24 July 2024 : The Hindu Editorial Analysis

1. Union Budget 2024-25 — no signs of learning

(Source – The Hindu, International Edition – Page No. – 10)

| Topic: GS3 – Indian Economy |

| Context |

|

Budget Presentation and Government Signals

- Prior to Nirmala Sitharaman’s seventh consecutive Budget presentation, signals from the government hinted at its focus.

- Despite a third term in office with a less decisive mandate, the government’s emphasis appeared to be on easing regulations for businesses rather than taxing excess profits for development.

- Economic Survey Highlights: The Economic Survey 2023-24 indicated that while industrialists and business elites were experiencing significant profits, the government aimed to reduce regulatory burdens and encourage the private sector to generate jobs through self-interest. The goal was for businesses to lead in the vision for Viksit Bharat 2047, with the government’s role being to motivate private sector leadership.

Initiatives and Their Impact

- Employment Initiatives: The Budget speech addressed employment concerns by announcing various initiatives aimed at increasing job opportunities. These initiatives fell into two categories:

- Employment Subsidies: Direct and indirect subsidies for employers, including a ₹15,000 subsidy in three instalments for new employees earning up to ₹1 lakh a month. This scheme is expected to impact the formal sector. Additionally, a ₹3,000 monthly contribution to provident fund subscriptions for two years was announced, benefiting employers directly.

- Skill Development Schemes: Programs such as subsidised internships and interest subvention on educational loans were introduced to enhance employability by addressing skill mismatches between job seekers and industry requirements.

- Tax Concessions and Manufacturing Adjustments: The Budget also included direct tax concessions for foreign firms and indirect tax adjustments to support domestic manufacturing. This approach aimed to encourage private capital to hire unemployed individuals for productive roles. The underlying assumption was that businesses were hesitant to hire due to high labour costs or inadequate skills, rather than due to insufficient economic growth.

Agricultural Sector Discontent

- Agricultural Challenges: The Budget’s focus on increasing agricultural productivity and production was unlikely to address the immediate concerns of farmers struggling with crop production costs.

- Farmers had long demanded procurement at a legally guaranteed minimum support price, and the Budget’s promises did not meet these demands, potentially leading to further dissatisfaction among the agricultural community.

Welfare Schemes and Financial Allocation

- Welfare Expenditure: The Budget showed little increase in allocations for welfare schemes. The National Social Assistance Programme and the National Rural Employment Guarantee Programme retained their previous year’s allocations. The food subsidy, despite the extension of free foodgrain allocation, was reduced. Only the Pradhan Mantri Awas Yojana (PMAY) saw a notable increase in allocation.

Fiscal Consolidation and Capital Expenditure

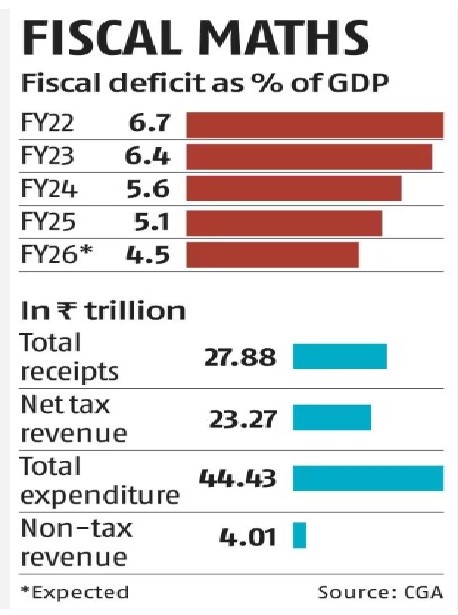

- Fiscal Targets: The Budget emphasised fiscal consolidation, aiming to reduce the fiscal deficit from 4.9% of GDP in 2023-24 to 4.5% in the current year and maintain this path thereafter.

- Capital expenditure, projected to increase from ₹7,40,025 crore in 2022-23 to ₹11,11,111 crore in 2024-25, was highlighted as a key focus area.

- The government relied on dividends and surpluses from the Reserve Bank of India and public financial institutions to meet these targets.

- Expected to rise significantly, these funds were primarily used for capital expenditure rather than welfare or support for allies.

- This approach reflected a focus on fiscal management and infrastructure development, with less emphasis on direct support for welfare and political allies.

Conclusion

- The Budget reflected a strategy centred on promoting private sector leadership in job creation and infrastructure development while maintaining a tight fiscal stance.

