Kurukshetra March 2023 Summary | Explained Point-Wise

Visionary Budget for Making India a Developed Nation

- The Indian agriculture sector has grown at an average annual growth rate of 4.6% during the last six years.

- It grew by 0% in 2021–22 compared to 3.3% in 2020–21.

- As a result of essential reforms undertaken by the government, the country has become the fifth-largest economy in the world.

- The budget aims:

-

- First to benefit small farmers.

- Then the emphasis is also laid on promoting the agriculture sector by linking agriculture sector with modern technological and scientific practices increasing production.

- Essential provisions in the budget for agriculture and allied sectors seek to reinforce the foundation of rural India.

Budget Allocation for Agriculture

- The total budgetary allocation for the Ministry of Agriculture and farmers’ welfare is Rs.1.25 Lakh crore. Much of this outlay is aimed at developing agriculture-related infrastructure in rural India.

- The Digital agriculture mission has been initiated to expedite the digitalisation of the agriculture A fund of Rs.450 crores is allocated for this mission.

- The method of natural farming has given a boost in recent years. If natural farming increases, there will be optimum utilisation of products from animal husbandry and bovines.

- Kisan Credit Cards: As per the economic survey, about 86% of small farmers are in the country. Therefore, small farmers benefit immensely from the Kisan credit card (KCC).

- For FPOs:

- The government has targeted providing all agriculture facilities by aggregating small farmers through farmer-producer organisations (FPOs).

- For this, 10,000 new FPOs are being formed across the country. The Constitution of FPO is regarded as a revolutionary step in tracing the quality of living of small and medium farmers.

- Food and nutritional security are one of the priorities of the government. An outlay of Rs.1623 crore has been assigned for the government’s ambitious scheme Pradhan Mantri Kisan Samman Nidhi.

- Agricultural Start-ups: To promote agriculture-related start-ups, the agriculture accelerator fund is being set up to encourage young entrepreneurs in agri start-ups.

- Millets will now be known as ‘Shree Anna’. The International year of millets is being celebrated under the leadership of India for 2023.

- Aatma Nirbhar Clean Plant Programme: To boost the availability of disease-free and quality planting material for high-value horticulture crops, Aatma Nirbhar Clean Plant Programme has been initiated with an outlay of 2200 crores.

- Under the Gobar Dhan scheme, 500 new ‘waste to wealth’ plants will be established to promote a circular economy for energy generation through agriculture and animal husbandry waste.

- Cooperative-based economic development model: With the motto of ‘Sahakar Se Samruddhi’, the government wants to promote a cooperative-based economic development model which can significantly increase the farmers’ income.

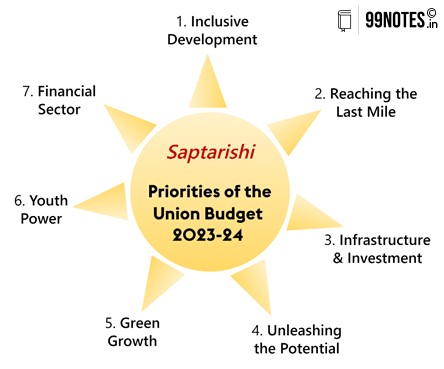

Development Directions in Budget

- The budget 2023–24 outlines seven priority areas and formulates policy intentions to achieve goals linked to these prioritised domains. The budget has outlined the government’s resolve to achieve the following:

- Inclusive development

- Connecting targeted clients and reaching the last mile.

- Boosting infrastructure and investment in rural India.

- Bringing innovation and technology for increasing productivity.

- Mitigating climate change and promoting green growth.

- Identification and consolidation of the power of youth.

- Strengthening the financial sector by effective financial inclusion.

- Higher allocation of resources for rural employment initiatives, animal husbandry, natural farming, food storage and warehousing indicate the government’s commitment to transforming rural areas into growth engines.

- To fulfil the above-mentioned targets, the government has initiated various programmes such as:

- National Mission on Natural Farming,

- National Rural Livelihood Mission,

- Deen Dayal Upadhyaya Grameen Kaushalya Yojana (DDUGKY) and

- many other initiatives.

- The budget seeks incremental, planned and participatory public investment and consequent public participation in growth and development initiatives. The planned government initiatives aim at inclusive development and reaching the last mile targets of disadvantaged sections of society.

Increasing farm Sector Production:

The government is focusing on increasing the farm sector’s production and productivity and farmers’ income. To achieve the expected goals of the government – the following steps must be taken:

- Reducing water stress by comprehensive water planning.

