26 August 2024 : Indian Express Editorial Analysis

1. One election, many questions

(Source: Indian Express; Section: The Ideas Page; Page: 09)

| Topic: GS2– Governance – Government policies – Interventions for development in various sectors |

| Context: |

| The article discusses the ongoing debate in India about implementing simultaneous elections for the Lok Sabha and state legislative assemblies, a proposal strongly supported by Prime Minister Narendra Modi. |

Introduction to the Issue of Simultaneous Elections

- The concept of simultaneous elections, which has been a subject of debate for over a decade, was reignited by the Prime Minister in his Independence Day speech this year.

- The Prime Minister expressed his determination to implement the idea, potentially by the 2029 general elections.

- This idea, which aims to synchronize the elections for the Lok Sabha and state legislative assemblies, has been a recurring topic in Indian political discourse.

- The proposition has sparked various reactions and debates, with both support and opposition from different quarters.

Historical Context and Committees Involved

- The notion of simultaneous elections has been advocated by Narendra Modi since before he became Prime Minister in 2014.

- He emphasized the need for simultaneous elections to reduce the exorbitant costs and disruptions to normal development activities caused by frequent electoral cycles.

- Over the years, several committees have been tasked with exploring the feasibility of this proposal. However, they have struggled to find an acceptable solution that balances the logistical, legal, and political challenges involved.

- The most recent effort was led by a high-level committee chaired by former President Ram Nath Kovind, which was focused on providing concrete steps for implementation rather than debating the pros and cons.

Findings of the Committee and Public Opinion

- The Kovind committee presented its extensive report after 191 days of deliberation, comprising 18,626 pages across 21 volumes.

- The report included inputs from a wide range of stakeholders, including political parties, legal experts, and the general public.

- According to the report, a significant majority (80%) of the 21,558 responses favored simultaneous elections. Among the 47 political parties consulted, 32 supported the idea, while 15 opposed it, citing concerns about its potential to marginalize regional parties and shift India towards a presidential form of government.

- Despite these concerns, the committee’s research suggested that the necessary constitutional amendments to enable simultaneous elections would not be anti-democratic or anti-federal in nature.

Critique of the Committee’s Recommendations

- While the report was comprehensive, the proposed solutions have been met with criticism.

- One significant point of contention is the exclusion of Panchayat elections from the simultaneous election proposal.

- The committee suggested holding Panchayat elections within 100 days of the general and Vidhan Sabha elections, which critics argue undermines the concept of simultaneous elections.

- This approach would require substantial logistical efforts, including setting up polling stations, training staff, and deploying security forces twice within a short span, which could exhaust electoral resources and voter participation.

- Additionally, the report’s recommendation for handling situations where state legislative assemblies are dissolved prematurely has also been criticized.

- The proposal to hold fresh elections for a truncated term until the next simultaneous election is seen as impractical and counterproductive, as it would not truly eliminate the need for mid-term polls.

- This has led to skepticism about the sincerity of the proposal, with some critics questioning whether the government’s actions align with its stated intentions.

Concerns Over the Implementation and Costs

- The report also highlighted the significant logistical requirements for implementing simultaneous elections, such as the need for a vastly increased number of electronic voting machines (EVMs) and voter-verifiable paper audit trails (VVPATs).

- However, the report did not specify the costs involved, which critics argue is a glaring omission given that cost reduction was a primary justification for the proposal.

- The potential financial burden of acquiring and maintaining the necessary equipment and resources could be substantial, casting doubt on the feasibility of the plan.

Conclusion: The Debate on Simultaneous Elections

- The proposal for simultaneous elections remains a contentious issue in Indian politics. While the idea has garnered significant support, it also faces substantial opposition due to concerns about its impact on the federal structure, regional parties, and the practicality of its implementation.

- The Kovind committee’s report, though exhaustive, has not fully alleviated these concerns.

