Yojana Summary: July, 2024 – Food Processing

1. Impact of Food Processing on Employment Generation and Skill Development

Food Processing: An Overview

- Food processing refers to the transformation of raw agricultural and livestock products into processed, value-added food items suitable for consumption.

- It encompasses a wide range of activities and technologies aimed at enhancing the safety, convenience, shelf life, taste, and nutritional quality of food.

- The sector plays a critical role in the broader food supply chain, ensuring that food is fit for consumption and meets consumer needs.

Status and Role of the Food Processing Sector in India

- The food processing sector is a significant contributor to India’s economy.

- Gross Value Added (GVA): In 2019-20, the GVA of this sector was ₹2.24 lakh crore, accounting for 1.69% of the total GVA of the country.

- It contributed 9.87% of GVA in the manufacturing sector and 11.38% of GVA in the agriculture sector (2019-20 at 2011-12 prices).

- The sector has seen consistent growth, with an Average Annual Growth Rate (AAGR) of 8.38% during the five years leading up to 2021-22.

Employment in the Food Processing Sector

- According to the Annual Survey of Industries (2019-20), 20.32 lakh people were employed in the registered food processing sector.

- The unregistered sector, according to the NSSO 73rd Round (2015-16), employed an additional 51.11 lakh workers.

Foreign Direct Investment (FDI) in the Sector

- The food processing sector attracted USD 709.72 million in FDI between April 2021 and March 2022.

- Cumulative FDI: From April 2000 to March 2022, the sector received a total FDI equity inflow of USD 11.08 billion.

Food Processing Sector and GDP Relationship

- GDP (Gross Domestic Product): Measures the total value of goods and services produced in a country during a given period. Key engines include:

- Private Final Consumption Expenditure (PFCE)

- Government Final Consumption Expenditure (GFCE)

- Gross Fixed Capital Formation

- Net Exports (Exports minus Imports)

- GVA (Gross Value Added): Represents the supply-side economic activity by adding value across sectors. It’s the value of output minus intermediary inputs.

- Relationship: GDP = GVA + Taxes – Subsidies.

State-Wise Distribution of Food Processing Units

- As per the Annual Survey of Industries (2018-19), there were 40,579 registered food processing units in India.

- Top States:

- Andhra Pradesh accounted for the largest share with 13.93%.

- Tamil Nadu (12.28%), Telangana (9.61%), Punjab (7.67%), and Maharashtra (6.88%) were other significant contributors.

Skill Development Initiatives in the Food Processing Sector

Collaborative Efforts and Course Development

- The Ministry of Food Processing Industries (MoFPI) collaborates with the Food Industry Capacity and Skill Initiative (FICSI) to validate job roles and create Qualification Packs (QPs).

- The National Institute of Food Technology Entrepreneurship and Management (NIFTEM) and Indian Institute of Food Processing Technology (IIFPT) develop course curriculum aligned with industry requirements.

Pradhan Mantri Kisan SAMPADA Yojana

- A government initiative to support the development of training modules in multiple languages.

- Focuses on establishing infrastructure for skill training centres to foster sector-specific competencies.

National Occupational Standards (NOS) Development

- FICSI, with the assistance of Ernst & Young (E&Y), identifies job roles and required skills to develop standards in various sub sectors:

- Fruits and vegetables

- Dairy

- Meat and fish

- Bakery, beverages, and packaged foods.

- Common standards include packaging and quality analysis, ensuring uniformity across the sector.

Entrepreneurship Programs

- The government regularly conducts skill development and entrepreneurship programs for farmers, youth, and professionals.

- MoFPI promotes entrepreneurship through these programs, with entrepreneurship modules integrated into all job role curricula.

NABARD’s Role in Food Processing and Storage Infrastructure

- The National Bank for Agriculture and Rural Development (NABARD) is instrumental in enhancing agricultural storage and food processing capabilities.

Warehouse Infrastructure Fund (WIF)

- Objective: To create modern, scientific storage infrastructure in rural areas.

- Achievements:

- ₹9,452.61 crore sanctioned for 8,162 projects.

- Resulted in 13.74 million MT of storage capacity.

- Collaborates with stakeholders to accredit existing warehouses.

Food Processing Fund (FPF)

- Objective: To promote the organised food processing industry by providing affordable credit for food parks and processing units.

- Achievements:

- ₹1,191.57 crore sanctioned for 41 projects.

- Projects cover 1,370.03 acres, creating necessary infrastructure like warehouses, silos, and cold storage.

Investment Potential in the Food Processing Sector

- 100% FDI is allowed under the automatic route in food processing.

- Additionally, 100% FDI is permitted through the Government approval route for e-commerce of food products manufactured or produced in India.

