30 July 2024 : Daily Current Affairs

1. Quad calls for end to violence in Ukraine, Gaza, and Myanmar

(Source – The Hindu, International Edition – Page No. – 4)

| Topic: GS2 – International Relations |

| Context |

|

Expansion of IPMDA into Indian Ocean Region

- The Quadrilateral group (Australia, India, Japan, and the U.S.) announced plans to expand the Indo-Pacific Partnership for Maritime Domain Awareness (IPMDA) into the Indian Ocean Region.

- External Affairs Minister S. Jaishankar emphasised the Quad’s role as a stabilising factor.

- The initiative aims to ensure the safety and security of critical sea lanes.

IPMDA and Maritime Security

- The IPMDA is a comprehensive system for monitoring and securing maritime activities in the Indo-Pacific.

- The Quad countries plan to work with the Pacific Islands Forum Fisheries Agency to enhance regional maritime domain awareness through satellite data, training, and capacity building.

- The expansion aims to link information fusion centres for real-time coordination in addressing maritime challenges.

Concerns Over China’s Maritime Activities

- The meeting highlighted the importance of freedom of navigation, overflight, and unimpeded commerce in accordance with international law.

- Growing concern about China’s activities in the South China Sea was evident.

Global Security Concerns

Ukraine

- The Foreign Ministers expressed deep concern over the ongoing war in Ukraine.

- They emphasised the importance of sovereignty and territorial integrity, calling for a comprehensive and just peace.

- Mr. Jaishankar hinted at increased India-Ukraine contacts, with Prime Minister Modi possibly visiting Ukraine soon.

Gaza

- The joint statement condemned the October 2023 attacks on Israeli targets by Hamas.

- The ministers highlighted the need for increased humanitarian assistance in Gaza and the prevention of regional escalation.

- They called for compliance with international law and an immediate ceasefire.

Myanmar

- The ministers expressed concern over the worsening situation in Myanmar.

- They called for the immediate cessation of violence, the release of detainees, and safe humanitarian assistance.

Conclusion

- The Quad emphasised its interest in ensuring peace and stability in the Middle East and globally.

- The joint statement reflected the Quad’s commitment to international law and humanitarian principles.

| The Quadrilateral Security Dialogue (Quad): |

|

| PYQ: ‘Quadrilateral Security Dialogue (Quad)’ is transforming itself into a trade bloc from a military alliance, in present Smes – Discuss. (250 words/15m) (UPSC CSE (M) GS-2 2020) |

| Practice Question: Discuss the strategic significance of the Indo-Pacific Partnership for Maritime Domain Awareness (IPMDA) expansion into the Indian Ocean Region by the Quadrilateral Security Dialogue (Quad) nations. (250 Words /15 marks) |

2. Defence Acquisition Council approves amendment to MQ-9B UAV deal with U.S.

(Source – The Hindu, International Edition – Page No. – 4)

| Topic: GS2 – Governance, GS3 – Internal Security |

| Context |

|

Procurement of UAVs from the US:

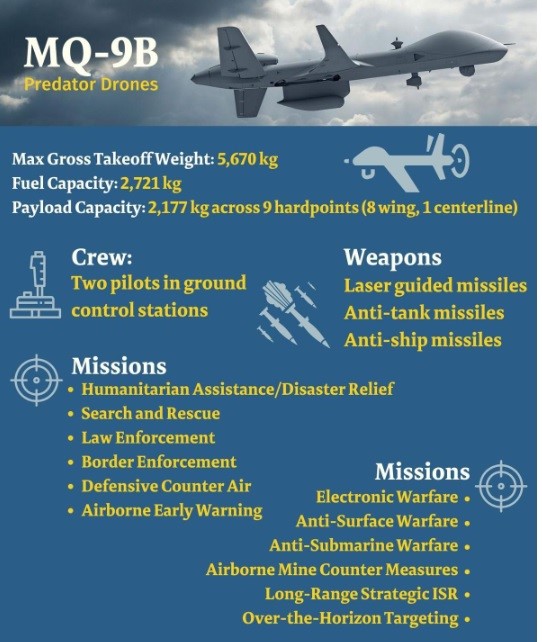

- The Defence Acquisition Council (DAC), chaired by Defence Minister Rajnath Singh, approved amendments to the deal for procuring 31 MQ-9B High Altitude Long Endurance (HALE) Unmanned Aerial Vehicles (UAV) from General Atomics.

