24 July 2024 : Indian Express Editorial Analysis

1. A SETBACK FOR THE FARM

(Source: Indian Express; Section: The Editorial Page; Page: 14)

| Topic: GS3– Indian Economy – Government Budgeting GS3 – Agriculture |

| Context: |

|

GDP Growth

- In the fiscal year 2023-24, the Indian economy demonstrated robust growth with an overall GDP increase of 8.2%.

- Projections suggest that this upward trajectory will continue, with growth expected to remain above 7% in FY25.

- However, a sectoral analysis reveals a contrasting scenario in agriculture, where growth declined significantly from 4.7% in FY23 to just 1.4% in FY24.

- This discrepancy suggests that while the overall economy is thriving, the agricultural sector is facing challenges that need to be addressed.

Budget Allocation for Agriculture

- Despite the decline in agricultural growth, the budget did not provide a substantial boost to this sector.

- The allocation for the Department of Agricultural Research and Education (DARE) increased marginally by 0.7%, from Rs 98.8 billion in FY24 to Rs 99.4 billion in FY25.

- This increment falls short of expectations and, when adjusted for inflation, represents a real-term decrease.

- The limited budget increase raises concerns about the future of agricultural productivity and climate resilience.

Investment in Agricultural Research and Development

Returns on Agri-R&D

- Investment in agricultural research and development (agri-R&D) is known to yield high returns, with marginal returns over 10 times the investment.

- For instance, an additional investment of Rs 1,000 crore can potentially generate Rs 10,000 crore in agri-GDP. However, the budget figures indicate insufficient support for this critical area.

Historical and Current Expenditure

- Research data shows that in 2020-21, agricultural R&D expenditure reached Rs 160 billion, with 89% from the public sector and 11% from the private sector.

- The Agriculture Research Intensity (ARI) ratio, which peaked at 0.75% in 2008-09, has decreased to 0.43% in 2022-23 and is projected to decline further in FY25.

- This downward trend poses risks to food security and efforts to curb food inflation.

Budget Allocation for Agriculture and Allied Sectors

Overall Allocation

- The budget for agriculture and allied sectors is Rs 1.52 trillion for FY25. The Ministry of Agriculture and Farmers’ Welfare received Rs 1.22 trillion, marking a modest increase of 5% from the previous year. However, this increase barely offsets inflation.

- The Ministry of Fisheries, Animal Husbandry, and Dairying saw a more substantial increase of 27%, from Rs 56 billion in FY24 to Rs 71 billion in FY25, indicating a positive shift for this growing sector.

Welfare Measures and Subsidies

- A significant portion of support for the agriculture sector comes from welfare measures and subsidies.

- Key components include food and fertilizer subsidies and the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA).

- The total projected expenditure for these measures is Rs 5.52 trillion for FY25, slightly less than the revised estimate of Rs 5.8 trillion for FY24.

- This support constitutes 11.5% of the overall budget and 21.4% of the central government’s net tax revenue.

Food Subsidy

- The food subsidy is budgeted at Rs 2.05 trillion, a slight decrease from Rs 2.12 trillion in FY24.

- Despite the reduction, the subsidy continues to benefit consumers significantly, particularly through the PM-Garib Kalyan Yojana, which provides free rations to over 800 million people.

- While politically advantageous, the necessity of maintaining this level of support is debatable, especially given the FM’s assertion that 250 million people have been lifted out of multi-dimensional poverty in the past decade.

Policy Implications and Future Directions

Economic Survey Insights

- The Economic Survey 2023-24 acknowledges the need to reorient agricultural policies to better align with farmers’ interests and environmental sustainability.

- Current policies have boosted productivity but at the cost of soil fertility, groundwater levels, and increased greenhouse gas emissions.

- These adverse effects highlight the urgent need for sustainable farming practices that benefit both the environment and the agricultural community.

Transformative Potential

- Effective policymaking can transform agriculture into a growth engine by re-orienting subsidies to generate higher value addition, boost farmers’ incomes, and create opportunities in food processing and exports.

