Yojana March 2023: Union Budget.

- The world is recognising the Indian economy as a “rising star” as it continues to grow with an annual growth rate of 7%, the highest among all the major economies.

- Indian economy is also withstanding the massive economic Global slowdown caused by the pandemic and global conflicts.

- With the ‘Vasudhaiva kutumbakam’ theme, India is progressing towards an ambitious and people-centric agenda to address global challenges and facilitate sustainable economic development.

- In the 75th year of India’s Independence, the “Amrut Kal” includes a technology-driven and knowledge-based economy with strong public finances and a robust financial sector.

- Jana Bhagidaari and Sabka Saath Sab Ka Prayas drive the Indian economy towards more inclusive and sustainable development.

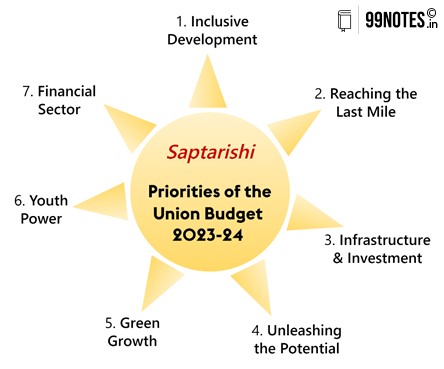

Saptarishi for Amrit Kaal

- The government is focusing on increasing citizens’ opportunities, providing impetus to growth and job creation and strengthening macroeconomic stability.

- The seven priorities of the union government mentioned in acting as the Saptarshi are as follows:

- It is a well-stated fact that investment in infrastructure and productive capacity significantly impacts growth and employment. Hence the government is taking positive steps towards increasing investment.

Increasing Investments – Budget Highlights

- Capital expenditure in the 2023–24 union budget doubled from 4.6 lakh crore of actual spending to 10.01 lakh crore budgeted in 2023–24.

- A capital of40 lakh crore has been provided for the Railways. This is the highest-ever outlay made for the railway sector.

- There are significant changes in the personal income tax regime. The indirect tax aims to promote exports, enhance domestic value addition, and encourage green energy and mobility. And new income tax regime has been made the default tax regime, with citizens having the option to benefit from the old tax regime.

- The budget seeks to support MSMEs in terms of – timely receipt of payments, the deduction for expenditure incurred on payments etc.

Laying the foundation for India’s Amrit Kaal

- The union budget is a key policy document that outlines the priorities of the government for the immediate and long-term – with an understanding of domestic and global economic realities.

- The budget for the year 2023-24 focuses on capital expenditure, inclusive growth, green economy, ease of living and ease of doing business.

- In the backdrop of global conflicts such as the Russia – Ukraine war, the economy is experiencing high prices of food, fuel and fertiliser. Therefore, the central bank has adopted a tight monetary policy to control this inflation.

- Despite these uncertainties, budget 23–24 has given much importance to fiscal management and fiscal prudence without compromising the economy’s growth.

- The budget for 2023–24 focuses on the following:

- Commitment to fiscal prudence.

- Conservative assumptions.

- Transparancy.

- Commitment to capital expenditure.

- Incremental and steady reforms without compromising growth prospects.

- Guided by the abovementioned principles, Amrit Kaal Saptarshi seeks to create world-class infrastructure, strengthening trust-based governance and providing impetus to MSMEs.

- The budget promotes green growth and skill development in modern robotics and artificial intelligence.

- The Capital investment outlay for this year is the highest ever and has been increasing for the third consecutive year almost 33%.

- The government is committed towards infrastructure development through:

-

- National Infrastructure Pipeline (NIP),

- National Monetisation Pipeline (NMP),

- InvITs & REITs and

- National Bank for Financing Infrastructure and Development (NaBFID).

- A larger share of the capital investment is towards roads, railways and defence infrastructure development.

- With the vision of “Sabka Saath, Sabka Vikas”, the government is committed to building trust between the government and citizens/businesses.

- In previous years, incentives such as the Udyam Portal and the Vivad Se Vishwas scheme have been introduced to improve the ease of business for MSMEs.

- Despite maintaining its per capita emissions for less than the world average, India has consistently demonstrated global leadership towards ensuring a low-emission growth pathway.

- Prime Minister’s vision for “LiFE” along with Panchamrit – India aims to become a net zero carbon economy by 2070.

- National Green Hydrogen Mission, Green Credit Programme, PM PRANAM, and Gobar Dhan schemes are some of the initiatives taken by the government in this aspect.

- India has reiterated its intention to develop a digital economy and digital governance through UPI, the CO-WIN platform, during the pandemic years. The budget 2023–24 reaffirms the stance of the government in increasing digitalisation.