- The debate continues, with questions about the sincerity of the government’s commitment to the proposal and the broader implications for India’s democratic system.

| PYQ: ‘Simultaneous election to the Lok Sabha and the State Assemblies will limit the amount of time and money spent in electioneering but it will reduce the government’s accountability to the people’ Discuss. (150 words/10m) (UPSC CSE (M) GS-2 2017) |

| Practice Question: Discuss the feasibility and implications of implementing simultaneous elections for the Lok Sabha and state legislative assemblies in India. What are the potential benefits and challenges, particularly in terms of cost, federalism, and the democratic process? (250 words/15 m) |

2. The ease of financing

(Source: Indian Express; Section: The Ideas Page; Page: 09)

| Topic: GS3– Indian Economy |

| Context: |

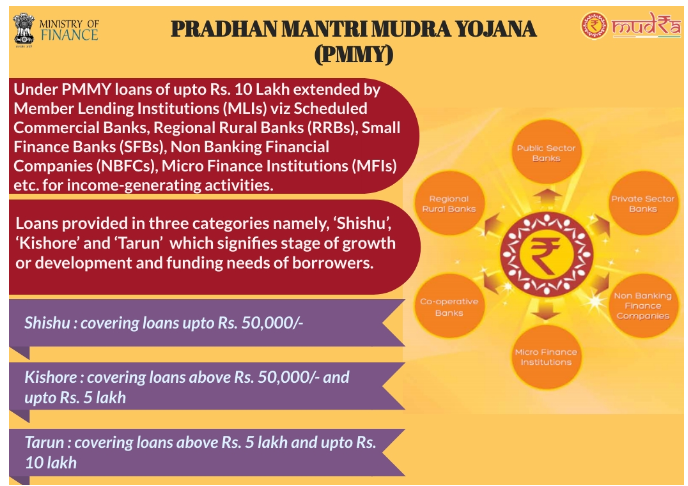

| The article discusses the Pradhan Mantri MUDRA Yojana (PMMY), a government scheme launched in 2015 to provide collateral-free micro-loans to small and micro-enterprises in India. |

Introduction to the Pradhan Mantri MUDRA Yojana (PMMY)

- The Pradhan Mantri MUDRA Yojana (PMMY) was launched in 2015 by the Narendra Modi government with the goal of promoting entrepreneurship by providing collateral-free micro-loans of up to ₹10 lakh.

- These loans were aimed at supporting small and micro-enterprises, particularly those that had limited access to formal credit.

- The Union Budget 2024 further expanded the scheme by increasing the loan limit to ₹20 lakh, especially targeting the Tarun category of loans.

- This move is set to benefit previous beneficiaries who have repaid their loans, but it also highlights the need to assess the success of MUDRA 1.0 and explore ways to enhance the scheme under a proposed MUDRA 2.0.

- Funding Provision:

- It is provided by Member Lending Institutions (MLIs) i.e. Scheduled Commercial Banks (SCBs), Regional Rural Banks (RRBs), Non-Banking Financial Companies (NBFCs) and Micro Finance Institutions (MFIs).

- Types:

- The loan can be used for income-generating activities in the manufacturing, trading, services sector, and agriculture.

- There are three loan products under PMMY:

- Shishu (loans up to Rs. 50,000)

- Kishore (loans between Rs. 50,000 and Rs. 5 lakh)

- Tarun (loans between Rs. 5 lakh and Rs. 10 lakh).

Achievements of MUDRA 1.0

- Since its inception, MUDRA 1.0 has disbursed over ₹27.75 lakh crore to approximately 47 crore small and new entrepreneurs.

- This massive financial injection has significantly impacted the grassroots economy, providing much-needed credit to those previously excluded from formal financial systems.

- The scheme’s inclusive approach has been a key feature, with 69% of loan accounts held by women and 51% by SC/ST and OBC entrepreneurs.

- This focus on marginalized groups has not only promoted gender equality and social equity but also allowed a broader section of society to participate in the country’s economic growth.

- Additionally, MUDRA 1.0 has been instrumental in creating jobs, especially in rural and semi-urban areas, by encouraging self-employment and supporting the development of small businesses.