- The amendments are within the scope of the Acceptance of Necessity (AoN) and relate to indigenous content.

- The U.S. has completed its part with a letter of offer and acceptance delivered to India in March.

- The deal awaits approval from India’s Cabinet Committee on Security before signing.

- The MQ-9B deal and the GE-414 jet engine deal are expected to be concluded during the U.S. President’s visit to India in December for the Quad leaders summit.

Future Prospects and Strategic Implications:

- India plans to procure 15 Sea Guardians for the Navy and 16 Sky Guardians for the Army and Air Force, costing $3.99 billion.

- General Atomics will establish a Global Maintenance, Repair and Overhaul (MRO) facility in India.

- The DAC also approved AoN for Advanced Land Navigation System (ALNS) for Army Armoured Fighting Vehicles and 22 Interceptor Boats for the Coast Guard.

- ALNS Mk-II will be procured from Bharat Electronics Limited for high accuracy in navigation.

- Interceptor Boats will enhance coastal surveillance, patrolling, search & rescue operations, and medical evacuation.

| The Defence Acquisition Council (DAC) |

|

| Practice Question: Discuss the role and significance of the Defence Acquisition Council (DAC) in India’s defence procurement process. (150 Words /10 marks) |

3. Indian scientists build breakthrough gene-editor, are aiming for patent

(Source – The Hindu, International Edition – Page No. – 7)

| Topic: GS3 – Science and Technology |

| Context |

|

Development of Enhanced Genome-Editing System

- Scientists from the CSIR-Institute of Genomics and Integrative Biology (IGIB), New Delhi, have developed an advanced genome-editing system based on FnCas9, a Cas9 enzyme from Francisella novicida bacteria.

- The new system aims to address the limitations of the CRISPR-Cas9 system, particularly its off-target effects and low efficiency.

CRISPR-Cas9 Overview

- CRISPR-Cas9 is a gene-editing tool that utilises a guide-RNA (gRNA) to direct the Cas9 enzyme to a specific DNA sequence, where it acts as a molecular scissor to cut and edit the genome.

- While effective for various applications, CRISPR-Cas9 faces challenges with off-target effects, especially with the SpCas9 enzyme from Streptococcus pyogenes.

FnCas9 Advantages

- FnCas9, derived from Francisella novicida, offers higher precision but has lower efficiency compared to SpCas9.

- Researchers at CSIR-IGIB engineered enhanced FnCas9 by modifying its amino acids to improve binding affinity with the PAM sequence, resulting in increased editing efficiency and flexibility.

Performance and Applications

- Enhanced FnCas9 demonstrated higher activity and precision in cutting target DNA and identifying single-nucleotide changes compared to unmodified FnCas9.

- In tests on human kidney and eye cells, enhanced FnCas9 showed superior performance with minimal off-target effects.

Therapeutic Potential

- The enhanced FnCas9 was used to correct a genetic mutation causing Leber congenital amaurosis type 2 (LCA2), an inherited blindness. It successfully restored normal levels of the RPE65 protein in retinal cells derived from patient-specific iPSCs.

- The precision of enhanced FnCas9 allows for potential use in therapeutic applications, such as treating genetic disorders.

Future Prospects

- Researchers are working on improving delivery methods and adapting the technology for broader applications.

- The team plans to patent the technology in India, aiming to develop affordable therapeutics for low- and middle-income countries and reduce reliance on foreign licences.

|

PYQ: Q. What is Cas9 protein that is often mentioned in the news? (UPSC civil services prelims 2019) (a) A molecular scissors used in targeted gene editing Ans: Option A |

| Practice Question: Evaluate the significance of the enhanced FnCas9 genome-editing system developed by CSIR-IGIB in improving gene-editing precision and its potential applications in treating genetic disorders. (150 Words /10 marks) |

4. Can States tax mining activities?

(Source – The Hindu, International Edition – Page No. – 10)

| Topic: GS2 – Indian Polity – Judiciary |

| Context |

|

Supreme Court Ruling on State Taxation of Minerals

- Landmark Ruling: On July 25, the Supreme Court ruled that States can impose taxes on minerals in addition to the royalty levied by the Centre, affirming the principles of federalism and clarifying that State legislatures have the authority to tax mineral activities within their territories.

