5 February 2025 : Daily Current Affairs

1. Scans of seemingly empty space reveal black holes not far from earth

- 1. Scans of seemingly empty space reveal black holes not far from earth

- 2. Why the tax cuts are a one way gamble

- 3. How beggar-thy-neighbour policies can make global trade come to a standstill

- 4. India’s ‘Mission for Aatmanirbharta in Pulses’: A Push for Self-Sufficiency Amid Rising Imports

- 5. Initiatives for the Empowerment of Divyangjans

- Prelims Facts

- 1. What is the Extremely Large Telescope?

- 2. Trump orders creation of U.S. sovereign wealth fund

- 3. Tribhuvan Sahkari University: India’s First National Cooperative University to Boost Rural and Cooperative Sector Education

(Source – The Hindu, International Edition – Page No. – 7)

| Topic: GS3 – Science and Technology |

| Context |

|

Introduction to Black Holes

- Black holes are cosmic objects that trap everything, including light, due to their immense gravity.

- They are visible indirectly through their effects on nearby objects, such as emitting X-rays when matter falls into them.

- The Milky Way contains around a thousand black holes, with Cygnus X-1 being one of the most well-known.

Gaia Telescope and Its Discoveries

- The European Space Agency’s Gaia telescope has been monitoring stars since 2013.

- It has detected black holes by observing stars orbiting “empty” spaces, revealing hidden massive objects.

- Scientists use Gaia’s data with ground-based telescope observations to estimate the mass of these objects.

| Gaia Telescope: |

|

The First Two Black Holes: Gaia BH1 and BH2

- Gaia BH1 was identified in 2022, located 1,560 light years away.

- The black hole is about nine times the Sun’s mass, determined using Kepler’s third law.

- Gaia BH2, detected in 2023, has a similar mass and was found by tracking a rapidly moving star.

Discovery of Gaia BH3: A Unique Find

- Gaia BH3, discovered in 2023, is the largest known stellar-mass black hole in the Milky Way.

- It has a mass of 33 times that of the Sun, making it significantly larger than Cygnus X-1.

- The black hole is located 2,000 light years away in the constellation Aquila.

- Unlike others, Gaia BH3 is not pulling in material or emitting X-rays, indicating a lack of surrounding matter.

Significance of Gaia BH3

- The orbiting star suggests that this black hole is very old.

- Scientists believe such massive black holes formed early in the universe’s history.

- The discovery provides an opportunity to study a massive stellar black hole within our galaxy.

- The detection of similar black holes through gravitational waves was previously only possible in distant galaxies.

Conclusion

- Gaia BH3 is an important astronomical discovery, helping scientists understand the formation and evolution of black holes.

- Future observations will provide deeper insights into the nature of these mysterious cosmic objects.

| Practice Question: Discuss the significance of Gaia BH3’s discovery in understanding black hole formation and the role of space telescopes in astronomical research (150 Words /10 marks) |

2. Why the tax cuts are a one way gamble

(Source – The Hindu, International Edition – Page No. – 10)

| Context |

|

Overview of the Tax Cut in the Union Budget

- The recent tax cuts in the Union Budget are described as one of the biggest tax reductions for the middle class.

- However, only a small percentage of the population (2-3%) directly benefits, as the middle class in India is not entirely “middle” in the income spectrum.

- For individuals earning between ₹7 lakh and ₹12 lakh, the tax rebate has been extended, which was earlier applicable only to those earning below ₹7 lakh.

- The exemption limit for those earning more than ₹12 lakh has also increased from ₹3 lakh to ₹4 lakh.

- Additionally, the other tax slabs and marginal tax rates have been adjusted, benefiting everyone earning more than ₹7 lakh.

- The Finance Minister has noted that these cuts will result in a ₹1 lakh crore fall in tax revenue, which accounts for 8% of the direct income tax collection of ₹12.57 lakh crore.

Implications of Tax Cuts on Economic Activity

- The budget’s aim is twofold: redistribution of income through tax changes and influencing economic activity via expenditure decisions.

- The government expects direct tax collections to increase by 14%, even with an 8% reduction in effective tax rates.

- Achieving this requires a 24% rise in income, which would be more than double the projected 10.1% growth in nominal GDP. This presents two possible scenarios.

Optimistic Scenario

- If higher tax exemption limits lead to a significant rise in people earning more than ₹12 lakh, or if existing taxpayers see a significant rise in income (known as higher tax buoyancy), the economy may experience growth.

- In this scenario, the income concentration in the upper classes could increase, contributing to a K-shaped recovery seen after the pandemic.

- If there is upward mobility in income, it could indicate broader economic growth at the upper end of the income spectrum.

Pessimistic Scenario

- If tax buoyancy does not work as expected, the burden will likely fall on the poorer sections of the population.

