COOPERATIVES & SHGS

Cooperatives and Self-Help Groups (SHGs) are vital grassroots institutions that contribute significantly to participatory governance and socio-economic development in India. Rooted in principles of collective effort, mutual support, and democratic functioning, they empower marginalized sections of society, especially in rural and semi-urban areas. These community-based models foster self-reliance, encourage savings, and improve access to credit, enabling people to take charge of their development.

While cooperatives focus on pooling resources and promoting member welfare through sectors like agriculture, dairy, and credit, SHGs concentrate on small-scale financial intermediation and livelihood support, often led by women. Both models bridge the gap between formal governance structures and the community by enhancing accountability, improving service delivery, and fostering inclusive growth. Their synergy with government schemes and local institutions makes them key pillars in strengthening decentralized and responsive governance.

COOPERATIVES IN GOVERNANACE

COOPERATIVES IN GOVERNANACE

Cooperatives are voluntary associations formed to collectively meet the economic, social, and cultural needs of their members through a democratically controlled and jointly owned enterprise. They are built on the principles of mutual help, equity, and collective responsibility. The International Cooperative Alliance (ICA) defines a cooperative as “an autonomous association of persons united voluntarily to meet their common economic, social and cultural needs and aspirations through a jointly-owned and democratically-controlled enterprise.”

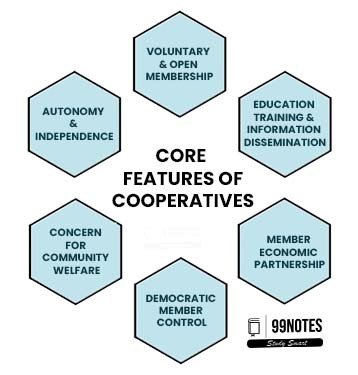

Core Features of Cooperatives

Significance of Cooperatives in India

Cooperatives play a crucial role in India’s socio-economic landscape, particularly in rural development. They serve as vehicles for collective growth and equitable distribution of resources.

- Economic Empowerment of the Marginalized: Cooperatives enable small farmers, laborers, artisans, and women to pool resources, access markets, and improve bargaining power. For instance, dairy cooperatives like AMUL transformed the rural economy in Gujarat and beyond.

- Credit and Financial Inclusion: Cooperative credit societies and banks provide affordable and accessible financial services to rural and semi-urban populations, reducing dependence on moneylenders.

- Promoting Agricultural Growth: Primary Agricultural Credit Societies (PACS), marketing co-ops, and multi-purpose societies support procurement, storage, input distribution, and irrigation.

- Women Empowerment and SHGs: Women-led cooperatives and SHGs under schemes like NRLM have been pivotal in increasing financial literacy, entrepreneurship, and household decision-making roles among women.

- Boost to Decentralized Development: By promoting participatory governance and local leadership, cooperatives contribute to bottom-up development. They align with Gandhian ideals of Gram Swaraj.

- Support during Crises: During COVID-19, cooperative societies played a critical role in ensuring supply chains of essentials and creating local employment opportunities.

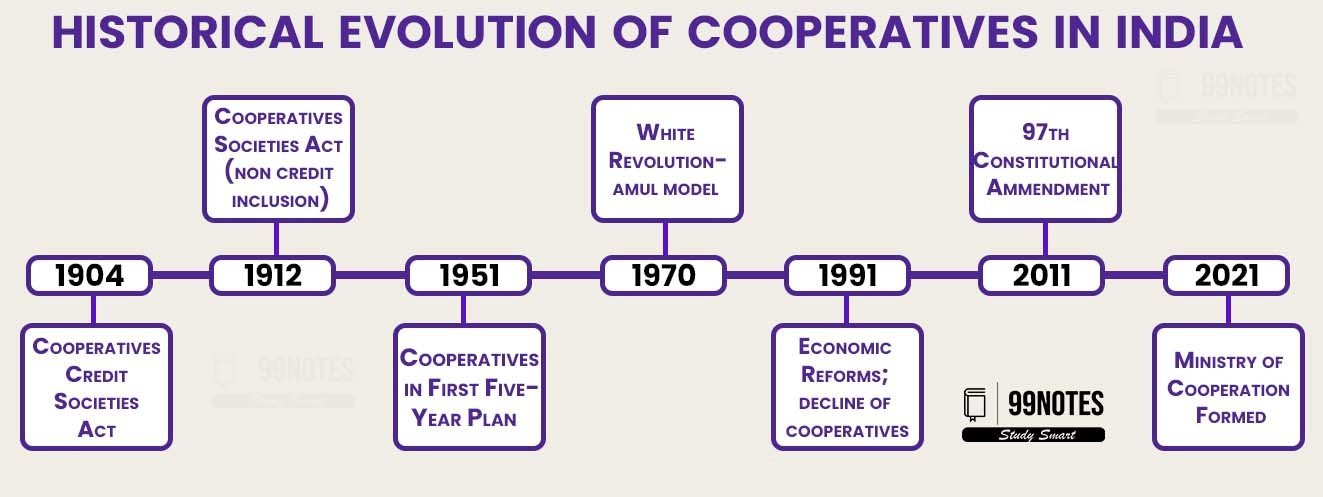

Historical Evolution of Cooperatives in India

The cooperative movement in India has evolved through various phases—colonial beginnings, post-independence expansion, policy support, and recent structural reforms.