Case Background

- The case, pending for over 25 years, stemmed from a dispute between India Cement Ltd and the Tamil Nadu government over the imposition of a cess on mining royalties.

- Earlier rulings in India Cement Ltd. v. State of Tamil Nadu (1989) and Kesoram Industries Ltd. (2004) led to conflicting precedents, prompting the issue to be referred to a nine-judge Bench.

Royalties vs. Taxes

- Definition: The Supreme Court clarified that royalties are “contractual considerations” paid to lessors for mineral extraction, while taxes are “impositions by a sovereign authority” used for public welfare.

- Thus, royalties do not fall under the category of “taxes on mineral rights” as defined in the Constitution.

State Authority

- Constitutional Powers: Under Entry 50 of the State List, States have the authority to impose taxes on mineral rights, but this power is subject to laws passed by Parliament regarding mineral development.

- The Court held that the Mines and Minerals (Development and Regulation) Act, 1957, does not limit States’ power to levy taxes beyond royalties.

Justice Nagarathna’s Dissent

- Justice B.V. Nagarathna dissented, arguing that allowing additional State taxes could hinder mineral resource development and create unhealthy competition between States.

- She expressed concern that this could disrupt market stability and exploit pricing differences.

Next Steps

- On July 31, the Court will decide whether the ruling should apply retroactively or prospectively.

- Retroactive application could significantly benefit mineral-rich States like West Bengal, Odisha, and Jharkhand, which have imposed additional taxes on mining lessees.

| Practice Question: Discuss the implications of the Supreme Court’s ruling regarding States’ authority to impose taxes on minerals in addition to central royalties. How does this decision impact federalism and mineral resource management in India? (250 Words /15 marks) |

5. EK BHARAT SHRESHTH BHARAT CAMPAIGN

(Source – https://pib.gov.in/PressReleseDetail.aspx?PRID=2038494 )

| Topic: GS2 – Governance – Government Policies |

| Context |

|

Ek Bharat Shreshtha Bharat (EBSB):

- The Ek Bharat Shreshtha Bharat (EBSB) campaign was launched by the Government of India on October 31, 2015, as part of the Sardar Patel’s birth anniversary celebrations and to promote national integration.

- Objective: The primary aim is to foster greater unity and strengthen the bonds between people of different states and regions of India by promoting cultural exchange and mutual understanding.

- The campaign pairs one state or Union Territory with another for a specified period, encouraging interaction and exchange in areas such as culture, language, literature, and heritage.

- It involves organising various cultural programs, exhibitions, language workshops, educational exchanges, and other activities that showcase the unique heritage and traditions of the paired states.

- Focus Areas: The campaign emphasises:

- Cultural integration

- Language learning and appreciation

- Sharing of best practices in governance and development

- Government institutions, educational organizations, cultural institutions, and civil society groups are involved in implementing the campaign’s initiatives.

- Impact: By promoting cross-cultural interactions and understanding, EBSB aims to reduce regional disparities, enhance national cohesion, and foster a sense of unity in diversity across the country.

- Success: The campaign has led to increased cultural awareness and collaboration between states, enriching the social and cultural fabric of India.

| Practice Question: Discuss the objectives and key initiatives of the Ek Bharat Shreshtha Bharat (EBSB) program and their impact on national integration. (150 Words /10 marks) |

6. SAMADHAN Portal

(Source – https://pib.gov.in/PressReleseDetail.aspx?PRID=2038690 )

| Topic: GS2 – Governance – E-governance |

| Context |

|

SAMADHAN portal:

