1 August 2024 : Indian Express Editorial Analysis

1. A Wayanad story

(Source: Indian Express; Section: The Editorial Page; Page: 10)

| Topic: GS3– Disaster Management |

| Context: |

|

The Broader Impact on Kerala

- Kerala’s resilience has been continually tested by severe weather events. The annual monsoons, once a time of relief and celebration, are now greeted with apprehension.

- The sense of security in homes and communities has been eroded. Between 2018 and the present, Kerala has faced five significant landslides in Kozhikode, Palakkad, Wayanad, and Malappuram districts, claiming the lives of 160 people.

- Data from the central government reveals that Kerala recorded the highest number of landslides in India between 2015 and 2022, with 2,239 incidents out of a national total of 3,782.

The Devastation of 2024

- The severity of the 2024 landslides in Wayanad is illustrated by the complete obliteration of two villages, Madikkai and Chooralmala, each home to about 1,000 people.

- These once-vibrant communities were swept away, leaving behind a trail of destruction and ongoing rescue challenges exacerbated by relentless rains.

The Reports and Their Resistance

- The recurring natural disasters have brought renewed attention to the Madhav Gadgil Committee (2011) and the K. Kasturirangan-led High Level Working Group (2013) reports.

- Both reports highlighted the ecological fragility of regions like Wayanad and recommended designating these as Ecologically Sensitive Areas (ESAs) with restrictions on construction, mining, quarrying, and other activities.

- Despite the clear environmental risks, these recommendations faced strong opposition.

- Protests erupted, driven by fears of eviction and economic disruption, particularly among settler-farmers in the high ranges.

- Accusations of inadequate stakeholder consultation and being overly “environmentally forward” led to significant public pressure, ultimately stalling the implementation of these measures.

The Need for a Balanced Approach

- The repeated natural disasters underscore that their occurrence may be inevitable, but the extent of their impact is shaped by human actions. Effective disaster management involves not only immediate rescue and relief efforts but also long-term strategies to build resilience.

- Wayanad’s plight highlights the necessity for environmental conservation measures that are inclusive and participatory. Policies must balance environmental sustainability with the developmental needs of local communities.

- As extreme weather events become more frequent, the need for robust infrastructure, political will, and environmental policies that consider the livelihoods of affected people becomes ever more critical.

- It is time to rebuild not just what has been lost but to construct a future that safeguards against recurring tragedies.

| Key Highlights of the Landslide Atlas |

|

Top States by Landslide Events:

Districts with Maximum Landslide Exposure:

Highest Landslide Density and Risk Exposure:

|

| PYQ: Disaster preparedness is the first step in any disaster management process. Explain how hazard zonation mapping will help in disaster mitigation in the case of landslides. (250 words/15m) (UPSC CSE (M) GS-3 2019) |

| Practice Question: Discuss the impact of recurring natural disasters on the socio-economic fabric of Kerala, highlighting the challenges faced by the residents during monsoon seasons. Critically analyze the effectiveness of the recommendations made by the Madhav Gadgil Committee (2011) and the K. Kasturirangan-led High Level Working Group (2013) in addressing these challenges. (250 words/15 m) |

2. An eye on debt

(Source: Indian Express; Section: The Ideas Page; Page: 11)

| Topic: GS3 – Indian Economy |

| Context: |

|

Unique Economic Factors and Challenges Across Indian States

- Each Indian state has distinct factors that drive its economy and unique challenges in achieving developmental goals.

- Fiscal outcomes, including deficits and debt levels, vary significantly across states despite common constitutional rules on borrowings.

