External Sector:Watchful and hopeful

Introduction

India’s external sector has been stroked by shocks and uncertainty manifested in terms of elevated global commodity prices; tightening international financial conditions; reversal of capital flows; heightening financial market volatility; currency depreciation, and looming worldwide growth and trade slowdown.

Trade Helping India Reap the Benefits of a Globalised world

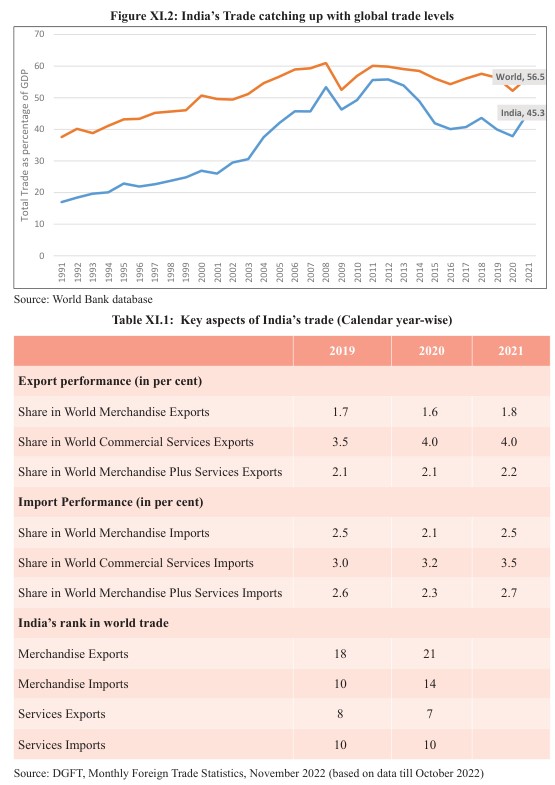

- In the current scenario, trade is indispensable for economic growth. With time, the trade openness of countries across the globe has been rising as measured by trade as a proportion of GDP.

- As per the World Bank, the share of trade as a percentage of total world GDP has been 50-60 %since 2003 and stood at 52 %in 2020.

- For India, the share of trade as a percentage of GDP has been steadily increasing, being above 40 %. The ratio stands at 46 %in 2021 and 50 %for H1 of 2022.

Global Scenario

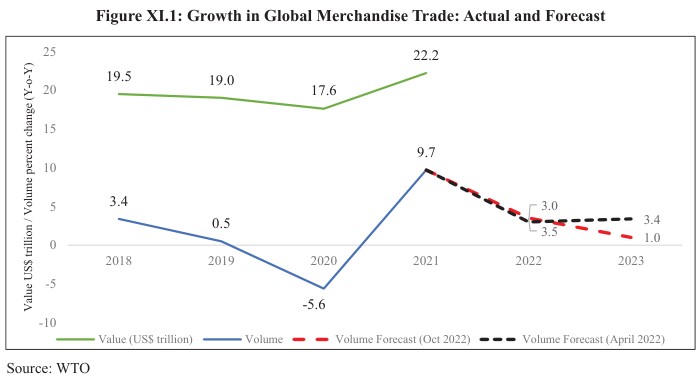

- Post Covid-19-induced disruptions, global trade prospects have improved in FY22.

- Global trade exhibited resilience in the first half (H1) of 2022, notwithstanding the headwinds from the Russia-Ukraine conflict.

- Other factors contributing to the trend were the appreciation of the dollar in the case of the United States, the relative dynamism of intra-regional trade in Europe, and favourable terms-of-trade effects in some large emerging economies due to elevated energy prices.

- However, the global trade outlook turned grimmer in the second half (H2) of 2022 on the back of a confluence of adverse factors, including the rising likelihood of a recession in the major economies and the tapering demand for consumer durables; aggressive monetary policy tightening by several central banks; disorderly financial conditions; continued supply-chain disruptions and elevated freight charges.

