Chapter 10 INDUSTRY: SMALL AND MEDIUM MATTERS

- Industrial growth in FY24 accelerated, with manufacturing and construction leading the recovery. Industrial Gross Value Added (GVA) at constant prices was 25% higher than pre-Covid levels, driven by increased credit offtake, infrastructure investments, and supportive policies.

- Consumer-oriented industries like automobiles and pharmaceuticals saw significant output gains, while sectors such as petroleum and textiles declined. Future growth depends on improving efficiencies in labor-intensive segments, incentivizing R&D, formalizing smaller manufacturers, and reducing MSME compliance burdens.

- Strong domestic demand and positive business expectations support this expansion, though global demand uncertainties and key input prices pose challenges.

INTRODUCTION

- Among the four sub-sectors of industry, manufacturing and construction achieved close to double-digit growth, while mining & quarrying and electricity & water supply also recorded strong positive growth in FY24.

- The share of manufacturing in total gross value added at current prices was 14.3 per cent in FY23. However, the output share is 35.2 per cent during the same period, indicating that the sector has significant backward and forward linkages.

Key Industrial Intermediates

Cement industry:

- The cement industry contributes approximately 11 per cent of the input cost to the construction sector in India.

- The Indian cement industry comprises 159 integrated large cement plants, 120 grinding units and 62 mini cement plants. The current annual installed capacity of the cement industry in India is about 622 million tonnes, with cement production of around 427 million tonnes in FY24.

- Domestic cement consumption in India is around 260 kg per capita against a global average of 540 kg per capita, signifying potential for growth. In the last ten years, the import of

clinker has increased. However, the quantity of imports is still low.

Steel Sector

Contribution of the sector: Iron and steel contribute approximately 47 per cent of all inputs in the building & construction sector. It also serves as a critical input for the production of machinery and consumer goods.

Export: India became a net exporter of finished steel over the past decade. In FY24, India started off as a net exporter in Q1. However, in Q2 and Q3, it became a net importer. However, the import dependence on coking coal, an essential raw material for steel production went up from 56.1 MT in FY23 to 58.1 MT in FY24.

Coal

- Coal accounts for more than 55 per cent of India’s primary commercial energy. Coalfire power generation accounts for about 70 per cent of the total power generation.

- In FY24, India produced 997.2 million tonnes of coal, imported 261 MT and consumed 1233.86 MT.

| Recent initiatives, challenges and opportunities in the coal sector | |

| Recent Initiatives | Challenges, opportunities and options |

|

|

Major Consumer-oriented Industries

Pharmaceuticals

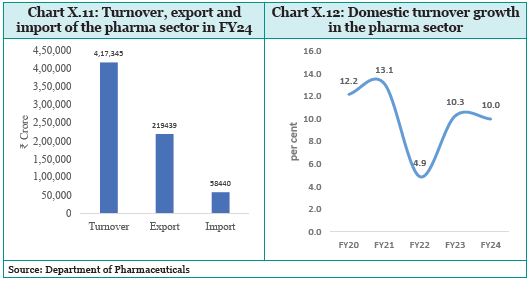

- India’s pharmaceutical market currently valued at USD 50 Billion is the world’s third largest by volume.

- “Pharmacy of the world” as it is often called offers around 60,000 generic brands across 60 therapeutic categories, accounting for 20 per cent of global generic drug exports by volume.

Need to enhance and Reimagine Pharma R&D

Industry Division

- Innovator Firms:

- Conduct extensive and costly research to develop new medicines and treatments for diseases.

- Benefit from intellectual property rights (IPR) that grant monopolies on their innovations, allowing them to set high prices to recoup research investments and fund further research.

- Generic Producers:

- Focus on producing off-patent drugs cost-effectively, leveraging existing research and reducing development costs.

- Driven by competition, they offer medications at lower prices, making healthcare more affordable and accessible.

Investment Trend

- Big Innovator Firms’ Investments:

- Between 2021 and 2023, large innovator pharmaceutical companies invested USD 54 billion in smaller, agile biotech firms.

- This strategic move aims to leverage the innovative potential of these smaller firms to enhance their own research capabilities and pipeline.

India’s Strength

Generic Drug Production:

- India excels in producing generic drugs efficiently and at a low cost, contributing significantly to global healthcare by providing affordable medication.

- The country’s robust pharmaceutical manufacturing infrastructure and skilled workforce enable high-quality, large-scale production of generic medicines.

Importance of Balance

- Combination of Innovators and Generic Producers:

- A diverse industry comprising both innovator firms and generic producers ensures a balance between high-cost, cutting-edge treatments and affordable, accessible medications.

- This balance is vital for sustainable healthcare, providing both groundbreaking treatments and widespread access to essential medicines.

Vision of Viksit Bharat

- Promoting Innovation:

- Essential for advancing healthcare and economic growth.

- India’s pharmaceutical sector R&D expenditure averaged 5% of sales turnover in FY20 and FY21, highlighting the need for increased investment in innovation.

- Developing New Drugs:

- Focus on addressing unaddressed health concerns to improve the breadth and quality of healthcare.

