Comptroller and Auditor General of India- UPSC Notes

Comptroller and Auditor General of India (CAG)

Article 148 of the Indian Constitution provides for the office of the Comptroller and Auditor General of India (CAG). It acts as the custodian of the public funds, overseeing the entire financial framework of the country at both levels- the Centre and the State.

Exercise of financial control is one of the main responsibilities of the legislature. The Parliament and state legislatures are aided by the CAG to ensure the financial accountability of the executive to the legislature of the Union and the states.

The CAG is the administrative head of the Indian Audit and Accounts Department. Its administrative power is governed by rules made by the President with his/her consultation. It ensures that the executive upholds the Constitution of India and the laws of Parliament in matters of financial administration.

The importance of the office of the CAG in the Indian democratic set-up is underscored by Dr BR Ambedkar, who aptly described it as “Probably one of the most important offices under the Constitution of India”.

| Historical Background of the Office of the CAG |

| The office of the CAG began as soon as the British crown took direct control of India in 1858.In 1919, the office of the ‘Auditor General in India’ was statutorily recognised under the Government of India Act 1919. In 1935, the position was renamed the ‘Auditor General of India’, and he was appointed by the King of England, signifying the independence enjoyed by the office. V Narahari Rao became the first Auditor General of India post-independence. |

Position and Autonomy of CAG

The Constitution has provided an important and independent position to the office of the CAG by providing adequate safeguards to ensure independence from the executive.

Appointment, Tenure and Removal of the CAG [Article 148]

- Appointment: The CAG is appointed by the President by warrant under his/her seal.

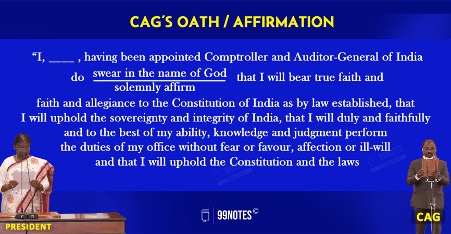

- Oath and affirmation: Before taking over the office, s/he subscribes to an oath or affirmation before the President [The oath of the CAG (same as judge of Supreme Court) is mentioned in the 3rd schedule of the Indian Constitution.

- Term: S/he holds office for a period of 6 years or up to 65 years of age, whichever is earlier. S/he can resign from his office at any time by addressing his/her resignation letter to the President.

- Removal: The CAG can be removed from office only on the grounds of proven misbehaviour and incapacity (as in the case of a Supreme Court judge). Though appointed by the President, s/he does not hold the office at the pleasure of the President.

Terms of Office (Independence of CAG)

Since the CAG audits government’s account, it is imperative for it to remain independent from the government, to ensure accountability. Following provisions have been ensured in this regard:

- The Constitution guarantees that the CAG’s salary and other conditions of the service (pensions, leave of absence, and age of retirement) cannot be revised to his/her disadvantage.

- The salaries, allowances, and administrative expenses of the CAG are charged on the consolidated fund of India, which means it is not subject to the Parliament’s voting.

- Upon his/her retirement, removal, or resignation, the CAG is prohibited from holding any office under the government of India or the state government. This provision has been made to keep the office of the CAG immune from the allurement of receiving favours from the executive, which might influence his/her decisions.

Duties and Powers of the CAG

Article 149 of the Constitution empowers the Parliament to make laws regarding the duties and powers of the CAG of India. Consequently, the Parliament enacted the Comptroller and Auditor General’s (Duties, Powers and Conditions of Service) Act 1971. The duties and functions of the CAG as per the provisions of the Constitution and laws made by Parliament are:

| Separation of Auditing and Accounting Functions |

| Earlier, the CAG was entrusted with both accounting and auditing functions.In 1976, the Indian government separated the accounting and auditing functions and assumed responsibility for accounting functions within its own administrative Ministry/Department.However, the CAG is still responsible for the preparation of annual accounts for each of the state governments and Union territories with legislative assemblies. |

Auditing functions of the CAG:

The CAG of India conducts the audit of the following accounts:

- The accounts related to the expenditure from the consolidated fund of India, the consolidated fund of each state and the consolidated fund of each Union territory having a legislative assembly.

- All expenditures from the contingency fund of India and of each state and the public account of India as well as of each state.

- All manufacturing, trading, balance sheets, profit and loss accounts and other subsidiary accounts kept by any department of Union and state government.

- The receipts and expenditures of all authorities and bodies substantially financed from Union or state revenues.

- The accounts of all bodies and authorities receiving grants and loans from Union and state governments for specific purposes.

- The accounts of all stores and stock kept in all the offices and departments of the central and state governments.

- The accounts of all Corporations whose statutes provide for audit by him/her.

- The accounts of all Government Companies in accordance with the provisions of the Companies Act.

- The accounts of any other body or authority when requested by the President or Governor.