- Since government spending is tied to tax revenue, any shortfall in tax collection would result in cuts in public expenditure.

- The government’s fiscal policy may become pro-cyclical, which means the government will spend less during slowdowns and more during economic booms, which goes against the usual countercyclical approach.

- With the Fiscal Responsibility and Budget Management (FRBM) Act in place, the government has to adhere to strict deficit targets, limiting its spending.

| Risks of Fiscal Contraction |

|

Conclusion

- The tax cuts in the Union Budget are a significant step, but their effectiveness depends on whether the expected rise in income and tax collection materializes.

- The government is taking a risk by relying heavily on income tax cuts as the main tool for economic recovery, which could either lead to growth or worsen inequalities if things don’t go as planned.

| Practice Question: How will the recent income tax cuts in India’s Union Budget impact fiscal policy, economic growth, and income inequality? Analyze with relevant data and arguments. (250 Words /15 marks) |

3. How beggar-thy-neighbour policies can make global trade come to a standstill

(Source – The Hindu, International Edition – Page No. – 11)

| Context |

|

Meaning of Beggar-Thy-Neighbour Policies

- Beggar-thy-neighbour policies are protectionist economic policies that benefit a country’s economy at the expense of other countries.

- A common example is a trade war, where a country imposes heavy tariffs and strict quotas on imports to protect domestic industries.

- Central banks may also engage in currency wars by devaluing their domestic currency to make exports cheaper and imports more expensive.

| Origins of the Concept |

|

Arguments in Favor of Beggar-Thy-Neighbour Policies

- Supporters claim these policies help domestic industries by shielding them from foreign competition.

- Governments justify protectionism for national security and to nurture industries in their early stages.

- Currency devaluation can boost exports by making them cheaper and reduce imports by making them more expensive.

- A trade surplus resulting from higher exports and lower imports is seen as beneficial to a nation’s economy.

Criticism of Beggar-Thy-Neighbour Policies

- Critics argue that these policies can harm all nations, especially when countries retaliate with their own trade barriers.

- Trade wars and currency devaluations in the 1930s contributed to the Great Depression by reducing global trade and investment.

- In recent times, countries like China and Japan have been accused of devaluing their currencies to gain a trade advantage.

- The rise of populist policies, such as those under former U.S. President Donald Trump, has increased concerns over renewed trade wars.

Impact on Consumers and Producers

- These policies mainly benefit domestic producers who hold political influence.

- Consumers suffer as tariffs increase prices by restricting foreign supplies.

- Currency devaluation reduces the purchasing power of domestic consumers, making goods more expensive.

Conclusion

- Beggar-thy-neighbour policies provide short-term economic advantages but often trigger retaliatory measures, harming global trade and economic stability.

- Sustainable growth requires balanced trade policies, international cooperation, and prioritizing consumer welfare over protectionist measures.

| Practice Question: What do you understand about beggar-thy-neighbour policies? Evaluate the impact of such policies on global trade and economic stability. (150 Words /10 marks) |

4. India’s ‘Mission for Aatmanirbharta in Pulses’: A Push for Self-Sufficiency Amid Rising Imports

(Source – Indian Express, Section – Explained – Page No. – 21)

| Topic: GS3 – Agriculture |

| Context |

|

Analysis of the news:

Budget Allocation

- The 2025-26 Union Budget has allocated ₹1,000 crore to provide MSP-based procurement and post-harvest warehousing solutions, with NAFED and NCCF handling procurement from registered farmers.

Rising Dependence on Imports

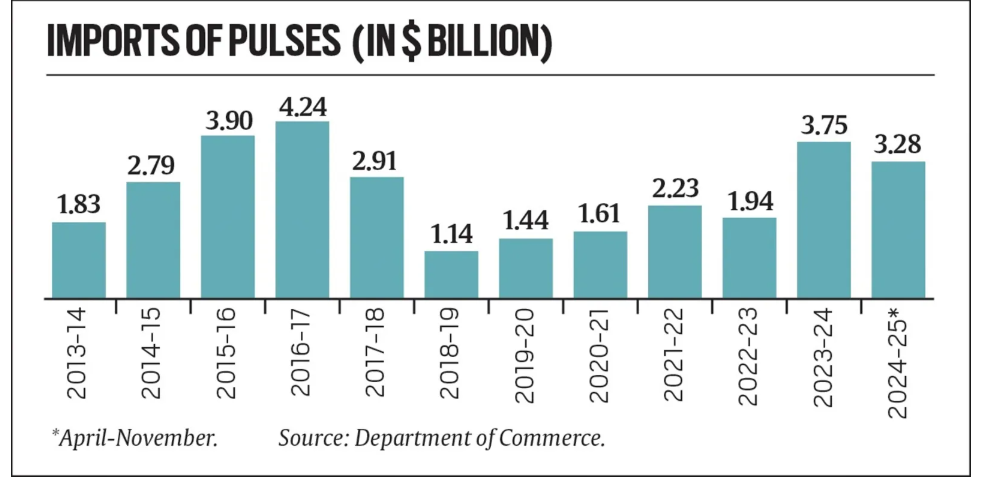

- Despite past efforts toward self-sufficiency, pulses imports have surged, reaching $3.28 billion during April-November 2024, a 56.6% increase from 2023.