- Promoting natural and organic farming practices.

- During balanced use of fertilisers.

- Operation Green initiatives through the promotion of FPOs and cooperatives.

- Establishing and enhancing agri-logistic facilities. For example, warehousing, cold storage, refrigerated vans etc.

- Mapping and Geo-tagging are existing agriculture-related infrastructure.

- Connecting unconnected areas and building a national cold supply chain.

- Improving agri-marketing facilities for increasing farmers’ income. For example, e-NAM.

- Focusing on low-hanging fruits such as animal husbandry, milk processing and the food processing industry.

- Promoting the growth of fisheries and fodder farms to increase employment opportunities in rural India.

- Promotion of agri-tech industry and start-ups in rural India.

- Reposing faith in cooperatives and ensuring easy credit availability through primary agricultural credit societies (PACS) and formal means of a loan.

- Integrating existing programmes such as MGNREGA and NRLM with other allied government programmes to improve overall infrastructure in rural India.

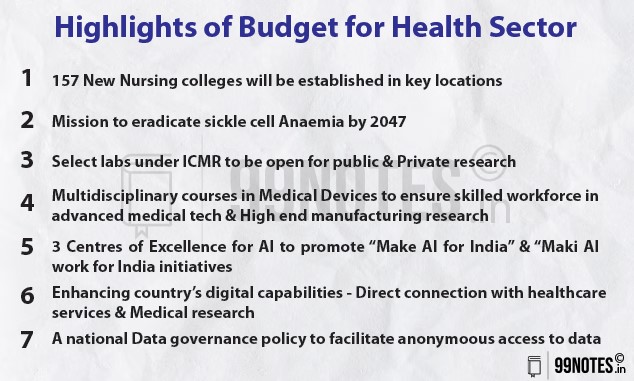

Efficient and Inclusive Healthcare Ecosystem

- The government is committed to building an efficient, affordable, accessible, inclusive and modern healthcare ecosystem in the country.

- The government’s desire is evident from the significant 3.5% increase in budget outlay this year for the health sector compared to last year’s allocation.

- India aims to emerge as a global centre for health care. The finance minister also expressed these intentions of making India the pharmacy of the world and promoting medical tourism in the country.

- India’s medical tourism industry is estimated at $9 billion, which makes India the 10th biggest global medical tourism hub.

Focus on skilled professionals:

- To meet the rising demand of the healthcare sector, the country needs a vast pool of skilled medical and healthcare professionals.

- For this, the budget includes provision for the creation of 157 new nursing schools across the country. This expansion of nursing schools will help close the gap in the number of nurses needed per bed.

- Further, under Skill India Programme – the government aims to bring together public and private sector institutions, academic institutions, the Ministry of health, state governments and the private sector to offer training courses, content and certifications.

Innovation and research:

- Approximately 3000 crores have been allotted to the Department of health research.

- Significant outlays have been made for ICMR and other health research institutions and organisations nationwide.

Important highlights in the budget related to the health sector

- Allocation for the Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana has increased by 12%, highlighting the government’s focus on expanding health coverage to over 400 million people were currently not recovered by any insurance scheme.

- The government has given special attention to the launch of a mission to eradicate sickle cell anaemia by 2047. This includes a focus on raising awareness and conducting universal screening of 700 million people between 0 to 40.

- The budget allocation for the AYUSH ministry has seen a significant increase of 28%.

Boosting Agriculture and Rural Development

- Enable rural development with a focus on agriculture and the allied sector has always been at the top of the development agenda in India. With the vision of “Sabka Saath Sabka Vikas and Sabka Vishwas”- the efforts in this direction have been accelerated over the last few years.

- In line with India’s targets of becoming a 5 trillion-dollar economy by the year 2025 and the third largest economy in the world by 2027 – it is highly essential to focus on the development of the rural economy.

Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS):

- MGNREGS is the most important among all of the schemes of rural development. The scheme was introduced in the year 2005 with an act of parliament.

- It seeks to strengthen the poor’s livelihood resource base by providing a hundred days of guaranteed wage employment per year to every rural household.

- In the recent past, the scheme has emerged as an important safety net for many rural workers who have been adversely affected by the COVID-19 pandemic.

- Owing to the lower demand for work under MGNREGA due to the solid agricultural growth and swift recovery from COVID-19-induced slowdown – the location for the MGNREGS has been reduced nearly by 33% compared to the last year.