Types of Audits conducted by CAG

- Compliance Audit: It involves assessing whether financial transactions, information and other activities are in compliance with the laws, rules, regulations, etc.

- Financial Audit: It provides assurance that the financial statements of an entity properly present the financial position.

- Performance Audit: It involves determining whether institutions, programmes and schemes operate in accordance with the principles of economy, efficiency and effectiveness. It focuses on achieving good performance in public administration.

Note: Unlike the first 2 audits, which are obligatory in nature, the performance audit is discretionary in nature.

Submission of reports [Article 151]:

The CAG submits the reports relating to:

- Audit reports related to the accounts of the Centre to the President, who places it before the Parliament.

- Audit reports related to states to the Governor, who places them before the state legislature.

| Types of Audit Reports |

| The CAG submit audit reports on: Appropriation accountsFinance accountPublic undertaking |

Other Functions of CAG

- Forms of Accounts of Union and State: As per Article 150, the CAG has the authority to prescribe [advise the President] the form in which the accounts of the Union and states will be kept. This provision has been made to ensure uniformity in the economic system.

- Assistance in Preparation of Budget: The CAG assists and provides information to the Union and states in the preparation of the budget.

- Relationship of CAG with respect to the Public Accounts Committee (PAC):

- The CAG has been described as the friend, philosopher and guide to the PAC.

- The PAC examines accounts and the report of the Comptroller and Auditor General of India from a legal point of view to find out whether there is any technical irregularity as well as to ascertain that the funds appropriated by the Parliament have been spent with economy and efficiency.

- The CAG provides assistance to the Public Accounts Committee in its functioning.

| Case Study: Should CAG question Policy decisions? |

| It is not the job of CAG to question policy decisions, that is the job of the Legislators and the general Public which elected the Government. The CAG’s job is to mine through piles of financial data and report financial mismanagement. This view has been supported by the Judiciary several times. • Mohammed Suleman Vs State of Gujarat (2013) Context: A PIL was filed against the Gujarat government based on a CAG report, which had made certain remarks regarding the policy decision on the state government’s decision to develop International Finance City at Ahmedabad. • Supreme Court’s Observation: Highlighting the importance of the CAG in monitoring public finance, the Court also observed that ultimately, it is the state that administers the state and is accountable to the people, subjecting every decision made by the government to microscopic scrutiny will hinder the administration, causing decision-makers to lose their initiative and enthusiasm. • Demonetisation Case: On the questions related to demonetisation, the CAG of India, Shashi Kant Sharma, stated that we will not question the policy decision of demonetisation but will look into other aspects of it like how much it affected the revenues of RBI and its impact on the dividends payable to the government. |

Can CAG Audit Private Companies?

Auditing of private companies by CAG is not a new phenomenon. In the past, the CAG has audited various private companies that were managing or exploiting natural resources or companies that were involved with the government in PPP projects; for example, audit of electric distribution companies in Delhi, audit of KG basin allocated to Reliance, PPP project in Delhi airport development.

Here, we will discuss the Supreme Court’s observation in the case in which CAG’s authority to audit private companies was challenged.

- Background: In 2009, the Department of Telecommunication (DoT) ordered an audit of telecom companies by private auditors selected by CAG. The telecom companies went to the Supreme Court opposing the order (of TDSAT and Delhi HC, who had ruled in favour of DoT).

- Supreme Court Observation: The Court observedthat natural resources (in this case, spectrum) belong to people, and whenever Union, state, local bodies or even private entities are exploiting natural resources, they are accountable to the people.

It held that the CAG could conduct an audit of the telecom companies to ensure the government is getting its legitimate share of revenue from natural resources allocated to them, such as spectrum.

However, the Supreme Court modified the Delhi HC order, which had ordered a statutory audit of the telecom companies; the Court said that the audit would not be statutory and would be limited to the examination of accounts to make sure there is no loss to public exchequer.

Evaluation of CAG’s Role

Significance of the CAG in the Indian Political System:

It is the supreme audit institution (SAI) that assists the Parliament and state legislatures in its role to ensure the financial accountability of the executive and acts as the guardian of the public purse and monitors the entire financial system.

The CAG plays an important role in ensuring transparency in public services, which is an essential component of good governance. For example-

- In 1962, the CAG audit report indicted the then defence minister VK Menon for contractual lapse in the purchase of army jeeps.

- CAG has also highlighted irregularities in high-profile cases like procurement of Bofors Howitzer guns, allocation of 2G spectrum, coal block allocations, and Augusta Westland VVIP choppers, etc.

Limitations of CAG:

- Paul H. Appleby has criticised the role of CAG as an auditor as irrelevant and harmful. He has provided the following criticism:

- Auditing is necessary but a very pedestrian function with a narrow perspective and limited usefulness.

- The auditing exercise by the CAG leads to a paralysing effect on the decision-making process.

