India’s Medium-Term Growth Outlook: Optimism and Hope

The Indian economy has made several strides in the last few decades. This chapter covers India’s economic growth story in the last few years and compares it with several key indicators of the last few decades.

The growth story of the past few decades:

Product and Capital Market Reforms since 1991:

- Liberalisation: It ended the public sector monopoly and encouraged private sector firms by initiating the automatic approval policy for FDI up to 51% in many sectors.

- Impact: The real growth went up from 5.5% on average during the 1980s to 6.3% till 2000.

- Exchange rate: The rupee became fully current account convertible and partially capital account convertible.

- Impact: External trade rose from 17.2% of GDP in 1990 to 30.6% in 2000.

- FDIs became the main source of non-debt-creating capital inflows.

- New Telecom Policy 1999 separated the licensing functions of the government from that of an operator (BSNL), which allowed private sector participation with a strengthened regulatory regime (TRAI).

- Impact: An IT sector boom in India had widespread spillover benefits on all sectors of the economy.

- Disinvestment and privatisation policy: Disinvestment in several key public enterprises such as Maruti Udyog, Hindustan Zinc, Bharat Aluminum, and Videsh Sanchar Nigam Limited(VSNL).

- The government set up a dedicated Ministry to oversee the liberalisation process.

- Infrastructure: The ‘Golden Quadrilateral’ project bridged the massive infrastructure deficit in India.

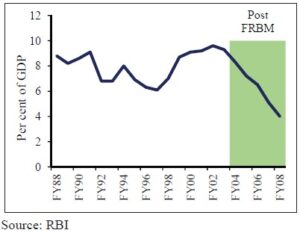

- Fiscal Responsibility and Budget Management (FRBM) Act: The massive investment made in government projects was by creating massive fiscal deficits.

- Impact: This immediately created fiscal responsibility amongst the people.

- Impact: This immediately created fiscal responsibility amongst the people.

- Managing bad debts in the Private sector: Banks sustained bad debts in the years after 1991. Thus, the deregulation of interest rates and the enactment of the SARFAESI Act 2002.

- Impact: The deregulation promoted competition amongst banks, providing more banking options to depositors, and strengthening monetary policy transmission. The SARFAESI Act streamlined the Insolvency and bankruptcy proceedings which helped the banks in easing their recovery.

Period of Capital inflow Decline: 2000-2002

- US imposed sanctions on India after the 1998 Pokhran nuclear test. This led to a sharp decline in capital inflows.

- India witnessed two successive droughts in 2000 and 2002.

- The global markets were weak after the end of the dot-com bubble and the 9/11 attacks.

- Moreover, the balance sheets of the Indian financial System and corporate sector were under-repair during the period.

Participation in Global boom: 2003-2008

- Due to the past reforms, India grew greater than the global average in the boom years of the 2000s. While the global growth averaged 4.8%, the Indian economy grew at more than 8% on average.

2008-2014

- The Economic survey skips any mention of this period.

Reforms for New India-Sabka Saath Sabka Vikaas: 2014-Now

A Different approach: Before 2014, the reforms primarily focused on product and capital market space. In the present phase, various new dimensions are added. These include ease of living and doing business, improving economic efficiency by creating public goods, adopting trust-based governance, co-partnering with the private sector for development, and improving agricultural productivity.

Creating public goods to enhance opportunities, efficiencies and ease of living:

- Infrastructure:

- The Golden Quadrilateral project was the starting of Infrastructure-intensive policy making in India.

- In recent years various major new projects have been added: for road connectivity (Bharatmala), for port infrastructure (Sagarmala), for electrification, for railways upgradation, and for operationalising new airports/ air routes (UDAN).

- This had significantly improved the physical infrastructure when in the last few years, the non-finance corporate sector was in balance sheet trouble.

- Funding: A strong baseline for infrastructure creation has been put in place with the launch of the National Infrastructure pipeline (NIP). The National Infrastructure Pipeline (NIP) in 2019 had a fund of ₹111 lakh crore, having 6,835 infrastructure projects. The National Monetization Pipeline launched in 2021 expanded its coverage to 9,000 projects across 35 sub-sectors. These are jointly funded by the Central Government, State Governments, and the private sector.