Pradhan Mantri Awas Yojana- Gramin:

- The scheme aims to provide financial assistance to the rural poor to construct Pucca houses of 25 sq. mt, with all basic amenities.

- It includes providing drinking water, electricity connection, LPG gas connection and other amenities.

- In the last seven years, the government has dedicated significant efforts towards improving the housing situation in rural areas with the vision of ensuring housing for all.

Pradhan Mantri gram Sadak Yojana:

- The scheme’s primary objective is to provide economic activities in rural India by providing all-weather road connectivity to eligible rural habitations.

- The scheme has had an immensely positive impact on agriculture, health, education, and employment generation, thus providing access to essential services and lifting the income of rural masses.

National Rural Livelihood Mission:

- This scheme aims at creating diversified and gainful self-employment for the rural poor through sustainable livelihood enhancements and improved access to financial services.

- The scheme seeks to promote and strengthen the SHGs which in turn are expected to mediate the livelihood of the rural poor.

- The programme envisages covering all the rural poor households to be organised in 70–75 lakh self help groups at the village and cluster level by 2025.

National social assistance programme:

- NSAP is a welfare programme which comprises many sub-schemes aimed at providing public assistance to citizens in case of unemployment, old age, sickness and any form of disability.

Syama Prasad Mukherji Rurban Mission

- This is a unique programme, designed to deliver catalytic interventions to rural areas, on the growth threshold.

- Aims to develop a cluster of villages that preserve and nurture the essence of rural community life with a focus on equity and inclusiveness without compromising the facilities available in urban India.

- The main objective is to bridge the rural-urban divide viz; economic, technological and those related to modern facilities for stimulating local economic development.

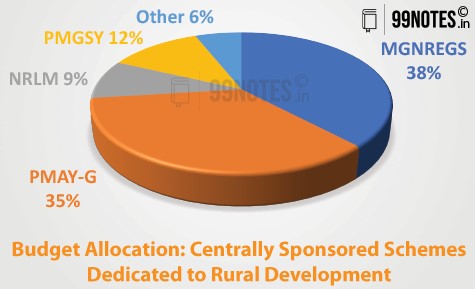

Budget allocation to centrally sponsored schemes related to rural development:

Way forward:

- As India is primarily a rural economy with economic inequalities and resource constraints, it is essential to promote economic activities.

- To attract unemployed educated youth to agriculture, agri-businesses and agri-entrepreneurship, impetus on creating scientific temper and fostering innovative spirit is the need of the hour.

- Public expenditure on social infrastructure is also needed to be prioritised to promote sustainable and inclusive growth.

- To reap the advantages of demographic dividend, it is imperative to improve educational standards and skilling of the rural youth, empowering rural women, providing affordable healthcare to all and enhance job opportunities.

MSME Sector on Growth Trajectory

- MSME primarily dominates India’s manufacturing sector. Therefore, it plays a critical role in achieving the objectives of faster and more inclusive growth in India due to its vast employment potential and contribution to total industrial output and exports.

- The contribution of the MSME sector to overall Gross Value Added (GVA) increased from 29.3% in 2018 to 30.5% in 2020.

- The MSME sector accounts for over 90% of industrial units, 40% of total manufacturing output and nearly 35% of India’s export.

Constraints to the growth of the MSME sector:

- Low-level technology in use

- Limited access to inputs and credits

- Unfavourable market environment

- Falling outside the ambit of formal business and labour regulations.

- Rural located Enterprises witness many locational disadvantages. e.g. logistics issues, storage issues etc.

- Disruptions in the supply chain.

- Lack of availability of skilled labour supply.

- Mismatch in the demand-supply ratio.

- Loss of revenue due to unforeseen COVID-19 pandemic.

- Lack of social safety net, delayed and irregular wage payments to workers in the MSME sector.

- Deferred and delayed payments from government/large industries.

Efforts taken by the government:

A series of efforts were initiated by the central government to help the MSME sector to transcend to a formal institutional network and gain from the services, schemes and programmes more systematically.

- The creation of digital identities such as:

- Aadhaar, and

- registration of unorganised workers on the e-shram portal.

- Registration of street vendors on the SVANidhi portal.

- Taxpaying of firms on GSTN and MSMEs on the Udyam portal has played a significant role in the inclusion of unorganised sector workers under the formal economic sector.

- To digitally empower the MSME sector, many IT-enabled porters and dashboards are being created. For example, MSME ‘SAMPARK’, MSME ‘Sambandh’, MSME ‘Samadhan’, MSME idea portal, Udyam Mitra etc.