Towards Cooperative Fiscal Federalism

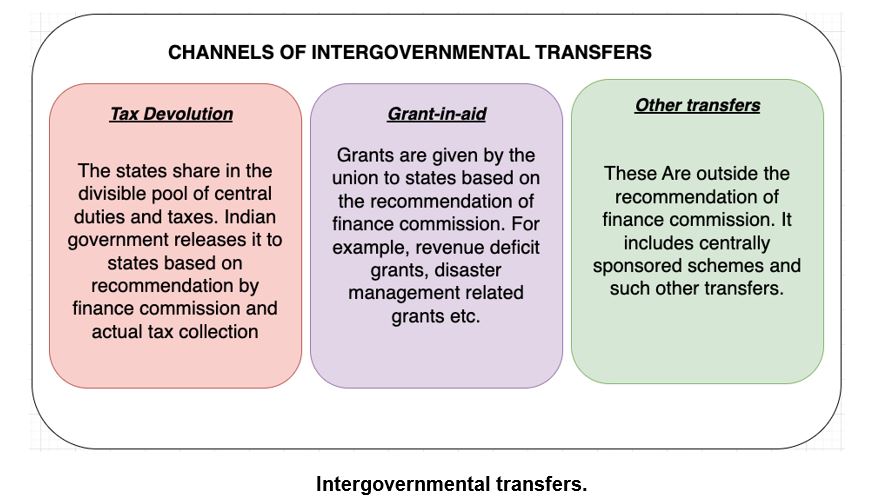

- Fiscal federalism refers to physical relations between various government units, i.e. Union government and the state governments.

- Both tiers of the government need to possess adequate financial resources for discharging their respective responsibilities as per the Constitution of India.

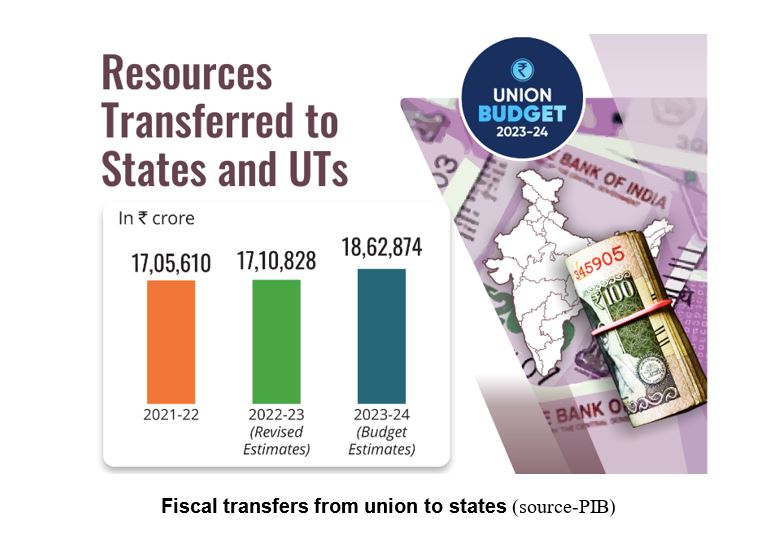

- In recent years, the Union government has enhanced fiscal decentralisation and distribution of revenue to state governments.

- The tax devolution is now formula-based rather than grants; this allows states greater flexibility and autonomy in incurring expenditures as per their priorities.

Constitutional provisions:

- Article 246, article 246A and the seventh schedule of the Constitution mention taxation powers between the Centre and the states,

- The central government inherently possesses more financial resources than state governments, while state governments are responsible for providing core public services.

- Finance Commission: The President of India establishes a finance commission under article 280 of the Indian Constitution. The commission recommends distributing net proceeds of central taxes between the Centre and the states. The commission also suggests principles for the devolution of grants in aid of revenues and devolution through the consolidated fund of India.

Channels of intergovernmental transfer

Ushering the new era of cooperative fiscal federalism:

- The annual transfers from the union to the states have increased from 4.7% of the gross GDP in 2013–14 to 7% in 2021-22.

- It is facilitated through recommendations of the 14th and 15th finance commissions.

- The 14th finance commission recommended increasing states’ share from 32% to 42%.

- The 15th finance commission has also reiterated the need for higher devolution to states. Accordingly, the commission has recommended devolution of 41% of central taxes after adjusting 1% for Jammu & Kashmir and Ladakh.

- NITI Aayog has played an essential role as the harbinger of cooperative fiscal federalism.

- The following steps have been taken to strengthen cooperative fiscal federalism further.

- Rationalisation of centrally sponsored schemes.

- Introduction of GST.

- Cooperation to boost capital expenditure in states with various incentives.

- Union government acting as a solid federal fiscal shield to states during pandemic years.

