Services: Source of Strength

- India has been a major player in services trade, being among the top ten services exporting countries in 2021, having increased its share in world commercial services exports from 3% in 2015 to 4% in 2021.

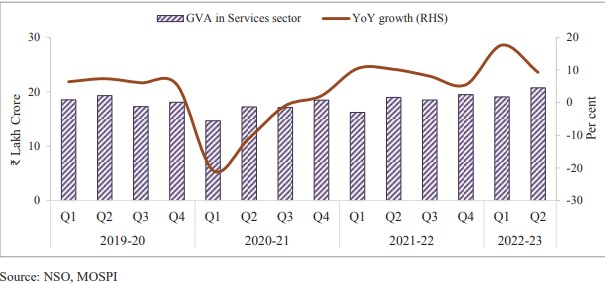

- The Covid-19 pandemic hurt most sectors of the economy, with the effect particularly profound for contact-intensive services sectors like tourism, retail trade, hotel, entertainment, and recreation. On the other hand, non-contact services such as information, communication, financial, professional, and business services remained resilient.

- However, the services sector witnessed a swift rebound in FY22, growing Year-on-Year (YoY) at 8.4% compared to a contraction of 7.8% in the previous financial year.

- The improvement was driven by growth in the ‘Trade, Hotel, Transport, Storage, Communication and Services related to the broadcasting sub-sector, which bore the maximum burden of the pandemic. This subsector completely recovered from the pre-pandemic level in Q2 of FY23, driven by the release of pent-up demand, ease of mobility restriction, and near-universal vaccination coverage.

- The growth momentum has continued in FY23 as well. As per the First Advance Estimates, Gross Value Added (GVA) in the services sector is estimated to grow at 9.1% in FY23, driven by 13.7% growth in the contact-intensive services sector.

Government Initiatives for the Services Sector

- To ensure the liberalisation of investments, the Government has permitted 100% foreign participation in telecommunication services, including all services and infrastructure providers, through the Automatic Route.

- The FDI ceiling in insurance companies was also raised from 49 to 74%.

- Launch of National Single Window System to facilitate investment.

- The introduction of Central Bank Digital Currency (CBDC) will also provide a significant boost to digital financial services.

- The Government’s push to digital economy, growing internet penetration, rise in smartphone adoption and increased adoption of digital payments have also given a renewed push to these industries.

Trends in High frequency Indicators

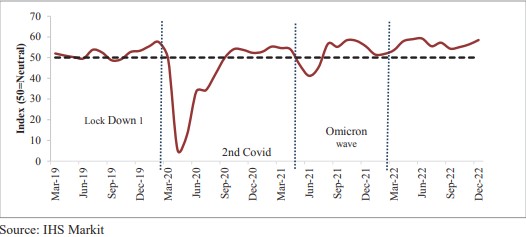

I. Services PMI

- In terms of Purchasing Manager’s Index (PMI), India’s services sector growth which contracted for several months during 2020 and 2021 Covid-19 lockdown, recovered swiftly with the waning of the Omicron variant at the beginning of 2022.

- Purchasing Manager’s Index or PMI is an economic indicator, derived from monthly surveys of various companies.

- PMI index shows trends in both Services and manufacturing sectors.

- PMI number less than 50 indicates contraction in business activity and number greater than 50 indicates expansion.

- However, PMI services again witnessed a setback with the outbreak of the Russia-Ukraine conflict.

- However, following an overall easing of retail inflation leading to retreating price pressures of inputs and raw materials, PMI services witnessed an uptick and expanded to 58.5 in December 2022.

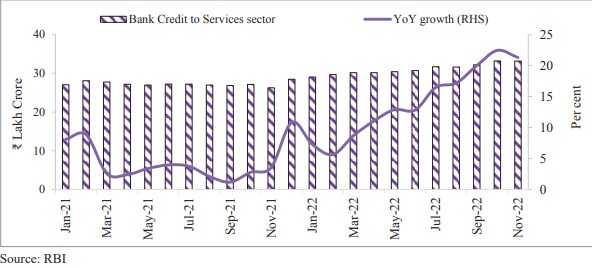

II. Bank Credit to service sector

- It has witnessed significant growth since October 2021 with the improvement in vaccination coverage and recovery in the services sector.