India’s Growing and Diversifying Trade

- International trade has been an essential pillar of the resilience of India’s external sector. Trade as a %age of GDP for India was 12-15 % in the 1980s, 16-25 % in the 1990s, and 25-50 % in the 2000s.

Trends In Merchandise Trade

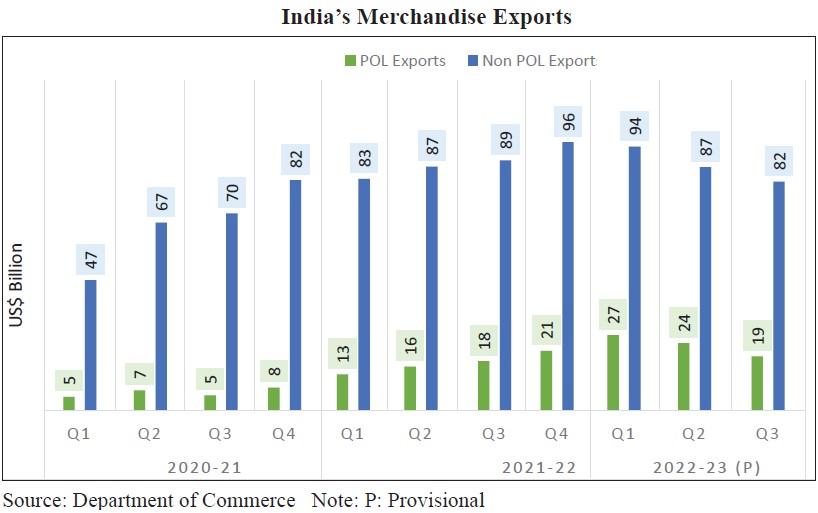

- India attained an all-time high annual merchandise export of US$ 422.0 billion in FY22.

- Owing to the increase in global crude oil prices, petroleum products remained the most exported commodity, followed by gems and jewellery, organic & inorganic chemicals, and drugs & pharmaceuticals.

Bright Spots In India’s Trade Performance

- Significant strides in exports were registered in electronic goods, drugs and pharmaceuticals, engineering goods and organic and inorganic chemicals sectors in FY22.

- India’s pharma exports registered a positive growth of 3.6 %over April- December 2021.

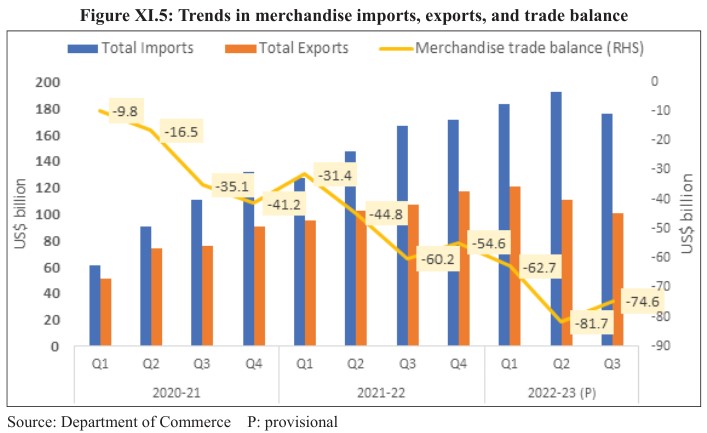

- Among major import commodities, petroleum crude & products imports increased by 45.6 % in April-December 2022 compared to April-December 2021 and continue to be the highest imported commodity.

- Due to excessive Energy demand India’s imports for fuel, including coal and Petroleum, Oil & Lubricants (POL), whose share rose to 37.1 %in total imports in April-December 2022 against 30.4 %in the corresponding period last year.

- The USA remained the top export destination in April-November, 2022, followed by UAE and the Netherlands. The Netherlands has displaced China from the 3rd spot as India’s exporting partner.

- In the case of imports, China, UAE, USA, Russia, and Saudi Arabia have a joint share of 40 %of the total imports of India.