- 1904: Cooperative Credit Societies Act enacted by the British to address rural indebtedness.

- 1912: Cooperative Societies Act broadened the scope to non-credit activities.

- Post-Independence Era

- Cooperatives became an integral part of Five-Year Plans.

- 1951: The Planning Commission promoted cooperatives as tools for rural transformation.

- White Revolution (1970s): Led by Verghese Kurien, AMUL became the model for dairy cooperatives.

- 1991 Economic Reforms: Shifted focus to self-reliance, but cooperatives struggled due to politicization and inefficiency.

- 97th Constitutional Amendment Act, 2011

Gave constitutional status to cooperatives.

Gave constitutional status to cooperatives.- Inserted Part IXB (Articles 243ZH to 243ZT) related to cooperative societies.

- Added the word “Cooperatives” in Article 19(1)(c) – Fundamental Right to form co-ops.

- Recent Steps

- 2021: Formation of a separate Ministry of Cooperation to strengthen the cooperative movement.

- Digitalization of cooperative banks, reform of PACS, and multi-state co-op laws are underway.

Types of Cooperatives

Cooperatives in India span across various sectors, serving different needs such as credit, production, marketing, and housing. Their structure allows members to collectively manage resources and share benefits. Below is a classification based on their functions and areas of operation.

| Type of Cooperative | Description |

| Credit Cooperatives | Provide short-term and long-term credit to members; include Primary Agricultural Credit Societies (PACS), District Central Cooperative Banks (DCCBs), and State Cooperative Banks (SCBs). |

| Consumer Cooperatives | Help consumers access quality goods at reasonable prices by eliminating middlemen; operate fair-price shops and consumer stores. |

| Marketing Cooperatives | Assist farmers in selling their produce at better prices by collective bargaining, storage, and transportation. |

| Producer Cooperatives | Formed by producers (especially small farmers/artisans) to pool resources and collectively market or process goods. |

| Dairy Cooperatives | Collect, process, and distribute milk and dairy products; AMUL is a leading example. |

| Housing Cooperatives | Provide affordable housing to members through collective ownership and construction of residential complexes. |

| Cooperative Farming Societies | Promote collective cultivation and shared use of land, tools, and inputs among small/marginal farmers. |

| Labour Cooperatives | Formed by workers to provide employment by undertaking construction, infrastructure, or repair works collectively. |

| Tribal Cooperatives | Address the specific needs of tribal communities by facilitating credit, forest produce marketing, and welfare activities. |

| Multi-purpose Cooperatives | Perform a mix of activities—credit, marketing, farming support, etc.—mainly in rural areas to serve multiple needs of members. |

Structure & Governance Mechanism

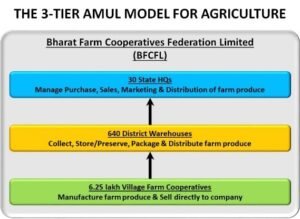

India’s cooperative sector is organized in a three-tier structure that promotes democratic functioning and efficient service delivery. It bridges the grassroots needs with institutional support and policy-level guidance. This structure ensures representation, accountability, and decentralization in managing cooperative affairs.

Structure of Cooperatives

- Primary Level: Grassroots units like PACS, dairy, housing, and weavers’ cooperatives operating at village/local level. They deal directly with individual members and offer services like credit, procurement, input distribution, and marketing.

- District Level: Comprises District Central Cooperative Banks (DCCBs) and district unions. They provide financial and administrative support to primary cooperatives and act as intermediaries with the state-level bodies.

- State/National Level: Includes State Cooperative Banks (SCBs), State Federations (like State Milk Federations), and national apex institutions (e.g., AMUL, IFFCO, KRIBHCO). They guide and support lower levels, coordinate with the government, and ensure scalability.

Governance Mechanism

The governance of cooperatives is rooted in the principle of democratic control and member participation. It ensures transparency, accountability, and decentralization through structured systems. Legal backing and constitutional recognition further strengthen their autonomous and democratic functioning.

- Democratic Control: Every member has one vote, irrespective of capital contribution, ensuring equal say in cooperative decisions.