- Enhances healthcare access for the population and offers better returns on investment for the industry.

Report Recommendations

- Foster Joint Research:

- Encourage collaboration among industry actors to create strategic partnerships and share resources, reducing redundant efforts and enhancing innovation.

- Enhance Industry-Academic Collaborations:

- Strengthen interactions between the pharmaceutical industry and academic institutions for applied research, leveraging academic expertise to drive practical, impactful innovations.

- Reduce Communication Barriers:

- Improve communication between knowledge-based institutions to facilitate better knowledge exchange and collaborative research, including contributions from Tier 2 and Tier 3 institutions.

- Support Exchanges Between Academia and Industry:

- Promote secondments and placements to align human capital development with industry needs, fostering practical skills and research-oriented mindsets.

- Strengthen Communication Channels:

- Enhance communication among knowledge-based institutions and intermediaries, particularly industry associations, to streamline research efforts and innovation dissemination.

- Increase Venture Capital and Angel Investor Funding:

- Expand funding channels to support the ideation-to-market process, enabling startups and small firms to bring innovative solutions to the market.

- Enhance Knowledge Sharing Among Government Bodies:

- Promote an ‘all of government approach’ to innovation, ensuring coordinated and strategic research efforts across different government entities.

Government Initiatives

- Centers of Excellence:

- Establish centers for excellence to promote collaborative research in the pharmaceutical sector and in artificial intelligence applications for healthcare.

- Promotion of Research and Innovation in Pharma MedTech Sector:

- Introduce initiatives aimed at transforming the pharmaceutical sector towards greater innovation, fostering a supportive ecosystem for research and development.

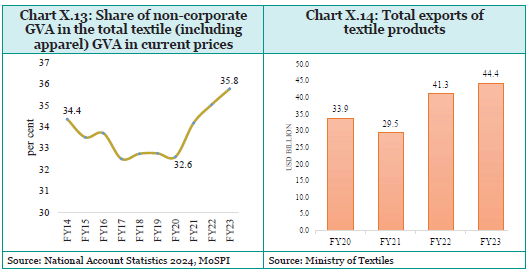

Textile industry

- As per the National Accounts published by the Central Statistics Office, textiles, including the wearing apparel sector, generated a gross value added of ₹3.77 lakh Crore in FY23, which was about 10.6 per cent of the manufacturing GVA at current prices during the year.

- India has a robust end-to-end value chain in the textile industry, spanning raw materials like natural and MMF fibre to the final product and covering apparel, home textiles, and technical textiles. India is the world’s second-largest clothing manufacturer and one of the top five exporting nations.

Electronics industry

- India’s electronics manufacturing sector has experienced significant growth since 2014, accounting for an estimated 3.7 per cent of the global market share in FY22. At the same time, the industry contributed 4 per cent to India’s total GDP in FY22

- Export: Domestic production of electronic items increased significantly to ₹8.22 lakh Crore, while exports rose to ₹1.9 lakh Crore in FY23. India has become an attractive destination for investments in this sector.

| Initiatives to Boost Electronics Industry |

| The Indian government places a high priority on electronics hardware manufacturing, which is a key aspect of both the “Make in India” and “Digital India” initiatives. In order to attract and encourage significant investments in the electronics value chain and boost exports, the government has introduced several schemes: (i) Production Linked Incentive Scheme (PLI) for Large Scale Electronics Manufacturing, (ii) PLI IT Hardware, (iii) Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS), and (iv) Modified Electronics Manufacturing Clusters (EMC 2.0). |

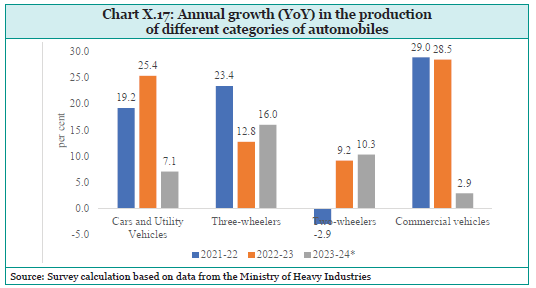

Automotive industry

- The Indian automobile industry includes major global auto manufacturers across different categories, as well as a vibrant auto component industry that produces various auto parts, body and chassis.

- The growth in the value of domestic production and consumption of automotive parts moderated during FY20 to FY23, compared to the previous five years.

- In the first half of the last decade, passenger vehicles, such as cars and utility vehicles,

experienced significant growth. However, the pandemic had a substantial impact on all segments of the automotive industry.

CROSS-CUTTING THEMES

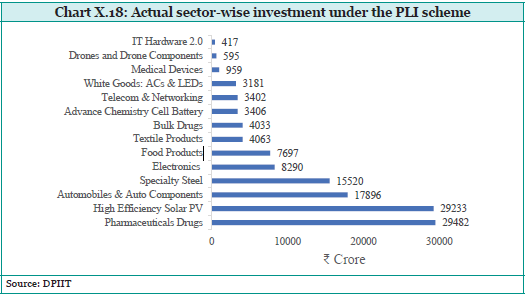

Production Linked Incentive (PLI) Scheme

- Keeping in view India’s vision of becoming ‘Aatmanirbhar’, Production Linked Incentive (PLI) Schemes for 14 key sectors were announced with an outlay of ₹1.97 Lakh Crore to enhance India’s manufacturing capabilities and exports.