- Auditors do not know and cannot be expected to know much about administration.

- Mode of Appointment:

- Conflict of Interest in Appointment Process: The executive has the sole power to appoint the Comptroller and Auditor General of India. Since the CAG audits the Union government’s account, there is a clear case of conflict of interest in the appointment process.

- No defined qualification: Further, there is no defined qualification for the office of the CAG; it allows the office to be dominated by the IAS officers.

- Post-Mortem Analysis: The Constitution visualises the CAG to be the Comptroller and Auditor General. However, the CAG has no control over the appropriation of money from the public exchequer. It only performs auditing functions once the expenditure is done. On the other hand, in the UK, no money can be withdrawn from the public exchequer without the CAG’s approval.

- Limitation on Auditing secret service expenditure: The CAG cannot ask for particulars of expenditure incurred by certain executive agencies.

- Accusations of Exaggerated Estimates: The office of the CAG has been subject to criticism related to exaggerated estimates of losses or notional losses, particularly in the 2G spectrum case and coalmines allocation case.

- No legal power to enforce actions: The CAG cannot enforce action on its findings or enforce recovery of loss of public exchequer.

- No legal status to Accountant Generals in states: The Accountant Generals in states under the CAG does not have any legal status despite the importance of its position.

- Absence of direct access to Parliament (unlike the Attorney General) in defence of his/ her official conduct, if and when questioned on the floors of Parliament.

Challenges as mentioned in the Second Administrative Reform Committee Report (14th report)

While the auditing exercise by the CAG has contributed a great deal to the financial management of the country, the effectiveness of the audit can be further enhanced. Below are some of the factors and perceptions that impede the effectiveness of the audit conducted by the CAG:

Issues affecting audit effectiveness:

- Inadequate examination of audit paras by PAC; generally, only 15-20 paras are discussed by the PAC as opposed to nearly 1000-1500 audit paras provided in the CAG reports.

- Huge delays in examination of audit paras (observation) by state PACs in state legislatures.

- There is no accountability for taking timely action on audit observations; thousands of such inspection reports lie unattended in Union and state departments.

- There is perceived untimeliness of CAG reports due to the time gap between the occurrence of irregularity and its reporting by audit.

- Difference in reality: The audit reports are based on documents and files; however, many times, ground reality is different from what is reflected on the paper.

- Do not recognise practical constraints: Often, audit reports are unduly harsh and negative and do not consider practical constraints on the ground. It can dissuade the officials from taking new initiatives and actions. Further, they do not give credit for good performance.

- Often, reports are not presented in a constructive manner: Often, they do not delve into the cause of the problem and how to address it. The audit must, therefore, identify systemic problems.

- Non-harmonious relationship between auditor and auditee: Auditing is seen as a policing function rather than a valuable aid to management.

- Lack of informed media coverage at the union and state level.

- Inadequate coordination between internal and external (CAG) audits.

- There is rarely any audit of grants and loans to NGOs.

Way Forward

- Reform in the appointment process: To bring transparency and objectivity to the appointment process, an institutional mechanism should be put in place in which view of the legislature (for example- Leader of Opposition and PAC) can also be included.

Further, qualification criteria should also be defined, including a sound understanding of governance and required experience in the field of financial management and audit and accounting procedures.

- Reform regarding CAG-PAC relationship: The Public Accounts Committee (PAC) and Committee on Public Undertakings can be promoted to constitutional status with defined duties and functions to enable them to properly examine CAG audit reports.

- Audit of CAG: External audit of the CAG can be conducted as practised in the UK to ensure professional soundness and efficiency of the supreme audit institution.

- Pre-audit of High-value projects: To avoid Rafael jet-like controversy, the high-value projects, especially defence projects, can be pre-audited by the CAG before the conclusion of the deal.

- Legal power of enforcement: In several countries like France, New Zealand and Japan, the supreme audit institutions have been given wide powers of investigation and enforcement of recovery of public money.

| Amendment Proposed by CAG Office in the Comptroller and Auditor General’s (Duties, Powers and Conditions of Service) Act 1971. |

| • Provisions should be added to ensure that the government departments reply to the audit enquiries within 30 days; currently, there is no fixed time limit. • The act should mention the period within which the audit reports should be tabled in the concerned legislature. • CAG’s legal mandate should keep up with the changes in the manner in which public money is spent. For example- the 73rd and 74th Constitutional Amendment and liberalisation in the economy (Public-private partnership) has altered expenditure management. |

As the second ARC report has pointed out, the CAG has contributed a great deal to the financial management of the country. However, there still remains ample room for improving the effectiveness of the CAG’s auditing process.

It is imperative for the government to pay attention to the gaps and lacunae identified by the Second ARC. Further, due consideration should be given to the reform proposals put forth by the CAG office itself in order to raise the standards of public finance management of the country even further, ensuring a more robust and transparent financial governance system.