- Cumulative FDI (2014-2023): The sector attracted USD 6.18 billion in equity inflow during this period.

Conclusion

- The food processing sector in India holds immense potential due to its consistent growth, significant contribution to the economy, and strong investment opportunities.

- With ongoing skill development initiatives, government support through schemes like Pradhan Mantri Kisan SAMPADA Yojana, and NABARD’s efforts in enhancing storage infrastructure, the sector is poised for substantial growth in the coming years.

- The sector’s role in reducing post-harvest losses, promoting agro-processing, and supporting employment makes it a cornerstone of India’s agricultural and industrial strategy.

2. India’s Food Regulatory Landscape: Transition Towards A Robust And Contemporary System

Introduction

- The Food Safety and Standards Act (FSSA), enacted in 2006, marked a transformative shift in India’s food regulatory landscape, aligning it with global best practices.

- The Act replaced outdated food safety laws and established the Food Safety and Standards Authority of India (FSSAI) as the apex regulator for both domestic and imported food products.

- This regulatory framework covers all aspects of food safety, including manufacturing, import, distribution, and sale.

Scope and Objectives of FSSAI

- Scope:

- FSSAI regulates all activities related to the manufacturing, import, distribution, and sale of food products in India.

- Objectives:

- Formulate science-based standards for food products, additives, and contaminants.

- Regulate packaging and labelling requirements to ensure product safety and transparency.

- Establish an integrated food safety surveillance system.

- Promote self-compliance and awareness among food businesses through training and certification.

- Collaborate with international organisations to align Indian standards with global benchmarks, ensuring India’s food regulations are competitive worldwide.

National Food Control Systems

- Definition:

- A National Food Control System is designed by countries to ensure the safety of food for human consumption. These systems focus on setting standards for domestic production, sales, and international trade.

- Objectives as Defined by FAO:

- Protect public health by reducing the risk of foodborne illnesses.

- Safeguard consumers from unsanitary, mislabeled, or adulterated food products.

- Contribute to economic development by maintaining consumer confidence and facilitating trade.

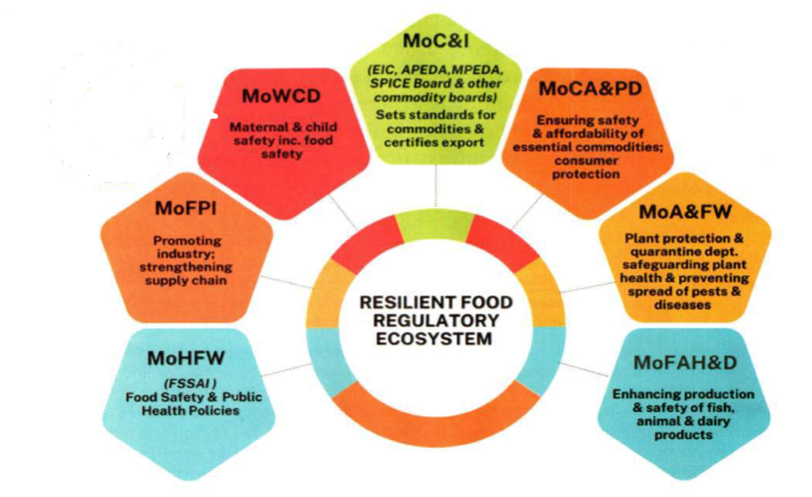

India’s Approach to a Resilient Food Regulatory Ecosystem

- Regulatory Leadership:

- FSSAI leads the food safety ecosystem in India, with various ministries and departments coordinating to ensure a robust regulatory framework.

- Collaborating Ministries:

- The Ministry of Agriculture and Farmers Welfare, Ministry of Health and Family Welfare, Ministry of Food Processing Industries, Ministry of Fisheries, Animal Husbandry and Dairying, Export Inspection Council, Spices Board, and others work together to ensure a transparent and efficient food regulatory ecosystem.

Export Regulation

- Autonomous Organisations:

- Export regulation is handled by various autonomous bodies such as Export Inspection Council (EIC), Agricultural and Processed Food Products Export Development Authority (APEDA), Marine Products Export Development Authority (MPEDA), Spices Board, and Tea Board.