- However, the lack of substantial support for immediate economic and welfare concerns, along with the limited financial backing for allies, indicated a potentially narrow approach to addressing broader socio-economic issues.

| PYQ: One of the intended objectives of Union Budget 2017-18 is to ‘transform, energise and clean India’. Analyse the measures proposed in the Budget 2017-18 to achieve the objective. (250 words/15m) (UPSC CSE (M) GS-3 2017) |

| Practice Question: Evaluate the impact of the 2024-25 Union Budget on employment generation, social welfare schemes. How does the reliance on RBI dividends and capital expenditure affect these aspects? (150 Words /10 marks) |

2. A message of fiscal stability, growth continuity

(Source – The Hindu, International Edition – Page No. – 10)

| Topic: GS3 – Indian Economy |

| Context |

|

Focus on Stability and Inclusive Growth

- The FY25 Union Budget under the new administration emphasises maintaining fiscal stability and ensuring continuity in sustainable growth, while also focusing on making growth more inclusive in India.

Economic Context

- GDP Growth and Economic Segmentation: The 8.2% GDP growth in FY24, although notable, was characterised by uneven K-shaped recovery. High-end consumption of luxury items contrasted with stagnant wages, low sales of fast-moving consumer goods, and persistent food inflation affecting lower-income groups.

- Fiscal Deficit and Growth Impetus: The fiscal deficit stood at 5.6% of GDP in FY24, which, despite being high compared to pre-COVID-19 levels, provided necessary growth impetus through capital spending. This was essential as private sector capital expenditure remained subdued.

Addressing Weaker Building Blocks

- Focus Areas in FY25 Budget: The FY25 Budget aims to address weaker aspects of the economy by improving employment quality, strengthening agriculture, and integrating micro, small, and medium enterprises (MSMEs) into India’s manufacturing sector.

- These measures are part of the broader goal of achieving a Viksit Bharat (Developed India) by 2047.

Agriculture Sector Initiatives

- Support for Farmers: Key priorities in agriculture include promoting self-reliance in pulses and oilseeds, enhancing agricultural research to adapt to climate change, developing large-scale vegetable production clusters, and implementing Digital Public Infrastructure (DPI) to support farmers and their lands.

- Extension of PMGKAY: The Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY), which provides foodgrains to the needy, has been extended for five years to further support the agricultural sector.

Employment Generation

- New Employment Schemes: The Budget introduced a new scheme offering incentives to both employers and employees joining the workforce for the first time, with an allocation of ₹10,000 crore through the Ministry of Labour.

- Additional schemes include incentives for internships and youth skilling, with a budget of ₹2,000 crore.

- Tripartite Compact: These initiatives align with the Economic Survey’s recommendation for a tripartite compact involving the Centre, States, and the private sector to meet the rising aspirations of Indian youth.

Housing Sector Developments

- Increased Allocation for Housing: The FY25 Budget allocated 37% more funds for the urban Pradhan Mantri Awas Yojana (PMAY) compared to FY24.

- This increase is significant but less pronounced than the 70% increase for the rural PMAY.

- Housing for all remains a crucial government objective, now evolving into its version 2.0.

Production Linked Incentive (PLI) Scheme

- Enhanced PLI Allocation: The PLI Scheme received a 75% increase in funding in the FY25 Budget, with higher allocations for the auto sector. The Budget also included adjustments to sectoral customs duties to support domestic manufacturing and local value addition.

- Support for MSMEs: The Budget promised to facilitate collateral-free term loans for MSMEs to purchase machinery and equipment. Additionally, banks will be allowed to develop in-house credit assessments, with government support to ensure continued credit extension to MSMEs during economic stress.

Macroeconomic Stability

- Fiscal Deficit Targets: The FY25 Budget reduced the fiscal deficit target to 4.9% of GDP from the interim Budget’s 5.1% estimate.

- The target consolidation of 70 basis points over FY24 remains, facilitating a smoother transition to a 4.6% fiscal deficit in FY26.

- Fiscal Discipline: The Budget reflects a commitment to consolidating fiscal positions beyond FY26, reinforcing trust among economy watchers despite new demands from regional partners.

Capex and RBI Dividend

- Capital Expenditure and RBI Dividend: The capital expenditure target remained unchanged at ₹11.1 trillion.

- The record-high dividend transfer of ₹2.1 trillion from the Reserve Bank of India was allocated between increased welfare spending and fiscal deficit reduction.

Implications for Sovereign Rating

- The inclusion of domestic bonds in global bond indices enhances scrutiny of India’s fiscal metrics by international agencies.

- Adherence to fiscal discipline positions India favourably for a potential sovereign rating upgrade in the future.

Conclusion

- The FY25 Union Budget strategically addresses economic disparities through targeted measures in agriculture, employment, and MSMEs while maintaining fiscal discipline.

- Increased funding for housing and production-linked incentives reflects a commitment to sustainable growth and economic stability, positioning India for future rating improvements and long-term development.

| Practice Question: Evaluate the key measures in the FY25 Union Budget aimed at enhancing economic stability, supporting agriculture, and promoting employment.(250 Words /15 marks) |