- While the current budget has made some strides, much of this transformative potential may be left for future budgets to realize fully.

| Practice Question: Discuss the implications of the budget allocations for the agricultural sector in India for the fiscal year 2023-24. Analyze the potential impact on agricultural productivity, food security, and the rural economy. What policy changes would you recommend to address the challenges faced by the agriculture sector? (250 words/15 m) |

2. A five-year roadmap

(Source: Indian Express; Section: The Ideas Page; Page: 15)

| Topic: GS3– Indian Economy – Government Budgeting |

| Context: |

|

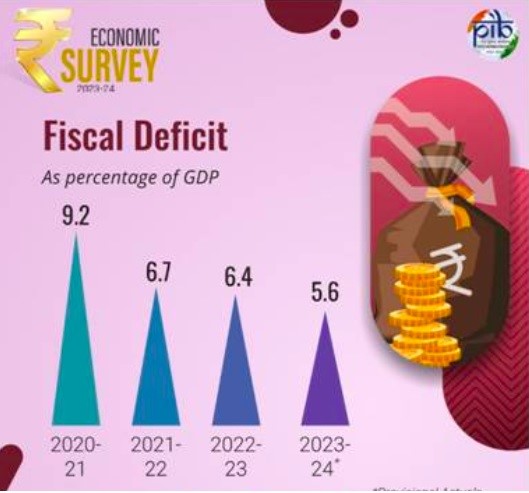

Resource Allocation and Fiscal Space

- In recent years, increased tax revenues have allowed for greater fiscal space, which has been utilized to augment spending on various programs. However, this year’s budget uses some additional resources for fiscal consolidation.

- The surplus expected from the Reserve Bank of India contributes significantly to this effort. There are also minor adjustments in expenditure and tax revenue compared to the interim budget.

- This dual focus on fiscal consolidation and spending highlights the government’s balanced approach to managing fiscal resources.

Medium-Term Economic Interventions

Addressing Economic Challenges

- The budget addresses key challenges highlighted by the Economic Survey 2023-24, particularly employability and infrastructure improvement. Several initiatives are proposed to enhance employability through skill development and increased employment via financial support for provident fund contributions.

- These measures aim to tackle critical issues facing the youth and infrastructure sectors.

- The announcement of an economic policy framework is a positive step, as it will help establish consistent medium-term expectations for upcoming reforms.

Tax Reforms and Changes

- The budget introduces significant changes in the tax domain. For indirect taxes, there is a focus on rationalizing GST rates and expanding the base, along with ongoing recalibrations of customs duties.

- Although the GST regime has been stable in recent years, some structural rationalization is necessary.

- The anticipated changes in the GST regime will complete its reform and establish a predictable system for taxpayers and governments.

- On the other hand, the customs duty regime continues to be adjusted to address various economic concerns, and a comprehensive framework could provide stability and predictability in this area.

Direct Taxes and Dispute Resolution

- The budget’s approach to direct taxes includes a proposal to review the Income Tax Act, aiming to make it concise, lucid, and easy to understand. A recurring theme is the reduction of disputes and litigation.

- The introduction of the “Vivad se Vishwas, 2024” scheme seeks to minimize revenue locked in litigation, and additional manpower will be allocated to address the backlog of first appeals cases.

- The budget also proposes limiting departmental appeals in cases involving small liabilities, focusing on dispute resolution. Addressing the root causes of disputes would further enhance this effort.

Addressing Inequality through Taxation

- Globally, there is a growing concern about increasing inequality and the need for higher taxes on the wealthy.

- The Economic Survey highlights the differential taxation of labor and capital income. The budget addresses this by raising taxes on both short-term and long-term capital gains while providing relief to retail investors by increasing the exemption to Rs 1.25 lakh.

- This initiative, along with an enhanced securities transaction tax on futures and options transactions, aims to temper capital market exuberance and bring medium-term stability.

Conclusion

Medium-Term Framework for Economic Stability

- While the budget introduces several elements of a medium-term framework, incorporating additional components would enhance economic stability and predictability.

- The combination of fiscal consolidation, targeted spending, tax reforms, and initiatives to address economic challenges sets a foundation for sustainable growth.

- However, a more comprehensive and detailed medium-term framework would further solidify these efforts, ensuring long-term stability and confidence in the economy.

| PYQ: One of the intended objectives of Union Budget 2017-18 is to ‘transform, energize and clean India’. Analyse the measures proposed in the Budget 2017-18 to achieve the objective. (250 words/15m) (UPSC CSE (M) GS-3 2017) |

| Practice Question: Analyze the fiscal consolidation measures and medium-term economic strategies proposed in the government’s budget for 2024-25. What additional steps can be taken to ensure a comprehensive and predictable economic policy framework? (250 words/15 m) |