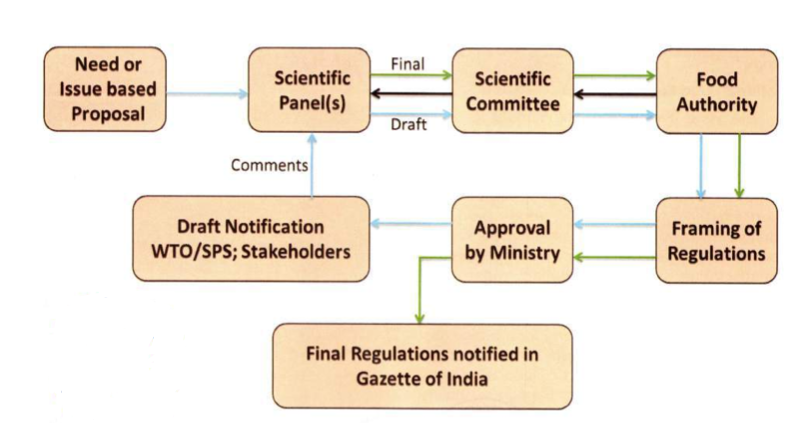

Standard Setting Process

- Science-Based Standards:

- FSSAI develops standards through a transparent and rigorous process, involving various scientific bodies including Scientific Panels and the Scientific Committee.

- Scientific Panels (SPs):

- Consist of experts from research institutes and government organisations who formulate food safety standards.

- Scientific Committee (SC):

- Reviews and validates the standards proposed by the Scientific Panels before final approval by the Food Authority.

- Harmonisation:

- Indian food standards are harmonised with international guidelines, particularly those set by the Codex Alimentarius Commission (CAC).

- Public Consultation:

- Draft standards are published for stakeholder comments before finalisation to ensure transparency and inclusivity in the standard-setting process.

- Final Notification:

- Once approved, the standards are notified in the Gazette of India.

Enforcement and Regulatory Oversight

- Multi-pronged Approach:

- FSSAI employs a combination of traditional inspections, self-compliance initiatives, and third-party audits to ensure effective enforcement of food safety regulations.

- Food Safety Compliance System (FoSCoS):

- An integrated online platform for licensing, registration, and monitoring of Food Business Operators (FBOs).

- Food Safety Officers:

- FSSAI’s network of Food Safety Officers conducts inspections and investigates complaints to ensure compliance with food safety standards.

- Risk-Based Inspection System (RBIS):

- FSSAI has developed RBIS to optimize regulations by targeting FBOs based on risk matrices.

- FoSCoRiS Mobile App:

- Supports real-time monitoring and data collection during inspections to ensure compliance.

Capacity Building and Self-Compliance

- Self-Compliance Initiatives:

- FSSAI has introduced several initiatives to promote self-compliance among food businesses.

- Food Safety Training and Certification (FoSTaC) Programme:

- Aims to build capacity among food handlers, ensuring trained food safety supervisors in establishments. Over 17.2 lakh food handlers have been trained under this program.

- Third-Party Audits:

- Recognized auditing agencies conduct mandatory audits for high-risk food categories to ensure compliance.

- Hygiene Rating Scheme:

- A voluntary initiative encouraging businesses to assess and improve their food hygiene and safety levels.

Import Management

- Food Import Clearance System (FICS):

- FSSAI regulates the safety of imported food through FICS, which is integrated with ICE-GATE for efficient scrutiny and approvals. FSSAI has officers at 156 entry points to facilitate the clearance process.

- Animal and Plant Quarantine:

- Import control related to animal and plant health is managed by respective ministries through quarantine certification services.

Food Testing and Surveillance

- Laboratory Network:

- FSSAI has established a robust laboratory network comprising 239 primary labs, 22 referral labs, and 12 national reference labs.

- Food Safety on Wheels (FSW):

- Mobile units equipped with Rapid Analytic Food Testing Kits (RAFT) to facilitate on-the-spot food testing and public awareness campaigns.

- DART Book and Food Safety Magic Book:

- Developed by FSSAI to help consumers detect common adulterants in food products at home.

- Surveillance Programs:

- FSSAI undertakes pan-India surveillance programs to identify non-compliance hotspots and improve food safety.

- Integrated Food Laboratory Network (IFOLNET):

- FSSAI is developing IFOLNET for real-time monitoring of food testing.

- NetProFaN and NetSCoFAN:

- NetProFaN is a network of food and nutrition professionals assisting FSSAI in implementing programs. NetSCoFAN is a collaboration among research institutions for food safety research and standard setting.

Role of Autonomous Organizations in Export Trade

- Export Inspection Council (EIC):

- The official certification body ensures the safety of exported products.

- APEDA:

- Promotes the export of agricultural and processed food products from India.

- MPEDA:

- Promotes the marine products industry and inspects marine products for export.

- Tea and Coffee Boards:

- Certify exports and promote the domestic trade of tea and coffee.

- Spices Board:

- Regulates and promotes the export of Indian spices.

- CAPEXIL and SHEFEXIL:

- Promote the export of chemical and allied products and shellac-based products, respectively.

- Indian Oilseed and Produce Export Promotion Council (IOPEPC):

- Promotes the export of oilseeds and oils, and issues export certificates.