- If this trend continues, imports may exceed $5.9 billion in 2024-25, surpassing the 2016-17 record of $4.24 billion.

- This marks a reversal of India’s earlier self-reliance, achieved between 2018-2023 when imports had significantly dropped.

Successes in Chana and Moong Production

Between 2013-14 and 2021-22, pulses production increased from 192.55 lakh tonnes (lt) to 273.02 lt, mainly due to higher yields of chana (gram) and moong (green gram).

- Chana production grew from 95.26 lt to 135.44 lt due to short-duration, low-irrigation varieties.

- Moong production rose from 14.56 lt to 36.76 lt, aided by photo-thermo insensitive varieties, allowing farmers to grow up to four crops annually.

- Government-backed MSP procurement further boosted production.

Challenges in Expanding Self-Reliance to Other Pulses

- Productivity and Cropping Constraints

- Tur/arhar remains a long-duration (150-180 days), low-yield crop (15-16 quintals/hectare), mostly grown in rainfed regions of Maharashtra and Karnataka.

- Yield improvements and hybrid development are essential to make cultivation competitive.

- Policy Ambiguity and Import Reliance

- While the government promotes pulses cultivation, tur/arhar prices (₹7,300-7,400 per quintal) remain below MSP (₹7,550), discouraging farmers.

- Import duty exemptions on most pulses (tur, matar, masoor, urad, desi chana) continue, impacting domestic production incentives.

- Imports mainly come from Mozambique, Tanzania, Myanmar, Sudan, Canada, and Australia.

Way Forward

- Develop short-duration, high-yield hybrid varieties, especially for tur/arhar, to increase productivity.

- Reinstate import duties to ensure price support for domestic farmers.

- Encourage private sector participation in research and supply chains.

- Improve post-harvest storage and procurement mechanisms to stabilize farmer incomes.

The success of this mission will depend on balancing farmer incentives, trade policies, and research advancements to achieve sustained Aatmanirbharta in pulses.

| Practice Question: India’s dependence on pulses imports has surged despite past achievements in self-sufficiency. Analyze the key challenges in achieving Aatmanirbharta in pulses and suggest measures to enhance domestic production and reduce import reliance. (150 Words /10 marks) |

5. Initiatives for the Empowerment of Divyangjans

(Source – https://pib.gov.in/PressReleseDetail.aspx?PRID=2099647®=3&lang=1 )

| Context |

|

Introduction to Initiatives

- These initiatives aim to empower Divyangjan (persons with disabilities) across India by ensuring equal opportunities, accessibility, and overall empowerment.

List of Initiatives

- Sugamya Bharat Abhiyan: An online platform introduced to empanel accessibility auditors for built environments, aiming to create inclusive infrastructure.

- Sugamya Bharat Yatra: A partnership initiative where Divyangjan will assess the accessibility of public spaces using the ‘Yes to Access’ app.

- Pathways to Access – Part 3 Compendium: A third installment that highlights key government documents related to employment, healthcare, and financial services for Divyangjan, providing them with necessary resources.

- High-Power Spectacles: Glasses developed by CSIR-CSIO to assist individuals with low vision, offering superior optical clarity and improving quality of life.

- Kadam Knee Joint: An innovation by IIT Madras and SBMT, providing enhanced mobility and durability, launched to improve the lives of Divyangjan.

- Awareness Generation and Publicity Portal: A digital platform that enhances transparency and efficiency under the Awareness Generation and Publicity Scheme.

- Standard Bharti Braille Code: A draft for a standardized Braille script in 13 Indian languages was introduced for public consultation to ensure consistency and compatibility.

- Braille Books Portal: A platform to facilitate the creation and submission of Braille books to support inclusive education.

- Employability Skills Book: A book released in 11 languages to bridge the gap between education and employment, helping Divyangjan achieve economic independence.

- Infosys Springboard Skill Programme: A collaboration with Yunikee to offer skill development courses for deaf learners across India.

- Google Extension for Persons with Hearing Impairment: A partnership to provide accessible sign language communication in entertainment, education, and information media for the Deaf community.