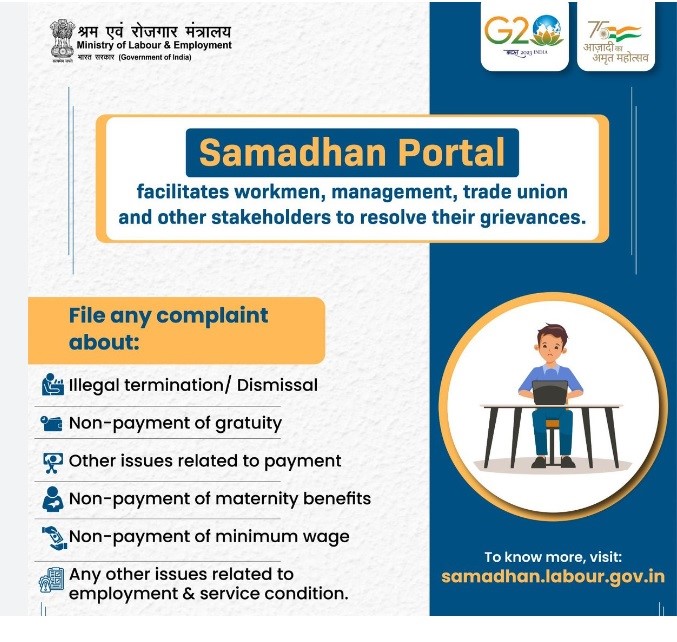

- Launch: The SAMADHAN portal was introduced to streamline the filing and management of industrial disputes and worker claims under various labour laws in India.

- It facilitates online filing of disputes under the Industrial Disputes Act, 1947, and claims under the Payment of Gratuity Act, 1972, Minimum Wages Act, 1948, Payment of Wages Act, 1936, Equal Remuneration Act, 1976, and Maternity Benefit Act, 1961.

- Access: Users can file disputes and claims through the portal, the UMANG app, or by visiting Common Services Centres, ensuring 24/7 accessibility.

- Tracking: The portal allows workers to monitor the status of their disputes and claims in real-time.

- Transparency: Notices and documents related to grievance redressal are sent electronically via SMS and email, enhancing transparency.

- Efficiency: The online system promotes faster case disposal compared to traditional methods.

- Monitoring: It provides tools for internal monitoring of grievances, improving overall efficiency.

Improvement: Features and services on the SAMADHAN portal are periodically updated based on user feedback and requirement.

7. Study Estimates 11.9 Lakh Excess Deaths in India During 2020, Sparking Controversy

(Source: Indian Express; Section: Explained; Page: 15)

| Topic: GS2 – Social Justice – Health |

| Context: |

|

Analysis of News:

Government Response

- The government has called the research “methodologically flawed” and “untenable,” asserting that it provides an overestimated figure of Covid-19 deaths.

- This response is part of an ongoing debate about the true extent of mortality during the pandemic in India. Official figures have consistently been much lower than independent estimates and studies.

Excess Mortality Concept

- Excess mortality is calculated by comparing the actual number of deaths during a specific period with the expected number based on trends from previous years.

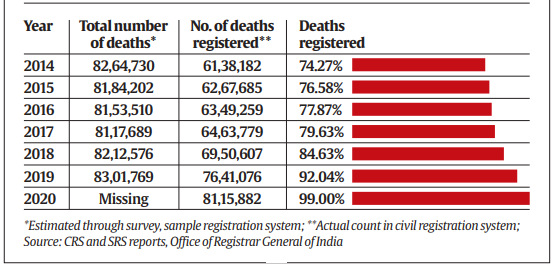

- In India, this method indicates a significant underreporting of Covid-19 deaths. Official data shows that between 82 lakh and 86 lakh people die annually.

- Any significant increase during the pandemic years, unexplained by normal annual variability, would be considered excess mortality, likely due to Covid-19.

Data Sources and Reliability

- India’s death data comes from the Sample Registration Survey (SRS) and the Civil Registration System (CRS). SRS provides estimates based on surveys, while CRS records actual registered deaths.

- However, not all deaths are registered, necessitating reliance on SRS data. Registration rates have improved, with 92% of estimated deaths registered in 2019.

- The government claims a 99% registration rate in 2020, but this data is not yet publicly available.

Contested Figures

- The government’s claim that 99% of deaths were registered in 2020 is questionable.

- If true, it would imply fewer deaths in 2020 compared to previous years, contradicting the expected increase due to the pandemic.

- The crude death rate (CDR) remained unchanged in 2020, which also raises questions about the accuracy of reported figures.