Conclusion

- India’s food regulatory framework, spearheaded by FSSAI, is designed to ensure food safety, protect public health, and promote trade.

- Through a multi-faceted approach that includes scientific standards, robust enforcement, capacity building, and international collaboration, India is building a resilient and globally aligned food safety ecosystem.

3. Processed Foods: Rising Demand For Healthier Food Options

Introduction: The Shift Towards Healthier Eating Habits

- In recent years, there has been a significant rise in awareness about the importance of a balanced and healthy diet. Modern lifestyles, often filled with stress and processed food consumption, have led individuals to seek healthier alternatives for overall well-being.

- Consumers are now more mindful of how their dietary choices impact their health, energy levels, and long-term vitality. This shift has driven demand for nutritious, natural, and minimally processed food products.

Growing Demand for Nutritious Foods

- As consumers become more health-conscious, the demand for natural and organic food products has surged.

- There has been a noticeable shift away from processed and artificial foods towards more wholesome, nutritious options that promote better health.

- With a heightened focus on fitness and well-being, individuals are now opting for grains, pulses, and whole grains that offer higher nutritional value.

NAFED’s Role in Promoting Nutritious Foods

- The National Agricultural Cooperative Marketing Federation of India (NAFED) has taken active steps in promoting healthy food choices.

- NAFED’s focus has shifted to include the promotion of products such as millets, Bharat Atta (whole wheat flour), Bharat Dal (pulses), and Bharat Chawal (rice) as part of its larger mission to encourage healthier eating habits.

- NAFED is working to ensure these products are available at affordable prices, supporting both the agricultural sector and consumer health.

Millets: The Future of Nutritious Grains

- Nutritional Benefits: Millets are packed with essential nutrients such as protein, fiber, vitamins, and minerals. They are particularly beneficial for people managing diabetes due to their low glycemic index. Additionally, millets are gluten-free, making them suitable for individuals with gluten sensitivities.

- Health Advantages: Millets support digestion, promote heart health, and can prevent conditions like asthma, making them an ideal choice for a balanced diet.

- Environmental Sustainability: Millets are known for their resilience in adverse weather conditions, making them a sustainable crop choice. They require fewer resources like water and fertilizers compared to other staple grains.

- NAFED’s Millets Initiatives:

- NAFED has introduced the “Millets Experience Centre,” showcasing the versatility of millets in various culinary forms.

- To promote millet-based businesses, NAFED supports startups and provides them with a platform for growth.

- Millets are now featured in “Millet Corners” in NAFED Bazaar outlets and are also available through millet vending machines in Delhi-NCR.

- Global awareness of millets has been boosted through custom millet-centred gift hampers distributed at international events like the G20 meetings.

Bharat Atta: Whole Wheat Flour for a Healthier Diet

- Nutritional Profile: Bharat Atta is a premium-quality whole wheat flour that retains the natural fibre, vitamins, and minerals found in wheat grains. It is a wholesome alternative to refined flour.

- Government Support: The Government of India, through its Open Market Sale Scheme (OMSS), offers Bharat Atta at subsidised rates. NAFED ensures its distribution through various retail outlets, ensuring accessibility to the public.

Bharat Chawal: Nutritious Rice Option

- Nutritional Value: Bharat Chawal is promoted by NAFED as a nutritious rice product. It provides essential nutrients and is a key part of a balanced diet.

- Government Initiatives: NAFED’s efforts to make Bharat Chawal affordable are part of the government’s larger agenda to ensure food security and stable food prices.

Bharat Dal: Pulses for a Healthier Lifestyle

- Nutritional Benefits: Pulses, such as those found in Bharat Dal, are rich in protein, fibre, and essential nutrients like iron, calcium, and magnesium. They are an excellent source of nutrition for maintaining a healthy weight and supporting heart health.

- Sustainability: Pulses are also environmentally friendly, as they require less water to grow and contribute to soil fertility. This makes them a sustainable crop choice for farmers.

- Health Benefits: Consuming pulses can help manage cholesterol levels, reduce the risk of heart disease, and provide slow-release energy, keeping individuals satiated for longer periods.

- Government Support: To stabilise prices and ensure a consistent supply of pulses, the government has implemented schemes like the Price Support Scheme (PSS) and the Price Stabilization Fund (PSF). These initiatives provide farmers with fair prices and ensure the availability of pulses in the market.

Government and NAFED’s Collaborative Initiatives

- NAFED collaborates with various government bodies to address issues related to food shortages, particularly in pulses, ensuring food security for the population.

- Through initiatives like the Price Support Scheme (PSS), the government supports pulse farmers by guaranteeing minimum support prices and creating buffer stocks to ensure price stability.