- General Body: The supreme authority of a cooperative society, responsible for major decisions like approving budgets, framing policies, and electing the board.

- Board of Directors: Elected from among members to handle operational management, implement policies, and ensure accountability.

- Professional Management: Many cooperatives now appoint skilled professionals to manage finances, operations, and service delivery efficiently.

- Legal Oversight: Cooperatives are registered under respective State Cooperative Acts or the Multi-State Cooperative Societies Act, 2002, and monitored by the Registrar of Cooperative Societies.

- 97th Constitutional Amendment (2011): Gave constitutional status to cooperatives, mandated regular elections and audits, ensured functional autonomy, and added Article 43B for state promotion of cooperative societies.

Role in Decentralized & Inclusive Development

Cooperatives are powerful instruments for achieving inclusive and sustainable development, especially in rural India. They empower communities, promote self-reliance, and facilitate last-mile delivery of essential services, thereby reducing inequalities.

- Deepen Grassroots Democracy: Cooperatives function on the principle of “one member, one vote,” ensuring participatory decision-making and fostering leadership among locals.

- Promote Livelihoods: Provide employment, credit, training, and collective bargaining to small farmers, artisans, and workers, especially in agriculture, dairy, fisheries, and handloom sectors.

- Support Women and Marginalized Groups: SHG-based cooperatives and women-led cooperatives increase economic independence and social status. E.g., Kudumbashree in Kerala.

- Strengthen PRIs and Local Governance: Collaborate with Panchayats in implementing rural development schemes, capacity building, and service delivery.

- Advance Financial Inclusion: Credit cooperatives offer loans at low rates to underserved populations, reducing reliance on informal credit sources.

- Enhance Access to Basic Services: Cooperatives in housing, health, and consumer supply chains ensure quality and affordability of basic services.

- Disaster Resilience and Crisis Support: During COVID-19, cooperatives ensured supply chains for milk, ration, and medicines remained intact—especially in states like Gujarat and Maharashtra.

Promote Social Equity: Cooperatives reduce economic disparities and foster a culture of mutual help, trust, and community cohesion.

Promote Social Equity: Cooperatives reduce economic disparities and foster a culture of mutual help, trust, and community cohesion.- Model of Sustainable Development: By balancing economic goals with social welfare, cooperatives align with SDG goals and Gandhian ideals of self-reliance.

Case Example: AMUL’s three-tier cooperative model has transformed millions of marginal dairy farmers into entrepreneurs—making it a global dairy leader while ensuring inclusive growth.

Government Support & Legal Framework

The Indian government has consistently promoted cooperatives as engines of inclusive growth and rural transformation. A robust legal framework and targeted policy measures ensure their democratic governance, autonomy, and capacity building. From constitutional amendments to digitization and financial aid, support spans structural and institutional levels. This ecosystem empowers cooperatives to reach the grassroots and drive sustainable development.

- Legal Foundations – Cooperatives are governed under State Cooperative Societies Acts for intra-state bodies and the Multi-State Cooperative Societies Act, 2002 for those operating across states. These laws define rules for registration, governance, dispute resolution, elections, and audits. They ensure transparency, democratic functioning, and accountability within cooperatives.

- 97th Constitutional Amendment Act, 2011 – This Act added Part IXB to the Constitution, giving constitutional recognition to cooperatives. Article 43B was inserted to guide the State in promoting their autonomy and democracy. It mandated regular elections, timely audits, and recognized the right to form cooperatives under Article 19(1)(c), strengthening member participation and legal safeguards.

- Ministry of Cooperation (2021) – A new ministry was created to revitalize and unify India’s cooperative movement. It focuses on policy convergence, digitization, capacity building, and business-friendly reforms. Flagship program “Sahakar Se Samriddhi” aims to unleash the economic potential of cooperatives and create a national cooperative-based development model.

- Financial & Institutional Support – Institutions like NABARD and NCDC offer refinance, subsidies, and capital for cooperative credit and enterprise development. Budgetary schemes like PMFME, Dairy Infra Fund, and FPO support offer tax benefits and incentives. This ecosystem ensures cooperatives have access to credit, markets, and infrastructure for growth.

- Digital & Structural Reforms – Initiatives include Computerization of PACS, e-governance models, and formulation of Model Bye-laws for uniformity and transparency. A national cooperative database and common software system are under development to improve efficiency. Training and capacity building of personnel are also being prioritized to modernize operations.

