Chapter – 11 SERVICES: FUELLING GROWTH OPPORTUNITIES

Over the past thirty years, India’s economic growth has been significantly supported by the services sector. Post-pandemic developments in FY24 highlight a transformation in domestic service delivery, driven by policy reforms, infrastructure improvements, and a shift towards digital services such as online payments, e-commerce, and entertainment platforms. The demand for high-tech services has also increased. India’s young, tech-savvy population presents an opportunity to improve vocational and educational systems, equipping the workforce with necessary digital and high-tech skills to fully capitalize on these opportunities.

Introduction:

- India’s services sector can be broadly classified into two categories: contact-intensive and non-contact-intensive services. The former includes trade, transport, real estate, social, community and personal services. The latter comprises financial, information technology, communication, broadcasting, and storage services. The sector also incorporates public administration and defence services.

- The services sector continues to be a significant contributor to India’s growth, accounting for about 55 per cent of the total size of the economy in FY24. Several demand and supply side factors determine the performance of the services sector.

OVERVIEW OF THE SERVICES SECTOR PERFORMANCE

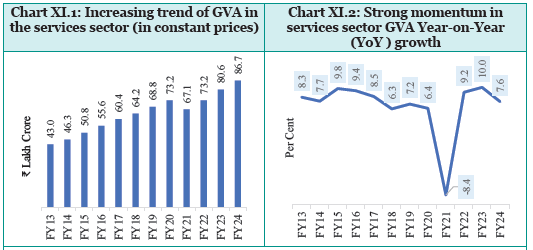

The services sector witnessed a real growth rate of more than 6 per cent in all the years in the last decade except in the pandemic-affected FY21. Globally, India’s services exports constituted 4.4 per cent of the world’s commercial services exports in 2022.

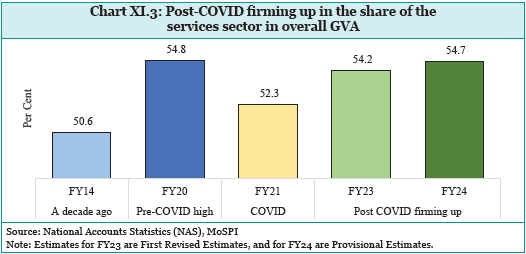

- The contribution of the services sector to the overall GVA has increased significantly in the last decade. The sector’s share dropped in FY21 due to the pandemic-induced contraction. However, as shown in Chart XI.3, the sector’s share has almost recovered to the pre-COVID levels.

- As per the Provisional Estimates, the services sector is estimated to have grown 7.6 percent in FY24. Various high-frequency indicators support the services sector’s growth story.Both GST collections and the issuance of e-way bills, reflecting wholesale and retail trade, demonstrated a double-digit growth.

Purchasing Managers’ Index (PMI)- Services

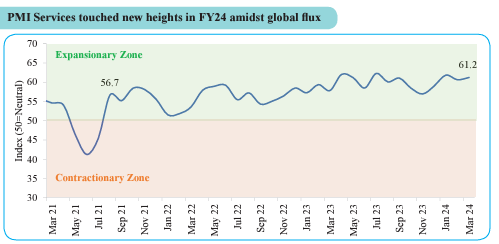

- The services sector in India demonstrated remarkable resilience, overcoming pandemic-related and global disruptions, with significant growth starting from April 2023 and maintaining throughout the financial year.

- HSBC’s India Services Purchasing Managers’ Index (PMI) is a key indicator of this growth. In March 2024, the services PMI reached 61.2, marking the highest expansion in sales and business activity in nearly 14 years, driven by strong demand, efficiency improvements, and positive sales trends.

- The average PMI for FY24 was 60.3, up from 57.3 in FY23. The services PMI has stayed above 50 since August 2021, indicating continuous expansion over the last 35 months despite varying market condition.

Trade in the service sector:

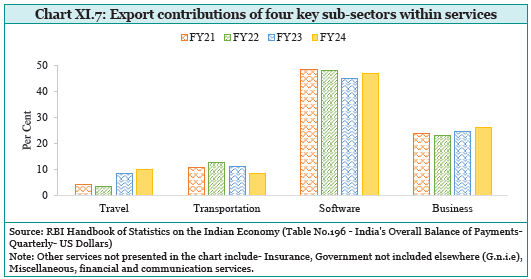

- Over the past three decades, India’s service exports have grown significantly, outpacing merchandise exports and becoming a major part of global exports. In FY24, services exports comprised 44% of India’s total exports. Despite a global trade slowdown reducing growth to 4.8% from 27.8% the previous year, India ranked fifth in global services exports. Key drivers included computer and business services (73% of exports, 9.6% YoY growth) and travel services (24.6% YoY growth due to post-pandemic tourism recovery). Conversely, transportation receipts fell by 19.1%, affected by declining global freight rates and a 3.9% drop in the Baltic Dry Index.