- Schemes for small retailers:

- Various initiatives have been taken to provide an opportunity to small retailers, manufacturers and SHGs for greater outreach. For example, one district – one product (ODOP) scheme.

- E-marketplace facilities are proving very beneficial to the MSME sector, especially for the disadvantaged sections of the society. For example, the tribesindia.com portal by TRIFED helps tribal artisans.

- The budget 2023 has provided to infuse Rs.9000 crores in the corpus of CGTMSE.

- The national financial information Registry will be set up to serve as a nodal repository of financial and ancillary information and enable an efficient flow of credit.

- The National Logistics Policy (NLP) aims to reduce logistics costs from 13–14% to 8% of the GDP. This will encourage more MSMEs is to use Tech powered logistic services.

- Skill Development: Several programmes, such as Pradhan Mantri Grameen Kaushalya Yojana, skill India have been launched to provide a better-equipped and skilled labour force.

Way forward:

- Attempts should be made for the budgetary provisions to be duly executed and the benefits to reach the desired MSME industry.

- Improvements should be made in extension machinery, especially in rural areas, for better information dissemination.

- A robust mechanism should be designed to aggressively sensitise the entrepreneurs regarding the benefits available to them.

- All the related government organisations should work in tandem with private sector industry and local associations.

Inclusive Development and Education

The education sector is going through significant changes with implementation of the national education policy in 2020. This year’s budget provided significant allocation for education and aims to promote equitable and inclusive education to all.

- Goal 4 of the UN sustainable development goals, “Quality Education”, intends to ensure inclusive and equitable quality education and promote lifelong learning opportunities for everyone.

- The gross access ratio (GAR) of schooling facilities at the primary level is 97.49% habitations, 97.01% at the upper primary level and 95.48% at the secondary level.

Initiatives taken by the government in the education sector:

- PM Schools for Rising India (PM SHRI): PM SHRI Schools will have state of the art facilities and demonstrate how the NEP is being implemented. They will eventually become models for other institutions of learning in the area.

- PRASHAST: This is a mobile app for disability screening. The app will assist in identifying disability issues at the school level, and it will provide a school-wise report that can be shared with the appropriate parties to start the certification process.

- India has about 52.3 crore population in the age group of 3 to 23, out of which 25.15 people are in the age group of 15 to 25. Hence India is positioned favourably mainly due to its demographic advantage.

Provisions for school education in budget 2023

- Re-envisioning teacher’s training: The NEP 2020 focuses on creating teachers with diversified perspectives. To improve primary education and facilitate the devolution of education to the district level, DIETs were envisioned.

- National Digital library for children and adolescents: National education policy 2020 emphasises reading and the availability of multilingual and diverse books for students at all stages. A national Digital library for schools will be developed with books by reputable Indian and international authors to enable all school students to read and learn with the books even when they do not have physical access to libraries.

Initiatives for higher education:

- Centres of excellence for artificial intelligence: Three Artificial Intelligence centres will be built in prestigious educational institutions to make the vision of “ Make AI in India” and “Make AI work for India”.

- Lab Grown Diamonds (LGDs): Research and development grants for indigenous production are given in recognition of IITs pioneering role in the nation’s research of excellence.

- 5G Services: to actualise a new variety of options, business models and employment potential – 100 Laboratories for developing apps using 5G services will be set up.

- National Data Governance Policy: To unleash innovation and research by start-ups and Accademia, national data governance policy will be introduced. This will enable access to anonymised data.