- Regulatory Reforms – Amendments to the Multi-State Cooperative Societies Act are proposed to ensure better transparency, stronger audit compliance, and protection of member rights. RBI and NABARD are enhancing oversight of urban and rural cooperative banks to safeguard depositor interests and ensure financial stability in the sector.

| Success Stories |

|

India’s cooperative movement has created transformative grassroots institutions, particularly in rural and agrarian contexts. These success stories illustrate how cooperatives, when democratically managed, can deliver inclusive growth and social equity. Their impact spans economic upliftment, gender empowerment, and self-sufficiency. These examples are globally recognized and reflect the power of collective action.

|

Challenges Faced by Cooperatives

Despite their grassroots reach and democratic ethos, cooperatives in India face persistent issues that hinder their performance and credibility. These include political interference, poor management, financial irregularities, and outdated laws. The cooperative model’s full potential remains untapped due to weak autonomy and fragmented ecosystems. Timely reforms are essential to sustain their relevance in the modern economy.

- Political Interference – Local political leaders often capture cooperatives, using them for electoral or personal gain. This disrupts democratic functioning, delays board elections, and erodes member trust. Politicization of decisions and appointments distorts priorities and damages institutional autonomy.

- Lack of Professional Management – Grassroots cooperatives usually lack skilled personnel in finance, operations, and marketing. With no career path or incentives, talent retention is poor. Absence of training, modern HR practices, and exposure limits their ability to compete with private players.

- Poor Financial Discipline and Audit Delays – Fund mismanagement, bad loans, and weak internal controls plague many cooperatives. Delayed audits and outdated accounting erode transparency and credibility. Small PACS suffer the most, often running into losses and becoming dependent on government bailouts.

Overregulation and Bureaucratic Control – Excessive control by registrars restricts autonomy and delays decision-making. Outdated cooperative laws vary across states, limiting reform uniformity. Tedious approval and registration processes discourage innovation and scalability.

Overregulation and Bureaucratic Control – Excessive control by registrars restricts autonomy and delays decision-making. Outdated cooperative laws vary across states, limiting reform uniformity. Tedious approval and registration processes discourage innovation and scalability.- Limited Market Access and Competition – Most cooperatives lack branding, market linkages, and digital outreach. In the face of rising competition from corporates and agribusinesses, they struggle to survive. Absence of logistics and e-commerce integration lowers profitability and member income.

- Low Member Participation and Awareness – Members often perceive cooperatives as welfare schemes rather than self-owned enterprises. Poor awareness leads to low meeting attendance and weak feedback. Without active involvement, cooperatives fail to respond to real community needs.

- Technology Backwardness – Rural cooperatives still rely on manual processes with little use of digital tools. This hampers efficiency, financial inclusion, and real-time reporting. Inadequate digital capacity creates a gap between rural and urban cooperatives.

- Fragmentation and Lack of Scale – With over 8 lakh cooperatives functioning in silos, there’s a lack of coordination and shared services. This prevents collective bargaining and economies of scale. Weak federations further increase operational costs and reduce impact.

Reviving India’s cooperative movement needs a combination of policy reform, internal strengthening, and professionalization. Cooperatives must evolve with time, embrace digital transformation, and ensure democratic values. Strong institutions backed by good governance can unlock their full potential. The following reforms are crucial for inclusive, member-driven growth:

- Strengthen Democratic Governance – Ensure timely elections, regular audits, and empowered general bodies as mandated under the 97th Constitutional Amendment. Reduce political interference through transparent processes and member awareness. This builds institutional credibility and member participation.

- Promote Professional Management – Encourage appointment of trained professionals in finance, operations, and IT. Set up cooperative management training institutes. Introduce modern HR practices like performance-linked incentives and periodic skill upgrades to boost efficiency.

- Modernize Legal Framework – Amend outdated state cooperative laws and streamline the Multi-State Cooperative Societies Act. Remove excessive bureaucratic control by registrars and simplify compliance norms. Promote ease of doing business through digital registration and audit systems.

- Improve Financial Sustainability – Diversify revenue sources, improve internal audits, and recover overdue loans. Encourage reinvestment of surplus in infrastructure and digitization. Strengthen financial literacy and transparency to build sustainable cooperatives.

- Leverage Digital Technology – Digitize member services, accounting, and record-keeping. Link cooperatives with e-NAM, ONDC, and online banking. A national cooperative digital platform can enhance transparency, communication, and monitoring in real-time.

- Encourage Youth & Women Participation – Promote leadership among rural youth and women through training, capital support, and role models. Incentivize women-led and youth-led cooperatives. Increased diversity improves innovation and social impact.

- Strengthen Federations & Scale Up – Build strong federations at state/national levels to help smaller cooperatives access markets, branding, and logistics. Encourage collaboration among cooperatives to benefit from shared resources and collective bargaining.

- Policy Support & Dedicated Ministry – Utilize the Ministry of Cooperation for focused reforms and convergence with schemes like SHGs, FPOs, and Start-Up India. Launch a National Cooperative Development Mission for scale, sustainability, and innovation.

