CHAPTER 3 – PRICES AND INFLATION: UNDER CONTROL

Low and stable inflation is crucial for sustaining economic growth. Governments and Central Banks aim to maintain moderate inflation while ensuring financial stability.

The Reserve Bank of India (RBI) and the Central Government are committed to price stability. India maintained retail inflation at 5.4% in FY24, the lowest since the Covid-19 pandemic.

Inflation trajectory

- Global Supply Chain Disruptions: Post-pandemic, supply chain disruptions were exacerbated by the Russia-Ukraine war in FY23.

- A decline in global inflation occurred in the latter half of FY23 and FY24 due to:

- Diminishing impact of price shocks, especially in energy.

- Lower core inflation.

- Monetary tightening.

- Role of Coordinated Monetary Tightening: The IMF highlighted that coordinated monetary tightening by Central Banks in major advanced economies during 2022-23 reduced energy prices. This synchronised effort helped lower global energy demand, reducing global inflation.

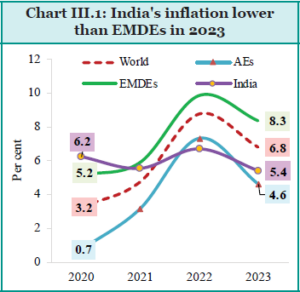

India’s Retail Inflation Compared to Global and EMDEs Averages

Despite synchronous monetary tightening by central banks, the global economy showed unexpected resilience in 2023. Both advanced economies (AEs) and emerging markets & developing economies (EMDEs) are moving back towards their inflation targets.

Inflation Rate in Advanced economies:

There is a negative relationship between cross-country inflation and per capita GDP. Historically, advanced economies have had lower inflation compared to EMDEs due to:

- Established monetary policies.

- Economic stability.

- Well-developed and efficient markets.

- Stable currencies.

These factors contribute to the effective management of inflation in advanced economies.

India’s Inflation

Since 2020, controlling inflation has been challenging globally. However, according to IMF data, India’s inflation rate in 2022 and 2023 was lower than the global average and that of EMDEs.

India’s Effective Inflation Management

Countries set inflation targets based on factors like economic development, structure, financial system, and trade-offs with other economic goals. Inflation management policies and measures vary by country.

- India’s Performance: In 2023, India’s inflation rate stayed within its target range of 2-6%. Compared to advanced economies like the USA, Germany, and France, India had one of the lowest deviations from its inflation target in the triennial average inflation (2021-2023).

- Global Context: Despite global demand-supply imbalances from geopolitical tensions, India’s inflation rate in 2023 was 1.4% below the global average.

- Inflation Analysis: The survey examines trends and drivers of retail inflation, including headline, core, and food inflation. It also looks at state-wise variations, rural-urban inflation differentials, and fiscal policy measures to contain inflation.

Domestic Retail Inflation

In FY23, India’s CPI-based retail inflation was influenced mainly by higher food inflation, while core inflation remained moderate. Factors affecting inflation:

- External factors like the Russia-Ukraine war and domestic factors such as excessive heat and uneven rainfall impacted food prices.

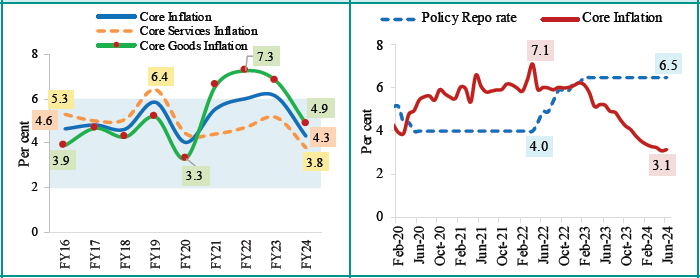

- Policy Rate Increases: From May 2022 to February 2023, the policy repo rate increased by 250 basis points, from 4% to 6.5%, to absorb excess liquidity.

- Gradual Withdrawal: The policy rate was then kept unchanged, focusing on gradually withdrawing accommodation to align inflation with targets and foster growth.

- Core Inflation: Declined from persistent levels in FY23 to 3.1% in June 2024.