- Digital Infrastructure: RBI’s Monthly Bulletin estimates that India’s core digital economy has grown 2.4 times faster than the overall economy between 2014 and 2019. It has strong forward linkages to the non-digital sectors and social advantages of higher financial inclusion, greater formalisation, increased efficiencies and enhanced opportunities.

- The JAM Trinity(Jandhan-Aadhar-Mobile) has helped the country significantly to achieve financial inclusion in recent years. As per NFHS data, the penetration of bank accounts has increased from 53% in 2015-16 to 78% in 2019-21 on average.

- Many Digital public goods have been launched: such as digital verification (e-KYC), digital signature, digital repositories (Digilocker), digital payments (UPI), Account Aggregator framework and Open Network for Digital Commerce (ONDC) for e-commerce.

- Accelerated formalisation of the economy: Due to the transformed digital financial architecture, digital GST system and growth of UPI. Further, the creation of digital identities such as Aadhar, eshram portal(for unorganised workers), SVANidhi portal (for street vendors), GSTN, e-way bill system, and Udayam portal(for MSMEs), too have been significant economic formalisation.

- For example, out of 1.27 crore enterprises registered on the Udyam Portal, more than 93,000 micro-enterprises have now become small enterprises, and 10,000 small enterprises have become medium enterprises over the last two years.

- Further, formalisation helps in availing of formal credit. For example, more than 32.7 lakh street vendors have availed of a ₹10,000 loan under the PM SVANidhi Scheme, and of these, around 6.9 lahks have availed a second loan of ₹20,000.

- The GST taxpayers have doubled from 70 lahks in 2017 to more than 4 crores in 2022.

- Solving Governance issues through Digitalization:

- Unified digital interfaces connect various initiatives/portals, which has simplified governance in India.

- The National Single Window System has simplified business approvals,

- The JanSamarth portal has simplified credit-linked Central Government scheme, and

- The UMANG app has simplified access to Central and state government services.

- The Eshram portal has connected more than 28.5 crore registered workers with various other digital portals for easy accessibility.

- PM Gatishakti is the GIS-based platform that brings multiple ministries together for integrated planning and coordinated implementation of multimodal infrastructure connectivity projects, reducing logistics costs.

Trust-based Governance:

- Consistent reforms have improved investor sentiment, ease of doing business, and more effective governance in the last eight years.

- Simplification of regulatory frameworks such as the and the Real Estate (Regulation and Development) Act (RERA) has enhanced the ease of doing business.

- The insolvency and Bankruptcy Code (IBC) has provided an honourable exit mechanism for honest businesses.

- This enables the release of credit locked into the stressed assets for better resource allocation.

- It is a market-driven, transparent resolution mechanism which has imbibed the best international practices of asset resolution.

- Debtors are now resolving stress early to avoid being pushed into insolvency.

- Already assets worth ₹7.3 lakh crore have been disposed of before their admission into the corporate insolvency resolution process (CIRP).

- Real Estate (Regulation and Development) Act (RERA) provides for the registration of real estate brokers and agents with the Real Estate Regulatory Authority, enabling a single window clearance for timely approvals to the developers. It also establishes a mechanism for the speedy redressal of disputes.

- It creates a culture of transparent transactions in the real estate sector.

- The Real Estate Regulatory Authorities across the country have disposed of more than 1.06 lakh complaints. About 1Lakh projects are already registered under RERA.

- Decriminalisation of minor economic offences under the Companies Act – 2013. It introduces civil liabilities for dealing with minor defaults where the nature of lapse is purely procedural and does not involve any fraud.

- It promotes doing business with domestic and global investors.

- More than 1400 default cases have already been decided without resorting to the court, and more than 4,00,000 companies have willingly rectified past defaults to avoid penalties under the Companies Act after this reform.

- Simplifying Processes:

- Doing away with more than 25000 unnecessary compliances.