- The growth in the ‘other business services’ segment was driven by sectors like consultancy, PR, engineering, advertising, and technical services. India’s reputation as a hub for Global Capability Centres (GCCs) boosted software and business services exports. The pandemic accelerated a shift towards digitally delivered services, increasing India’s global share from 4.4% in 2019 to 6.0% in 2023.

- In FY24, services imports were USD 178.3 billion, down 2.1% YoY, primarily due to lower global freight rates. The increase in exports and decrease in imports improved net services receipts, helping to cushion India’s current account deficit.

FINANCING SOURCES FOR SERVICES SECTOR ACTIVITY

The services sector fulfils its financing needs domestically through credit from domestic banks and capital markets and internationally through Foreign Direct Investment (FDI) and External Commercial Borrowings (ECBs). The following section explores in detail how the services sector secures its financing.

Bank credit

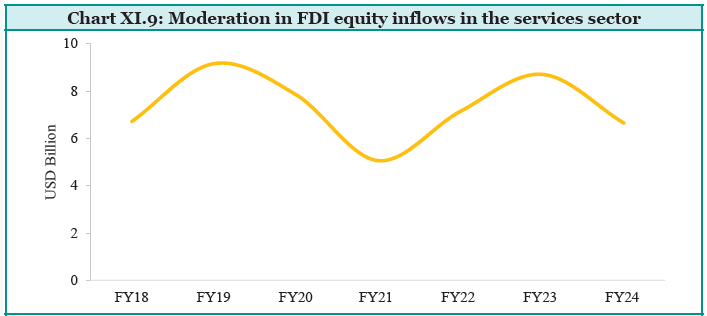

- UNCTAD has published the World Investment Report 2024 (WIR 2024) and has ranked India 15th in terms of FDI inflow (top 20 host economies) for the year 2023. As per the WIR 2024, India is the 2nd largest host country in terms of number of international project finance deals and 4th largest in terms of number of Greenfield project announcements.

- FY24 witnessed a decline in the FDI equity inflows to the services sector (Chart XI.9), as in the case of the overall FDI equity inflows to India. Higher interest rates, geopolitical conflicts, heightened global uncertainties and rising protectionism that favour domestic sourcing have all contributed to lower FDI inflows into the sector.

MAJOR SERVICES: SECTOR-WISE PERFORMANCE

Physical connectivity-based services

- The seamless movement of goods, people, and information across infrastructure networks involves varied transportation services like passenger and freight transport, vehicle maintenance, and airport handling. Logistics services optimize supply chains across roadways, railways, waterways, and airways. Infrastructure development details are in Chapter 12.

Roadways

- India’s cargo transport heavily relies on roads, with significant improvements in toll digitization reducing wait times from 734 seconds in 2014 to 47 seconds in 2024. Future enhancements include Automatic Number Plate Recognition and GNSS for tolling.

- The government’s ‘4E’ strategy aims to improve road safety, while PM Gati Shakti and single-window clearances address infrastructure and efficiency challenges. Development of high-speed corridors and expressways is significantly reducing travel time and boosting economic growth.

Indian Railways

- Indian Railways (IR) enhanced user experience and efficiency in FY24, with 673 crore passengers and 158.8 crore tonnes of freight, showing increases of 5.2% and 5.3%, respectively.

- Initiatives include Wi-Fi at 6108 stations, advanced online ticketing via IRCTC, and comprehensive freight and train management systems. IR also focuses on digitized maintenance, cashless transactions, and centralized training for personnel. Further details are in Chapter 12.

Ports, Waterways and Shipping

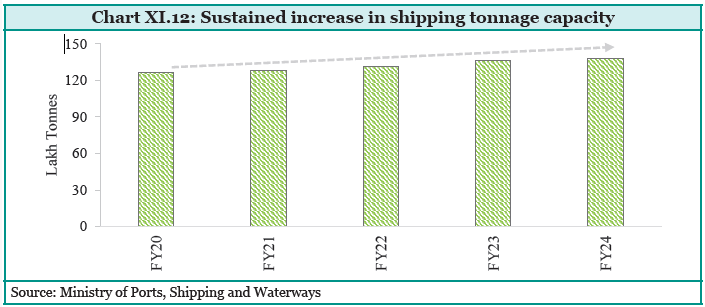

- Decentralisation and Expertise Integration Increased decentralisation, professional expertise, and public-private partnerships have enhanced port management. The Sagar Setu app streamlines operations and integrates 13 major ports, 22 non-major ports, and 28 private terminals.

