3 August 2024 : Indian Express Editorial Analysis

1. EASING THE BURDEN

(Source: Indian Express; Section: The Editorial Page; Page: 14)

| Topic: GS3– Indian Economy |

| Context: |

|

Historical Context and Simplification Efforts

- In 1958, the Law Commission of India undertook the task of reorganizing the Income Tax Act of 1922 to simplify it.

- Experts recognized that true simplification required not just a reorganization of the Act but also a fundamental simplification of the tax structure. Decades later, the objectives of income tax reform remain focused on achieving simplicity and stability.

- Over the past five years, notable efforts have been made to improve the tax structure, reflecting the recommendations of previous tax committees, including the Direct Taxes Code of 2009.

Corporate Tax Reforms

- Significant changes in corporate taxation have been implemented to streamline the system and attract foreign investment.

- Corporate tax rates were reduced, and incentives are being phased out under the new tax regime.

- As a result, about 58% of corporate taxpayers opted for the new tax regime, reducing the effective tax rate from 29.49% in 2017-18 to 23.26% in 2021-22.

- The corporate tax rate for foreign companies was also lowered to 35%, and the angel tax was abolished.

Personal Income Tax Reforms

- Efforts to simplify personal income tax have led to fewer tax slabs and easier compliance, bringing more taxpayers into the system. Between assessment years 2019-20 and 2022-23, the number of taxpayers increased from 89.8 million to 93.7 million.

- The current budget further reduced the tax rate for incomes below Rs 12 lakh, impacting more than 80% of individual returns and 51% of the gross income filed.

- Despite a projected revenue loss of Rs 29,000 crore from these changes, it is less than the revenue foregone due to current exemptions and deductions.

Direct Tax to GDP Ratio and Tax Potential

- Despite reductions in tax rates, the direct tax to GDP ratio has increased. However, there is a belief that India has not yet reached its full tax potential.

- As the country aims for developed status by 2047, the role of tax policy in balancing growth and equality becomes crucial. One focus is on reforming the capital gains regime, a priority aligned with global trends post-COVID-19.

- The surge in capital markets and increased trading in futures and options have prompted policymakers to propose higher capital gains taxes on equity and higher securities transaction taxes.

Capital Gains Tax Reforms

- In the assessment year 2022-23, capital gains accounted for 11% of the gross incomes reported in tax returns. A significant portion of long-term capital gains were from high-value transactions, with 60% above Rs 500 crore and over 40% reported by corporates.

- The higher exemption limit of Rs 1.25 lakh on long-term gains is expected to benefit lower-income taxpayers. However, higher rates on equity and the removal of indexation are aimed at increasing revenue from wealthier asset holders.

- Rationalizing rates across asset classes and removing indexation benefits indicates a shift away from prioritizing certain investments.

Dispute Resolution and Certainty in Tax Application

- Certainty in the application of the Income Tax Act is essential for preventing and resolving disputes.

- The Vivad Se Vishwas scheme provides a means to settle long-standing disputes. Additionally, shortening the reassessment period and setting higher monetary thresholds for disputes are measures to reduce confrontations between taxpayers and the tax department.

- The government has expressed its intention to review the IT Act, aiming for a fundamental resolution of contentious sections through careful redrafting.

- This effort is expected to achieve the goals of simplification and meet the stated objectives.

Conclusion

- The journey towards a simplified and stable tax system in India continues, with significant reforms in corporate and personal income taxes and ongoing efforts to streamline capital gains taxation.

- The focus on reducing disputes and ensuring certainty in tax application is crucial for fostering a favorable tax environment.

- As India progresses towards its development goals, the effectiveness of these tax policies in balancing growth and equality will be pivotal.

| PYQ: What is the meaning of the term ‘tax expenditure’? Taking the housing sector as an example, discuss how it influences the budgetary policies of the government. (2013) |

| Practice Question: Discuss the key reforms in the Indian income tax system since 1958 aimed at simplification and stability. What further steps can be taken to enhance the effectiveness of the tax system in India’s pursuit of developed country status by 2047? (250 words/15 m) |

2. Before the landslide

(Source: Indian Express; Section: The Editorial Page; Page: 14)

| Topic: GS3 – Disaster Management |

| Context: |

|

Climate Factors: Warming of the Arabian Sea

- Climate experts attribute the landslide to extremely heavy rainfall caused by the warming of the Arabian Sea.

- The southeast Arabian Sea is becoming warmer, leading to atmospheric instability over large parts of the Western Ghats, including Kerala.

- This results in rain-laden areas with deep clouds moving southward, causing excessive rain.