Challenges Faced by MUDRA 1.0

- Despite its successes, MUDRA 1.0 encountered several challenges. One significant issue was ensuring that the benefits reached the intended target groups, particularly the smallest and most marginalized entrepreneurs.

- While the scheme disbursed loans to millions, the distribution was uneven, with rural and remote regions lagging behind.

- For instance, in 2021-22, the top 10 districts received more than ₹26,000 crore, comparable to the amount sanctioned to the bottom 318 districts, indicating a regional imbalance in credit distribution.

- Additionally, inadequate monitoring and implementation led to leakages and misuse of funds, although the non-performing assets (NPAs) under the scheme have decreased from 3.61% in FY21 to 2.1% in FY24.

Financial Literacy and NPAs

- A significant challenge for MUDRA 1.0 was the limited financial literacy among beneficiaries. Many first-time borrowers lacked the knowledge to manage their loans effectively, leading to defaults and financial mismanagement.

- This issue was particularly evident in the Kishore and Shishu categories, where NPAs were consistently high. From FY20 to FY22, NPAs in these categories accounted for over 75% of bad loans under the scheme.

- The lack of business knowledge and skills among early-stage entrepreneurs contributed to these defaults, highlighting the need for comprehensive financial literacy programs.

Expanding MUDRA 2.0: Proposed Enhancements

- Given the experiences and challenges of MUDRA 1.0, the proposed MUDRA 2.0 aims to widen the scheme’s scope and improve its effectiveness.

- One of the key recommendations is to establish focused outreach and empowerment zones in rural and semi-urban areas.

- These centers would provide micro-entrepreneurs with access to comprehensive services, including financial literacy programs, mentorship, and business support.

- By consolidating these resources, the government can create an environment that empowers small businesses and ensures that the benefits of the scheme reach the most marginalized sections of society.

Financial Literacy and Credit Guarantee Mechanisms

- MUDRA 2.0 should also introduce nationwide financial literacy programs covering key topics such as budgeting, savings, credit management, investment strategies, and digital literacy.

- Empowering entrepreneurs with this knowledge will reduce default rates, improve financial health, and enhance business operations.

- Additionally, the Enhanced Credit Guarantee Scheme (ECGS) should be included in MUDRA 2.0 to encourage banks to lend more to small and micro-enterprises by providing a credit guarantee and reducing the risk for financial institutions.

Monitoring and Evaluation: Ensuring Efficiency and Transparency

- To address the issues of misuse and inefficiency, MUDRA 2.0 should implement a Robust Monitoring and Evaluation Framework (RMEF).

- Leveraging technology to track loan disbursements, utilization, and repayments in real-time will ensure transparency, minimize misuse, and improve the scheme’s overall efficiency.

- This framework should also include beneficiary impact assessments to measure the socioeconomic outcomes of the scheme and provide insights for policy enhancements, thereby building stakeholder trust and ensuring the long-term success of MUDRA 2.0.

Conclusion

- MUDRA 1.0 has made significant strides in promoting entrepreneurship and financial inclusion in India.

- However, to build on this success, MUDRA 2.0 must address the challenges of financial literacy, credit distribution, and monitoring.

- By expanding its scope and implementing robust support systems, MUDRA 2.0 can further empower micro-entrepreneurs and contribute to sustained economic growth.

| PYQ: Pradhan Mantri MUDRA Yojana is aimed at (2016) (a) bringing the small entrepreneurs into formal financial system (b) providing loans to poor farmers for cultivating particular crops (c) providing pensions to old and destitute persons (d) funding the voluntary organizations involved in the promotion of skill development and employment generation Ans: (a) |

| Practice Question: Evaluate the impact of the Pradhan Mantri MUDRA Yojana (PMMY) on financial inclusion and entrepreneurship in India. Discuss the challenges faced by the scheme and propose measures for enhancing its effectiveness in the context of a proposed MUDRA 2.0. (250 words/15 m) |