- River Cruise Tourism Promotion of river cruise tourism on national waterways has led to a 100% increase in overnight cruise trips in FY24. Improved facilities for cargo ships benefit tourist vessels.

- Lighthouse Tourism Lighthouses are becoming tourist attractions with development works like museums, amphitheatres, and cafeterias at 75 sites.

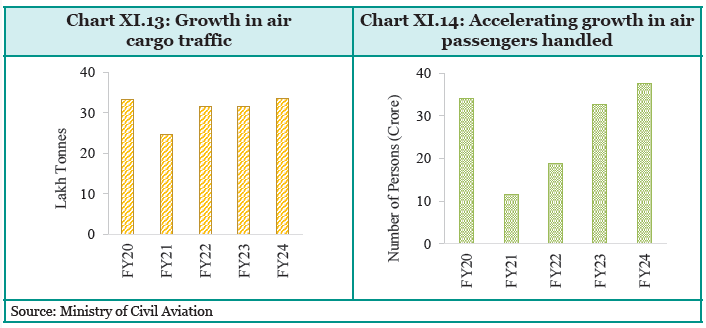

Airways

- Passenger and Cargo Growth India’s aviation sector saw a 15% YoY increase in total air passengers to 37.6 crore in FY24. Domestic traffic rose by 13% to 30.6 crore, while international traffic surged by 22% to 7 crore. Air cargo increased by 7% to 33.7 lakh tonnes.

- Infrastructure and Government Initiatives The government approved 21 greenfield airports and new terminals, promoting regional connectivity through the UDAN scheme. Digi Yatra has enhanced efficiency, benefiting over 2.5 crore passengers.

- Future Prospects and Challenges The Maintenance, Repair, and Operations sector and drone industry are growing. India aims to be a global drone hub by 2030. The sector faces sustainability concerns and a need for skilled workers, with significant progress in pilot training and opportunities for women. Investments in infrastructure and skill development are crucial for future expansion.

Tourism

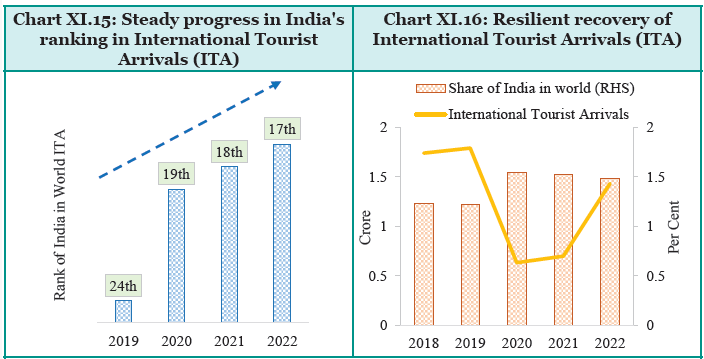

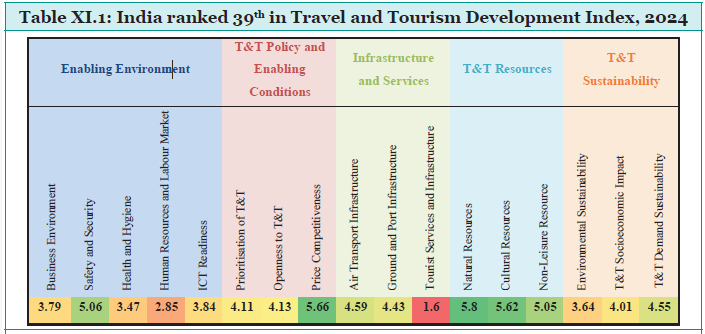

- The tourism sector in India is rapidly expanding, with India being ranked at the 39th position in the World Economic Forum’s Travel and Tourism Development Index (TTDI) 2024. Showing positive signs of revival post-pandemic, the industry witnessed over 92 lakh foreign tourist arrivals in 2023, implying a YoY increase of 43.5 per cent.

- India has significantly earned foreign exchange receipts amounting to over ₹2.3 lakh crore through tourism, indicating a 65.7 per cent YoY increase. India’s share of foreign exchange earnings in world tourism receipts increased from 1.38 per cent in 2021 to 1.58 per cent in 2022.