Methodological Critique

- The study in Science Advances used data from the National Family Health Survey (NFHS) 2019-2021, which collected death-related information over three years.

- The government argues this method is flawed as the NFHS sample is only representative when considered as a whole, not as a subset.

Importance of Accurate Data

- Accurately determining Covid-19 mortality is crucial for health, demographic, economic, and policy implications.

- The government has yet to provide a realistic assessment of the death toll, despite rejecting higher estimates.

- The forthcoming 2021 Census, postponed to 2026, presents an opportunity to collect definitive data on Covid-19 deaths.

Conclusion

- The controversy over Covid-19 death counts in India highlights the need for transparent and reliable data.

- The government’s dismissal of higher estimates without providing a credible alternative continues to fuel debate.

- The 2021 Census offers a chance to resolve this issue and provide a clearer picture of the pandemic’s impact on mortality in India.

| Practice Question: The recent study estimating 11.9 lakh excess deaths in India during the first year of the Covid-19 pandemic has sparked significant controversy. Discuss the methodologies used for estimating Covid-19 mortality and the challenges associated with obtaining accurate data. How can the government improve the accuracy and transparency of health data reporting in future pandemics? (250 words/15 m) |

8. Delhi Government Schools Face Persistent 30-40% Failure Rate in Class 9

(Source: Indian Express; Section: Explained; Page: 15)

| Topic: GS2 – Social Justice – Education |

| Context: |

| The article discusses the high failure rate among Class 9 students in Delhi government schools, highlighting that around 30-40% of students fail each year. |

Analysis of News:

High Failure Rate in Class 9 in Delhi Government Schools: Key Points

- Persistent Issue: Class 9 in Delhi government schools consistently sees the highest failure rate, ranging from 30-40%.

- Recent Data: In the 2023-24 academic year, 36% of students were held back after failing remedial exams. Nearly two-thirds of students who failed Class 9 twice face dropout risks as they are not enrolled in the National Institute of Open School (NIOS).

- Historical Context: In 2022, 42% of Class 9 students failed, with around 40% dropping out of school.

Contributing Factors:

- No-Detention Policy: Under the Right to Education, students are promoted automatically until Class 8, making Class 9 the first critical exam they face. The policy was recently changed to allow failures in Classes 5 and 8 as well.

- Examination Pattern: The shift to multiple-choice questions (MCQs) in Class 9 leads to rote learning, contributing to higher failure rates.

- Pressure on Schools: Government schools, pressured to maintain good results in Class 10 and 12, often push weaker students towards open schooling options.

- Teacher Insights: Teachers report that students with weak performance are encouraged to join open schooling to improve overall school results.

- Government Interventions: Steps taken include remedial classes, teacher training, and strategies to trace and train dropouts. The NIOS, initially a government initiative to retain students, now struggles with its reputation.

- Current Enrollment: Of the 17,308 students who failed Class 9 across 903 government schools, only 6,200 enrolled in NIOS this year.

| Challenges faced by Government schools |

|

Infrastructure issues:

Poor quality of education:

Teacher issues:

Poor implementation of RTE Act:

Corruption:

Perception of private schools:

|

| PYQ: National Education Policy 2020 is in conformity with the Sustainable Development Goal-4 (2030). It intends to restructure and reorient education system in India. Critically examine the statement. (250 words/15m) (UPSC CSE (M) GS-2 2020) |

| Practice Question: Discuss the underlying causes of the high failure rate among Class 9 students in Delhi government schools and evaluate the effectiveness of the measures taken to address this issue. (150 words/10 m) |

9. SC’s Bail Order for Kejriwal Prompts Mumbai Court to Release Accused, Exposes ED’s Procedural Lapses

(Source: Indian Express; Section: Explained; Page: 15)

| Context: |

|

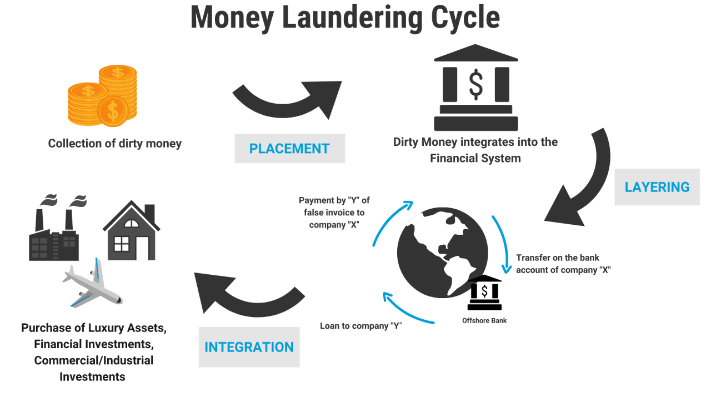

What is PMLA?

