Monetary Management and financial intermediation: A Good year

In the wake of the global scenario of growing economic uncertainties in the past couple of years – RBI and the government has taken necessary steps to deal with the situation of growing inflation. On the lines of other central banks across the globe, RBI has adopted a dear money policy along with some other systemic reforms, resulting in lower NPAs and bettering other operational indicators for financial institutions.

Developments in this regard are as follows:

The monetary stance of the RBI

- Tight Monetary Policy by RBI:

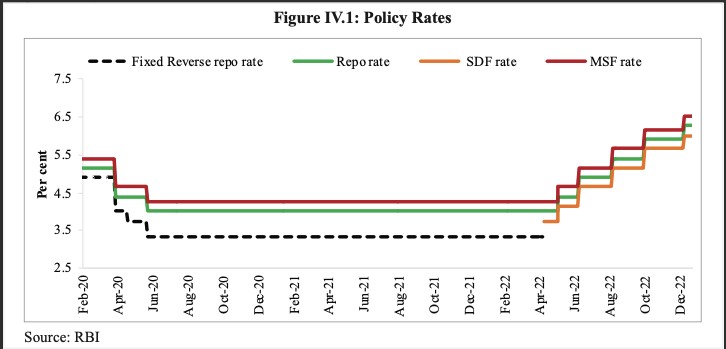

- Since retail inflation has crossed RBI’s tolerance band since January 2022 – RBI initiated a tight monetary policy for better liquidity management. RBI has introduced a standing deposit facility (SDF)– which will allow banks to park their funds with RBI without the need for collateral, i.e. G-secs.

- The SDF has replaced the reverse repo rate as the new floor for the liquidity adjustment facility (LAF) This indicates RBI is “adopting an accommodative stance with supporting growth”.

- With the expectation of supply chain disruptions and rising commodity prices, RBI decided to increase the repo rate, SDF, MSF, and CRR during the second half of 2022.

- There has been little increase in Reserve Money (M0) and currency in circulation (CIC) compared to FY2021-22. There were little fluctuations in the same during the Russia–Ukraine conflict, but they faded away soon.

- During the last FY – Broad money stock (M3) increased by 7%. This growth is mainly driven by bank credit to the commercial sector and net bank credit to the government.

- The money multiplier, i.e. the ratio of M3 and M0, has remained stable at 1 in FY2021–2022 compared to last year’s 5.2.

- Liquidity conditions:

- RBI has slowly increased its policy rates to deal with the surplus liquidity condition of post-Covid times. With the change in the MSF rate, the liquidity adjustment facility (LAF) corridor has become symmetric with the repo rate. The subsequent hike in CRR has absorbed approximately 87,000 crores from the banking system.

- For better liquidity management – RBI has undertaken variable repo rate auctions worth 50,000 crores with 3 days and overnight maturity. With the increase in repo rate, there has been a consequent increase in interest rates of treasury bills and short-term government securities.

- Transmission of monetary policy:

- Following the policy repo rate changes, there has been an increase in lending and deposit rates of banks. To put forth a comparison- the weighted average lending rate (WALR) for fresh loans was higher for public sector banks, while the same was higher for outstanding loans in the case of private sector banks.

- Developments in G-sec Market:

- The bond yields rose in 2022 mainly due to volatile crude oil prices, contractionary policies of central banks, hardening of bond yield and pressure on the rupee. However, this volatility somewhat declined in the second half of 2022.

- There has been an increase in trading volume in G-secs (Government Securities), which is a sign of the growing interest of traders in the G-secs market.

Status of the banking sector

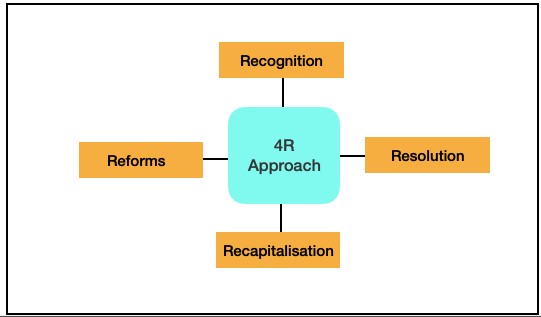

- The 4R Approach:

- To strengthen the regulatory and supervisory framework, the government has adopted the 4R approach of recognition, resolution, recapitalisation and reforms to clear banks’ balance sheets.

- The Gross Non-Performing Asset (GNPA) ratio has decreased from 8.2% to 5% in the past three years. At the same time, net non-performing assets are at a decade low of 1.3%. CRAR of scheduled commercial banks(SCBs) has been rising in the given time.

- GNPA is lower for the industrial sector and higher for the Gems, jewellery, and construction sector.