SELF-HELP GROUPs (SHGs) IN GOVERNANCE

Self-Help Groups (SHGs) are informal associations of individuals—usually women—from similar socio-economic backgrounds, who come together to improve their living conditions through collective savings, lending, and group-based activities. They are a grassroots response to poverty, exclusion, and lack of access to credit, especially in rural areas. SHGs enable financial inclusion, empower women socially and economically, and foster participatory development. Over the decades, they have become vital instruments of community-led progress and microfinance in India.

Self-Help Groups (SHGs) are informal associations of individuals—usually women—from similar socio-economic backgrounds, who come together to improve their living conditions through collective savings, lending, and group-based activities. They are a grassroots response to poverty, exclusion, and lack of access to credit, especially in rural areas. SHGs enable financial inclusion, empower women socially and economically, and foster participatory development. Over the decades, they have become vital instruments of community-led progress and microfinance in India.

Concept of SHGs

Self-Help Groups (SHGs) are informal associations of 10–20 individuals, mostly rural poor women. They are formed to promote savings, credit discipline, and collective problem-solving. SHGs serve as vehicles of both financial inclusion and social empowerment.

- Homogeneous Membership – SHGs are formed by people from similar socio-economic backgrounds, mainly women. This fosters mutual understanding, shared goals, and trust. It ensures cohesive functioning and group solidarity.

- Thrift and Internal Lending – Members regularly save small amounts and create a common fund. This corpus is used for need-based loans to members. It builds credit discipline and reduces dependence on moneylenders.

- Democratic Functioning – SHGs follow collective decision-making and rotational leadership. Every member has an equal voice in discussions and planning. This promotes inclusivity, leadership, and empowerment.

- Flexible and Simple Norms – Rules of SHGs are member-made, locally relevant, and easy to follow. Regular meetings and record-keeping are emphasized. Simplicity ensures active participation and compliance.

Platform for Social Empowerment – SHGs engage in issues like education, health, domestic violence, and sanitation. They encourage women to raise voices and act collectively. This strengthens community leadership and gender justice.

Platform for Social Empowerment – SHGs engage in issues like education, health, domestic violence, and sanitation. They encourage women to raise voices and act collectively. This strengthens community leadership and gender justice.- Linkage with Formal Institutions – SHGs are connected with banks under the SHG–Bank Linkage Programme. This enhances access to formal credit and financial literacy. It enables entrepreneurship and economic resilience.

Purpose of SHGs

The core purpose of SHGs is to foster financial inclusion and self-reliance among marginalized communities, especially women. They aim to reduce poverty through savings, credit access, and skill-building. SHGs also function as agents of social change and collective empowerment.

- Promote Savings & Financial Discipline – SHGs inculcate the habit of regular saving among poor households. Members learn budgeting, thrift, and financial management. This builds economic resilience and future security.

- Access to Credit without Collateral – SHGs provide easy, timely loans from the group’s own corpus. This eliminates dependence on exploitative moneylenders. It promotes creditworthiness and income-generating activities.

- Empowerment of Women – SHGs enhance self-confidence, decision-making, and leadership among women. They gain control over finances and family matters. This challenges traditional gender roles and promotes equality.

- Skill Development & Livelihoods – SHGs facilitate vocational training, entrepreneurship, and small businesses. Many women start income-generating activities through group support. It promotes self-employment and poverty reduction.

- Social Awareness & Community Action – SHGs create awareness about health, education, rights, and governance. They take collective action on local issues like sanitation or domestic violence. This makes them powerful tools of grassroots mobilization.

- Link to Government Schemes & Institutions – SHGs act as a bridge between rural poor and development schemes. They are linked to programs like NRLM, PMFME, and health missions. This ensures last-mile delivery and inclusive governance.

Role in Women Empowerment & Social Capital Building

SHGs have been instrumental in transforming the lives of rural women by enabling them to become financially independent and socially aware. Beyond credit access, SHGs foster leadership, solidarity, and collective identity. They build social capital by strengthening networks of trust, cooperation, and shared responsibility.

- Economic Independence of Women – SHGs provide access to income, savings, and credit. Women start micro-enterprises and support household finances. This reduces dependency and boosts confidence.

- Leadership & Decision-making Skills – Rotational leadership in SHGs trains women in public speaking and management. They participate in group decisions and community meetings. This enhances their role in household and village governance.

- Collective Identity & Mutual Support – SHGs create a safe space for women to share experiences and solve problems. Peer support builds solidarity and emotional strength. This collective identity strengthens social bonds.

- Awareness of Rights & Entitlements – Through trainings and meetings, SHG women learn about legal rights, schemes, and services. They assert rights on issues like domestic violence, land, and education. This leads to greater social justice and inclusion.