- The Prevention of Money Laundering Act, 2002 (PMLA) was enacted to prevent cases of money laundering and provide for the confiscation of property derived from money laundering.

- It aims to combat money laundering related to illegal activities such as drug trafficking, smuggling, and terrorism financing.

Key Provisions of PMLA:

- Offences and Penalties: PMLA defines money laundering offences and imposes penalties for such activities. It includes rigorous imprisonment and fines for offenders.

- Money laundering is the process of converting illegally earned money into seemingly legal money.

- Attachment and Confiscation of Property: The Act allows for the attachment and confiscation of property involved in money laundering. It provides for the establishment of an Adjudicating Authority to oversee these proceedings.

- Reporting Requirements: PMLA mandates certain entities, such as banks and financial institutions, to maintain records of transactions and report suspicious transactions to the Financial Intelligence Unit (FIU).

- Appellate Tribunal: Section 25 of PMLA provides for the establishment of an Appellate Tribunal, which is vested with power to hear appeals against orders passed by the Adjudicating Authority.

Analysis of Supreme Court Order Impacting ED’s Arrest Powers

- Bail Grant to Arvind Kejriwal: The Supreme Court’s order granting bail to Delhi CM Arvind Kejriwal has influenced subsequent cases, highlighting concerns over the Enforcement Directorate’s (ED) arrest powers.

- Mumbai Special Court Ruling: A Mumbai court released businessman Purushottam Mandhana, accused of money laundering linked to a Rs 975 crore bank fraud, due to the ED not providing the “reasons to believe” necessary for his arrest.

- ED’s “Reasons to Believe”: Under the Prevention of Money Laundering Act (PMLA), an ED officer must record “reasons to believe” that the accused is guilty, based on material on record. This must be communicated to the accused post-arrest.

- High Bar for Bail: Section 45 of PMLA sets a high threshold for granting bail, requiring the court to be satisfied that the accused is “not guilty,” making procedural challenges to arrest crucial.

- Supreme Court’s Stance: In Kejriwal’s case, the SC underscored the need for valid “reasons to believe” to avoid arbitrary arrests, asserting judicial scrutiny over ED’s decisions and mandating the sharing of these reasons with the accused.

- Procedural Safeguards: The SC has mandated sharing the grounds for arrest in writing within 24 hours. This procedural shield extends to stringent laws like the Unlawful Activities Prevention Act (UAPA).

- Significance of the Trial Court Ruling: Emphasizing due process, these rulings guard against arbitrary state action, marking a retreat from the 2022 SC ruling in Vijay Madanlal Chaudhary vs Union of India, which upheld PMLA’s broad powers and allowed ECIRs to remain internal documents.

| PYQ: Discuss how emerging technologies and globalisation contribute to money laundering. Elaborate measures to tackle the problem of money laundering both at national and international levels. (150 words/10m) (UPSC CSE (M) GS-3 2021) |

| Practice Question: Analyze the impact of procedural safeguards on the arrest powers of enforcement agencies under the Prevention of Money Laundering Act (PMLA). How have recent judicial rulings influenced these safeguards?. (250 words/15 m) |

Prelims Facts

1. Mekedatu project will ensure Cauvery water for T.N. even in distress years: Karnataka CM

(Source – The Hindu, International Edition – Page No. – 3)

| Context |

|

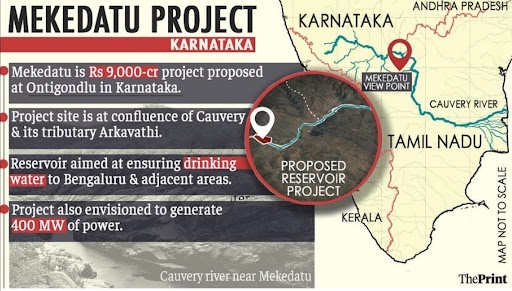

Mekedatu Project:

- Location: The Mekedatu balancing reservoir project is proposed to be constructed across the Cauvery River at Mekedatu in Karnataka.

