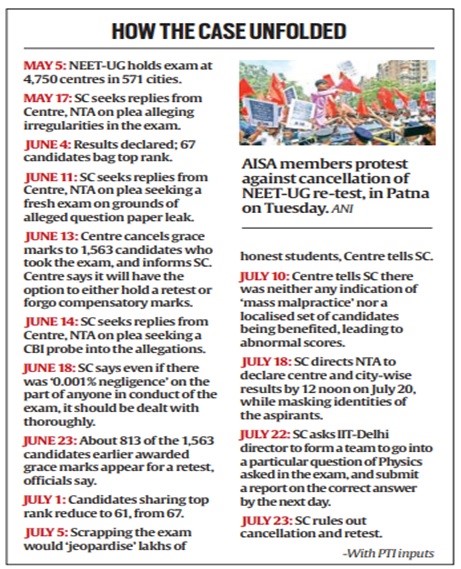

Key points from the ruling include:

- The cancellation of the entire NEET-UG 2024 exam is unjustified based on existing records.

- Data from 2022, 2023, and 2024 does not indicate a systemic leak.

- A fresh NEET-UG exam would significantly disrupt over 2 million students’ admissions and future medical education.

The court emphasized that any student found guilty of malpractice during the ongoing CBI investigation would face consequences and be disqualified from admission.

It acknowledged a question paper leak in Hazaribagh, Jharkhand, and Patna, Bihar, involving 155 students. The SC awaits a detailed judgment and further investigation outcomes.

| PYQ: How have digital initiatives in India contributed to the functioning of the education system in the country? Elaborate on your answer (250 words/15m) (UPSC CSE (M) GS-2 2020) |

| Practice Question: Discuss the Supreme Court’s recent decision to uphold the NEET-UG 2024 results despite allegations of malpractice and systemic breaches. What were the key factors influencing the Court’s decision, and what implications does this ruling have for the future of standardized testing in India? (250 words/15 m) |

14. Finance Minister Nirmala Sitharaman Announces E-Commerce Export Hubs to Boost MSME and Artisan Trade

(Source: Indian Express; Section: Infra; Page: 09)

| Topic: GS3 – Indian Economy |

| Context: |

|

Analysis of News:

- Indian MSMEs and artisans have limited e-commerce exports ($5 billion) compared to China ($300 billion).

- The move comes amidst disruptions in traditional exports due to global tensions and logistical issues.

- The new hubs will offer a seamless regulatory and logistic framework to facilitate international trade.

- The Commerce and Industry Ministry has already increased the consignment cap for e-commerce exports, projecting potential growth to $200-$300 billion by 2030.

- India’s e-commerce exports predominantly consist of small businesses exporting items like handicrafts, art, and garments.

- A GTRI report highlights the need for a cohesive e-commerce export policy to reduce compliance burdens.

- Southeast Asia’s e-commerce market growth, especially during the COVID-19 pandemic, illustrates the potential for India’s e-commerce sector.

15. Finance Minister Nirmala Sitharaman Announces Phase IV of PMGSY, 3 Crore New Houses, and Major Rural Development Initiatives

(Source: Indian Express; Section: Agri & Rural; Page: 11)

| Topic: GS3 – Indian Economy |

| Context: |

|

Analysis of News:

- PMGSY Phase IV: 25,000 villages to get all-weather roads; Rs 19,000 crore allocated.

- PMAY: Three crore houses announced, two crore in rural areas; Rs 54,500 crore allocated.

- Jal Jeevan Mission: Rs 69,926.65 crore allocated.

- Total rural development outlay: Rs 2.66 lakh crore, an 11.2% increase.

- Phase IV of PMGSY extends the rural road scheme, originally launched in 2000.

- PMAY-G: Unit cost of houses increased; Rs 4,18,200 crore to be spent in coming years.

- Rural land reforms: Unique Land Parcel Identification Number, digitization of cadastral maps, and other measures to facilitate credit flow.

These initiatives are set to boost rural infrastructure, housing, and development, spurring investment and growth in rural areas.

16. Union Budget Abolishes ‘Angel Tax’ to Boost Start-Up Funding and Innovation

(Source: Indian Express; Section: Cover Page; Page: 01)

| Topic: GS3 – Indian Economy |

| Context: |

|

What is Angel Tax?

- Angel tax is an income tax levied at the rate of 30.6% when an unlisted company issues shares to an investor at a price higher than its fair market value.

- Fair market value is the price of an asset when buyer and seller have reasonable knowledge of it and are willing to trade without pressure.

- Initially, angel tax was applicable only to investments made by resident investors. The Finance Act, 2023 extended this provision to include foreign investors as well.

- This means that when a start-up raises funding from a foreign investor, it will also be counted as income and subjected to taxation.

- However, DPIIT-recognized start-ups are now excluded from the angel tax levy.

Analysis of News:

- The tax’s removal aims to bolster the start-up ecosystem and support innovation.

- Initially introduced in 2012 to deter money laundering through overvalued shares, the tax’s scope was expanded last year to include foreign investments.

- Industry bodies like the CII and government agencies such as DPIIT supported the tax’s removal.

- Concerns remain about tax demands raised before the announcement.

- The decision comes amid a significant decline in start-up funding, which fell 62% in 2023 compared to 2022.

- The Finance Ministry had previously exempted investors from 21 countries from the tax but left out key investment hubs like Singapore and Mauritius.

- Start-ups rely heavily on foreign capital, with many successful ventures backed by international investors.

- The Finance Ministry had notified rules for evaluating shares issued by unlisted start-ups, including various valuation methods for non-resident investors.

The abolition of the ‘angel tax’ is expected to simplify the investment process, reduce conflicts and delays, and provide relief to start-ups in a challenging funding environment.

17. Finance Minister Nirmala Sitharaman Allocates `500 Crore for Drone Initiative, Supports Natural Farming and Agricultural Innovation

(Source: Indian Express; Section: Agri & Rural; Page: 11)

| Topic: GS3 – Indian Economy |

| Context: |

|

Analysis of News:

- Namo Drone Didi Scheme: `500 crore allocated to equip 15,000 women SHGs with drones for rental services to farmers (2023-2026).

- Natural Farming Initiative: One crore farmers to be introduced to natural farming, supported by certification and branding, with `365.64 crore allocated for the National Mission on Natural Farming.

- Agriculture Research: Comprehensive review of agriculture research setup to focus on productivity and climate-resilient varieties; new 109 high-yielding and climate-resilient crop varieties to be released.

- Kisan Credit: JanSamarth-based Kisan Credit to be rolled out in five states, streamlining access to government schemes.

- Pulses and Oilseeds: Strategy to achieve self-sufficiency in pulses and oilseeds; emphasis on production, storage, and marketing.

- Vegetable Supply Chains: Development of large-scale vegetable clusters near consumption centers; support for farmer-producer organizations and cooperatives.

- National Cooperation Policy: To foster all-round development of the cooperative sector.

- Shrimp Production: Financial support for establishing shrimp breeding centers.

- Overall Budget Allocation: 1.52 lakh crore allocated for agriculture and allied sectors, with 60,000 crore for PM-Kisan.

These measures aim to boost the rural economy, enhance agricultural productivity, and support the cooperative and fisheries sectors.

| What is the NaMo Drone Didi Initiative? |

|