- Community Participation & Civic Engagement – SHG women participate in gram sabhas, panchayat elections, and local campaigns. Their engagement improves grassroots democracy. They become change agents in their communities.

- Reduction in Social Evils & Gender Bias – SHGs raise awareness on dowry, child marriage, and gender discrimination. Collective efforts reduce harmful practices in villages. This promotes a culture of equality and dignity.

SHG–Bank Linkage Programme (SBLP)

Launched by NABARD in 1992, the SHG-Bank Linkage Programme is a flagship initiative to connect informal SHGs with the formal banking system. It enables SHGs to access institutional credit without collateral. The model has become the largest microfinance programme in the world in terms of outreach.

- Collateral-Free Loans – SHGs can get loans without individual security. Group savings act as moral collateral. This reduces credit exclusion of poor women.

- Financial Inclusion of Marginalised – Brings rural poor, especially women, into banking network. Promotes savings habits and responsible borrowing. Acts as a gateway to pensions, insurance, and DBTs.

- NABARD’s Role – NABARD provides refinance to banks, capacity building, and policy support. It ensures standardisation of processes and monitoring. Also incentivises banks for SHG financing.

- Improved Repayment Rates – SHG loans have high recovery rates due to peer pressure and social responsibility. Banks find it safer to lend to groups. This builds credit history and trust.

- Empowerment through Financial Literacy – SHG members receive training on budgeting, savings, and credit use. This builds confidence in dealing with banks. It enhances decision-making in households.

| Three-Linkage Models |

|

Government Schemes Supporting SHGs

The Indian government has launched various schemes to strengthen Self-Help Groups and enhance their access to finance, capacity, and markets. These initiatives aim to reduce poverty, empower women, and promote inclusive development. The focus is on sustainable livelihood, skill-building, and digital empowerment.

- DAY-NRLM (Deendayal Antyodaya Yojana – NRLM) – Launched in 2011, it is the largest SHG promotion programme. It helps poor rural women form SHGs, get bank linkage, and access livelihood training. Also supports Community Resource Persons (CRPs) and federations.

- Start-Up Village Entrepreneurship Programme (SVEP) – Sub-scheme under NRLM to promote rural entrepreneurship. Provides financial aid and mentoring to SHG members to start small businesses. Builds local value chains and jobs.

- Mahila Kisan Sashaktikaran Pariyojana (MKSP) – Aims to empower women farmers through SHGs. Provides training in sustainable agriculture and land rights. Enhances food security and gender equity in farming.

- PMFME (PM Formalisation of Micro Food Processing Enterprises) – SHG members engaged in food processing are supported. Offers credit-linked subsidy, branding, and marketing help. Promotes local food units under ‘One District One Product’.

- MUDRA Yojana (Micro Units Development and Refinance Agency) – Provides collateral-free loans to SHG entrepreneurs. Divided into Shishu, Kishore, and Tarun categories. Encourages small-scale enterprise growth.

- Digital SHG Platforms– Facilitate data management, credit tracking, and transparency. Promote digital literacy and access to online markets. Help integrate SHGs with Digital India.

SHGs in Poverty Alleviation & Livelihood Generation

Self-Help Groups (SHGs) have emerged as grassroots institutions that play a vital role in lifting poor households out of poverty. By promoting savings, credit access, and entrepreneurship, SHGs enhance livelihood security. Their collective strength enables women to engage in sustainable income-generating activities.

- Microcredit Access – SHGs provide collateral-free credit for essential needs and enterprises. It reduces dependence on moneylenders and improves financial resilience. This supports asset creation and income growth.

- Skill Development – Training through NRLM and NGOs helps members learn tailoring, food processing, and farming. Equipped with skills, members start small ventures. This leads to self-reliance and local employment.

- Enterprise Promotion – SHG members run businesses like dairy, poultry, handicrafts, and retail. Collective production ensures better quality and bargaining power. It boosts rural entrepreneurship and income levels.

Market Linkages – Government schemes help SHGs connect with local and digital markets. Branding and exhibitions promote their products nationwide. It increases profits and scales up operations.

Market Linkages – Government schemes help SHGs connect with local and digital markets. Branding and exhibitions promote their products nationwide. It increases profits and scales up operations.- Social Capital Building – SHGs foster trust, networks, and community support systems. Members help each other during crises and share resources. This strengthens resilience and group solidarity.

- Inclusive Growth – SHGs include the poorest women and marginalized communities. They create equitable opportunities for participation and leadership. This ensures broad-based development and poverty reduction.

Role in Strengthening Local Governance & PRIs

Self-Help Groups (SHGs) act as grassroots democratic platforms that empower women to engage with local governance. Their presence strengthens the accountability and inclusiveness of Panchayati Raj Institutions (PRIs). SHGs enhance participation, transparency, and service delivery in rural governance systems.