Conclusion: Building a Sustainable and Health-Conscious Future

- The rising demand for healthier food options reflects a growing awareness of the importance of a balanced diet for long-term well-being.

- NAFED’s initiatives, including the promotion of Bharat Atta, Bharat Dal, Bharat Chawal, and millets, align with the broader goals of supporting sustainable agriculture and improving public health.

- By embracing these products, consumers contribute to a more sustainable food system, supporting both their health and the well-being of future generations. NAFED’s efforts are instrumental in creating a food ecosystem that is nutritious, affordable, and environmentally friendly.

4. Export Potential and Global Competitiveness of Indian Processed Foods

Introduction: The Importance of India’s Food Processing Industry

- India’s food and agricultural products account for around 11% of the country’s total exports, reflecting the critical role of this sector in the economy.

- The Food Processing Industry (FPI) is crucial as India is one of the top global producers in key food categories, including dairy, cereals, fruits, vegetables, animal proteins, fish, spices, and tea.

- The sector, dominated by Small and Medium-sized Enterprises (SMEs), is vital for employment creation and enhancing farmers’ incomes, making it a cornerstone of India’s agricultural and economic landscape.

India’s Export Landscape

- India ranks as the 18th largest exporter globally, contributing around 1.8% of the global merchandise exports.

- Exports account for approximately 23% of India’s GDP, which is comparatively higher than some major economies like the USA (12%), Japan (19%), and China (21%).

- After the COVID-19 pandemic, India saw a recovery in its exports, but there was a slowdown in the last fiscal year, with merchandise exports slightly declining to USD 437 billion in 2023-24.

Export Potential in the Processed Food Sector

- Despite being the second-largest producer of agricultural products globally, India’s share in global processed food exports remains relatively low.

- The country’s export basket is dominated by a few key food items, including rice, spices, buffalo meat, sugar, and oil meals.

- Established markets for these items include countries such as the USA, China, UAE, Saudi Arabia, Bangladesh, Iran, Indonesia, Vietnam, Sudan, and the Netherlands.

- There is significant untapped potential for export growth in processed food products, indicating the need for economic diversification and sectoral growth.

Key Policy Initiatives to Enhance Exports

- Agricultural Export Policy (2018): Aims to boost agricultural exports to USD 100 billion by creating a conducive export environment through supportive policies and measures.

- Production Linked Incentive Scheme for Food Processing Industry (PLISFPI): Focuses on diversifying India’s export portfolio by promoting value-added food segments such as ready-to-cook/ready-to-eat foods, processed fruits and vegetables, marine products, and mozzarella cheese.

- Brand India Promotion: Includes global branding and marketing support aimed at enhancing the international presence of Indian processed foods.

- Infrastructure Modernization: The Pradhan Mantri Kisan Sampada Yojana (PMKSY) addresses the infrastructure challenges faced by SMEs in the FPI sector and promotes the adoption of modern technology.

- Mega Food Parks (MFPs): MFPs facilitate the clustering of processing units, knowledge sharing, and the enhancement of quality and competitiveness in export markets.

Support from the Federation of Indian Export Organizations (FIEO)

- FIEO plays a crucial role in supporting exporters by providing market research reports, country-specific information, and data on global trade trends.

- These resources help exporters explore new markets, identify export opportunities, and make well-informed decisions.

Technological Advancements in Food Processing Industries

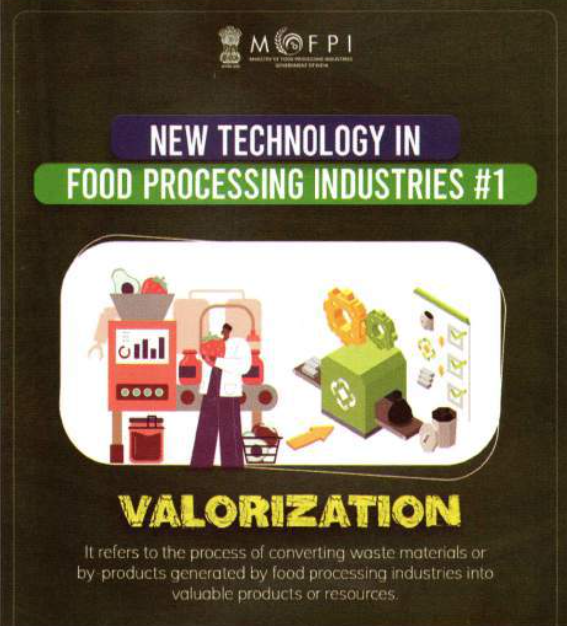

- Valorization: Involves converting waste materials from food processing industries into valuable products, reducing waste and creating new revenue streams.