- The credit to services sector witnessed a 21.3% YoY growth in November 2022, the second highest in 46 months, compared to a 3.3% growth in November 2021.

- Credit to NBFCs grew by 32.9% as NBFCs shifted to bank borrowings because of high bond yields. Earlier NBFCs used bonds to raise debt.

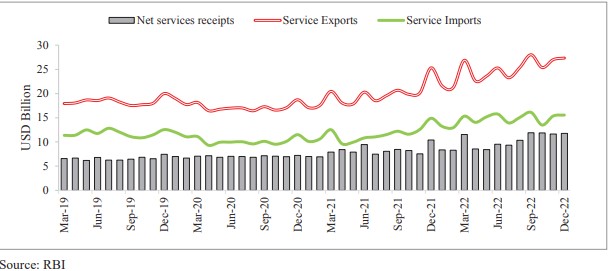

III. Services Trade

- Global Scenario: World services trade volume finally surpassed its pre-pandemic peak in the second quarter of 2022 and was expected to remain strong in the third quarter, buoyed by spending on travel, Information and Communication Technology (ICT) services, and financial services.

⇨Financial and ICT Services have been so far most resilient to the slowing global economy, whereas construction services and container shipping fell into contraction territory.

- India: India’s services exports may improve as runaway inflation in advanced economies drives up wages and makes local sourcing expensive, opening up avenues for outsourcing to low-wage countries, including India.

⇨Among services exports, software exports have remained relatively resilient during the Covid- 19 pandemic as well as amid current geopolitical uncertainties, driven by higher demand for digital support, cloud services, and infrastructure modernisation catering to new challenges.

⇨Transport and travel exports have been the most impacted sub-components of the services exports in FY21 and FY22, which contracted due to the imposition of restrictions on international travel and tourism during the Covid-19 pandemic.

IV. FDI in services

- The World Investment Report 2022 of UNCTAD places India as the seventh largest recipient of FDI in the top 20 host countries in 2021.

- In FY22, India received the highest-ever FDI inflows of US$ 84.8 billion including US$ 7.1 billion FDI equity inflows in the services sector.

- Government has allowed 100% FDI in Telecommunication sector, through automatic route. The FDI ceiling in insurance companies was also raised from 49 to 74%, under Automatic Route.

- Government has allowed 20% foreign investment in Life Insurance Corporation (LIC) under the automatic route.

Major Services: Sub-sector wise performance

I. Tourism and Hotel Industry

- As per the World Tourism Barometer of the United Nations World Tourism Organisation (November 2022), international tourism showed robust performance in January-September 2022, with international tourist arrivals reaching 63% of the pre-pandemic level in the first nine months of 2022, boosted by strong pent-up demand, improved confidence levels and the lifting of restrictions.

- Condition during Pandemic:

- Hotel Occupancy rate was mere 33-36%.

- Revenue per Available Room (RevPAR) declined to a dismal low of ₹1,500 – ₹1,800, a decline of around 57-59%.

- Entire aircraft movement (cargo aircraft + passenger aircraft) in the country has reached 93.9 % of the movement recorded in 2019.

- Medical tourism:

- India is ranked 10th in the Medical Tourism Index FY21 released by Medical Tourism Association out of top 46 countries.

- India’s medical infrastructure has improved during the Pandemic.

- India boasts world-class hospitals and skilled medical professionals,

- Low cost of treatment compared with other countries,

- credibility in alternative systems of medicine, and

- increased global demand for wellness services like Yoga and meditation.

- It makes India a popular destination for medical tourism. Thus, the Medical Value Tourism (MVT) is expected to grow to US$ 13 billion by 2022.