- Grassroots Participation – SHGs mobilize women to attend gram sabhas and local meetings. This boosts awareness of rights and schemes. It leads to more democratic decision-making at the village level.

- Policy Feedback Loops – SHG members raise local issues directly with panchayat leaders. Their collective voice influences policy priorities and fund allocation. This ensures governance is more responsive to real needs.

- Women’s Leadership – Many SHG members contest elections for PRI seats. Their experience in SHGs equips them with skills in finance, communication, and leadership. It increases gender representation in local governance.

- Monitoring Service Delivery – SHGs monitor implementation of schemes like PDS, MGNREGA, and sanitation. They report irregularities and ensure accountability. This improves the effectiveness of welfare programs.

- Convergence with PRIs – PRIs collaborate with SHGs for implementing schemes like NRLM, Swachh Bharat, etc. SHGs serve as executing arms of governance. It ensures last-mile delivery of benefits.

- Social Mobilization – SHGs promote awareness on education, health, sanitation, and legal rights. They initiate campaigns in collaboration with PRIs. This builds an informed and active rural citizenry.

| Success Models |

|

Across India, several SHG models have emerged as benchmarks of inclusive development and women-led change. These success stories illustrate the transformative potential of collective effort and state-supported community institutions. They also reflect how SHGs go beyond credit to drive empowerment, livelihoods, and governance.

|

Challenges Faced by SHGs

Self-Help Groups (SHGs) have proven effective in grassroots empowerment, but their journey is not without obstacles. Operational, financial, and institutional challenges hamper their growth and impact. Overcoming these requires targeted reforms, capacity building, and systemic support.

- Low Financial Literacy – Many SHG members struggle with basic accounting, budgeting, and bank processes. This weakens internal transparency and credit readiness. Regular training programs are essential for sustainability.

- Lack of Market Linkages – SHG products often remain local due to poor branding and marketing channels. This limits income potential and scalability. Support in packaging, digital access, and retail networks is needed.

- Credit and Loan Repayment Issues – Irregular repayment behavior affects group credibility with banks. It leads to limited future credit access. Strengthening credit discipline and monitoring is crucial.

- Unequal Participation – Dominance by a few members leads to elite capture and exclusion of the marginalized. This hampers democratic decision-making. Promoting rotation of leadership and inclusion is vital.

- Over-dependence on Government Schemes – Some SHGs exist mainly to access subsidies or loans, not to build self-reliance. This reduces long-term sustainability. Focus must shift to empowerment and entrepreneurship.

- Weak Convergence with PRIs – SHGs are often disconnected from Panchayati Raj Institutions and local development plans. This isolates them from grassroots governance. Formal linkages with PRIs should be strengthened.

- Inadequate Capacity Building – Lack of ongoing skill development in livelihood activities reduces group effectiveness. Without market-relevant training, SHGs fail to scale. Continuous skilling must be integrated.

- Limited Use of Technology – Most SHGs do not leverage digital tools for bookkeeping, marketing, or training. This limits efficiency and outreach. Promoting digital inclusion can modernize SHG operations.

Digital & Tech Integration in SHGs

Technology is a game-changer for Self-Help Groups, enabling transparency, efficiency, and market reach. Digital tools empower SHGs to manage finances, access information, and connect with wider ecosystems. Integration of tech can scale impact and improve governance.

Digital Bookkeeping & MIS – Use of mobile apps and digital platforms enables transparent recordkeeping and data management. It reduces manual errors and builds credibility with banks and institutions. Platforms like e-SHRAM and SHGSoft are being promoted.

Digital Bookkeeping & MIS – Use of mobile apps and digital platforms enables transparent recordkeeping and data management. It reduces manual errors and builds credibility with banks and institutions. Platforms like e-SHRAM and SHGSoft are being promoted.- Financial Inclusion through Digital Banking – SHG members use mobile banking, Aadhaar-enabled payment systems, and ATMs for financial transactions. This ensures timely credit, savings, and reduced dependence on middlemen. It fosters digital financial literacy among women.

- Access to Government Schemes Online – SHGs can register, apply, and track schemes through portals like e-Gram Swaraj, DAY-NRLM dashboard, and PFMS. It reduces delays and leakages. Digital access empowers SHGs to claim their entitlements efficiently.

- E-Commerce & Online Marketing – Digital platforms like GeM, Amazon Saheli, and Flipkart Samarth help SHG products reach national and global markets. It boosts incomes and entrepreneurship. Digital branding and packaging are also being supported.

- Skill Development through Online Courses – SHG members access digital literacy, financial skills, and entrepreneurship training via apps like DIKSHA and PMGDISHA. This bridges knowledge gaps and builds employability. Tech-enabled learning makes training scalable and inclusive.