- Repealing more than 1400 archaic laws,

- Abolishing the Angel tax

- Removing retrospective taxation on offshore indirect transfer of assets located in India.

- Reforms in the taxation ecosystem has rectified the distortionary incentives from the economy.

- Adopting a unified GST has reduced compliances and ensured a free flow of goods across states. Now businesses do not need to have a separate warehouse for every state to overcome compliances under the earlier origin-based tax regime. The destination-based GST regime has promoted ease of doing business manifolds.

- Reduction in corporate tax rates and removal of the Dividend Distribution tax.

- Exemption of sovereign wealth funds and pension funds from taxes.

- All this has improved Tax buoyancy despite the lowering of the tax rates. For example, the average monthly gross GST collection has increased from ₹90,000 crores in FY18 to ₹1.49 lakh crore in FY23. This can be attributed to the introduction of technology-backed tax governance reforms, which have simplified the tax collection processes, enhancing compliance.

Promoting the private sector as a co-partner in the development

- Disinvestment: The government’s disinvestment policy realises the private sector as an important partner in the growth of the country.

- During FY15 to FY23, about ₹4.07 lakh crore has been realised as proceeds from disinvestment through 154 transactions using various modes/instruments, including privatisation of Air India and disinvestment in coal India.

- Important terms:

- Disinvestment: Selling of Shares of PSUs.

- Strategic disinvestment: Transferring Management while selling shares.

- Privatisation: complete transfer of ownership.

- Evidence shows that privatisation has improved the efficiency of the PSCs and the labour productivity during 1990-2015.

- Government initiatives:

- Aatmanirbhar Bharat, Make in India and Production Linked incentives (PLI) have been introduced to incentivise domestic and foreign investments to boost the manufacturing industry.

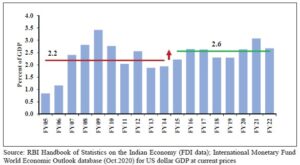

- Further, most sectors are now open for 100% FDI under the automatic route, resulting in a visible structural shift in the gross FDI flows to India.

- The importance of the promotion of domestic manufacturing can be understood from the industrialisation experiences of East Asian countries such as South Korea and Taiwan.

- Early impact of the schemes:

- The PLI scheme for large-scale electronics has attracted an investment of ₹4,784 crores, generating a total production of ₹2.04 lakh crore, including exports of ₹80,769 crore.

- Aatmanirbhar Bharat has also incentivised foreign investments for domestic production. There is a marked increase in the annual inflow of FDI.

- National Logistics Policy (2022) has been launched to create an overarching logistics ecosystem for lowering the cost of logistics in India and bringing it to par with other developed countries.

- Several strategic sectors such as defence, mining and space have been opened for the private sector.

- Start-up India: The number of recognised Start-ups has increased from 452 in 2016 to

84,012 in 2022.

- Addressing Structural challenges faced by MSMEs:

- Emergency Credit Line Guarantee Scheme (ECLGS) is aimed at increasing credit support to MSMEs by providing them with collateral-free loans. It has benefited 1.14 crore MSMEs by providing credit worth ₹2.38 lakh crore in the last two years.

- Revision in the definition of MSMEs to suit the GST Network and other formats simplifies the System.

- TReDS System addresses the delayed payments for MSMEs,

- Extension of non-tax benefits for three years in case of an upward change in the status of MSMEs has created a resilient support system for the MSME sector to grow.

- Open Network for Digital Commerce(ONDC) creates e-commerce platforms through a network based on open-source technology, providing opportunities for MSMEs to access the power of e-commerce technology and compete with the e-commerce giants in diverse markets.

Enhancing productivity in Agriculture:

- India’s agriculture sector has grown at an average annual growth rate of 4.6% during the last six years. It is a high growth for a low-growth sector like agriculture.

- The introduction of Soil Health Cards and Micro irrigation Fund have helped the farmers optimise their resources.

- Support from Extension services through the promotion of Farmer Producer Organisations (FPOs) and the National Agriculture Market (e-NAM) Platform.

- Extension services refer to the set of services which involve the delivery of information inputs to farmers to increase agricultural productivity.