Trade and Industry

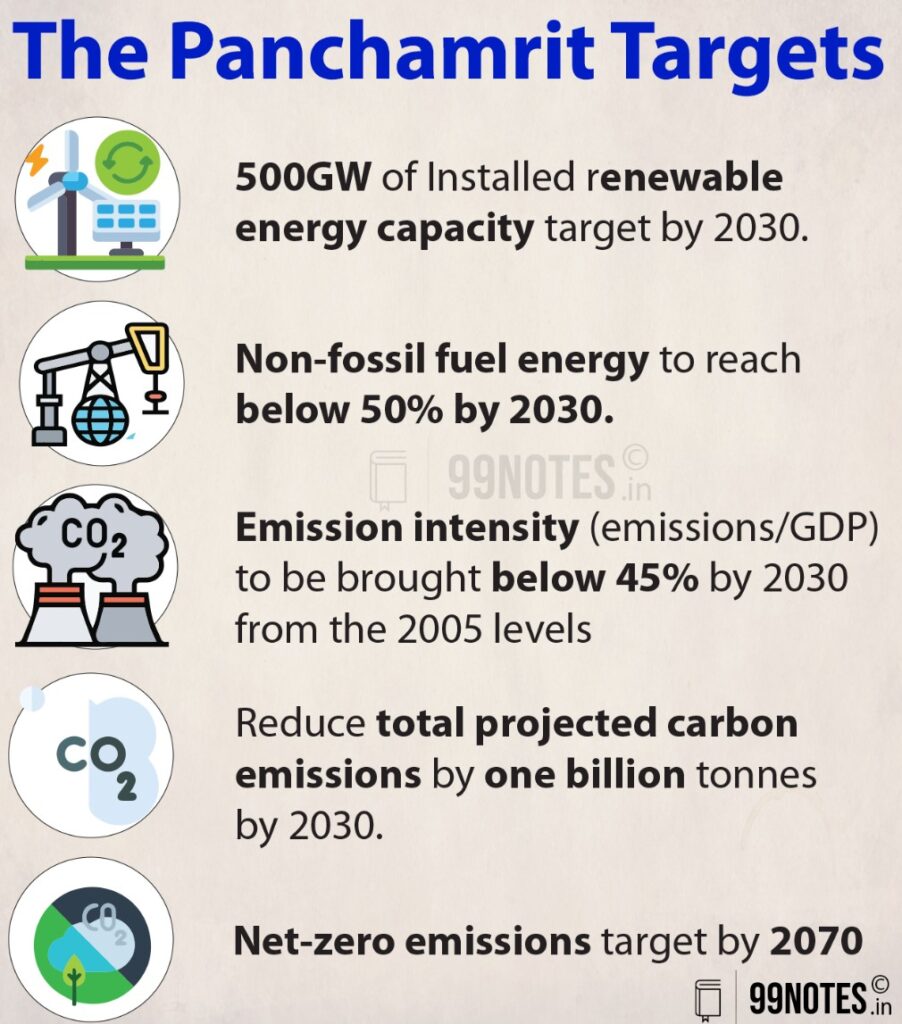

Budget 2023-24 is an essential step towards boosting the domestic manufacturing and services sector through increased public spending and incentivising domestic manufacturing on the path of green growth, thereby emphasising the country’s commitment to net zero emissions by 2070.

Government spending:

- The government’s proposed fiscal deficit for FY23-24 is at just 5.9% of the GDP. This would also mean less boring by the government in the next financial year.

- This would in turn result in more money in the market being available for the industry and businesses at the lower interest rate – thereby helping keep inflation under check.

- A capital investment outlay has been increased steeply for the third year by 33%. An increase in capital investment would help propel the domestic manufacturing and employment generation.

Direct Taxation:

- A corporate tax rate along with exemptions are used to make the domestic industry more competitive. (by leaving more money with them for investing in the businesses)

- While personal tax slabs are used for two purposes – increasing domestic savings rates or leaving more money in their hands so that consumption can be increased.

- In the budget 2023 – the government has chosen to not only give tax incentives to MSME and cooperative societies but also lower the personal tax rate.

Indirect taxation:

- Reduction or increase of customs duty is an effective tool to promote domestic manufacturing.

- By lowering the import duty on raw materials, the government sometimes reduces the cost of manufacturing for a specific sector, thereby making them more competitive.

Recent initiatives:

One of the significant highlights of budget 2023 is the thrust on green growth. India is committed firmly to the ‘Panchamrit’ and net zero carbon emission by 2070.

Many programmes for green fuel, green energy, green farming, green mobility, green buildings, green equipment, and policies for efficient energy use across various economic sectors are being implemented.

- National green hydrogen mission has been launched with an outlay of 19,700 crores – which will facilitate the economy’s transition to low carbon intensity, reduce dependence on fossil fuel imports and usher innovation.

- The new sub-scheme of PM Matsya Sampada Yojana Will be launched further activities of fishermen, fish vendors and MSME enterprises in the fisheries sector.

- A new programme to promote research and innovation in pharmaceuticals is proposed.

- 100 critical transport infrastructure projects will be initiated for the last and 1st-mile connectivity of ports, coal, steel, and fertilisers.

- For enhancing the ease of doing business, more than 39,000 compliances have been reduced, and more than 3400 have been decriminalised.

- A credit guarantee scheme will be further extended for MSMEs under stress.

- 500 new plants will be set up under the GobarDHAN scheme.