- However, the share of China declined to 13.8 %during April-November 2022 from 15.5 %a year ago. Similarly, the share of the USA fell to 6.9 % in April-November 2022 from 7.2 %a year ago.

Trade in Services

- .Despite pandemic-induced global restrictions and weak tourism revenues, India’s services exports registered a growth of 23.5 %over FY21.

- .Software and business services together constitute more than 60 %of India’s total services exports and exhibited strong growth during Q2FY23.

- .Services imports rose by 25.1 %between FY22 and FY21 and have registered a growth of 36.7 %in 2022 over the same period of FY22.

- The increase in services imports is mainly because of payments for transport services, travel and other business services.

- Shortages of shipping vessels and high transportation costs resulted in a spike in transport payments.

- Travel imports saw growth following the easing up of travel restrictions.

Foreign Trade Policy

- India’s Foreign Trade Policy (FTP) has, conventionally, been formulated for five years at a time.

- To give policy stability during the five-year FTP, 2015-20 was extended from 2020 to 2022. The policy has been further extended till March 2023 on account of volatile global economic and geopolitical situations and currency fluctuations.

- The Government is actively working on facilitating trade agreements and launched various schemes in this line.

- In 2022, India signed Free Trade Agreements (FTAs) with UAE and with Australia.

- The Export Preparedness Index has also been introduced to evaluate States’ potentials and capacities.

International Trade Settlement in Indian Rupees

- Recently, the Reserve Bank of India (RBI) emanated a circular permitting a provision for invoicing, payment, and settlement of imports/export in INR to promote the growth of global trade and to support the growing interest in the global trading community in INR as an international currency.

- The framework involves invoicing of exports and imports in INR, market-determined exchange rates between the currencies of the trading partner countries, and settlement through Rupee Vostro accounts.

- Significance:

- This could hugely reduce the foreign exchange net demand (specially the US dollar)for the settlement of the current account.

- Using INR in cross-border trade will mitigate currency risk for Indian businesses.

- It reduces the necessity of holding ample foreign exchange reserves, making India less vulnerable to external shocks.

- It could favour Indian exporters in getting advance payments in INR from overseas clients.

- In the longer term, it will promote INR as an international currency as soon as the rupee settlement mechanism gains traction.

India’s Global Trade Engagements

- India considers Regional Trading Arrangements (RTAs) as ‘building blocks’ towards the objective of trade liberalisation and as complementing the multilateral trading system.

- Till today, India has concluded 13 FTAs and 6 Preferential Trade Agreements (PTAs). This includes the two recently signed ones:

- The India-UAE Comprehensive Economic Partnership Agreement (CEPA) signed in March 2022.

- India-Australia Economic Cooperation and Trade Agreement (Ind-Aus ECTA).

- Some notable FTAs in which India recently engaged are –

- India-UK FTA,

- India-EU FTA, and

- India-Canada CEPA/ Early Progress Trade Agreement (EPTA)

- India has also initiated action to review some of the existing FTAs, namely, India-Singapore CECA, India-South Korea CEPA, and India-ASEAN Trade in Goods Agreement and began discussions on scoping for the CECA with Australia.