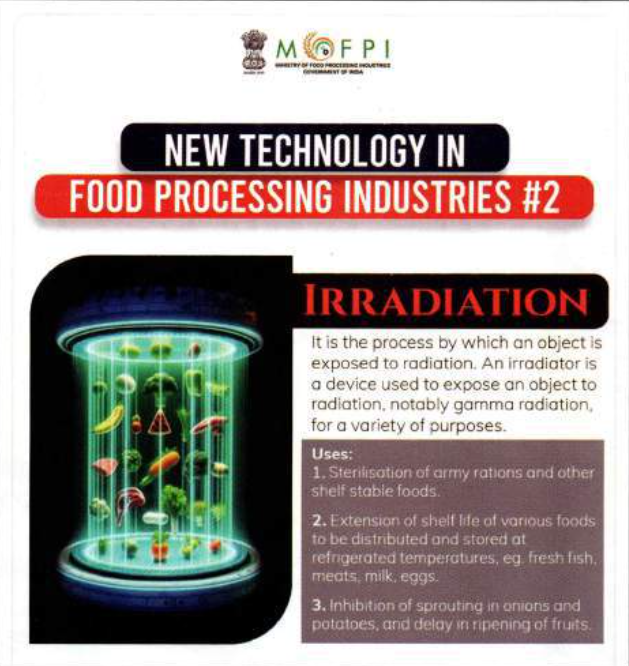

- Irradiation: This technology uses radiation for sterilisation, extending the shelf life of food products and inhibiting sprouting, ensuring both safety and quality for export markets.

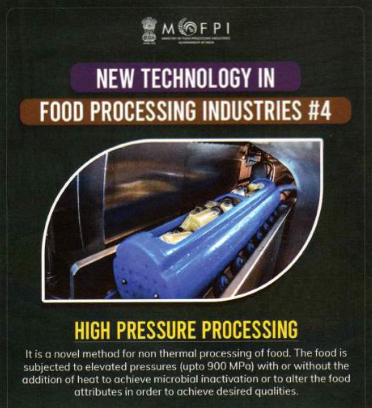

- High Pressure Processing (HPP): A non-thermal food processing method that subjects food to high pressures to inactivate microbes or modify food attributes, enhancing safety and maintaining nutritional quality.

Challenges and Areas for Improvement

- India’s share in global imports of processed food products, such as pet food and bakery items, remains low despite rising global demand.

- Data-Driven Policies: India could benefit from introducing separate Harmonized System (HS) codes for processed foods to maximize export potential, as seen in countries like Singapore.

- Compliance with Global Standards: Compliance with World Trade Organization (WTO) Sanitary and Phytosanitary (SPS) measures is essential for accessing and maintaining international market presence.

- There is a need for a centralised repository of standards for SMEs to ensure easier compliance.

- Free Trade Agreements (FTAs): FTAs with Mutual Recognition Agreements (MRAs) are necessary to streamline certification processes for Indian exports and reduce barriers to market entry.

Quality Assurance and Raw Material Supply

- The formation of 10,000 Farmer Producer Organizations (FPOs) by the government is a positive step toward ensuring a consistent supply of high-quality raw materials for processed food exports.

- Capacity Building and Training: There is a need to align local manpower with export demands by providing training in food safety, HACCP certification, and professional courses in food technology, science, engineering, and packaging.

Logistics and Marketing Strategies

- Efficient Logistics: The establishment of cold chains, temperature-controlled warehouses, and reefer vans is crucial for maintaining product quality during transportation, especially for exports.

- Global Trade Fairs: Trade fairs play an important role in exposing Indian processed food exporters to international buyers. These events are particularly beneficial for startups and SMEs, which may lack the resources to access key global markets directly.

Conclusion: The Path Forward for Indian Processed Food Exports

- India’s food processing sector holds immense potential for growth in exports, driven by its rich agricultural base.

- By investing in modern infrastructure like food parks, improving compliance with global food safety standards, and fostering innovation, India can become a global leader in processed food exports.

- The continued support of government initiatives, collaboration within the industry, and a focus on capacity building will be vital in transforming India’s processed food industry into a key driver of economic growth and establishing a strong position in the global market.

5. The Coconut Craze – It is Real and Here to Stay

Introduction: The Global and National Importance of Coconut

- India is the largest producer of coconuts globally, playing a pivotal role in the international coconut industry.

- Coconut is primarily grown in coastal areas of tropical countries and contributes significantly to sustainable agriculture.

- Its versatility, with every part of the coconut being used, supports rural livelihoods and social security, making it crucial for economic, social, and environmental sustainability in these regions.

- As a crop, coconut has wide-ranging applications in industries such as food, health, beauty, and beverages, highlighting its global significance.