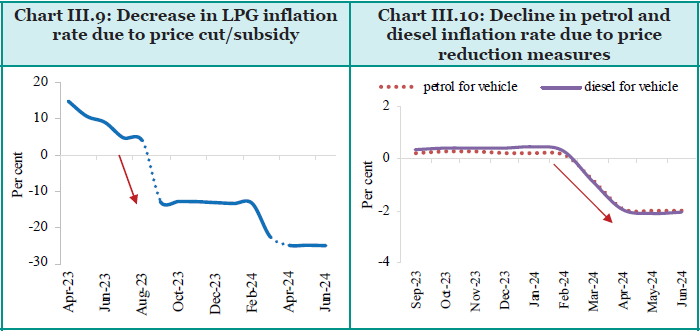

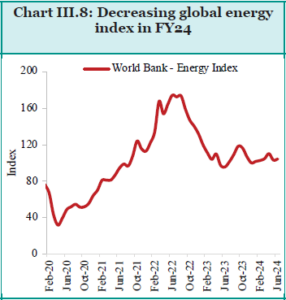

- Global Energy Prices: A sharp decline in the global energy price index in FY24 led to low retail fuel inflation.

Government Price Cuts:

Government cut the price of LPG cylinder by ₹200 per cylinder in 2023, and of Non-subsidised cylinders by ₹200 per cylinder. The prices of petrol and diesel prices lowered by ₹2 per litre. LPG inflation entered the deflationary zone since September 2023, and petrol and diesel inflation followed in March 2024.

- Global Commodity Decline: Decreased prices in energy, metals, minerals, and agricultural commodities reduced imported inflation pressures.

- Prudent Measures and Inflation Trends: Inflation moderation attributed to administrative measures and monetary policies post-pandemic. Retail inflation rate at 5.1% in June 2024.

- Food Inflation: Volatility observed despite overall inflation decline.

- Core Inflation: Continued downward trend contributing to overall inflation moderation.

Core Inflation Dynamics in the Post-Pandemic World

| What is Core Inflation? |

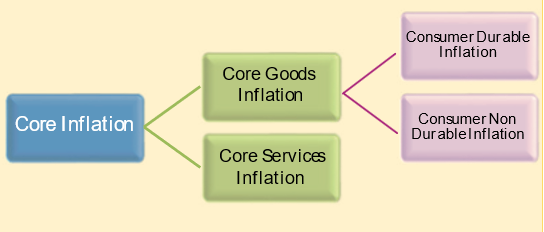

Core inflation excludes food and energy from CPI headline inflation to assess underlying price trends, reducing the impact of transitory supply shocks. Core inflation excludes food and energy from CPI headline inflation to assess underlying price trends, reducing the impact of transitory supply shocks.

Core inflation can be split into goods (durables and non-durables) and services. |

Inflationary pressures in India eased in FY22 with softening food inflation, though core inflation hit 6% due to rising international commodity prices.

- FY23 Pressures: Core inflation rose again, driven by the Russia-Ukraine war affecting supply chains, increasing food and fuel prices. Economic recovery led to higher core services inflation, especially in housing rents as urbanization resumed.

- FY24 Improvement: CPI inflation moderated due to a decline in core inflation. Core services inflation hit a nine-year low, and core goods inflation reached a four-year low.

Monetary Policy Response

- Repo Rate Increases: RBI increased the repo rate by 250 basis points since May 2022 to combat inflation, reducing core inflation by 4 percentage points between April 2022 and June 2024.

- Service Prices: Declining service prices, especially in housing, contributed significantly to core inflation moderation.

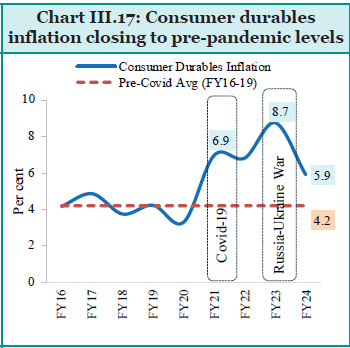

Consumer Durable Inflation

- Trends: Consumer durables inflation increased from FY20 to FY23, driven by gold prices and clothing costs due to higher input material prices.