Balance of Payments In Challenging Times

1. Current Account Balance

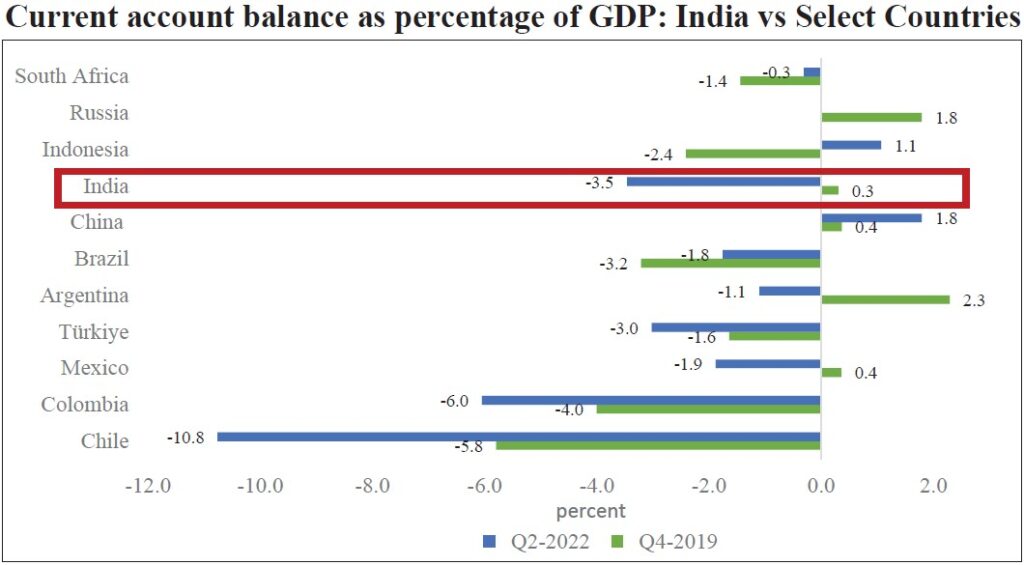

- India’s current account balance (CAB) is 4.4 %of GDP in Q2 FY23.

- India recorded a CAD of 3.3 %of GDP on the back of an increase in the merchandise trade deficit, compared with 0.2 %in H1FY22.

- However, a comparison with the position of the CAB for selected countries shows that India’s CAD is modest and within manageable limits.

Invisibles

- Net services receipts increased from US$ 51.4 billion in H1FY22 to US$ 65.5 billion in H1FY23 due to robust computer and business services receipts.

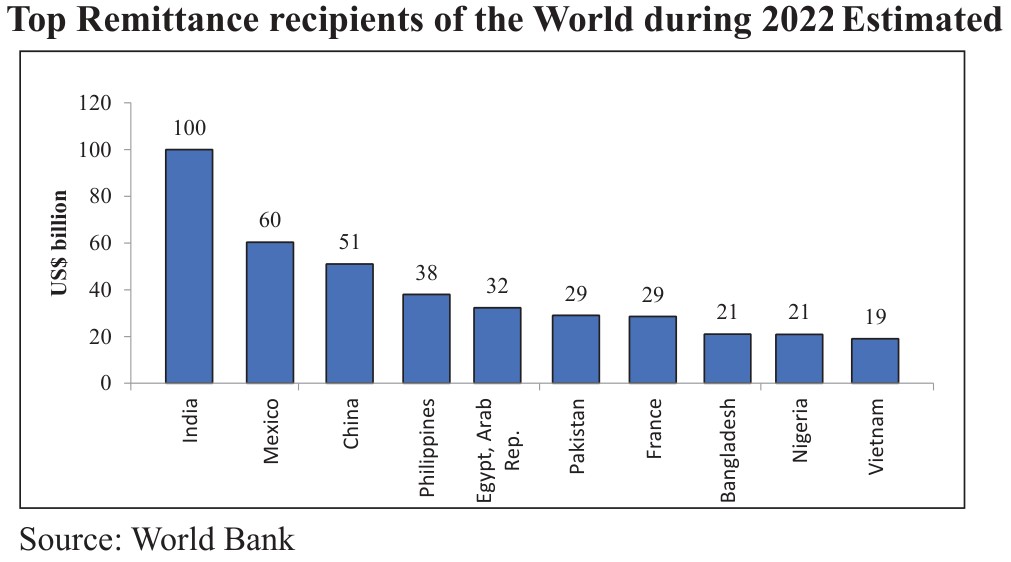

- The net private transfer receipts, mainly remittances by the overseas Indians, was US$ 48.0 billion in H1 FY23 against their level of US$ 38.4 billion during the same period before one year.