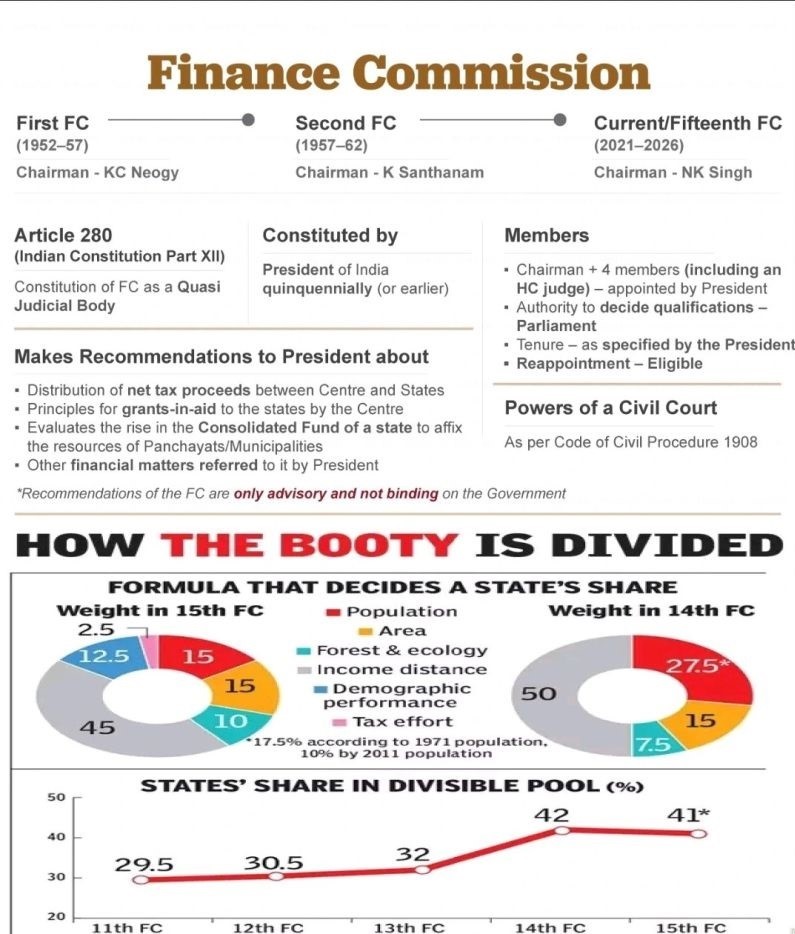

Future Fiscal Guidance by the 16th Finance Commission

- The 16th Finance Commission’s recommendations will shape state fiscal deficits from 2026-27 to 2030-31.

- It is assumed that state fiscal deficits will remain at 3% of GDP in the medium term, which will determine the net borrowing ceiling (NBC) set by the Government of India for each state annually.

- The gross borrowings permitted each year are calculated by adding the fiscal redemption amount to the NBC.

Shift from Central Loans to Market Borrowings

- Historically, central government loans were the primary debt source for state governments until the 12th Finance Commission recommended the Centre withdraw from state borrowings.

- Since 2006-07, market borrowings have become the main funding source for states. Market borrowings surged from Rs 4.8 trillion in 2018-19 to Rs 10.1 trillion in 2023-24.

- The stock of state government securities (SGS) is estimated to reach Rs 56.5 trillion by end-March 2024, growing faster than the central government securities (G-secs).

Projected SGS Redemptions and Borrowings

- The current debt stock indicates that SGS redemptions will peak at Rs 20.7 trillion between 2025-26 and 2029-30 and Rs 18 trillion in the subsequent four years, driven by states like Uttar Pradesh, Tamil Nadu, Maharashtra, Karnataka, and Gujarat.

- This trend suggests elevated gross market issuance by state governments over the next decade.

Variations in Borrowing Tenors

- The tenor of securities issued by states influences the redemption profile of market borrowings. Until 2011-12, most states borrowed primarily in the 10-year segment.

- Recently, some states have opted for shorter tenors, while others have issued debt with tenors ranging from 15 to 40 years.

Roll-over Risk and Weighted Average Maturity

- Debt issuers face roll-over risk when large amounts need refinancing. The weighted average maturity of debt stock is a key measure of this risk.

- A longer average maturity indicates lower near-term roll-over risk. The weighted average maturity of SGS was 8.5 years at end-March 2024, up from 6.7 years at end-March 2019, benefiting from increased issuance of longer-term papers.

State Preferences for Longer-Tenor Borrowings

- In 2023-24, states like Andhra Pradesh, Karnataka, Kerala, Madhya Pradesh, Punjab, Telangana, and West Bengal issued 75-100% of their debt in longer tenors due to relatively attractive long-term interest rates and high front-ended redemption profiles.

- Conversely, Gujarat and Chhattisgarh predominantly borrowed in shorter tenors.

Evolution of Central Loans Amidst the Pandemic

- As market borrowings became predominant and previous loans were repaid, the stock of central loans declined.

- However, new forms of loans emerged during the Covid-19 pandemic, including back-to-back GST compensation loans and 50-year interest-free loans from the Centre.

GST Compensation Loans and Interest-Free Capex Loans

- Out of Rs 2.7 trillion in GST compensation loans raised in 2020-21 and 2021-22, Rs 781 billion has been repaid using GST compensation cess collections.

- The remaining Rs 551 billion is due in June and November 2025, and Rs 1.4 trillion in April 2026.

- The interest-free capex loan scheme has significantly increased from Rs 118 billion in 2020-21 to Rs 1.3 trillion in the current budget.

- Future allocations under this scheme will impact states’ resources for capital spending and market borrowings.

| Practice Question: Examine the variations in fiscal outcomes across Indian states, highlighting the shift from central loans to market borrowings. Discuss the impact of the 16th Finance Commission’s recommendations on state fiscal deficits and debt management practices. (250 words/15 m) |