Fiscal Developments: Revenue Relish

Introduction

- Fiscal space with governments has become essential due to global risks and economic uncertainties. The Government’s fiscal policy was instrumental in economic growth and providing a safety net to the vulnerable sections in the past years.

- Several factors, such as the conflict in Europe, overstimulation of demand, and supply chain disruptions, have led to inflationary pressure.

- In this light, the Government of India adopted calibrated fiscal response and planned to withdraw fiscal stimulus gradually to cope with the inflationary situation.

Developments in Central Government Finances

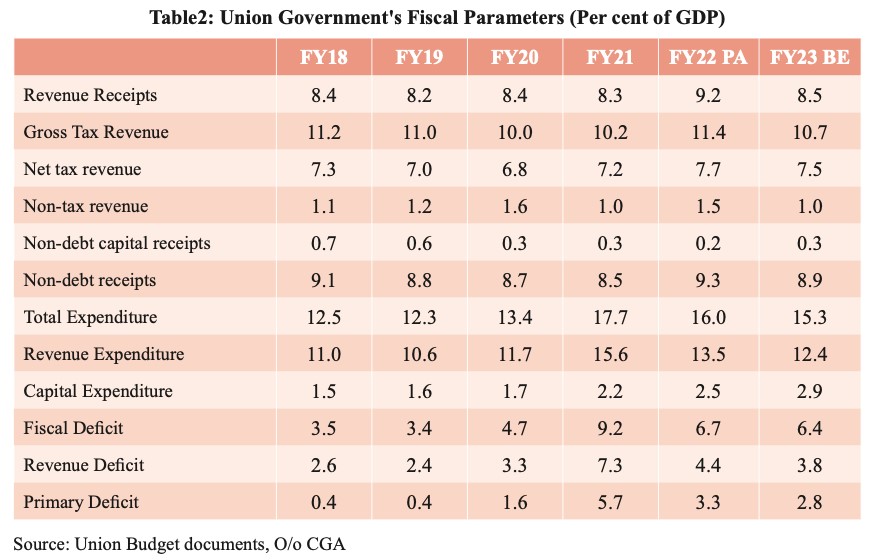

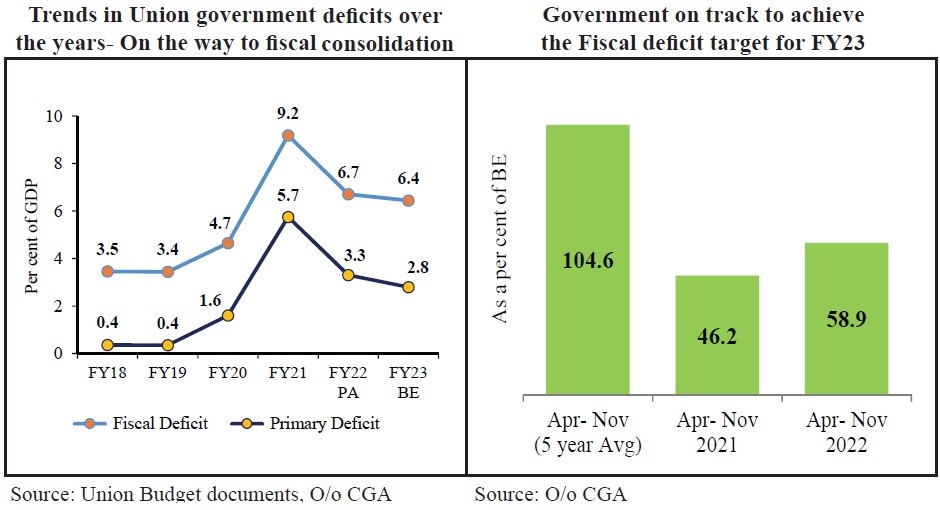

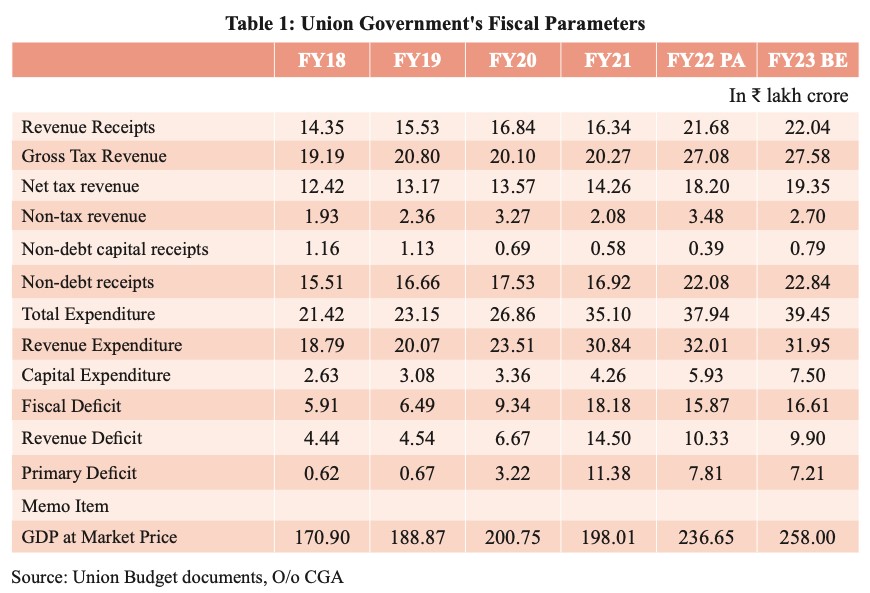

- The central Government’s fiscal Deficit has declined from 9.2% in FY2021 to 6.7% of GDP in FY2022. It is budgeted to reach 6.3% in FY2023.

Union Government on track to achieve the Fiscal deficit target for FY23