- FY24 Decline: Improvement in raw material supply led to a decline in consumer durables inflation, though record-high gold prices continued to exert upward pressure.

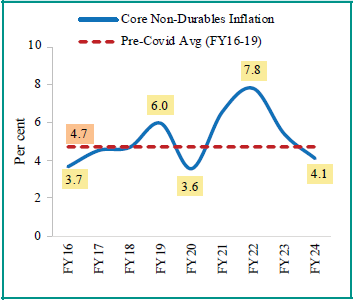

Core Consumer Non-Durable Inflation

- Components: Excludes food, beverages, and fuel, focusing on other consumption items.

- Trends: Core non-durable inflation increased in FY21, peaked in FY22, and then declined sharply in FY23 and FY24, influenced by changes in transport costs.

Core inflation in India reached a four-year low in FY24 due to effective monetary policy and improvements in the supply chain, particularly in housing and raw materials. The decline in core services and goods inflation has significantly contributed to the overall moderation of CPI inflation.

Elevated Risks for Core Services Inflation in Advanced Economies |

According to the March 2024 Quarterly Review of the Bank of International Settlements, core services inflation in advanced economies (AEs) remained elevated in 2023, even as food, energy, and core goods prices began to retreat due to the normalization of supply chains.

Similar Trends Across Regions:

|

Food Inflation

Consumer Food Price Index (CFPI): Food inflation increased from 3.8% in FY22 to 6.6% in FY23, and further to 7.5% in FY24.

Global Phenomenon and Climate Change

- Climate Impact: Rising vulnerability of food prices to climate change, including heat waves, uneven monsoon distribution, unseasonal rainfall, hailstorms, and dry conditions.

- Agriculture Sector Impact: Extreme weather events in FY23 and FY24 led to lower reservoir levels, damaged crops, and reduced farm output, increasing food inflation.

Causes of Food Price Pressures

Adverse weather conditions affected production affected the prices of food:

- Tomato Prices: Increased due to seasonal changes, crop diseases, early monsoon rains, and logistics disruptions.

- Onion Prices: Affected by poor-quality rabi onions, delayed kharif sowing, dry spells, and trade measures by other countries.

- Pulses: Prices, particularly of tur and urad, rose due to low production over the past two years and climatic disturbances.

- Milk Prices: Increased due to reduced artificial inseminations during the pandemic and higher animal feed costs, with moderation by the end of FY24.

Government Actions

- Supply Measures: Actions included open market sales, specified retail outlets, timely imports, and extension of the Pradhan Mantri Garib Kalyan Anna Yojana for five years from January 2024, providing free food grains to over 81 crore beneficiaries.

- Edible Oils: India imports over 50% of its edible oil needs, making it sensitive to global prices. The FAO edible oils price index’s decline led to lower domestic prices. The National Mission on Edible Oils – Oil Palm aims to boost domestic production.

- Sugar: Export restrictions since June 2022 ensured local supply, stabilizing domestic sugar prices despite global volatility.

Measures to Contain Food Inflation in FY24

Wheat/Atta

- Export Restrictions: Wheat flour, maida, and semolina exports prohibited since August 2022.

- Stock Limits: Imposed from June 2023 to March 2024 to prevent hoarding and speculation.

- Subsidised Wheat: Introduced Bharat Atta at ₹27.50 per kg in November 2023.

- Market Offloading: Periodic offloading of wheat and rice from the central pool under open market sales.

Rice/Paddy

- Export Prohibition: Broken rice and non-basmati rice export prohibited since September 2022 and July 2023, respectively.

- Floor Price for Basmati: Fixed in October 2023 to prevent mislabelled exports.

- Export Duty: 20% duty on parboiled rice until 31 March 2024.

- Stock Declaration: Mandated for traders, wholesalers, retailers, big chain retailers, and processors/millers from February 2024.

- Subsidised Rice: Introduced Bharat Rice at ₹29 per kg for sale through NAFED, NCCF, and Kendriya Bhandar in February 2024.