- Agri-Infrastructure Fund (AIF) to support the creation of various agriculture infrastructures.

- Kisan Rail exclusively caters to the movement of perishable Agri Horti commodities.

- Cluster Development Programme (CDP) promotes integrated and market-led development for horticulture clusters.

Returns to the Economic and Structural Reforms after 2014

- India’s stressed balance sheet problem was a major legacy issue which has stopped India from growing in the period after 2014.

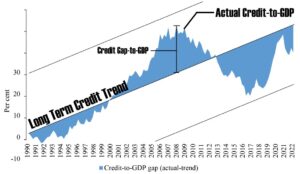

- As per Bank for International Settlements data, India’s non-financial private sector debt raised from 72.9% of GDP in March 2004 to 113.6% by December 2010 – a whopping 40.7% increase in just over six years.

- In absolute terms, the amount of debt went up from nearly ₹44 lakh crore to almost ₹133 lakh crore.

- The non-financial private sector debt to GDP ratio came down meaningfully only after 2015 onwards, dropping to 83.8% by December 2018.

- However, the credit to the private non-financial sector remained at its trend value, i.e. credit gap to GDP ratio remained negative.

- The credit gap to GDP ratio is the gap between the credit-to-GDP ratio and its long-term trend, as per the Basel III norms.

- This gap worsened significantly to 25% in 2017!

- It shows that the banks’ credit supply was severely constrained due to the stressed balance sheet banks.

- Poor money supply also accelerated the NPAs setting in motion a long period of repair of the financial and non-financial sector balance sheets after 2015. The government and the RBI took several policy initiatives in this regard, such as:

- Insolvency and Bankruptcy Code (IBC),

- Recapitalisation and merger of Public Sector Banks (PSB), and

- RBI’s ‘Asset Quality Review’ (AQR) and prompt corrective action (PCA) framework.

However, Challenges still remained –

- NBFC Crisis:

- The collapse of big NBFCs like Infrastructure Finance and Leasing Services (IL&FS) with a huge asset base in September 2018. This had a huge ripple effect on other NBFCs like Diwan Housing finance.

- Usually, NBFCs lend to riskier borrowers than banks and are refinanced by Scheduled commercial banks. Therefore, bank credit growth too came down to single digits towards the end of 2019 due to the NBFC crisis.

- Government response: Corporate tax cut in September 2019.

- The Pandemic:

- The government had to address the emerging health, social and economic consequences of unprecedented nature.

The way forward – Growth Magnets in this Decade (2023-2030)

- India is now prepared to grow at its potential (similar to the 2003-2008 growth phase) after a long period of balance sheet repair in the financial and corporate sectors and the economic shocks of the pandemic.

Reasons for this Optimism:

- Credit Growth due to the sound and healthy financial system developed over the last few years. Bank credit growth has been well into double-digits for quite some time now.

- The information revolution in Banks: After India’s digital revolution, banks have far more information about the customer’s credit risks than before. This will make a healthier and longer credit cycle than before.

- Higher financial inclusion and more economic opportunities is other important driver of India’s economic growth.

- Productivity-enhancing reforms such as Skilling initiatives will help unleash the benefits of the demographic dividend.

- The evolving geo-political situation favours the diversification of the global supply chains, presenting a unique opportunity. Global Firms now do not want to face the risk of concentrating their production in a single country(China). India is one of the options which can replace China.

- Partnership-based governance ecosystem can restore the ability of the economy to

grow healthily.

India might still face a few Challenges:

- State governments need to address power sector issues, and the financial viability concerns of the Discoms have to be addressed.

- Education and skilling to match the demands of modern technology and industry to deal with the challenges of climate change and energy transition.

- Making the most out of India’s demographic dividend. There are modern issues, such as rising obesity levels.

- Mineral and Energy requirements require Long-range plans such as securing the necessary metals and minerals supply.

- Public sector Asset Monetisation taken up by the government needs concentrated efforts for the successful realisation of wide-ranging efficiency gains. This can also reduce public sector debt, leading to a lower cost of capital.