- The tourism sector has embraced the digital revolution. One such initiative is

E-Marketplace, designed to facilitate interactions between tourists and certified tourist facilitators and guides through web and mobile applications. The Union Government, in collaboration with State Governments and Union Territory administrations, is actively working on registering accommodation units nationwide in the National Integrated Database of Hospitality Industry (NIDHI) portal.

Real Estate

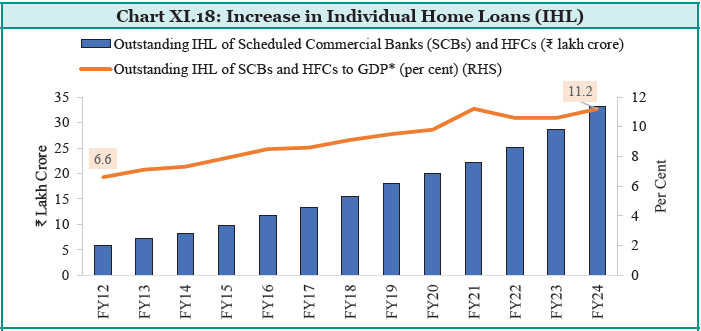

- The real estate sector has significantly recovered post-pandemic, driven by preferences for larger, sustainable homes and remote work trends. Residential sales hit a decade-high in 2023, with a 33% YoY growth to 4.1 lakh units. Housing loans’ demand surged, with banks and Housing Finance Companies (HFCs) playing crucial roles in housing finance.

Information Technology Services, Tech start-ups and Global Capability centres

- Information Technology (IT) services: The IT and IT enabled services have been instrumental in maintaining the country’s external balance through export earnings, which are set to increase further. The flourishing growth of IT services has also supported the expansion of Global Capability Centres (GCCs) and the tech start-up ecosystem in India.

- Global Capability Centres: Global Capability Centres (GCCs) in India have grown significantly, from over 1,000 centres in FY15 to more than 1,580 centres, with over 2,740 units by FY23. These centres contribute to economic growth by providing high-quality employment. In FY23, the total talent employed in Indian GCCs exceeded 16.6 lakh.

- Technology start-ups in India: As per NASSCOM, India’s tech start-up ecosystem ranks third globally and has performed considerably better than the USA and the UK. The strength of the Indian tech start-up ecosystem lies in its large pool of start-ups, unicorns, and ability to scale.

Telecommunications:

- Teledensity and Internet Expansion India’s teledensity rose to 85.7% by March 2024, with 116.5 crore wireless connections. Internet subscribers increased from 25.1 crore in 2014 to 95.4 crore in 2024, driven by the Digital India campaign.

- 5G and 6G Developments India’s 5G services, launched in October 2022, improved mobile broadband speed rankings from 118 to 15. The Bharat 6G Vision and Bharat 6G Alliance were launched to advance 6G technology.

- Broadband and Regulatory Reforms The BharatNet Program aims to connect all Gram Panchayats with broadband. Reforms include spectrum sharing and 100% foreign direct investment to boost competition.

- R&D and Skill Development The Telecom Technology Development Fund supports R&D, while new educational courses focus on 5G technology. The Sanchar Saathi portal enhances subscriber security and awareness.

CHALLENGES AND OPPORTUNITIES

- Skilled Workforce Development The rapid digitisation in services demands a skilled workforce. The government’s Skill India and National Education Policy aim to bridge the gap in digital and high-tech skills, fostering expertise in cybersecurity, enterprise management, and more.

- Logistics and Transport Enhancement Efforts to ease infrastructure bottlenecks and leverage inland waterways, inspired by successful models like the Netherlands and Kerala’s Kochi Water Metro, can streamline transportation, reduce costs, and boost efficiency.

- Access to Finance Accessing finance remains challenging for SMEs. Initiatives like Mudra Yojana and Start-up India help, but further streamlining loan processes, expanding credit schemes, and innovative financing are needed.

- Regulatory Simplification Reforms in the regulatory landscape, including GST simplification and single-window systems, are creating a more conducive business environment. Continued efforts to digitize government processes and streamline legal provisions are essential.

- Data Privacy and Cybersecurity With increased digitisation, data privacy and cybersecurity are critical. The government is enacting data protection laws and cybersecurity policies to safeguard consumer data and promote secure technological adoption.

CONCLUSION AND WAY FORWARD

India’s services sector is transforming with digitisation and diversified exports, becoming a hub for Global Capability Centres and innovative start-ups. Future job demands necessitate skill development in technologies like AI, blockchain, and big data. Despite economic uncertainties, the sector’s post-pandemic resilience, strategic policies, and focus on tourism and technology skills can sustain growth and meet employment goals. Collaboration between government and private sectors is crucial.