Blueprint for an Inclusive and Empowered Bharat.

- The thrust of the union budget 2023–24 is on broad-based growth and development.

- Taking the benefits of economic growth and development to all sections and sectors of the economy is of utmost priority for the central government.

- Inclusive growth and last-mile delivery are among the top seven priorities termed

- The efforts to provide toilets to eliminate open defecation and access all tap water, electricity, LPG cylinders, healthcare, and bank accounts underline the government’s commitment to inclusive development.

Social sector allocations: Endeavour for effective outcomes.

- The government has always prioritised strengthening and expanding the social sector in the country in recent years.

- This year’s budget also reflects advancements in social sector outcomes.

- The development action plan for the STs has been put forth for the nutritional security of tribal groups by providing nutritious food.

- Similarly, PM Garib Kalyan Anna Yojana and PM Poshan Shakti Nirman have been introduced to promote nutrition.

- In the social sector, the government is ensuring a better quality of life, a life of dignity and expansion of the economy.

- This is evident from the fact that the per capita income has more than doubled to Rs.1.97 lakh.

- With initiatives such as Swachh Bharat Mission, Ujjwala scheme, PM Kisan Samman Nidhi and various insurance schemes – the Union government is ensuring the abovementioned social sector targets.

- The expenditure on the health sector as a percentage of GDP has increased from 4% in 2020 to 2.1% in 2022–23.

Inclusive Development and Modernisation Of Agriculture:

- Agriculture and allied sectors are essential pillars of the Indian economy. Therefore, the inclusive growth of agriculture is critical for overcoming current economic challenges.

- Ministry of agriculture and farmers welfare has been allotted 1.25 lakh crore.

- Following the resolution tabled by India, the UN has declared the year 2023 as the international year of millets.

- Presently India is the highest producer and fifth highest exporter of millets. In this aspect, India has good scope to become a “global hub of millets”.

- The Budget also provides for the promotion of digital agriculture to make farming more profitable and internationally competitive. In addition, digital infrastructure will help agriculture-based industries and start-ups, giving impetus to their development.

- In the last few years, the Government has taken several steps to promote natural and organic farming. It is beneficial to the environment, farmers and consumers. For example, the PM PRANAM scheme has been initiated for land improvement, nourishment and rejuvenation.

- The Government has proposed to make one crore farmers volunteering for natural farming practices in the next three years and to support them.

- For further development and doubling farmers’ income, animal husbandry and dairy play a very vital role. Understanding this, the Government is committed to promoting these sectors through many schemes.

Post-pandemic Health

- Health is a very integral part of any prosperous society. With India aiming to become a US$ 5 trillion economy, taking care of the health of every citizen becomes necessary.

- The allocation for the Government’s flagship scheme Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana, increased by 13% to reach around 7200 crores.

- The Government has proposed to start several health facilities, such as the Centre for excellence in artificial intelligence, opening 157 new nursing colleges in different districts and improving research facilities in the health sector.

- The Government is focusing on the following parameters for tackling issues in the health sector:

- Effective, timely and science-based communication in health services.

- Better vaccination for all vaccine-preventable diseases.

- Betterment of health services and well-functioning primary healthcare services PHC.

- Particular emphasis on eliminating neglected tropical diseases such as filariasis, Kala Azar etc.

- Improving health data quality and availability.

- Re-examination of the role of federalism in health policy. As health is a State subject, it requires better coordination between the central and state governments to attain desirable results.

- Improvement in disease surveillance systems and public health measures.

- Reduction of malnutrition and anaemia in children and women.

- Focus on tackling mental health issues.

- Stepping up investment in research and development of vaccines and therapeutics.

Banking: Focus on New Responsibilities and Good Governance

- In the union budget 2023–24, several measures have been taken to promote savings among women and older people.

- Widening the acceptance of digital payments and providing necessary financial support for digital public infrastructure are among the top priorities for the Union government.

- Net market borrowing from dated securities has been estimated at Rs.11.8 lakh crore against a fiscal deficit of 17.87 lakh crore in this year’s Budget.

- With advancements in technology, the definition of a bank is not limited to the brick and mortar buildings. Banking through virtual mediums has become a necessity of today’s time.

- The agriculture sector is the most important for specific sector lending. It is stated in the Budget that about 86% of small farmers in the country had significantly benefited from the Kisan credit card (KCC). Hence considering the importance of KCC – Rs.23 Thousand crores outlay has been made.

- Some systemic changes have been implemented to improve the banks’ balance sheets and reduce the rising NPAs problem.

Strengthening the Financial Sector

- The Budget has laid a blueprint for India@100. The Budget focuses on inclusive development, employment generation and boosting infrastructure and development through – self-reliance, transparency and digitalisation.