- Steps taken by the government in this regard:

- Ayush visa for tourists who want to visit India for medical treatment,

- National Strategy for Sustainable Tourism & Responsible Traveller Campaign has been launched,

- Introduction of the Swadesh Darshan 2.0 scheme, and

- Heal in India can assist in capturing a larger share of the global medical tourism market.

- NIDHI portal: Tourism Ministry is working with the State Governments to register accommodation units in the country with the Ministry’s National Integrated Database of Hospitality Industry (NIDHI) portal. This will help in creating policies and strategies for the promotion of tourism at various destinations.

- System for Assessment, Awareness, and Training for Hospitality Industry (SAATHI) is launched jointly by the Tourism ministry and Quality Council of India (QCI) to sensitise the industry about Covid-19 regulations and work towards ensuring safety and hygiene at the workplace.

- Regional Connectivity Scheme (RCS- UDAN) – 3: was launched by the Civil Aviation ministry to facilitate regional air connectivity by making it affordable. It now covers 59 routes.

- Loan Guarantee Scheme for Covid Affected Tourism Service Sector (LGSCATSS) is being administered through the National Credit Guarantee Trustee Company (NCGTC). This scheme covers 10,700 Regional Level Tourist Guides, and about 1,000 Travel and Tourism Stakeholders (TTS) recognised by the tourism ministry and the State Governments.

- 5 lakh free Tourists Visas were announced by the Government for tourists of foreign nationals visiting India. The scheme was applicable

- until 31st March 2022 and was available only once per tourist.

- G20 presidency too is an opportunity for Indian travel and tourism.

II. Insurance Sector:

- Indian Insurance Market is now the 10th largest in the world and is poised to become the 6th largest by 2032, ahead of Germany, Canada, Italy, and South Korea.

- IRDAI (the insurance regulator) aims to provide universal insurance. When India celebrates 100 years of its independence in 2047, every Indian should have appropriate life, health, and property insurance cover and every enterprise should be supported by appropriate insurance solutions.

- Thus, it has taken various steps to promote the insurance industry by rationalising the regulatory framework: –

- A Single Window NOC Portal (www.noc.irdai.gov.in): It facilitates the incorporation of an insurer by making the NOC available in a hassle-free and timely manner, easing entry into the sector.

- Quick launch of Insurance Products: No need for prior approval from IRDAI before launching certain products like: any Health & General Insurance products, and a few Life Insurance products. This will reduce the time taken to launch a new product.

- Ease of doing business: So far about 85 circulars have been repealed and 70 returns have been rationalised.

- Tech-based add-ons: General insurers have been permitted to introduce tech-enabled concepts such as:

- Pay as You Drive, Pay How You Drive, etc. for motor insurance,

- Expansion of cashless facility in health insurance,

- Innovative products in Fire Insurance,

- Ease of living for Senior Citizen.

III. Real-estate Sector:

- Problems faced by Real estate sector during COVID:

- Project delays,

- Deferment of big-ticket purchases,

- Stagnation of property prices, and

- Scarce funding for developers

- Slackening of demand

- Declined office space demand aggravated by the work-from-home model

- Revival of Demand in Housing sector due to:

- Easing of curbs: interest in the residential housing sector got revived and especially in the affordable segment and ready to move-in houses.

- Work from home and Hybrid work mode improved the sentiments in the residential units’ market and encouraged first-time home buyers to move away from the conventional metros towards Tier II and III cities.

- Measures taken by the government such as lowering of interest rates, reduction in circle rates, cut in stamp duties on sale/purchase of immovable property,

- the extension of the Real Estate Regulation Act (RERA) brought in better regulatory framework.

- Steps taken to boost Housing Finance Sector:

- Government’s incentive under ‘Housing for All’, Aatmanirbhar Bharat, etc.,

- RBI’s 6 Month Moratorium: allowed lending institutions to grant a moratorium in case of payment failure due between 1st March 2020 to 31st August 2020.