Pulses

- Buffer Stock Release: Calibrated release to ensure availability and affordability.

- Import Facilitation: Tur and urad imports under ‘Free Category’ until 31 March 2025; zero import duty on masur until 31 March 2024.

- Subsidised Dal: Launched Bharat Dal in July 2023, including chana, moong dal, and moong sabut.

- Imports: Significant imports of Tur, Masur, and Urad from countries like Mozambique, Myanmar, Tanzania, Sudan, Malawi, Australia, Canada, and Russia.

Onion

- Buffer Size Increase: From 1.00 LMT in FY21 to 7.00 LMT in FY24.

- Stock Release: Through retail sales, e-Nam auctions, and wholesale market sales.

- Minimum Export Price: Imposed on specific onion varieties from October to December 2023.

- Export Prohibition: Policy amended to prohibit onion exports until 31 March 2024.

Edible Oils

- Duty Reduction: Basic duty on crude palm, soybean, and sunflower oils cut to nil, agri-cess reduced from 20% to 5%; extended until 31 March 2025.

- Refined Oils: Reduced basic duty on refined soybean, sunflower, and palm oils extended until 31 March 2025.

- Free Import: Continued for refined palm oils until further orders.

Sugar

- Export Restrictions: Extended on raw, white, refined, and organic sugar beyond 31 October 2023 until further notice.