- Employment: Over ₹1.28 Lakh Crore of investment was reported until May 2024, which has led to production/sales of ₹10.8 Lakh Crore and employment generation (direct & indirect) of over 8.5 Lakh.

- Export: Export boosted by ₹4 Lakh Crore, with significant contributions from sectors such as large-scale electronics manufacturing, pharmaceuticals, food processing, and telecom & networking products.

- Investment: PLI Scheme for White Goods (ACs and LED Lights) with a total outlay of ₹6,238 Crore was approved by the Government. As of May, 2024 the cumulative investment achieved by white goods(AC, LEDs) under the PLI scheme was ₹3181 crore which generated cumulative sales of ₹13320 crore.

MSME

- Share of MSMEs in all-India manufacturing output during the year FY22 was 35.4 per cent. Data Dissemination Portal of Directorate General of Commercial Intelligence and Statistics (DGCIS) states that the share of export of MSME-specified products in all-India exports in 2023-24 was 45.7 per cent.

- The Udyam Registration portal, launched in July 2020, has been instrumental in formalising MSMEs by providing a simple, online, and free registration process based on self-declaration.

- The Union Budget 2023-24 allocated ₹9,000 Crore to the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), aiming to enable an additional ₹2 Lakh Crore in credit with reduced costs. Significant growth was witnessed from FY20 to FY24 in the amount and number of guarantees for micro and small enterprises.

- Challenges and Opportunities: MSMEs face challenges, including issues with formalisation and inclusion, limited access to finance, markets, technology, and digitalisation, infrastructural bottlenecks, and skilling.

- To address these challenges, the Government has implemented initiatives and platforms aimed at supporting formalisation, ease of registration and grievance redressal, like the Samadhaan Portal, Sambandh Portal, and Champions Portal, which aid in delayed payment issues, procurement monitoring, and speedy resolution of grievances.

Central Public Sector Enterprises (CPSEs)

- As of March 31, 2023, 254 CPSEs were operational. Around 66 per cent of the CPSEs operated in the service sector; the rest in manufacturing, processing & generation and mining & exploration.

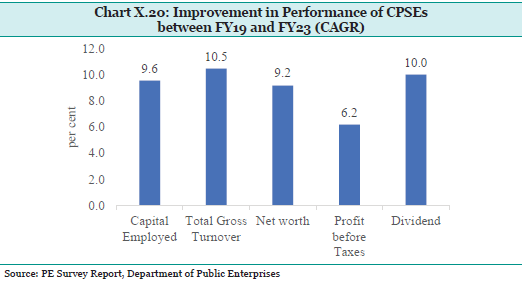

- CPSEs achieved stronger financial parameters FY23 and FY24. The total Market Capitalisation (M-cap) of 63 CPSEs traded on stock exchanges of India was ₹16.69 Lakh Crore as of March 31, 2023, as against ₹15.46 Lakh Crore as of March 31, 2022, reflecting an increase of 7.95 per cent.

- The overall net profit of operating CPSEs in FY23 was ₹2.12 Lakh Crore. The major financial parameters of CPSEs are presented in the Charts below.

Industrial Credit

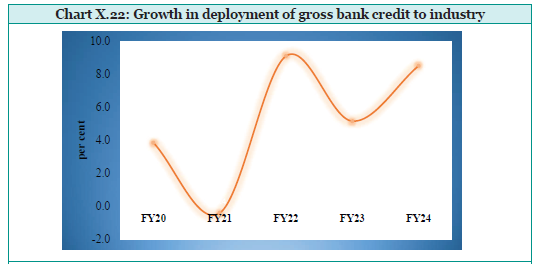

- Industrial credit growth depends on a host of factors, including the cyclicality of economic activity, relativity in the availability and cost of bank funds and other market options, the position of own resources of industrial enterprises and the banking system’s own risk appetite.

- Recovering from the pandemic-driven moderation in FY21, industrial credit picked up strongly in the next year. In FY23, credit growth was mainly driven by large industries; however, this growth was hampered by a decrease in credit to certain sectors.

CONCLUSION AND OUTLOOK

- The foregoing analysis gives an indication of the emerging trends in the Indian industrial landscape. First, over the last decade, there has been a significant realignment of output shares among industrial segments. Sectors like chemicals, wood products and furniture, pharmaceuticals, transport equipment, steel and machinery and equipment have gained in strength.

- Secondly, the export-import balance of different industrial segments has vastly varied

over the last few years. Consistently, major net exporters include industries such as steel,

pharmaceuticals, and automobiles. On the other hand, import dependency in key sectors like coal, capital goods and chemicals continue.

Two common requirements across industries relate to incentivising R&D and innovation and improving the skill levels of the workforce. With respect to both, industry must take the lead. Commitment to R&D must be in the DNA of the industry, independent of any fiscal incentive, since it is about global competitiveness and profitability.