- GIS & Remote Monitoring – GPS tagging and GIS tools are used to track SHG activities, assets, and impact. It enhances transparency and evaluation. Government agencies use it for better targeting and planning.

- Digital Credit Scoring & Fintech – AI-based models assess SHG creditworthiness using non-traditional data, enabling quick loans. Partnerships with fintechs reduce loan processing time. It promotes formal credit inclusion.

- Cybersecurity & Digital Risk Awareness – SHGs face rising risks of fraud, phishing, and identity theft in digital operations. Training programs on digital safety are being introduced. Responsible usage is key for sustainable digital integration.

Way Forward

Self-Help Groups (SHGs) have proven their potential as engines of empowerment, inclusion, and grassroots development. However, to scale and sustain their impact, reforms and innovations are essential. A multi-dimensional approach integrating finance, technology, and governance is the way forward.

- Capacity Building & Skill Upgradation – Regular training in financial literacy, digital tools, and enterprise management should be institutionalized. This will enhance SHG sustainability and member confidence. Partnerships with NGOs and CSR can help.

- Access to Larger and Diversified Credit – Beyond microcredit, SHGs must be linked to higher-value loans for enterprise expansion. Banks should adopt flexible collateral norms. Credit guarantee mechanisms must be strengthened.

- Strengthening Digital Ecosystem – Expand mobile connectivity, digital infrastructure, and access to devices in rural areas. Promote use of SHG apps, MIS, and digital marketplaces. Cybersecurity awareness must also be built in.

- Product Diversification & Value Addition – Encourage SHGs to move beyond traditional activities like stitching or papad-making. Promote food processing, eco-tourism, handicrafts, etc. Training in branding and packaging is crucial.

- Convergence with Government Schemes – SHGs should be strategically integrated with schemes like DAY-NRLM, PMFME, and PMKVY. This ensures better funding, skill development, and backward-forward linkages. PRIs can facilitate this synergy.

- Social Inclusion & Gender Mainstreaming – Focus on inclusion of marginalized groups: SC/STs, minorities, differently abled, and single women. Encourage male sensitization for gender-inclusive development. Intersectional equity must be ensured.

- Robust Monitoring & Evaluation – Use of data analytics, GIS mapping, and dashboards for real-time monitoring of SHG performance. Feedback loops and grievance redressal need strengthening. Impact evaluation must be periodic and participatory.

- Strengthening Federation Structures – Promote SHG federations at cluster, block, and district levels for economies of scale. These can manage common facilities, marketing, and procurement. It ensures SHG voice in governance processes.

Conclusion

SHGs are not just credit collectives—they are platforms for dignity, solidarity, and grassroots governance. When supported through financial, technological, and institutional innovations, they become key drivers of inclusive development. Strengthening SHGs means empowering the last woman standing. It is central to realizing the vision of Atmanirbhar Bharat and Sustainable Development Goals.

Related FAQs of COOPERATIVES & SHGS

Cooperatives play a crucial role in India’s rural development by empowering small farmers, artisans, and laborers through collective ownership and democratic functioning. They enhance access to credit, markets, and resources, promote agricultural growth, and ensure financial inclusion. Success stories like AMUL and IFFCO showcase their impact on income generation, women empowerment, and decentralized governance.

SHGs empower women by promoting financial independence, leadership skills, and community participation. Through regular savings, internal lending, and livelihood training, SHGs enable women to start micro-enterprises and participate in local governance. Initiatives like Kudumbashree (Kerala) and Jeevika (Bihar) have transformed rural women into decision-makers and entrepreneurs.

While both SHGs and cooperatives promote collective action and grassroots empowerment, SHGs are usually small, informal groups (mainly women) focused on microfinance and social change. Cooperatives, on the other hand, are formally registered entities that operate across various sectors like dairy, agriculture, housing, and credit, with a larger and more structured membership base.

Key schemes include DAY-NRLM, PMFME, MUDRA Yojana, and MKSP for SHGs, offering financial aid, skill development, and entrepreneurship support. Cooperatives benefit from NABARD, NCDC, and PMFME funding, and the Ministry of Cooperation drives structural reforms and digitization. The 97th Constitutional Amendment further empowers cooperatives with legal recognition and autonomy.

Cooperatives face challenges like political interference, poor professional management, outdated laws, and financial irregularities. SHGs struggle with low financial literacy, limited market access, unequal participation, and weak digital adoption. Addressing these issues through reforms, capacity-building, and digital integration is key to their long-term sustainability and impact.

![Centre State Relations- Legislative, Administrative, And Financial [Upsc Notes] | Updated April 24, 2025 Centre State Relations- Legislative, Administrative, And Financial [Upsc Notes]](https://www.99notes.in/wp-content/uploads/2023/10/central-state-relation-featured-768x500.webp)