20 July 2024 : The Hindu Editorial Analysis

1. Living in denial about unemployment

(Source – The Hindu, International Edition – Page No. – 6)

| Topic: GS3 – Indian Economy – Issues relating to development and employment. |

| Context |

|

Prime Minister’s Statement and Employment Data

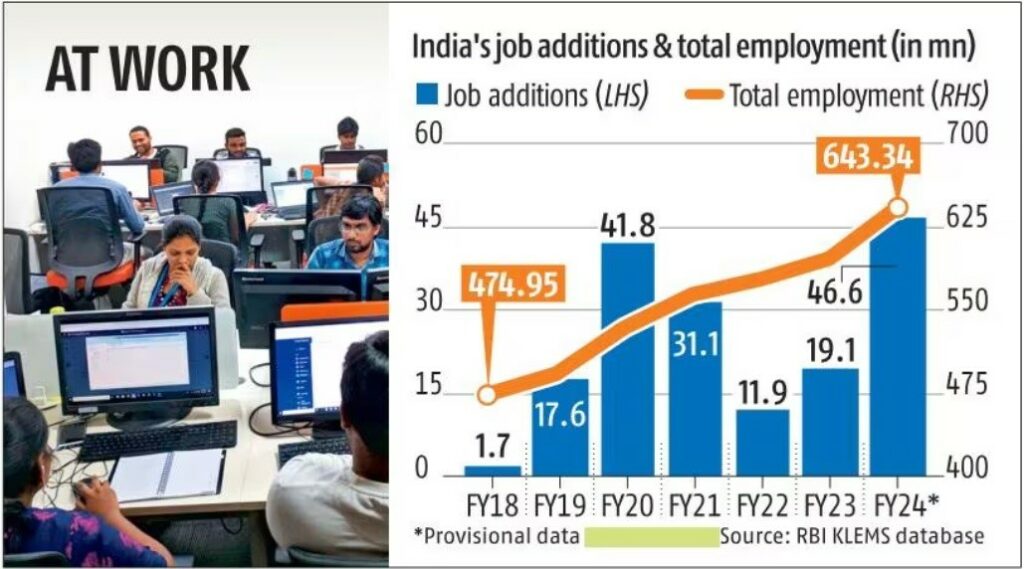

- The Prime Minister of India recently cited a Reserve Bank of India (RBI) report claiming that 8 crore jobs have been created in the last 3-4 years.

- This statement was made to counter the Opposition’s narrative of high unemployment and to respond to reports from financial institutions like Citigroup, which pointed to inadequate employment generation in India.

- The Prime Minister emphasised that upcoming infrastructure projects would create more jobs.

RBI ‘Data Manual’ and KLEMS Database

- The Prime Minister referred to a Reserve Bank of India ‘Data Manual’ released on July 7, called ‘The India KLEMS Database.’

- The KLEMS Database includes measures of Gross Value Added, Gross Value of Output, Labour Employment, Labour Quality, Capital Stock, and Capital Composition.

- The database covers 27 industries across the entire Indian economy.

State Bank of India Report

- Following the Reserve Bank of India’s release, the State Bank of India published its own report to counter financial institutions’ claims.

- The State Bank of India stated that, excluding agriculture, 8.9 crore jobs were created in manufacturing and services from FY14 to FY23, and 6.6 crore jobs from FY04 to FY14.

- The report noted that India’s total labour force is 59.7 crore, which is close to the 56.8 crore figure from the recently released Annual Survey of Unincorporated Sector Enterprises (ASUSE) survey.

- The State Bank of India highlighted significant differences between these figures and those from private employment surveys.

Centre for Monitoring Indian Economy Report

- The Centre for Monitoring Indian Economy, a private data-gathering agency, reported in July that the unemployment rate rose to an eight-month high of 9.2% in June 2024, up from 7% in May.

- This report contrasted sharply with the official narrative of significant employment generation.

