19 July 2024 : Indian Express Editorial Analysis

1. ALL-WIN

(Source: Indian Express; Section: The Editorial Page; Page: 10)

| Topic: GS2– Governance – Government Policies and Intervention GS2 – Social Justice – Health |

| Context: |

|

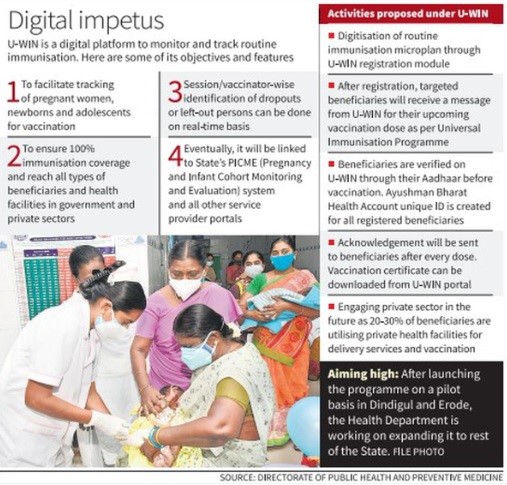

About U-WIN Portal

- It is aiming to maintain an electronic registry of routine immunizations.

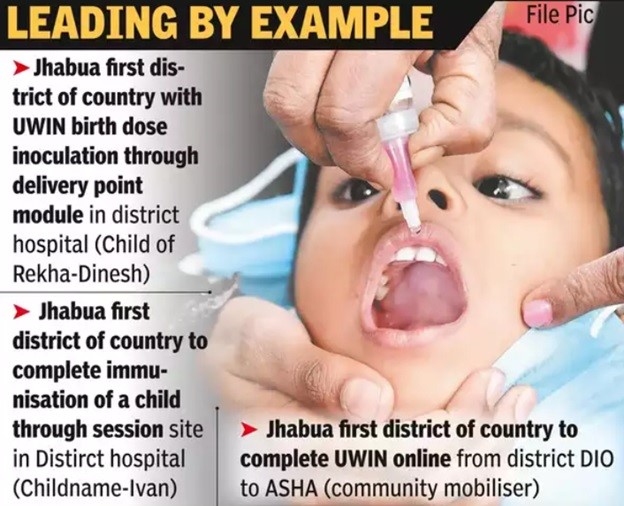

- Currently, U-WIN is in pilot mode across all states and Union Territories, except for West Bengal.

- It captures every vaccination event for pregnant women and children under the Universal Immunization Programme (UIP).

- It will ensure timely administration of vaccine doses by digitally recording every vaccination event under the Universal Immunisation Programme among all pregnant women and children aged 0-5 years.

Features

- The platform generates a uniform QR-based, digitally verifiable e-vaccination certificate, similar to Covid vaccination certificate, which can be accessed anytime by the citizens through a single click.

- The U-WIN is going to be the single source of information for immunisation services which will record pregnancy details and outcome, newborn registration and immunisation at birth.

- It will update vaccination status, and delivery outcome, among others, in real time.

- Citizens can self-register for vaccinations via the U-WIN web portal or its Android mobile application, select preferred vaccination centres, and schedule appointments.

- Automated SMS alerts inform citizens about registration confirmations, administered doses, and upcoming dose reminders, ensuring timely and age-appropriate vaccinations.

- It also facilitates the creation of Ayushman Bharat Health Account (ABHA) IDs for comprehensive health record maintenance.

- It also supports the frontline workers to digitally record all vaccination events for children and pregnant women for complete, accurate and easy record maintenance.

What is Universal Immunization Programme (UIP)?

- UIP is one of the largest public health programmes targeting close of 2.67 crore newborns and 2.9 crore pregnant women annually.

- Under UIP, immunization is providing free of cost against 12 vaccine preventable diseases:

- Nationally against 9 diseases – Diphtheria, Pertussis, Tetanus, Polio, Measles, Rubella, severe form of Childhood Tuberculosis, Hepatitis B and Meningitis & Pneumonia caused by Hemophilus Influenza type B

- Sub-nationally against 3 diseases – Rotavirus diarrhoea, Pneumococcal Pneumonia and Japanese Encephalitis;

- A child is said to be fully immunized if child receives all due vaccine as per national immunization schedule within 1st year age of child.

Major milestones

The two major milestones of UIP have been the elimination of polio in 2014 and maternal and neonatal tetanus elimination in 2015.

Current System and Its Limitations

- Under the current system, inoculation data is recorded manually by ASHA workers and then collated in state and national-level registries—a process that usually takes more than a month.

- Immunisation at private healthcare facilities is often not recorded. U-Win will capture every vaccination event and ensure the availability of real-time vaccination data to healthcare policymakers.

- Such information flows could improve planning and lead to more responsive, outbreak-averting interventions.

Evolution and Achievements of the UIP

- In 1978, India’s first national immunisation programme against multiple diseases—then called the Expanded Programme for Immunisation—comprised four vaccines.

- Today, the UIP targets 12 diseases.

- National Family Health Survey (NFHS) data show that close to 80 percent of children in the 12-23 month age bracket have received the recommended vaccines.

- Despite disruptions during the COVID-19 pandemic, the vaccination drive picked up in 2022.

- However, WHO-UNICEF data for last year indicate a minor dip in the percentage of children inoculated against diphtheria, pertussis, and tetanus.

Challenges and Potential of U-Win

- Surveys have highlighted concerns such as the exclusion of a section of India’s migrant population from the UIP or their not receiving timely jabs.

- Another significant challenge is reducing the number of children who drop out from the vaccination program. U-Win, which can be accessed from any geographic location, could be a game-changer.