- Purpose: The primary aim is to store 65 tmcft of water, which will be utilised to meet the drinking water needs of Bengaluru and surrounding areas and to release water to Tamil Nadu during distress years.

- Capacity: The reservoir is designed to hold up to 65 tmcft (thousand million cubic feet) of water.

- Benefits to Tamil Nadu: It ensures water availability during deficient rainfall years, thus aiding lower riparian regions and preventing excess water from flowing into the sea during heavy rainfall years.

- Current Status: Despite the Karnataka government’s push for the project, it has faced delays due to lack of permission from the Centre and objections from Tamil Nadu.

- Political Aspect: Opposition from Tamil Nadu is seen as politically motivated, with concerns about water-sharing disputes between the two states over Cauvery river.

2. Remittances to touch $160 bn in 2029: RBI

(Source – The Hindu, International Edition – Page No. – 13)

| Context |

|

Analysis of the news:

- Remittances to India are projected to rise from $115 billion in 2023 to $160 billion in 2029, according to the RBI’s Report on Currency and Finance (RCF).

- India is the top global recipient of remittances, holding a 13.5% share, which has been increasing over time.

- The remittances-to-GDP ratio for India grew from 2.8% in 2000 to 3.2% in 2023, surpassing the gross FDI inflows-to-GDP ratio of 1.9% in 2023.

- India’s external sector is strengthened by this increase in remittances.

- India is expected to be the leading global labour supplier until 2048 due to a rising working-age population, while major advanced economies face declines.

- The global demand for Indian labour and ongoing workforce skill upgrades are likely to sustain high remittance inflows.

- The cost of sending remittances has decreased due to digitalization.

3. Yazidi community uprooted by IS onslaught struggles to find stable homes

(Source – The Hindu, International Edition – Page No. – 15)

| Context |

|

The Yazidi community:

Rebuilding efforts are complicated by the presence of various armed groups and bureaucratic disputes.

The Yazidi community is a religious minority primarily residing in the Sinjar district of northern Iraq.

Yazidis follow a unique faith that blends elements of Zoroastrianism, Christianity, and Islam, and are often misunderstood as heretical by extremist groups.

In August 2014, ISIS militants attacked Sinjar, leading to mass killings, abductions, and forced conversions.

Thousands of Yazidis were killed, and many women and girls were enslaved.

The ISIS assault displaced over 300,000 Yazidis, with many fleeing to displacement camps in the Kurdish region.

Despite the defeat of ISIS in 2017, the community faces significant challenges in returning home due to widespread destruction and ongoing political and militia conflicts.

The central Iraqi government and Kurdish author

4. New Nasal Spray Developed to Target Tau Proteins in Alzheimer’s Treatment

(Source: Indian Express; Section: Explained; Page: 15)

| Context: |

| Scientists at the University of Texas Medical Branch have developed a nasal spray that targets tau proteins in the brain, potentially offering a new treatment for Alzheimer’s disease. |

Analysis of News:

About Alzheimer’s Disease

- It is a brain condition that causes a progressive decline in memory, thinking, learning, and organizing skills.

- It is the most common type of dementia, accounting for 60-80% of all dementia cases.

- It involves parts of the brain that control thought, memory, and language.

- It can seriously affect a person’s ability to carry out daily activities.

- The condition usually affects people aged 65 years and over, with only 10% of cases occurring in people younger than this.

- Cause: The exact cause of Alzheimer’s disease is not fully understood, but it is believed to be influenced by a combination of genetic, environmental, and lifestyle factors.

Symptoms:

- The early signs of the disease include forgetting recent events or conversations.

- Over time, it progresses to serious memory problems and loss of the ability to perform everyday tasks.

- Treatment: There’s no cure for Alzheimer’s, but certain medications and therapies can help manage symptoms temporarily.

What are Tau Proteins?