- The profitability of SCBs measured in terms of return on equity (ROE) and return on assets (ROA) has improved compared to last year.

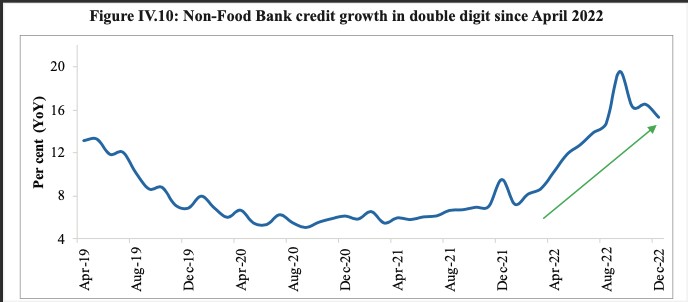

- Credit growth synopsis:

- The YoY growth in non-food bank credit has been rising for the last year. This growth signifies an acceleration in the growth of current economic activities and the future course of economic activity.

- Due to various institutional and support measures taken by the central government, credit to the agricultural and MSME sectors has been on the rise in the past FY.

- Due to the contraction of private investment and venture capital, the needs of the corporate sector or being met from the funds of SCBs.

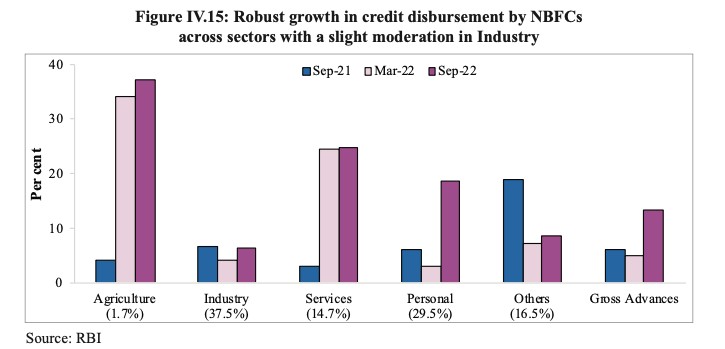

- State of Non-Banking Financial Companies (NBFCs):

- A consistent rise in NBFC credit as a proportion to GDP underlines the importance of NBFCs in the Indian financial system. Moreover, NBFCs have been a major shock absorber of economic distress due to the pandemic.

- The GNPA ratio of NBFCs has decreased by 2% in the last FY owing to continuous improvement in asset quality.

- Credit extension by NBFCs is slowly gaining pace, with the largest share of NBFC credit going to the industrial sector, followed by retail, services and agriculture.

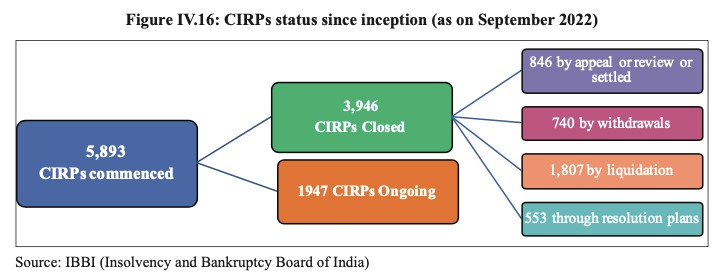

Advancements with Insolvency and Bankruptcy Code (IBC):

- The implementation of IBC has facilitated an easy exit for distressed firms.

- This has improved the efficiency of the utilisation of resources across various economic sectors.

- As per the sectoral analysis, about 52% of the cases belong to the industry, and around 37% belong to the services sector.

- One of the most important spillover effects of IBC is behavioural change. For example, IBC has pushed debtors to voluntarily settle the dues even before starting the insolvency procedure.

- Another important achievement of IBC is that it has facilitated the realisation of 92% of the value through the liquidation of distressed companies.

Developments in the capital market:

- Despite macroeconomic uncertainties, inflation, tight monetary policy, volatile markets, and negative investor sentiments Indian capital market performed better than other major economies.

- Even with the hurdles mentioned above, the number of SMEs coming with an IPO almost doubled last year.

- Sluggishness in public debt issuance is compensated by activity in the private debt market.

- Due to the Russia-Ukraine conflict, the global outbreak of Covid, and depressed economic activity across the globe- Global stock markets declined. However, during the same time, the dip in the Indian stock market is relatively low.

- The rise in prices of commodities driven by the Russia–Ukraine conflict was restored due to the central bank’s monetary tightening.

- On account of gloomy market conditions, India witnessed a net outflow of 16,000 crores approx. by FPIs.

- However, because of strong macroeconomic fundamentals, India still remains among the top attractive destinations for investors.

Crypto ecosystem and regulations:

- Recent trends of high volatility and the geographically pervasive nature of crypto assets can’t put Indian investors at risk. Realising this, the government has decided to come up with several regulations in the coming times to safeguard the investors.