- Infusion of ₹75,000 crore for NBFCs, Housing Finance Companies (HFCs) and Micro Finance Institutions (MFIs),

- Interest subvention under Pradhan Mantri Awas Yojana-Credit Linked Subsidy Scheme Urban) (PMAY-CLSS (U)). Government has released a subsidy amounting to ₹ 53,548 crore benefitting approximately 22.87 lakh households since its launch.

- National housing Bank provided Liquidity support of ₹ 88,400 crore through various refinance schemes such as Affordable Housing Fund (AHF) and RBI’s Special Liquidity Facility during the pandemic, to ensure seamless business as usual in the sector.

- The Co-lending model aims to leverage the liquidity of the banks and HFCs to deliver formal housing credit to the bottom of the pyramid.

- Smart City Project, aimed to build 100 smart cities across India.

- Reduction in import duties on steel products, iron ore, and steel intermediaries.

- Due to these efforts, the weighted average annual interest rate on home loans reduced from 8.6% during January-March 2020 to 7.3% during January-March 2022 for Scheduled Commercial Banks.

- Fresh Emerging challenges for Real Estate:

- High Input cost: The WPI inflation for Cement, Lime & Plaster has increased by about 9% in last one year.

- The Russia-Ukraine conflict has affected the supply chain raising the price of steel, cement, finishing materials, imported chemicals, and fuel.

- The unsold inventory stands at 8.5 lakh at the end of 2022 with 80% of the stocks under various stages of construction.

- Current Situation – the positives:

- There has been a resilient growth in the current year.

- The inventory overhang has dipped to 33 months during December 2022, from 42 months last year.

- According to JLL’s 2022 Global Real Estate Transparency Index, India is among the top ten most improved markets globally, with a composite transparency score improving from 2.82 in 2020 to 2.73 in 2022. This is backed by increased institutional investment and the growing number of Real Estate Investment Trusts (REITs).

- Regulatory initiatives such as the Model Tenancy Act.

- Digital initiatives: Digitisation of land registries & market data through the Dharani and Maha RERA platforms have helped to broaden the market and bring more formalisation to the sector.

IV. Information Technology and Business Process Management (IT-BPM) Industry:

- Covid-19 has accelerated the digitalization of India’s end-user industries across the value chain. The companies have witnessed more complex technology convergence, and the prioritisation of enterprise-scale data and cloud strategy.

- The IT industry has addressed the immediate challenges with swift and wide-scale adoption of remote working, and moved beyond to become a future-ready organisation.

- The IT industry is estimated to have recorded nearly 10% growth in direct employee pool in FY22 which is the highest-ever net addition to its employee base.

- Exports have witnessed a growth of 17.2% in FY22 compared to 1.9% growth in FY21.

- India’s major IT markets include US and Europe. Now, many firms are focusing on diversification into new markets, such as the Middle East and Latin America to increase the resilience of the Industry in the coming years.

- Major Growth Drivers:

- India is becoming Engineering R&D (ER&D) Powerhouse: For example, patent filing has increased significantly. Over 138,000 patents filed between 2015- 21, with over 85,000 filed in emerging technologies.

- Digital talent pool: India has a high share of the working population and growing undergraduate enrolments. New talent hiring from tier-2 cities has led India to evolve as a significant subcontractor base. It has also allowed more women getting into the workforce.

- Margin defence through operational excellence: The growing demand for tech talent puts pressure on the profit margins of the company. Thus companies defend their margin through increased capacity utilisation, a higher share of offshore revenue, a declining share of travel and facility costs, and operating leverage.

- Hybrid work models: Indian tech industry has easily adopted the hybrid work models.