- Due to uncertain global markets and supply chain disruptions due to COVID-19 and high food and fuel prices, the Government had to spend more than planned.

- Despite this, the Union Government is well on track to achieve the budget estimate for the fiscal Deficit in FY23.

- The central Government’s fiscal Deficit was at 6% of the budgetary estimates last year.

Performance of central government non-debt receipts

- Central government non-debt receipts consist of revenue receipts and non-debt capital receipts. The shortfall in non-debt receipts to meet the expenditure requirement is met through borrowing (Fiscal Deficit).

- Collection from the revenue receipts has increased in the last year after dropping in the Covid year of FY2021.

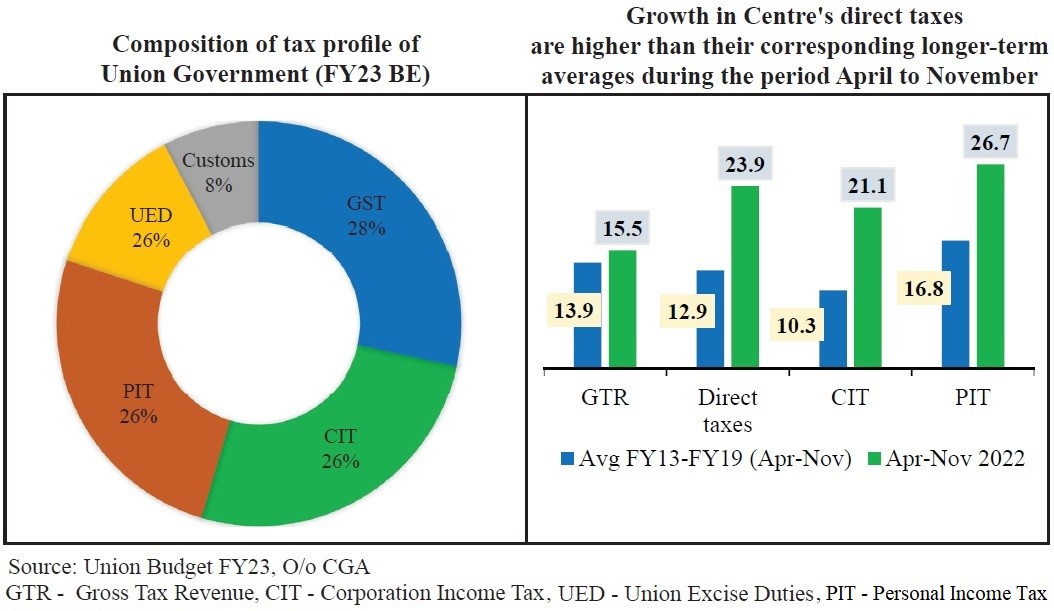

- The gross tax revenue increased by 15.5% in the last financial year. While the net tax revenue, i.e. after assignments to the states, increased by 7.9%. This implies the sustained revenue buoyancy in the previous two years.