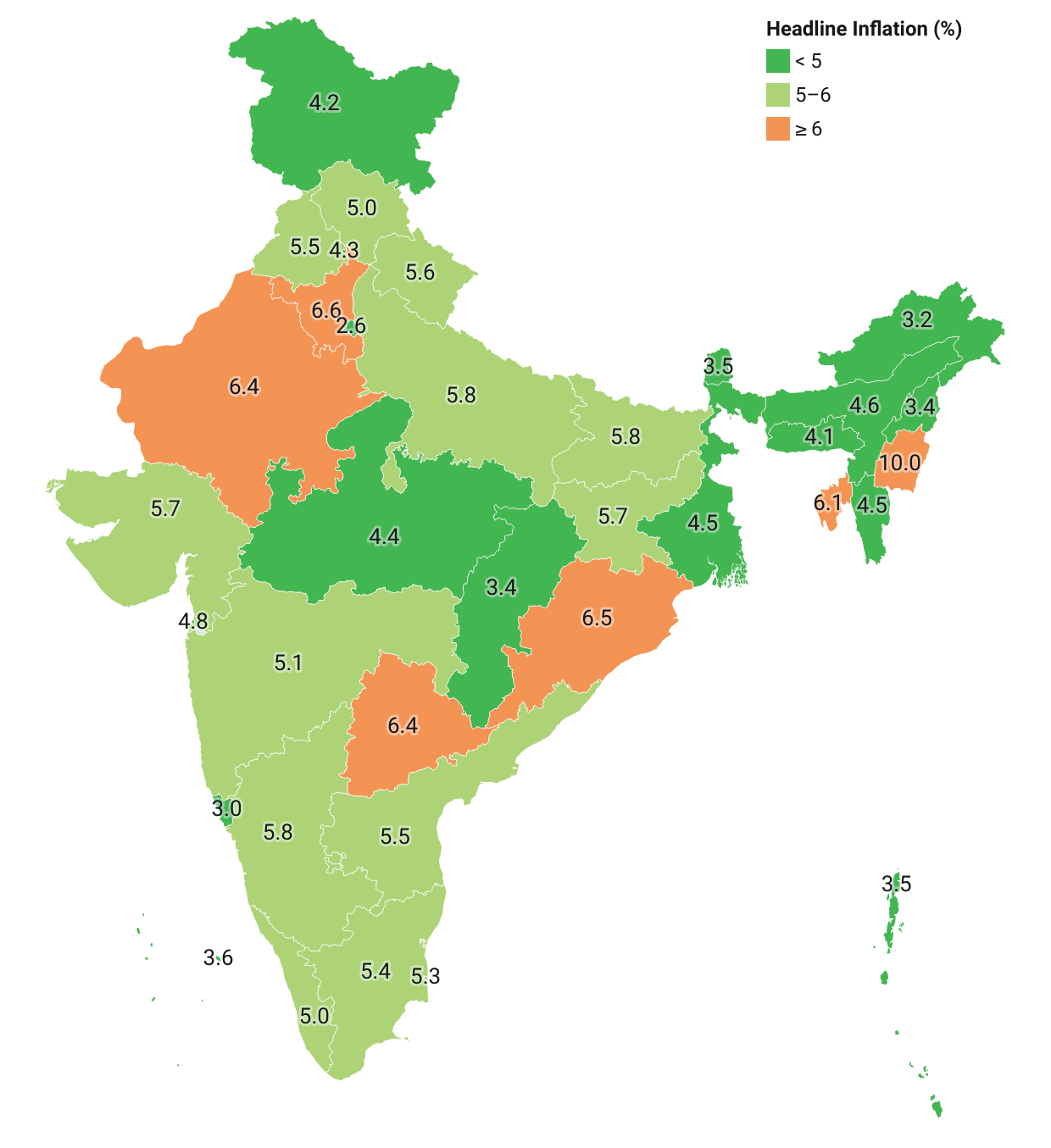

Interstate Variations in Retail Inflation

All-India average retail inflation rate declined in FY24 compared to FY23.

State-wise Reduction: Inflation was less than 6% in 29 out of 36 States and Union Territories (UTs).

Rural vs Urban Inflation

- Higher Food Weightage: Rural consumption baskets have a higher food weightage (47.3%) compared to urban (29.6%).

- Elevated Rural Inflation: States with high food prices experienced higher rural inflation.

- Variation in Inflation: Inter-state variation in inflation is more pronounced in rural areas than urban areas, calculated through standard deviation.

- Rural-to-Urban Gap: States with higher overall inflation tend to have a wider rural-to-urban inflation gap, with rural inflation exceeding urban inflation. For example, Haryana exhibited a much wider gap between rural and urban inflation compared to other states like Goa, which had relatively lower inflation.

Outlook and Way Forward

Inflation Projections

- RBI: Expects headline inflation to be 4.5% in FY25 and 4.1% in FY26, assuming normal monsoon and no external or policy shocks.

- IMF: Projects an inflation rate of 4.6% in 2024 and 4.2% in 2025 for India.

- World Bank Outlook: Anticipates a 3% decline in the commodity price index in 2024 and a 4% decrease in 2025, driven by lower prices for energy, food, and fertilisers.

Commodity Price Trends

- Energy Prices: Expected to decrease significantly due to declines in coal and natural gas prices.

- Fertiliser Prices: Likely to weaken but remain above pre-2019 levels due to strong demand and export restrictions.

- Base Metal Prices: Projected to rise due to increased industrial activity and clean energy production.

The current downward movement in imported commodity prices is positive for India’s domestic inflation outlook in the short term.

Long-term Price Stability Options

Following strategies are needed for long term price stability:

Edible Oils:

- Increasing Production: Focused efforts to increase the production of major oilseeds like sunflower and rapeseed & mustard.

- Exploring Non-conventional Oils: Potential expansion of the National Mission on Edible Oils to include other major oilseeds like rice bran oil and corn oil.

Pulses:

- Expanding Cultivation: Increase the area under pulses, particularly lentils, tur, and urad, in more districts and rice-fallow areas.

- Promoting Summer Cultivation: Encourage summer cultivation of urad and moong in areas with assured irrigation.

Vegetable Storage and Processing:

- Modern Storage Facilities: Assess progress in developing storage facilities for vegetables like tomatoes and onions to manage seasonal price surges.

- Evaluating Viability: Evaluate the viability of such facilities with highly seasonal demand.

Price Monitoring and Administrative Actions:

- High-Frequency Data: Link high-frequency price monitoring data from different departments to quantify and monitor price build-up from the farm gate to the final consumer.

- Producer Price Index: Expedite the construction of the producer price index for goods and services to better understand cost-push inflation episodes.

- Revising Consumer Price Index: Revise the consumer price index with fresh weights and item baskets based on the 2022-23 household consumer expenditure survey by MoSPI.