27 August 2024 : Indian Express Editorial Analysis

1. A win-win on pension

(Source: Indian Express; Section: The Ideas Page; Page: 11)

| Topic: GS2– Governance – Government policies – Interventions for development in various sectors |

| Context: |

| The article discusses the recent decision by the Maharashtra government to adopt the Unified Pension Scheme (UPS) for its employees, following a similar move by the Union government. |

Adoption of the Unified Pension Scheme (UPS) by Maharashtra

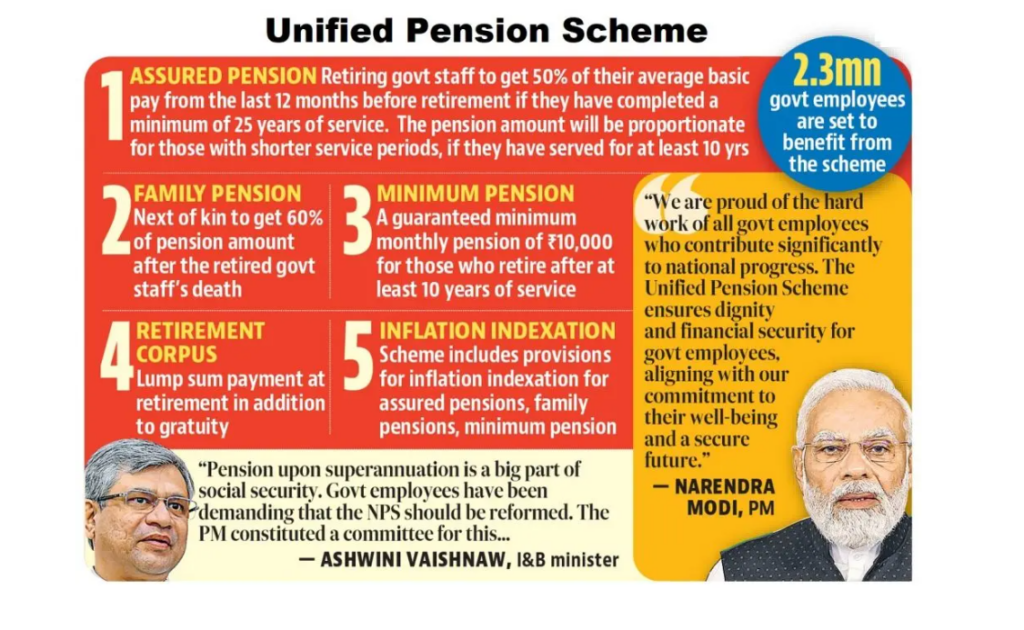

- In a swift move following the Cabinet decision to implement the Unified Pension Scheme (UPS) for 23 lakh Union government employees, the Maharashtra government decided to adopt the UPS framework for its employees.

- This decision underscores the success of cooperative federalism, a hallmark of Prime Minister Narendra Modi’s government.

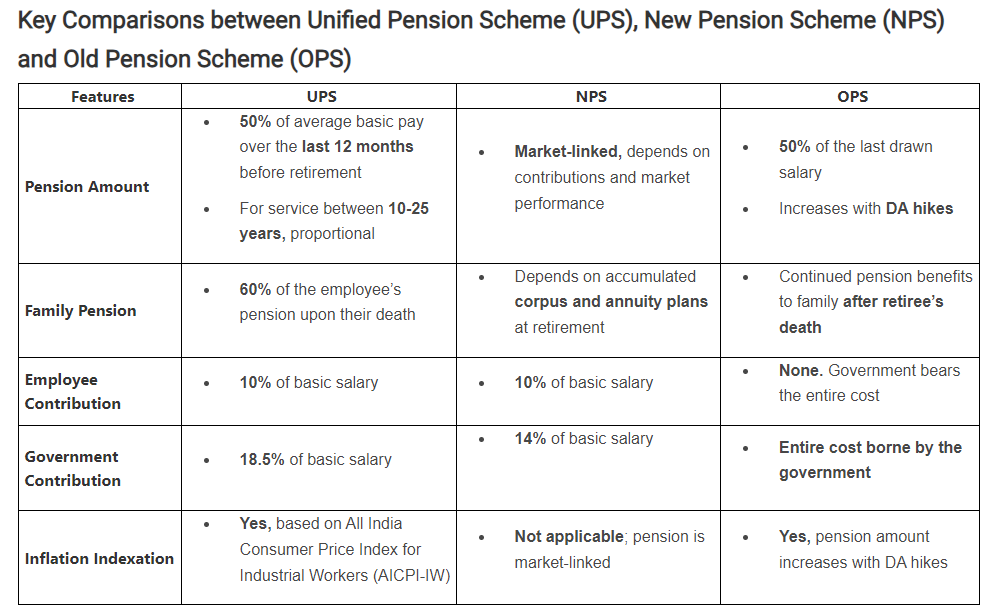

- The UPS framework, which ensures that pensioners receive 50% of their average basic pay from the last 12 months in service, preserves the contributory and funded nature of the pension system introduced by Prime Minister Atal Bihari Vajpayee.