Global and National Significance of Coconut

- India’s leadership in coconut production underlines the country’s importance in the global coconut market.

- Coconut is considered vital for sustainable agriculture as it grows primarily in tropical coastal regions, contributing to the environment by supporting soil conservation and coastal protection.

- The versatility of the coconut tree allows every part to be utilized, offering various products that support rural employment and provide social security to people in coastal areas.

Uses of Coconut Products

- Coconut Oil (CO)

- Cooking Oil: Widely used in South Indian cuisine.

- Beauty Products: Face creams, soaps, detergents.

- Health Supplement: Lauric acid and monolaurin support immunity.

- Antimicrobial Applications: Medium Chain Triglycerides (MCT) oil with caproic, caprylic, and capric acids.

- Virgin Coconut Oil (VCO)

- Health Benefits: Skin care, Alzheimer’s, Type 2 Diabetes, Psoriasis, reduces abdominal obesity.

- Daily Consumption: 10-15 ml to boost immunity.

- Coconut Water (CW)

- Hydration: Natural rehydrating beverage, used in emergencies as intravenous fluid.

- Oral Rehydration: Popular drink in India.

- Desiccated Coconut (DC)

- Food Ingredients: Snacks, bakery products, toppings.

- Dietary Needs: Vegan and gluten-free.

- Coconut Milk (CM) & Coconut Milk Powder (CMP)

- Culinary Use: Staple in South and Southeast Asian cuisines.

- Convenience: Powder for vegan diets and lactose intolerance.

Technological Advancements and Support in Coconut Processing

- Technological advancements in food production are being developed worldwide to exploit coconut’s potential, including innovations like dietary fibre products and coconut water capsules for rehydration.

- The Coconut Development Board (CDB) plays a key role in promoting coconut processing and value addition through technology development, training, and technology transfer to manufacturers.

- Entrepreneurs are encouraged to establish processing units with support from credit-linked back-end subsidies covering 25% of project costs.

Future Outlook: The Role of Coconut in Global Food Security

- Coconut, often referred to as the “Kalpavriksha” or “tree of life,” is indispensable due to its varied health and nutritional benefits.

- The crop’s diverse applications make it an ideal product in the global fight against hunger and poverty, reinforcing its role in promoting sustainable food security.

Conclusion: Unlocking Coconut’s Full Potential

- Coconut’s immense potential in food, health, and industrial sectors positions it as a vital crop in both the global and Indian contexts.

- The wide range of products derived from coconuts offers economic opportunities while ensuring sustainability in agriculture.

- With technological advancements and government support, the coconut industry is set to play a significant role in future agricultural development, rural livelihood enhancement, and global food security.

6. Production Linked Incentives Scheme for Food Processing Industry

Introduction

- India’s food processing sector is a vital economic component, bridging agriculture and the consumer market.

- everaging government initiatives like the PLISFPI, PMKSY, and PMFME schemes, the sector aims to enhance production, export capabilities, and farmer incomes while creating substantial employment opportunities.

Production Linked Incentive Scheme for Food Processing Industry (PLISFPI)

- Objective: Support food manufacturing entities with minimum sales and investments to expand processing capacity and enhance global branding.

- Goals:

- Support creation of global food manufacturing champions.

- Strengthen select Indian food brands for international markets.

- Increase off-farm job opportunities.

- Ensure better farm produce prices and higher farmer incomes.

- Salient Features:

- Central sector outlay of ₹10,900 crore.

- Focus areas: Ready to Cook/Ready to Eat foods, processed fruits and vegetables, marine products, and mozzarella cheese.

- Includes support for branding and marketing abroad.

- Implementation period: 2021-22 to 2026-27.

- Implementation:

- Nationwide rollout with a Project Management Agency (PMA) overseeing application appraisals and claims.

- Incentives paid for six years, with expected processed food output of ₹33,494 crore and employment for 2.5 lakh individuals by 2026-27.

Pradhan Mantri Kisan SAMPADA Yojana (PMKSY)

- Overview: Comprehensive scheme to boost farmers’ income and the food processing sector, extended until 31.03.2026 with a total allocation of Rs. 4600 crores.

- Key Objectives:

- Develop modern infrastructure and efficient supply chains from farm gate to retail.

- Enhance food processing growth and farmers’ returns.

- Create employment in rural areas and reduce agricultural produce wastage.

- Increase processing levels and processed food exports.

- Components:

- Mega Food Parks.

- Integrated Cold Chain and Value Addition Infrastructure.

- Infrastructure for Agro-Processing Clusters.

- Creation of Backward and Forward Linkages.

- Expansion of Food Processing and Preservation Capacities.