- E-Sanidhya Portal: A platform developed by Tata Power Community Development Trust and NIEPID to assist individuals with neuro-diversity, especially those affected by autism.

- Computer-Based Indian Intelligence Test: Developed by NIEPID, an indigenous intelligence test that is culturally relevant, with data from over 4,000 children across India.

Review and Monitoring

- The Department regularly reviews these initiatives and conducts follow-ups with stakeholders for improvements.

- The focus remains on strict policy implementation and strengthening monitoring mechanisms to address any gaps.

National Disability Information Helpline Service (NDIHS)

- Launched in January 2024, the NDIHS provides round-the-clock telephonic assistance, offering information about aids, assistive devices, educational and economic empowerment programs, and government schemes.

- The helpline has assisted around 65,000 people so far.

Conclusion

- These initiatives launched by the Department are vital steps toward ensuring equal opportunities and empowerment for Divyangjan.

- With regular monitoring and collaborative efforts, the initiatives aim to create a more inclusive society for persons with disabilities across India.

| Practice Question: Discuss the role of recent initiatives launched by the Department of Empowerment of Persons with Disabilities in promoting inclusion and empowerment of Divyangjan in India. (150 Words /10 marks) |

Prelims Facts

1. What is the Extremely Large Telescope?

(Source – The Hindu, International Edition – Page No. – 7)

| Context |

| The Extremely Large Telescope, under construction in Chile, aims to revolutionize astronomy by studying early galaxies, stars, and exoplanet atmospheres. |

Extremely Large Telescope (ELT):

- The Extremely Large Telescope (ELT) is a $1.51 billion project by the European Southern Observatory (ESO).

- Located in the Atacama Desert in northern Chile, it is under construction on Armazones Hill, 3 km above sea level.

- Expected to be completed by the end of 2028, it will be the world’s largest optical-infrared telescope.

- The telescope’s primary mirror will measure 39.3 meters, made up of 798 small mirrors.

- It will enable the study of the universe’s earliest stars and galaxies.

- Researchers aim to study exoplanet atmospheres for signs of life and improve our understanding of stars in other galaxies.

- The telescope will revolutionize astronomy, impacting various fields, from star formation to exoplanet exploration.

2. Trump orders creation of U.S. sovereign wealth fund

(Source – The Hindu, International Edition – Page No. – 13)

| Context |

| U.S. President Donald Trump signed an executive order to explore the creation of a U.S. government-owned sovereign wealth fund. |

What is Sovereign Wealth Fund?

- A Sovereign Wealth Fund (SWF) is a state-owned investment fund used to manage national wealth and assets.

- These funds invest in various assets, including stocks, bonds, real estate, infrastructure, and commodities.

- SWFs are usually created from budgetary surpluses, foreign exchange reserves, natural resource revenues, or trade surpluses.

- They aim to stabilize the economy, generate long-term returns, and support national development.

- Countries like Norway, China, Saudi Arabia, and the UAE have some of the largest SWFs.

- The Norwegian Government Pension Fund Global is the world’s largest SWF, managing over $1.4 trillion in assets.

- In the Indian context, the National Investment and Infrastructure Fund (NIIF) can be called India’s sovereign wealth fund, aimed at boosting infrastructure investment and attracting long-term capital for economic growth.

3. Tribhuvan Sahkari University: India’s First National Cooperative University to Boost Rural and Cooperative Sector Education

(Source – Indian Express, Section – Explained- Page No. – 21)

| Context |

|

Analysis of the news:

Location

- Located at the Institute of Rural Management Anand (IRMA) in Gujarat, the university will be an institution of national importance with a focus on cooperative sector training and research.

Objectives of the University

The Tribhuvan Sahkari University aims to:

- Provide technical and management education for the cooperative sector.

- Promote research and development in cooperatives.

- Establish sector-specific schools for dairy, fisheries, banking, finance, and more.

- Leverage digital learning platforms like SWAYAM for online education.

Why a Cooperative University?

- The cooperative sector plays a critical role in India’s economy, contributing significantly to agricultural credit, fertilizer production, sugar production, and milk procurement.

- However, the sector lacks standardized education and training infrastructure, making capacity-building crucial.

- The new university seeks to address these gaps by ensuring high-quality manpower for managerial, administrative, and technical roles.

How is it Different from Other Universities?

- Unlike conventional universities, Tribhuvan Sahkari University will focus exclusively on cooperatives.

- It will have affiliated colleges across states, emphasizing cooperative governance, finance, and law.

- This model is inspired by cooperative universities in Germany, Kenya, Colombia, and Spain.

Impact on IRMA

- IRMA, established by Dr. Verghese Kurien in 1979, will become a Centre of Excellence under the new university while retaining its autonomy.

- The IRMA society will be dissolved, and its role will be integrated within the broader framework of the university.