- Tau protein is a microtubule-associated protein primarily found in neurons, crucial for maintaining the cytoskeletal network by aiding in microtubule assembly.

- It is considered a significant biomarker in various central nervous system disorders associated with axonal damage.

Details

- Researchers at the University of Texas Medical Branch have developed a nasal spray that targets and removes tau protein aggregates, associated with Alzheimer’s disease, in mice brains.

- Alzheimer’s, the most common form of dementia affecting over 55 million people globally, gradually impairs memory and cognitive functions.

- Traditionally, Alzheimer’s treatments, including FDA-approved drugs, have focused on removing amyloid proteins.

- However, this new approach targets tau proteins, which misfold and accumulate in brain cells as neurofibrillary tangles.

- Published in Science Translational Medicine, the study demonstrates the potential of this method using specific antibodies.

- The complexity of Alzheimer’s has made finding a cure challenging, as evidenced by the failure of the experimental drug crenezumab in 2022, which primarily targeted beta-amyloid.

5. UP Bill Proposes Life Imprisonment for Unlawful Religious Conversions, Expands Scope for Complaints

(Source: Indian Express; Section: Cover Page; Page: 01)

| Context: |

| The Uttar Pradesh Prohibition of Unlawful Conversion of Religion (Amendment) Bill, 2024, proposes harsher penalties, broadens the scope for filing complaints, and tightens bail conditions to combat unlawful religious conversions. |

Analysis of News:

Key Changes in the Uttar Pradesh Prohibition of Unlawful Conversion of Religion (Amendment) Bill, 2024:

Increased Penalties:

- Maximum punishment increased from 10 years to life imprisonment.

- Forcibly inducing conversion can lead to 20 years to life imprisonment, with a fine to be paid to the victim.

- Minimum fine for violating provisions involving minors, disabled, mentally challenged persons, women, or Scheduled Castes/Tribes raised to Rs 1 lakh.

Expanded Scope for Complaints:

- Any person, not just related individuals, can file a complaint about unlawful conversions.

Specific Provisions:

- Punishment for receiving foreign or illegal funds for conversion: 7 to 14 years imprisonment and a minimum fine of Rs 10 lakh.

- Mass conversions: 7 to 14 years imprisonment and a minimum fine of Rs 1 lakh.

Stringent Bail Conditions:

- Offences under the Act are cognizable and non-bailable.

- Bail can only be granted after giving the public prosecutor a chance to oppose it, and only if the court is convinced that the accused is not guilty and will not commit an offense while on bail.

6. Tax Deductions for Political Donations Cost ₹3,967.54 Crore in FY 2022-23, Marking a 13% Increase

(Source: Indian Express; Section: Govt & Politics; Page: 07)

| Context: |

|

Analysis of News:

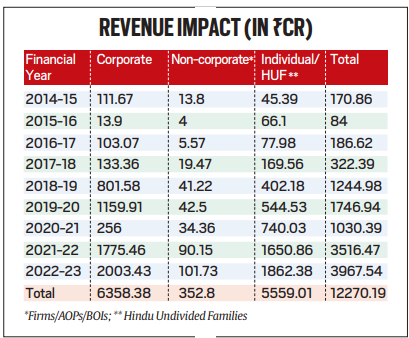

Revenue Impact of Tax Deductions for Political Donations (FY 2022-23)

- Estimated Revenue Impact: ₹3,967.54 crore.

- Year-on-Year Increase: 13% higher than FY 2021-22.

Historical Context:

- FY 2021-22: ₹3,516.47 crore (300% increase from the previous fiscal).

- FY 2014-15: ₹170.86 crore.

Total Impact (2014-15 to 2022-23): ₹12,270.19 crore.

Main Contributors:

- Corporate Donations (Section 80GGB): ₹2,003.43 crore.

- Individual Donations (Section 80GGC): ₹1,862.38 crore.

- Non-Corporate Taxpayers (Firms/AOPs/BOIs): ₹101.73 crore.

Tax Deduction Rules:

- Section 80GGB: Corporate donations to political parties are deductible, except for cash donations.

- Section 80GGC: Individuals can claim deductions for donations to political parties, excluding cash donations.

Definition of Political Party: Registered under Section 29A of the Representation of the People Act, 1951.