Ground-Level Reality and Public Confusion

Unemployment as a Major Issue

- Ground reports indicate that unemployment is a major issue, with large numbers of applicants for limited job vacancies.

- In February, about 47 lakh applicants competed for around 60,000 constable positions in Uttar Pradesh.

- In 2022, 1.25 crore aspirants applied for the Railway Recruitment Board’s Non-Technical Popular Categories recruitment exam.

- Protests erupted in Bihar, Uttar Pradesh, and other states when the Agnipath scheme was announced in 2022.

- The situation for educated youth is particularly grim, despite expectations of them leading the ‘demographic dividend.’

Differences in Data Sources

- The confusion over unemployment rates arises from differences in the various databases used.

- The KLEMS data, cited recently, measures productivity growth but does not estimate employment independently; it relies on official data from sources like the National Sample Survey Office (NSSO) and the Periodic Labour Force Survey (PLFS).

- This raises questions about the employment figures presented by government agencies, as KLEMS data is based on pre-existing official data.

Complex Structure of the Indian Economy

Organised and Unorganised Sectors

- India’s economy comprises both organised and unorganised sectors.

- Reliable data is available for the organised sector through annual statutory publications.

- However, data for the unorganised sector, which employs 94% of the labour force, is sparse.

- This sector includes approximately 11 crore farms and 6.5 crore micro, small, and medium-sized enterprises (MSMEs), making annual surveys challenging.

Data Collection Challenges

- Data for the unorganised sector is collected periodically via the Census every ten years and the ASUSE survey every five years.

- The government aims to conduct the ASUSE survey annually, but this survey relies on outdated data from the Census and the Urban Frame Survey (UFS), the latter covering the period from 2012-17.

- The use of pre-2016 data poses challenges, as the Indian economy experienced significant shocks from demonetisation, the introduction of the Goods and Services Tax, the Non-Banking Financial Companies crisis, and the COVID-19 pandemic.

- These shocks particularly impacted the unorganised sector, leading to closures and migrations, making pre-2016 data unreliable for current sampling.

Differences in Labour Force Surveys

Periodic Labour Force Survey (PLFS) Vs. Centre for Monitoring Indian Economy (CMIE):

- The PLFS, an official data source, differs significantly from the Centre for Monitoring Indian Economy data due to differences in definitions of employment.

- The Centre for Monitoring Indian Economy adopts the International Labour Organization definition, counting only those who earn an income from work as employed.

- In contrast, the PLFS includes those who work without income, such as unpaid family workers or those engaged in subsistence activities.

- This difference results in the PLFS reporting higher labour force participation rates (50%-55%) compared to the Centre for Monitoring Indian Economy (40%-45%), leading to a discrepancy of about 90 million people.

Disguised and Underemployment

- The PLFS also counts the disguised unemployed and underemployed, making it appear that almost no one is unemployed.

- The Centre for Monitoring Indian Economy highlights those who have stopped looking for work, which is a form of unemployment not recognized in official data.

Conclusion:

Ground-Level Unemployment

- The real situation of unemployment is evident from frequent reports of youth struggling to find work and facing difficulties in competitive examinations.

- Despite this, the government often denies the severity of the problem, citing data with significant gaps and limitations.

Need for Accurate Data

- Officials have been reluctant to acknowledge the issues with outdated and unreliable data, including the use of KLEMS data that does not independently estimate employment.

- It is crucial to recognize and address these data issues to formulate effective employment policies and mitigate growing frustration among the youth.

| PYQ: Most of the unemployment in India is structural in nature. Examine the methodology adopted to compute unemployment in the country and suggest improvements. (250 words/15m) (UPSC CSE (M) GS-3 2023) |

| Practice Question: Discuss the challenges of accurately measuring employment in India, considering the conflicting reports from different sources and the impact on policy-making. (150 Words /10 marks) |

2. The promise of parametric insurance

(Source – The Hindu, International Edition – Page No. – 6)

| Topic: GS3 – Social Security |

| Context |

|

Record-Breaking Year 2023

- The year 2023 was recorded as the warmest year on record.