- On account of the Government’s efforts to enhance the tax base and tax compliance, revenues have grown at a pace much higher than the growth in GDP.

- Structural reforms such as GST have resulted in increased formalisation of the economy, thereby increasing the tax base.

- Other vital interventions such as faceless tax assessment and appeal, simplification of return filing, and e-way bills in the GST system have resulted in better tax compliance.

Status of Tax collection:

Direct taxes

- Direct tax comprises almost 50% of the gross tax revenue Direct taxes registered a YoY growth of 26% in the past year from April to November 2022.

- While direct taxes provided much-needed security to revenue buoyancy, the Government used indirect taxes such as customs duty and excise duty as a policy tool during the pandemic years.

- For example, to cope with plummeting direct tax revenue collection in FY2021– The Government raised excise duty on petroleum products to compensate for the shortfall in direct taxes.

- And due to higher pulses, cotton, and steel prices, the Government reduced the customs duty on these products.

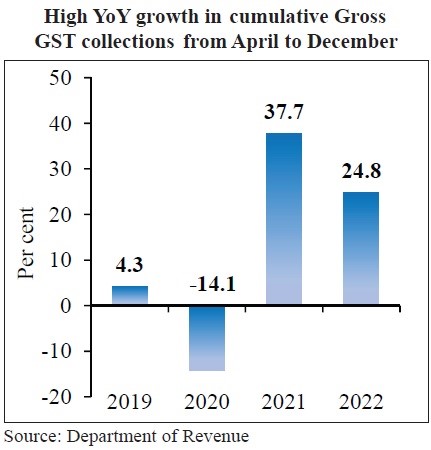

Goods and Services Tax:

- The gross GST collection in the last financial year was 40 Lakh crore rupees, implying a YoY growth of 24.7%.

- The improvement in GST collection is due to post-Covid rapid recovery, a nationwide drive against tax evaders and decisions taken by the GST Council for rationalisation of the inverted duty structure.

- The total number of GST taxpayers increased from 17 lahks in 2017 to 1.4 crore in 2021.

Non-tax revenue targets:

- Central Government’s non-tax revenue mainly consists of the interest received on loans, dividends and profits from PSUs and RBI, and external grants.

- Disinvestment targets: Disinvestment has emerged as a crucial non-tax revenue source for the Government in recent years. Out of the budgeted 65,000 crores for FY23, nearly 50% was collected last year.

Performance of Union government with Expenditure:

- The Government has adopted a countercyclical fiscal policy approach to boost the economy during the crisis. The Government adopted a practical approach of increasing Expenditure in a calibrated manner.

- The total union government expenditure was 16% of GDP last year.

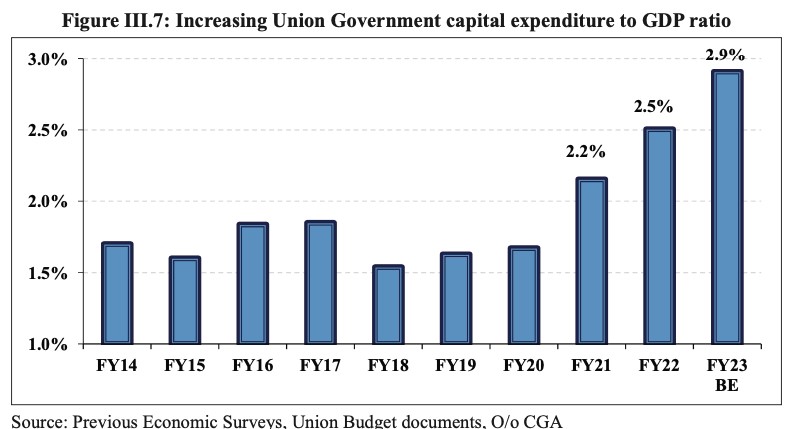

- Out of this total Expenditure, Capital expenditure amounted to about 5% of GDP in FY22. It is expected to increase to 2.9% in FY23. This is a good sign for a growing economy.