- This move by Maharashtra, aligning with the Union government’s policy, is expected to be followed by other states, reflecting the collaborative spirit between the central and state governments.

The Risk of Reverting to the Old Pension Scheme (OPS)

- Several states, including Rajasthan, Chhattisgarh, Jharkhand, Punjab, and Himachal Pradesh, have recently reverted to the Old Pension Scheme (OPS) of the pre-2003 era.

- These states, led by non-NDA governments at the time, opted for the OPS, a non-contributory and unfunded scheme, as a short-term financial strategy.

- By reverting to OPS, these governments temporarily avoided contributing to pension funds, effectively deferring the financial burden to future administrations.

- The Reserve Bank of India (RBI) highlighted the fiscal risks of this reversion in its September 2023 bulletin, warning that the actual pension burden could increase by 4.5 times under OPS compared to the New Pension Scheme (NPS).

- The UPS, therefore, represents a more sustainable approach, balancing fiscal responsibility with the need to provide security for retirees.

Strengthening State Finances through Cooperative Federalism

- The Modi government has made significant strides in strengthening cooperative federalism by increasing tax devolution to states, incentivizing capital spending, and promoting transparency in state finances.

- The adoption of the UPS by Maharashtra aligns with these broader initiatives, ensuring that states have the fiscal space to invest in capital infrastructure, creating employment opportunities and improving the quality of life for their citizens.

- The central government’s support for state capital investment through interest-free loans and enhanced borrowing ceilings is designed to complement state budgets, not substitute them, fostering an environment conducive to growth and development.

Transparency and Fiscal Responsibility in State Borrowings

- A critical aspect of the government’s push for cooperative federalism is the emphasis on transparency and sustainability in state finances.

- The inclusion of borrowings by state public sector companies, corporations, and special-purpose vehicles (SPVs) in state budgets aims to prevent the off-budget borrowing practices that have strained state finances, as seen in Telangana.

- By addressing these issues, the government is plugging gaps in fiscal responsibility, ensuring that states can manage their finances more effectively and avoid the pitfalls of unsustainable debt.

The Unified Pension Scheme: A Win-Win for Stakeholders

- The UPS is a balanced policy that provides predictability for retired government employees while maintaining the contributory and funded nature of pensions.

- It represents a continuity of reforms initiated by previous governments, ensuring that employees who have dedicated their lives to public service receive fair and predictable pensions.

- Moreover, the UPS should be viewed as part of a broader strategy to boost state capital investment, promote fiscal transparency, and strengthen state finances.

- This comprehensive approach to governance reflects Prime Minister Modi’s commitment to cooperative federalism, making the UPS a significant achievement in his administration’s policy framework.

| Challenges with the Unified Pension Scheme (UPS) |

|

Following are the few challenges with the Unified Pension Scheme (UPS) that need to be considered: Transition Process: Merging different schemes could be complex and requires careful planning to ensure that existing beneficiaries are not disadvantaged. Funding and Sustainability: Ensuring the financial sustainability of the UPS is critical. This includes determining contribution rates, government support, and investment strategies to ensure long-term viability. Legal and Regulatory Framework: The implementation of the UPS would require significant changes to the existing legal and regulatory framework governing pension schemes in India. Higher burden on the Exchequer: The UPS set to provide an assured pension to 23 lakh eligible central government employees, will bring an additional financial burden of Rs 6,250 crore per year to the exchequer.

|

|

PYQ: [2017] Who among the following can join the National Pension System (NPS)? (a) Resident Indian citizens only. (b) Persons of age from 21 to 55 only. (c) All State Government employees joining the services after the date of notification by the respective State Governments. (d) All Central Government employees including those of Armed Forces joining the services on or after 1st April, 2004. Ans: c |

| Practice Question: Discuss the implications of the Unified Pension Scheme (UPS) on cooperative federalism and fiscal responsibility in India. How does the adoption of UPS by states compare with the risks associated with reverting to the Old Pension Scheme (OPS)? (250 words/15 m) |