- Food Safety and Quality Assurance Infrastructure.

- Human Resources and Institutions.

- Incorporates ‘Operation Greens’ for perishable products, expanding to 22 items.

- Expected Impact:

- Leverage investment of Rs. 11,095.93 crore.

- Benefit 28,49,945 farmers.

- Generate 5,44,432 direct and indirect employment opportunities by 2025-26.

PM Formalization of Micro Food Processing Enterprises (PMFME) Scheme

- Overview: Centrally sponsored scheme operational from 2020-21 to 2024-25 with an outlay of Rs. 10,000 crore to support 2 lakh micro food processing enterprises.

- Funding Ratios:

- 90:10 for North Eastern and Himalayan States.

- 60:40 for UTs with legislatures; 100% funded by the Centre for other UTs.

- 60:40 between Central and State Governments for other states.

- Objectives:

- Increase credit access for micro food processing entrepreneurs, FPOs, Self Help Groups, and Co-operatives.

- Integrate enterprises into the organized supply chain with enhanced branding and marketing.

- Transition 2 lakh enterprises into the formal framework.

- Provide access to common services like processing facilities, laboratories, and marketing.

- Strengthen institutions and training in the food processing sector.

- Support Details:

- Credit-linked subsidy at 35% of eligible project cost, up to Rs. 10 lakh.

- Minimum 10% beneficiary contribution; balance covered by loan.

- Seed capital of Rs. 4 lakhs per SHG for working capital and tools.

- Grants for backward/forward linkages, common infrastructure, and marketing.

- Nodal Ministry: Ministry of Food Processing Industries.

Conclusion

- India’s strategic investments in food processing through targeted schemes will bolster sector growth, improve global competitiveness, and support farmers.

- These initiatives are crucial for transforming the industry into a significant economic driver, fostering sustainable development and food security.

7. Smart Food Processing in India – Innovation And Future Prospects

Introduction

- The food processing industry is experiencing a significant transformation driven by technological advancements.

- Innovations such as the Internet of Things (IoT), Artificial Intelligence (AI), and robotics are enhancing efficiency, quality, and sustainability. These technologies are setting new standards in food production and processing.

Internet of Things (IoT) in Food Processing

- Real-Time Monitoring and Data Collection: IoT enables continuous monitoring of various parameters throughout the food processing supply chain. Sensors track conditions such as temperature, humidity, and product quality, providing real-time data for analysis.

- Predictive Maintenance: IoT-powered systems can predict equipment failures before they occur, reducing downtime and maintenance costs. This proactive approach helps in maintaining smooth operations.

- Optimised Resource Utilisation: Data collected through IoT helps in efficient use of resources, minimising waste, and improving overall process efficiency.

- Enhanced Food Safety: IoT systems monitor food safety conditions, alerting operators to any deviations that could compromise product safety. This improves compliance with safety regulations and enhances consumer trust.

- Improved Supply Chain Visibility: IoT traceability systems provide end-to-end visibility in the supply chain, enabling better inventory management and quicker response to potential food safety issues. This results in more reliable and efficient supply chains.

Artificial Intelligence (AI) Applications

- Product Development: AI accelerates product development by analysing market trends, consumer preferences, and ingredient interactions. This helps in creating innovative products that meet consumer demands.

- Quality Control: AI-powered computer vision systems automate the inspection, grading, and sorting of food products. Machine learning algorithms enhance accuracy, ensuring consistent product quality and reducing human error.

- Demand Forecasting: AI algorithms analyse historical data and market trends to forecast demand more accurately. This helps in optimising production schedules and reducing overproduction or underproduction.

- Process Optimization: AI-driven systems analyse production processes to identify inefficiencies and recommend improvements. This leads to optimised processes, reduced waste, and enhanced productivity.

Robotics and Automation

- Material Handling: Robotics streamline material handling processes, such as transporting raw materials and finished products within the facility. This reduces manual labour and improves efficiency.

- Packaging and Palletizing: Robotic systems automate packaging and palletizing tasks, enhancing precision and speed. Automation in these areas reduces packaging errors and increases throughput.

- Labour Savings: Robotics perform repetitive and labour-intensive tasks with greater precision and consistency. This reduces the need for manual labour, lowers labour costs, and improves worker safety.

- Operation in Harsh Environments: Robots can operate in environments that are too harsh or hazardous for human workers. This minimises the risk of exposure to contaminants or injuries.

Conclusion

- The integration of IoT, AI, and robotics in the food processing industry is driving a new era of efficiency, quality, and sustainability.

- These technologies are not only enhancing operational capabilities but also setting new standards for safety and productivity.

- Embracing these advancements will enable the industry to meet growing demands and achieve greater success in the global market.