- It has the potential to improve vaccine coverage among disadvantaged groups, ultimately reducing infant mortality rates. Parents will receive SMS alerts on the date for the next jab and can book slots in advance anywhere in the country without having to carry physical records.

- However, authorities must ensure that India’s digital divide does not prevent beneficiaries from keeping their appointments with the vaccinator.

Role of Digital Platforms

- During the COVID-19 pandemic, the CoWIN platform played a key role in vaccine delivery.

- Another portal, e-Vin, has been tracking vaccine-related cold chain logistics since 2015, ensuring an 80 percent reduction in instances of vaccine stock-outs.

- Now, U-Win is slated to become the world’s largest immunisation registry. The country’s impressive suite of digital delivery systems should pave the way for making the UIP more expansive.

Future Directions

- There is a compelling case for including additional vaccines, such as the HPV vaccine, in the UIP.

- The successful integration of digital platforms like U-Win will not only streamline the immunisation process but also ensure higher coverage and better health outcomes for India’s population.

| What are the Major Global Initiatives Related to Immunization? |

|

Immunization Agenda 2030 World Immunization Week Expanded Programme on Immunization (EPI):

|

|

PYQ: ‘Mission Indradhanush’ launched by the Government of India pertains to (2016) (a) immunization of children and pregnant women Ans: (a) |

| Practice Question: Discuss the impact of India’s Universal Immunisation Programme (UIP) on public health, highlighting the challenges faced and the potential benefits of introducing a digital vaccination registry like U-Win. How can such a digital platform address the existing issues and improve vaccination coverage, especially among disadvantaged groups? (250 words/15 m) |

2. DISABLING THE DISABLED

(Source: Indian Express; Section: The Editorial Page; Page: 10)

| Topic: GS2 – Social Justice – Vulnerable sections |

| Context: |

|

Discriminatory Tax Regime

- Revenue policymakers in India have created a regime that not only discriminates against the disabled but goes a step further by effectively penalizing them for their disability.

- This is surprising given Prime Minister Narendra Modi’s expressed concern for the disabled, whom he refers to as “divyang,” meaning divine in Hindi.

- The constitutional position regarding this blatant illegality is clear: a tax regime that penalizes movement and learning—activities for which able-bodied individuals do not pay any tax—fails the test of reasonableness under Article 14 of the Constitution.

- Even without applying complex legal principles, the unfairness of this taxation is evident to any layperson.

Case Study: The Burden on Wheelchair Users

- Consider the case of a wheelchair user who pays five percent GST on a motorized wheelchair costing Rs 1 lakh. If the life of the wheelchair is taken to be 500 kilometers, the tax burden on the disabled user can be easily calculated as Rs 10 per kilometer.

- An able-bodied person would naturally scoff at the notion of having to pay the government a tax for every kilometer they walk.

- Similarly, a blind person today must bear the tax burden of a Braille publisher, an additional levy solely because of their blindness.

- Such a tax on goods used by people with disabilities for their movement and to acquire knowledge amounts to explicit and severe discrimination.

Constitutional Challenges and Judicial Precedents

- The Supreme Court of India has had numerous occasions to test the constitutionality of taxes levied by the government in landmark cases such as Sakal Papers (1961), Indian Express (1984), and more recently, Aashirwad Films (2007).

- The judiciary has consistently struck down any tax, cess, or duty that indirectly curtailed a fundamental right.

- In Sakal Papers, the Supreme Court struck down government-imposed restrictions on advertising in newspapers, noting that reduced advertising would lower newspaper circulation, thus impacting the citizen’s fundamental right to free speech and expression under Article 19(1)(a).

- Similarly, in Indian Express, the Supreme Court struck down the customs duty imposed on newsprint, terming such a levy as a burden on the common man for being literate and conscious of his duty to inform himself about the world.

- In Aashirwad Films, the Court struck down a discriminatory tax on non-Telugu movies in Andhra Pradesh, terming it “socially divisive.”

The Way Forward: Repealing Discriminatory Taxes

- The tax imposed on disability aids perpetuates negative stereotypes against those who are disabled by expressly penalizing their disability, unlike their able-bodied counterparts who bear no such tax burden for performing basic tasks like walking and reading.

- Such a tax regime should not remain in effect in 2024. Even under Article 15, which prohibits discrimination on grounds of “place of birth,” this tax fails.

- The phrase “place of birth” must be interpreted to include individuals with disabilities, and on this ground too, the tax must be struck down.

- The Rights of Persons with Disability Act, enacted by the government in 2016, specifically prohibits discrimination against persons with disabilities under Section 3.

- Chief Justice DY Chandrachud, in a landmark 2021 judgment on Article 15 (Lt. Col. Nitisha), emphasized the need to recognize indirect discrimination.

Conclusion

- Even though the GST revenue collected from disability aids is minuscule compared to the total, the issue is one of dignity for the disabled.

- By taxing them for basic activities such as movement and reading, society sends a message not of empowerment but of inferiority.

- Repealing this discriminatory tax would be a significant step towards ensuring equality and dignity for all citizens, regardless of their physical abilities.

| Rights of Persons with Disabilities Act, 2016 |

|

| PYQ: Does the Rights of Persons with Disabilities Act, 2016 ensure effective mechanism for empowerment and inclusion of the intended beneficiaries in the society? Discuss. (150 words/10m) (UPSC CSE (M) GS-2 2017) |

| Practice Question: Discuss the implications of the Goods and Services Tax (GST) on essential mobility aids for disabled individuals in India. How does this align with constitutional principles and judicial precedents? Suggest measures to address any disparities. (250 words) |