- A major chunk of this capital expenditure is in infrastructure-intensive sectors such as roads, railways, and housing. This is expected to have a positive spillover effect in the long term in the coming years.

- Other initiatives, such as PM Gati Shakti, are also crucial in this regard.

Prioritising Expenditure and rationalisation of subsidies:

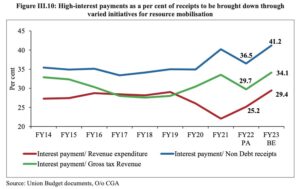

- A significant component of government revenue expenditure is interest payments, subsidies, salaries, and transfers to states. This leaves Central Government with very little fiscal flexibility.

- Hence prioritising Expenditure and rationalising subsidies is of utmost importance to stimulate aggregate demand and fulfil redistributive imperatives.

- Due to the reduction of subsidies post-pandemic, the revenue expenditure of the Government decreased from 15.6% to 13.5%.

- Subsidy expenditure decreased to2% in FY23 compared to 1.9% of the GDP in FY22.

- Interest payments: Higher resource requirements and lower revenue collections during the pandemic years resulted in higher borrowing by the Government. This subsequently increased the interest payments in the last couple of years.

Major Reforms in Budget:

- Improved Fiscal Transparency: Union Government has given utmost importance to improving transparency in the budget formation procedure. No extra-budgetary resources were estimated for FY23. Government has adopted cleaner fiscal accounting and realistic assumptions of revenue projections.

- Discontinuation Plan & Non-Plan Expenditure: Plan and non-plan classification of the budget was discontinued from the budget from FY18. It seeks to give more emphasis on classification in terms of revenue and capital expenditure.

- Shifting of Date of Budget 1 February: The advancement of the budget to 1st February paved the way for early completion of the budget cycle. With this reform, ministries can ensure better planning and execution of schemes from the beginning of the financial year.

- The Merger of the Railway Budget: The railway budget was merged with the main budget in FY18. This enables to give a holistic picture of governments’ financial position. The reform has helped to enhance the efficiency of resources for both Railways and the Union Government.

Overview of government finances:

- The combined gross fiscal Deficit (GFD) of states which increased to 4.1% in FY2022, has decreased to8%.

- Given the lack of resources of states compared to the Centre, the central Government enhanced the net borrowing ceiling (NBC) to 5% to deal with the sluggishness in the economy.

Cooperative Fiscal federalism

- Transfer of funds from Centre to states: This involves union taxes devolved to the states, finance commission grants, centrally sponsored schemes and other transfers. The total transfer of funds to states has risen in the last three years.

- GST compensation payments: To meet the shortfall in GST collection for states, the Centre passed on 2.69 lakh crore to the states. This compensation scheme was designed to safeguard the states in the new GST tax regime by ensuring revenue growth of 14% per annum for five years.

- Enhanced limits of borrowing for states: Centre enhanced the ceiling for borrowing by states to 5% in Covid years. It was linked to reforms undertaken by the states in various sectors. E.g. Implementation of the ‘One Nation One Ration Card’ scheme, ease of doing business, urban local body reforms, Power sector reforms etc.

- Centre’s support to states’ capital expenditure: The Central Government has provided 50 years interest-free loans under the ‘Scheme for Special Assistance to States for Capital Investment’.

Debt Profile of Central Government:

- In an unprecedented situation of the global pandemic, Government liabilities are rising for governments all across the globe.