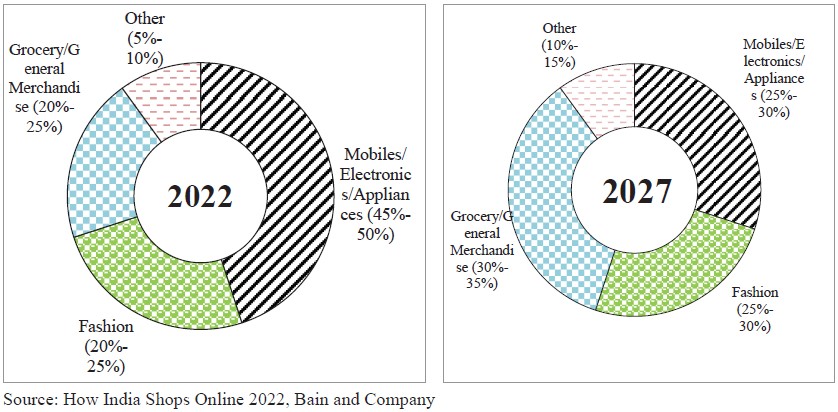

V. E-Commerce:

- E-Commerce sector has witnessed a renewed push and a sharp increase in penetration in the aftermath of the pandemic. According to the Global Payments Report by Worldpay FIS, till 2025, India’s e-commerce market would grow at 18% annually.

- Expansion into newer segments: such as grocery and fresh-to-home fruits and vegetables has contributed to the expansion of customer base. According to ‘How India Shops Online 2022’ report by Bain & Company, emerging categories – fashion, grocery and general merchandise – would capture nearly 2/3rd of the Indian e-commerce market space by 2027.

- E-commerce adoption by MSMEs: for selling and procurement has had many advantages:

- It has increased revenues and margins, and

- It has improved access to new markets.

- It has empowered small businesses by removing geographical barriers and provided them a large customer base.

- It has reduced the cost of procurement by increasing access to suppliers.

- Penetration of E-commerce:

- It has allowed a phenomenal geographical expansion driven by increased smartphone penetration, internet adoption, and increased purchasing power of rural customers.

- The pandemic helped boost e-commerce penetration in Tier 3 and 4 cities and rural areas. Retailers and distributers are using local distribution centres as Pick Up Drop Off points, enabling logistics companies to serve even the rural consumers.

- Overall e-commerce order volume has witnessed a growth of 69.4% YoY in FY22, driven mainly by consumers from tier-II and tier-III cities, which accounted for 61.3% of the overall market share in FY22, increasing from 53.8% in FY21.

- The order volume growth from tier-II and tier-III cities (around 90%) was almost double the pace of tier-I cities (47.2%).

- Factors leading to such growth:

- Digital India program,

- Unified Payment Interface (UPI),

- GeM, etc.

- One District – One Product (ODOP) initiative provides greater visibility for small local businesses from the rural sector.

- E-marketplace (www.tribesindia.com) portal run by TRIFED (Tribal Cooperative Marketing Development Federation of India Ltd.) provides a platform to tribal artisans.

- Open Network for Digital Commerce (ONDC) is democratising digital payments by enabling interoperability, and bringing down the transaction costs. It is an integrate e-commerce marketplace based on open-source technology.

- The Government E-Marketplace (GeM) has also witnessed tremendous growth in Gross Merchandise Value (GMV) and is catching up with E-commerce giants like Amazon and Flipkart.

- GeM attained an annual procurement of ₹1 lakh crore within FY22, at a growth rate of 160% higher than last year.

- GeM has taken a host of steps to onboard products of SHGs, tribal communities, artisans, weavers, and MSMEs.

- 57% of the total business on GeM has come through the MSME units.

VI.Digital financial services:

- Digital Financial Services are financial products like insurance, payment system, banking services, investment services which are provided Digitally.

- The financial services are increasingly becoming digital in India due to the innovative solutions. This has accelerated financial inclusion and democratised access. JAM trinity, UPI, better regulation and the pandemic has accelerated the digitalisation process.

- According to the latest Global FinTech Adoption Index India has a fintech adoption rate of 87%, substantially higher than the world average of 64%.