- A stiff rise in crude oil prices and the deprecation of the INR seem to have boosted remittance flows into India.

- Remittances are the 2nd largest major source of external financing after service export.

3. Capital Account Balance

- Foreign Direct Investment (FDI) and foreign portfolio investment (FPI) is the most significant component of the capital account.

- The net capital inflows declined to US$ 29.0 billion in H1FY23 from US$ 65.0 billion19 in H1FY22, primarily due to FPI outflow. Net FDI inflows remain almost the same.

- Computer Software and Hardware attracted the highest share of FDI equity inflow (23.4 %), followed by Services (15.4 %) and Trading (12.2 %).

- In terms of FDI inflow, Singapore was the top investing country with a 37.0 % share, followed by Mauritius (12.1 %), UAE (11.0 %), and the USA (10.0 %).

- Among other forms of capital flows, banking capital reported higher net

Inflows.

Balance of Payments and Foreign Exchange Reserves

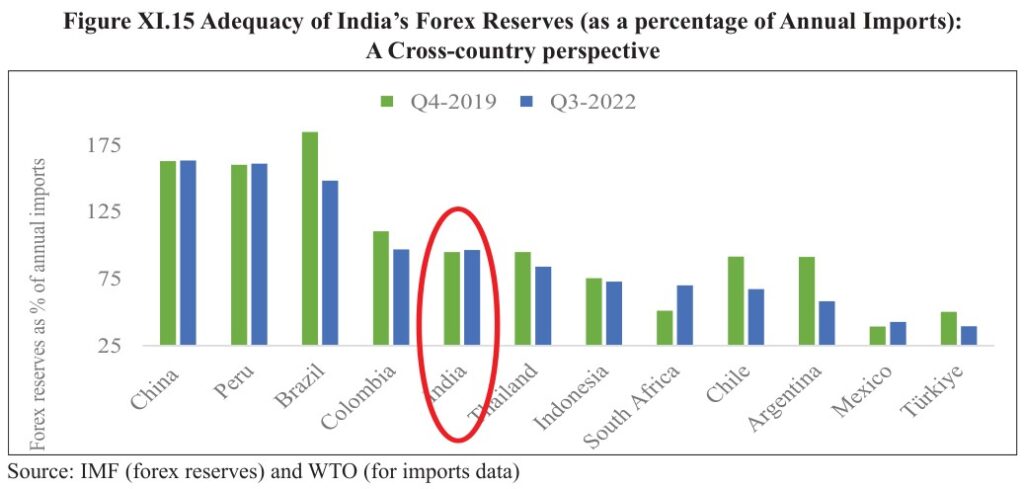

- India’s foreign exchange reserves stood at US$ 532.7 billion as of end-September 2022, covering 8.8 months of imports.

- India was the 6th largest foreign exchange reserves holder in the world according to IMF as of the end of November 2022.

Exchange Rates Moving In Tandem with Global Developments

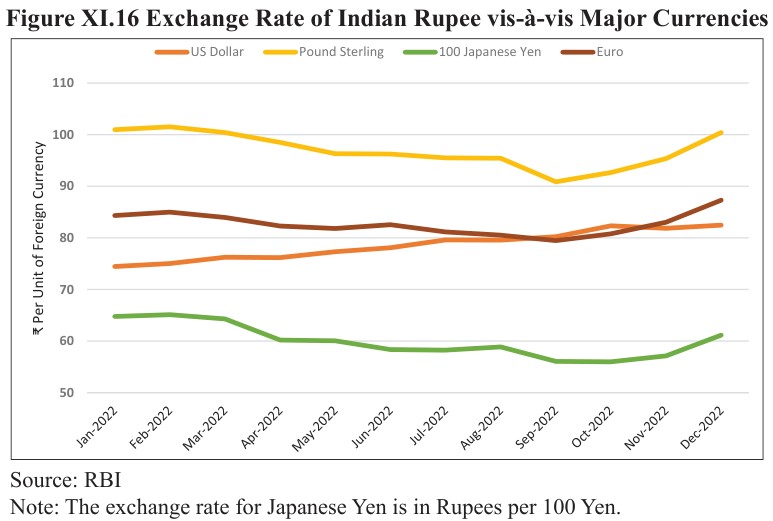

- On a calendar year basis (Jan-Dec 2022), the INR has depreciated by 10.8 %, whereas the US dollar has appreciated by 6.4 %.