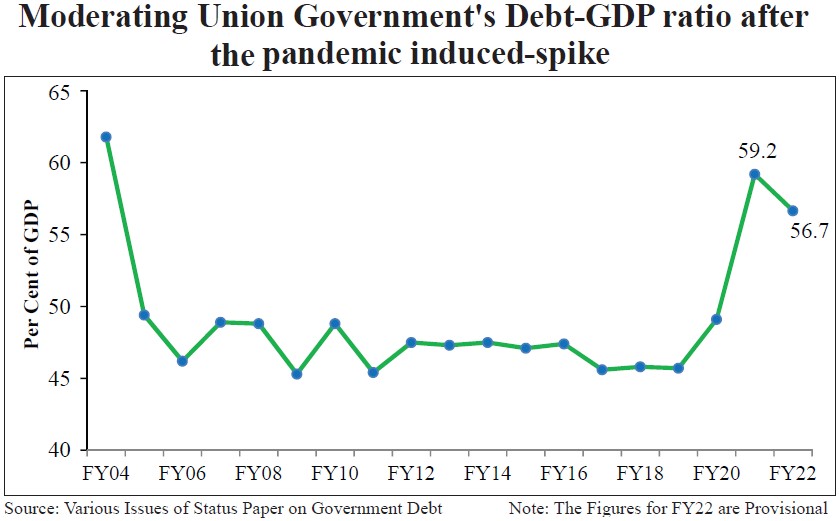

- The total liabilities of the Government of India witnessed a sharp hike in the post-pandemic year. However, these liabilities moderated from 59.2% to 56.7% in FY2022.

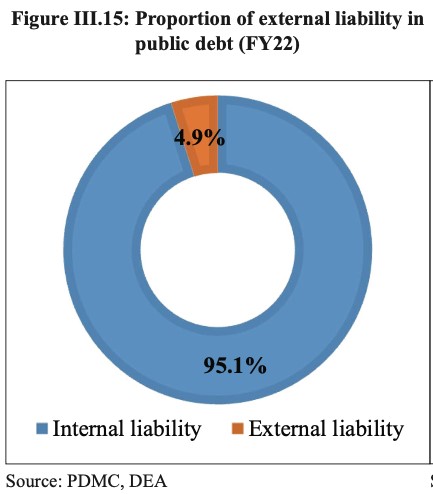

- Of the total liabilities of the Central Government,1% are domestic liabilities, while the external debt constitutes 4.9%. India’s public debt profile is relatively stable and less risky.

General government finances

- General government finances project an overview of the fiscal position of the Government across all sectors.

- After a steep spike in general government liabilities in FY2021, they have been reduced to permitted levels in FY2022. It can be said that the Government is on the right path of fiscal consolidation.

Conclusion

- The central Government is slowly adopting the policy of fiscal consolidation and stability. Along with some policy and structural changes, the Government is bringing transparency to the budget and transforming the tax ecosystem with growing digitalisation.

- Some of the major policy changes include implementing technology, rationalising GST, reducing tax rates, simplifying tax compliance and ending the uncertainty with retrospective inspection.

- All these changes have resulted in the growing formalisation of the economy, improving the tax base, compliance, and reporting of income by the public. The positive impact of these changes can be easily highlighted through the improved economic criterion.

- The rise in India’s debt and deficit ratios can be attributed to the need to increase Expenditure during the pandemic’s doldrums. However, India witnessed a ‘V-shape recovery’ after FY2021, and he’s on the right track of fiscal prudence.

ANNEX:

- Important Data:

Changes in the Indirect Tax Regime:

- Reform measures regarding customs: the custom duty structure is adopted to incentivise domestic value addition under Make In India and Aatma Nirbhar Bharat initiatives. This implies a lower duty on raw materials and reasonable tariff incentives for products manufactured in India. Such a policy benefits petroleum products, electronics manufacturing, MSMEs etc.

- All these measures comply with India’s commitments under the WTO Trade Facilitation Agreement.

- Changes in GST rates: The GST Council decided to increase the GST rates on items such as printing, writing Ink, power-driven pumps, and Solar water heaters, among others, to correct the inverted duty structure in case of these items.

- GST Council decided to withdraw exemptions related to cheques, maps and hydrographic charts, atlases, and wall maps.

- Similarly, concessional rates of GST in the case of petroleum – coal bed methane, and e-waste were rationalised.