- Neo-Banking platforms have spurred in the recent times due to the need for on-demand and easier-to-access financial solutions by India’s young demography. This has also eased access to financial services for MSMEs.

⇨ Neo-Banking platforms are those banking services providers which exist entirely in the digit space rather than physical space.

- Government support to Neo-banking:

⇨ Digital Banking Units (DBU) announced in Union Budget 2022-23 to take banking solutions to every corner of the country have been launched across 75 districts.

- Introduction of Central Bank Digital Currency (CBDC) – India’s own crypto currency – offers several benefits, including reduction in operational costs and bringing innovation in the payments system.

⇨ Currently, there are more than 100 countries, covering 95% of the global GDP, that are in the process of exploring Digital/Crypto-currency. Some countries have already launched a digital currency, while others are in the pilot stage.

⇨ RBI has recently launched pilot-projects of CBDC in both the Wholesale and Retail segments.

- Digital Rupee –Wholesale– was launched on 1st November 2022, for settlement of secondary market transactions in government securities. This will make the inter-bank market more efficient.

- Digital Rupee –Retail – was launched on 1st December 2022, for a closed user group.

⇨ RBI is gradually expanding the scope of these pilots’ to include more banks, users, and locations based on the feedbacks.

- Digitalisation of documents: It ensures safety, online verification, improved accessibility for end customers and the service providers.

- Account Aggregator (AA) is a NBFC which provides the service of retrieving or collecting financial information pertaining to the customer (after receiving consent of the customer).

⇨ Registration with AA is fully voluntary for consumers and it transfers data from one financial institution to another based on the consent.

⇨ A Financial Information Provider (FIP) can also register on AA framework.

- FIPs can be banking companies, NBFCs, asset management companies (AMC), depositories, insurance companies, insurance repositories and pension funds etc.

- Till now, 27 such Financial Institutions have gone live as FIPs, which includes all 12 PSBs.

⇨A Financial Information User (FIU) which is regulated by any financial sector regulator can also register as AA. Till now, 119 Financial Institutions have gone live as FIUs.

⇨In this direction, RBI has issued the Master Direction in which it has granted a Certificate of Registration to six companies as AA.

Digital Document Execution (DDE) platform is launched by National e-Governance Services Limited (NeSL) in 2020.

- NeSL is an Information Utility registered with the Insolvency and Bankruptcy Board of India (IBBI).

- The DDE platform is launched at the behest of the IBBI and with the support of the Department of Financial Services (DFS), M/o Finance.

- It aims to digitise all the steps of the document/agreement execution journey, eliminating the need for the physical presence of the executants.

- Features of the DDE platform: –

- Submission of information/document/agreement which is to be executed on the platform.

- Secured storage, transmission and retrieval of the digitally executed document generated

- It accommodates any document format.

- It is a consent-based process.

- Allows digital payment of stamp duty and affixing of digital e-stamp certificate

- Verification of the identity of the executants

- Digital execution using an electronic signature

- Advantages of DDE platform:

- Lower execution time and cost,

- Bulk processing,

- A secure system with authorised access,

- Transparency and fraud prevention,

- Legal robustness, and

- Evidentiary value.

- Further, Aadhaar e-Sign has made electronic signatures widely available to citizens at a nominal cost.

- The NeSL-DDE platform has garnered the support of state governments, ministries, and financial institutions. DFS has been encouraging banks to consider adopting DDE for their agreements.

- Usage:

- Currently, 23 States are available for digital e-stamping on the NeSL DDE platform.

- Currently, 27 banks/NBFCs are using the platform for executing their agreements.

Conclusion: In the last two years, the services sector has performed poorly. However, in the current fiscal it has taken a strong rebound on the back of pent-up demand, ease of mobility, and near-universal vaccination coverage. Further, the reforms in the shape of public digital infrastructure should keep the sector strongly growing in the coming decade.