- The Nominal Effective Exchange Rate of the US dollar appreciated by 7.8 % in the calendar year 2022, while the NEER of India depreciated by 4.8 %.

- In other words, it is not that the INR has weakened, but it is the US dollar that has strengthened. Further, the INR appreciated against select major currencies barring the US dollar.

International Investment position: a reflection of India’s financial Soundness

- The net claims of non-residents, enraged by US$ 31.4 billion over the level as of end-March 2022. India’s international financial assets covered 68.5 %of global financial liabilities as of end-September 2022.

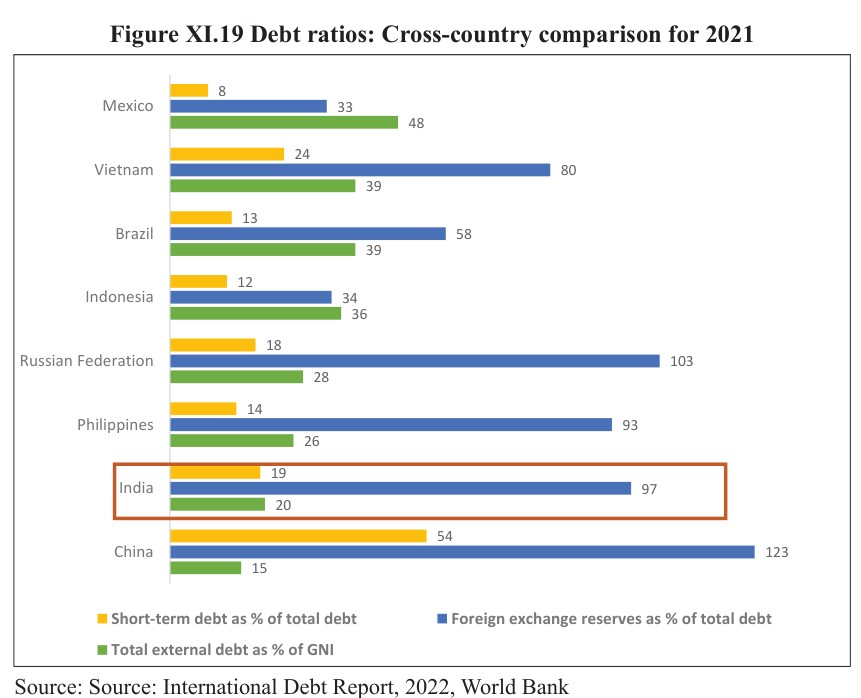

Safe and Sound External Debt Situation

- India’s external debt grew by 1.3 % over the last year. However, external debt as a ratio to GDP fell to 19.2 % as of end-September 2022 from 20.3 % a year ago.

- The major part of India’s external debt is denominated in the US dollar, whereas the Indian rupee-denominated component occupies the second-largest position. This insulates the external debt from foreign currency risk.

Outlook for the External Sector: Cautious Amidst Global Headwinds

- According to IMF, global growth is forecast to slow down in 2022 and 2023. However, many forecasts indicate that the export outlook may lie flat if global growth does not pick up in 2023. In such cases, product basket and destination diversification, which India is doing through FTAs, would help enhance trade opportunities.

Conclusion

In summary, while India’s external sector faces challenges, it performs relatively better than many of its peers, as it has inbuilt shock absorbers to weather them.