- Issues with crypto assets:

- They do not necessarily pass the test of being a financial asset.

- High volatility.

- Anonymity and governance gaps.

- Absence of geographical constraints.

- Regulatory gaps- an absence of a centralised agency to regulate the crypto market.

- Monopolistic nature of number of crypto assets.

- Lack of standardisation makes them vulnerable to greater risks.

- Understanding this, several countries such as Japan, Switzerland, the UK, EU are looking forward to better regulation of the crypto market. India is in tandem with these countries.

IFSC GIFT City:

- India has come up with its maiden IFSC GIFT city in Gujarat. It has opened new opportunities and avenues for capital market investors.

- What is IFSC GIFT city?

IFSC is a jurisdiction with a high concentration of Financial institutions such as banks, stock markets, Insurance firms, fund managers and others, which offer specialised financial services to residents and non-residents with innovation and cross-border transactions.

- Relevance of IFSC GIFT city:

- From the Past evidence of countries like Singapore – it can be said that GIFT city can play an important role in accelerating the pace of financial globalisation in India.

- It underlines India’s growing liberal outlook towards capital account convertibility. In the long run, this will help build confidence among investors.

- World-class infrastructure will spur the growth of banking and other financial sectors at a rapid pace.

- Better regulation: Setting up of Indian Financial Services Centre Authority (IFSCA) as a single regulatory body will improve the regulatory framework.

- With an internationally aligned regulatory regime, competitive tax structure and lower operational costs – it will attract top-class global financial services to India.

- It will act as a Gateway for the flow of capital into India.

- Global collaboration, e.g. with Singapore, Dubai, and Qatar of IFSC, will bring more innovation and developments in the Indian financial services sector.

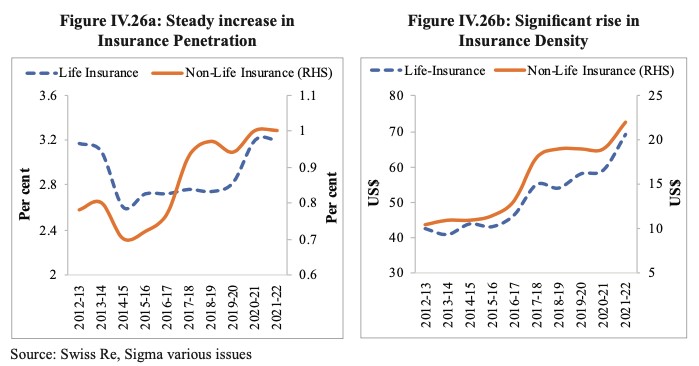

Development in the insurance market:

- India is among the fastest-growing insurance markets in the world. It is expected to emerge as one of the sixth-largest insurance markets in the world by 2032.

- The pandemic years have highlighted the striking significance of the insurance sector. Insurance serves the dual benefit of protection against mortality, property, and casualty risks, and it also encourages savings and provides funds for long-term investment.

- The performance of the insurance sector can be assessed through insurance penetration and insurance density.

- Insurance penetration: It is the ratio of total insurance premiums to the GDP.

- Insurance density: It is the ratio of total insurance premiums to the population.

- Insurance penetration in India has increased steadily from 2.7% to2% in the last two decades. The life insurance penetration in India was at 3.2% in 2021.

- Various schemes by the government, such as Ayushmann Bharat Yojana, Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhan Mantri Fasal Bima Yojana – have been immensely important to improve the penetration and density of insurance in India.

- These schemes, coupled with other reforms such as raising the FDI cap and growing digitalisation of the insurance sector, will definitely help in improving the insurance landscape of India.

Pension sector in India:

- The government has announced various measures to provide relief in the form of pensions to families who have lost their earning members due to Covid.

- The government is also implementing a number of schemes such as the Indira Gandhi national old age pension scheme (IGNOAPS), Indira Gandhi national widow pension scheme (IGNWPS), Indira Gandhi national disability pension scheme (IGNDPS) under the National Social Assistance Programme (NSAP) to impart social security to marginalised sections.

- Apart from this, schemes like Atal Pension Yojana (APY), the National pension scheme (NPS) are being implemented, which mainly cater to the working-age population.

All these measures taken by the government have resulted in creating a robust financial system, betterment of balance sheets of banks, and better capital levels of NBFCs, among others. All these improvements are evident from the resilience shown by the Indian financial sector during the last couple of years.

It can be rightly said that the government and the central bank have been apt to deal with the uncertainties of post-Covid times. The dual demand of controlling the rate of inflation on the one hand and making the availability of money for covid hit economy, on the other hand, has been well managed by the central bank in the past financial year.