Historical Warnings: Gadgil Committee Recommendations

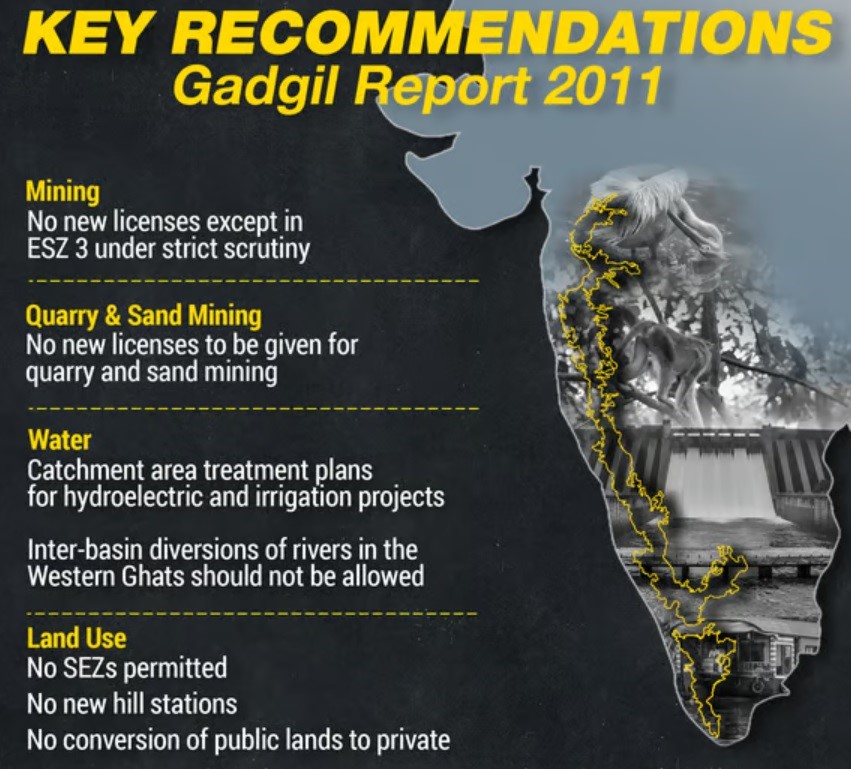

- In 2011, the Western Ghats Ecology Expert Panel, led by ecologist Madhav Gadgil, designated the region as an ecologically sensitive area (ESA).

- The Gadgil Committee recommended banning construction, mining, and quarrying activities in large parts of the Western Ghats, one of the world’s eight hottest biodiversity hotspots.

- Despite these warnings, unchecked construction and tourism-related activities have continued.

Unchecked Development: Impact on Wayanad

- Wayanad has become an eco-tourism hotspot, leading to rampant construction activities, including resorts, roads, tunnels, and quarrying, often without proper assessment of the region’s carrying capacity.

- Such activities have exacerbated the damage caused by landslides. Nearly half of Kerala consists of hills and mountainous regions with slopes exceeding 20 degrees, making these areas particularly prone to landslides during heavy rains.

Environmental Degradation: Forest Cover Decline

- A 2022 study on Wayanad’s depleting forests revealed that 62% of the district’s green cover disappeared between 1950 and 2018, while plantation cover rose by around 1,800%.

- The study indicated that about 85% of Wayanad’s total area was under forest cover until the 1950s.

- Now, the region is dominated by extensive rubber plantations, which are less effective in holding soil compared to the dense forest cover of pre-plantation times, increasing the intensity of landslides.

Unscientific Construction Practices

- Unscientific construction practices have greatly contributed to such disasters across hilly and mountainous regions.

- Experts highlight that extensive construction of roads and culverts in Kerala has not accounted for current rainfall patterns and intensities, relying instead on outdated data.

- This oversight leads to structures failing to accommodate river flow, resulting in significant destruction.

Ecological Sensitivity: Sustainable Land Management

- The Western Ghats have been classified as an ecologically fragile region. Recent research by the Indian Institute of Science divided the 1.6 lakh sq km of the Western Ghats into four ecologically sensitive regions (ESR).

- Promoting sustainable land management practices, such as reforestation, controlled deforestation, and sustainable agriculture, is crucial to maintaining hillside stability and reducing soil erosion, thereby mitigating the effects of heavy rains.

Recurring Disasters: The Need for Climate-Resilient Infrastructure

- Kerala has witnessed numerous climate-induced disasters over the past decade. In 2018, devastating floods killed over 400 people across the state.

- In 2020, 65 tea plantation workers were killed in a landslide in Idukki district. The following year, landslides and floods again claimed many lives in Idukki and Kottayam districts. Landslips and flash floods struck once more in 2022.

- These tragedies underscore the urgent need for climate-resilient infrastructure.

Conclusion: The Delicate Balance Between Nature and Human Activity

- The Wayanad tragedy is a stark reminder of the delicate balance between nature and human activity.

- It highlights the dire consequences of neglecting ecological warnings and the pressing need to adopt sustainable development practices to safeguard the environment and the lives dependent on it.

| What are the Government Initiatives to Mitigate Landslide Risks in India? |

|

National Landslide Risk Management Strategy (2019):

Landslide Risk Mitigation Scheme (LRMS):

Flood Risk Mitigation Scheme (FRMS):

National Guidelines on Landslides and Snow Avalanches:

Landslide Atlas of India:

|

| PYQ: Disaster preparedness is the first step in any disaster management process. Explain how hazard zonation mapping will help in disaster mitigation in the case of landslides. (250 words/15m) (UPSC CSE (M) GS-3 2019) |

| Practice Question: Discuss the impact of unchecked development and climate change on the ecological balance in regions like Wayanad. Analyze the recent landslide in Wayanad in the context of historical warnings and environmental degradation. What measures can be taken to promote sustainable development and prevent such disasters in the future? (250 words/15 m) |