- A report estimated losses from natural disasters amounted to $280 billion in 2023, with only about $100 billion insured.

- There is a significant gap in insurance coverage, particularly between developed and developing economies.

- With increasing extreme weather events, the insurance industry must enhance disaster resilience through alternative coverage methods.

Current Methods of Disaster Risk Reduction

Indemnity-Based Insurance Products

- The globally accepted method of disaster risk reduction involves indemnity-based insurance products.

- These products require physical assessment of damage for payouts.

- Given the unpredictability of future calamities, past precedents are no longer reliable.

- Verification of losses becomes challenging, especially for economically disadvantaged communities with little record of their assets.

| Characteristics of Parametric Insurance |

|

Benefits and Implementation

- Parametric insurance builds trust between states and insurers, leading to reasonable pricing and trigger-payout combinations.

- Historically, these products have been offered for low-frequency, high-impact disasters like earthquakes and cyclones.

- In 2023, Morocco received $275 million in parametric insurance after a 6.8 magnitude earthquake, facilitated by the World Bank.

- High-frequency, low-impact disasters like landslides and rain are now increasingly considered due to climate change.

Parametric Insurance in India

Early Adoption and Government Initiatives

- One of the earliest uses of parametric policies in India was for crop insurance.

- The Pradhan Mantri Fasal Bima Yojana is based on verification of loss.

- The Restructured Weather Based Crop Insurance Scheme uses threshold limits, eliminating the need for field verification.

- Private insurance in India is increasingly offering parametric products customised for states, corporations, self-help groups, and micro-finance institutions.

State and Corporate Adoption

- Nagaland was the first Indian state to purchase parametric insurance for extreme precipitation in 2021.

- Learning from experience, Nagaland has tendered for an improved version with specific annual premiums, duration, and competitive bidding for lower threshold limits and maximised payouts.

- The state uses credible data from the India Meteorological Department for precise precipitation measurements.

Sector-Specific Implementations

- The Co-operative Milk Marketing Federation in Kerala has implemented parametric insurance for dairy farmers to cover lower milk yields due to heat stress in cattle.

- Non-profits and micro-finance institutions have collaborated with private insurers to provide daily payouts to workers losing jobs due to excessive heat, based on pre-defined temperature and moisture triggers.

- Large corporations have initiated parametric products for cyclonic winds and high waves using data on wind speed, cyclone tracks, and storm surges.

Ensuring Effective Use of Parametric Products

Key Factors for Government Implementation

- Precise thresholds and proper monitoring mechanisms are essential for effective parametric insurance.

- Governments should share experiences to incorporate lessons learned.

- A mandatory bidding process is necessary for transparent price discovery.

- There must be a widespread retail payout dissemination system.

- Encouraging premium payment by households is crucial, though challenging for poorer populations.

Examples from Other Countries

- Parametric insurance for earthquakes in New Zealand and Turkey demonstrates successful implementation even among poorer populations.

Potential for India and South Asia

India’s Unique Position

- India is well-placed for the use of parametric products due to its Aadhaar-based payment dissemination system.

- Regional pooling of risk has been successfully implemented by the Pacific and Caribbean Catastrophe Risk Insurance Companies.

- Given South Asia’s vulnerability to climate change, India and its neighbours could consider collaborative risk pooling and parametric products.

Conclusion:

- The increasing frequency of natural disasters and the existing gap in insurance coverage necessitate innovative approaches.

- Parametric insurance offers a viable solution for enhancing disaster resilience and financial protection.

- By leveraging credible data and adopting collaborative risk management strategies, India and other climate-vulnerable regions can mitigate the financial burden of natural disasters.

| Practice Question: Discuss the role of parametric insurance in addressing the challenges of disaster resilience and financial protection, especially in the context of increasing natural disasters and the existing insurance coverage gap. (250 Words /15 marks) |