- It seeks to empower women, scheduled castes, scheduled Tribes, senior citizens, BPL families, MSMEs and other vulnerable sections with the more robust and risk-free financial sector.

- Various innovative financing methods, such as the PPP model, are being considered for sustaining economic growth and helping build financial, productive capacity.

Empowering India’s Gen-Z Through Budget

- The Government is committed to empowering future generations through better skill development and employment opportunities.

- Skill-based training to youth: Programmes such as Pradhan Mantri Kaushal Vik as Yojana and skill India are at the CentreCentre of skill development initiatives.

- Tapping the demographic dividend: the median age in our country is 28.4, which is much less than in other countries such as China and developed countries. In this regard, it is indispensable for India to capitalise on this human capital prospect.

- Supporting start-up ecosystem and entrepreneurship: The Government promotes entrepreneurship by creating a competitive age for innovation and prosperity in Indian youth. Atal tinkering labs and skill India mission are flagship programmes of the Indian Government in this regard.

- Simplifying the KYC process, establishing a Central Processing Centre for ease of doing business, and creating a unified filing process are helping in setting up a new business compared to previous times.

Skills, Employment, and Human Resource Development

- The disruptive changes and structural transformation in the employment market demand the skill development of existing workers.

- According to the WEF report published in 2020, automation and economic certainty caused by the pandemic can cause 85 million jobs to be displaced.

- With a Youth population of around 66%, the Indian workforce is expected to grow by 8 million annually in the coming decade.

- One of the significant challenges in this sector is creating gainful employment and providing meaningful work opportunities for the ever-increasing Indian youth population.

- However, the government is trying to combat the issues of institutionalising skill development and vocational education.

Fiscal Deficit Policy Shift and Sustainable Development

The Budget is essential to the country’s overall development and socio-economic transformation.

Fiscal deficit and analysis

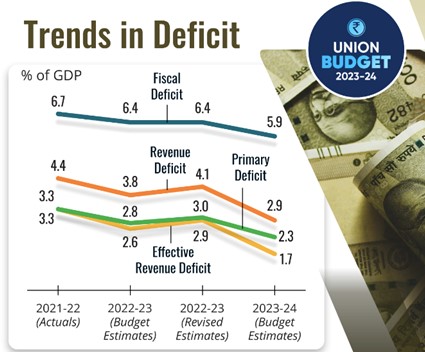

- A fiscal deficit indicates the total borrowing requirements of a country during a fiscal year. It is used to measure fiscal discipline and set up a budgetary roadmap of the country in future liabilities and needs.

- The extent and magnitude of fiscal deficit are determined by two components – revenue deficit and capital expenditure.

- In the Budget 2023–24, the proposed fiscal deficit is 5.9% of GDP. It was 6.4% for FY 2022–23.

- Due to the post-Covid impact, global conflicts and other geopolitical tensions maintaining a 5.9% of fiscal deficit will be a difficult task.

- However, the Government is committed not to deviating from the estimated deficit – as it may escalate the economic crisis leading to inflation and other fiscal disturbances.

Revenue deficit and sustainability:

- Revenue deficit shows the excess of revenue expenditure over revenue receipts of the Government.

- A higher revenue deficit compels the Government to look for borrowings to meet the revenue shortfall.

- The Government has proposed a revenue deficit of 2.9% for FY 2023-24 compared to 3.8% in FY 2022–23.

- The revenue deficit can be reduced by

- Higher revenue mobilisation through tax buoyancy

- Wider tax base

- Quality tax administration

- By prioritising expenditure through expenditure rationalisation.

Way forward

- The Government of India has adopted a holistic policy of gradually reducing the deficit and a progressive movement towards fiscal consolidation.

- With Government’s growing focus and commitment to 4I – infrastructure, investment, innovation and inclusion Government can achieve its targets.

- Fiscal management and consolidation have become vital to sustainable growth and social development.

- However, the credible implementation and sincere monitoring of every event become necessary to keep the situation in check.

- Following the guidelines under the FRBM act in its true spirit and with higher accountability and expenditure, Government can reduce the fiscal deficit and revenue deficit.

Creating a Conducive Business Environment

- Improving ease of doing business and reducing compliance burden is at the core of creating a conducive business environment.

- Government seeks to achieve this through the following:

- Simplification of the procedure is related to applications, renewals, inspection, filing records etc.

- Rationalisation of existing laws through repealing and amending.

- Digitalisation by creating online interference to eliminate manual interference.

- Decriminalisation of minor technical and procedural defaults.

- The introduction of GST, reduction in corporate taxes, financial market reforms, liberal FDI policy and enactment of four labour codes have come a long way in creating a conducive business environment.