Legislative Procedures in the Parliament

Parliament being the supreme legislative body in the country, its primary function is law-making. All legislative proposals in Parliament are brought in the form of bills.

A Bill is a draft statute and cannot become act or law unless it has received the approval of both the Houses and the assent of the President. The process of law-making begins with the introduction of a Bill in either House of Parliament. All stages of legislative processes are the same in both Houses.

A Bill can be introduced either by a Minister or a private member. If a bill is introduced by a minister, it is called a Government Bill, and if it is introduced by a private member, it is known as a Private Member’s Bill.

| Private Bill | Government Bill | |

| Definition | It is introduced by a private member (a member who is not a minister) | Can be introduced only by a minister. |

| Point of View | It usually reflects the stand of opposition parties. | It reflects the legislative agenda of the government. |

| Notice of Intention | Its introduction requires 1-month notice. | “Rules of Procedure” mentions no such requirement. |

| Drafted by | The member who is introducing the bill is responsible for its drafting. | It is drafted by the concerned ministry in consultation with the law department. |

| Significance | Its rejection by the House has no bearing on the confidence in the government. | Its rejection by the House may have implications on the House’s confidence in the ministry. |

Types of bills

The bills introduced in the Parliament can be categorised into four types. The Constitution and the Rules of Procedure have laid down separate procedures for all types of bills.

- Ordinary bills: These can be related to any matters except financial subjects;

- Money bill: These bills are concerned with subjects mentioned in Article 110 of the Constitution, such as taxation, expenditure, etc.

- Financial bills: These are also related to financial subjects, but they are not restricted to subjects mentioned in Article 110.

- Constitution amendment bills: Such types of bills seek to amend, add or remove provisions of the Constitution. We have already read about them in the chapter “Amendment of the Constitution”.

Procedure for Ordinary Bills

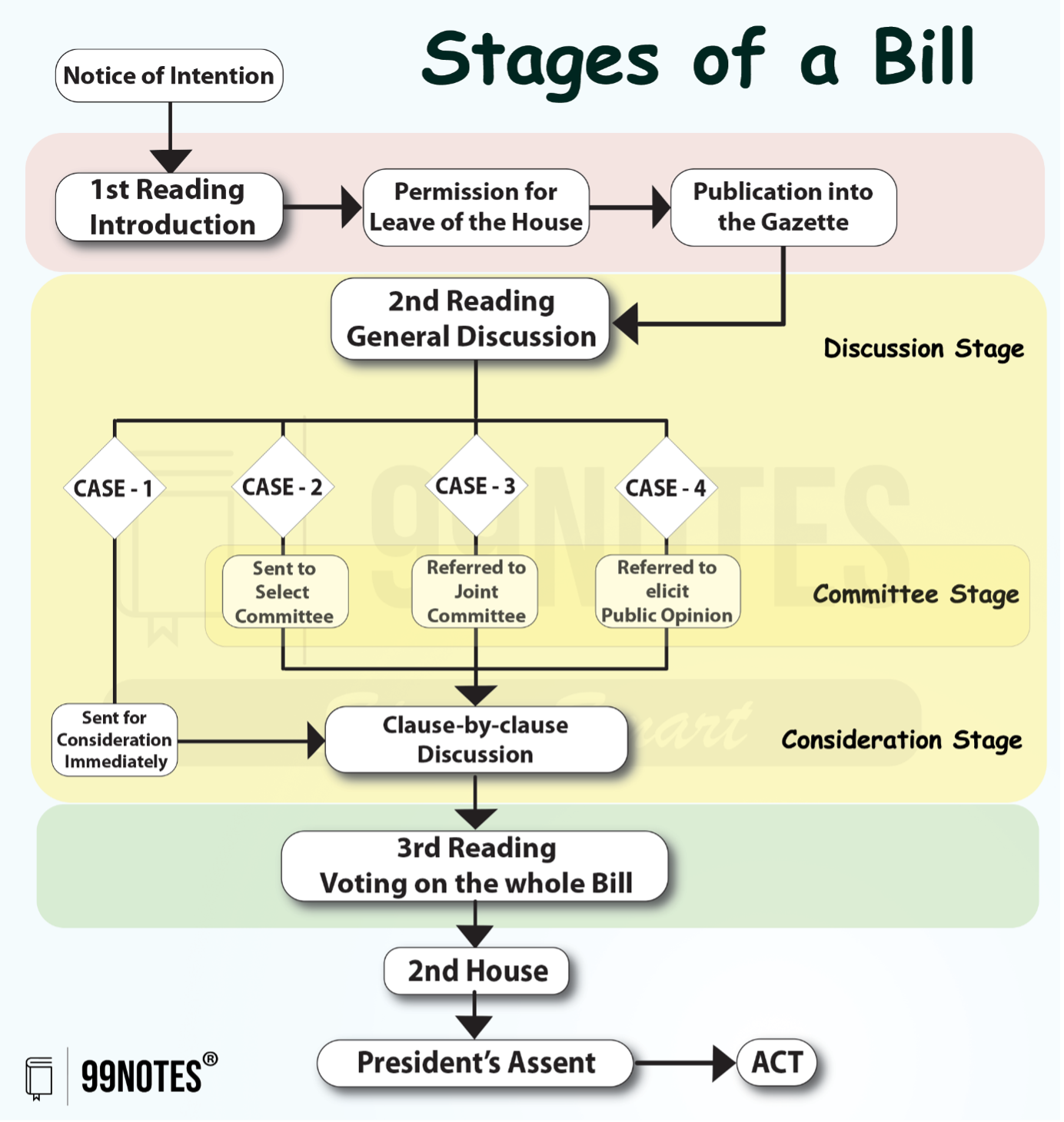

A bill has to pass through various stages before it becomes an act. These stages are:

1. First Reading

The legislation starts with the introduction of the bill in either the House of the Parliament.

- Introduction: It can be introduced by either a minister or a private member.

- Leave of the House: Before introducing a bill, a member has to submit a notice of intention asking for the leave of the House. If the leave is granted, the bill stands introduced.

- At this stage, the presiding officer may allow for a brief introductory remark regarding the bill by the member in charge and the member who opposes the motion.

- At this stage, no discussion over the bill takes place.

- However, if the motion to oppose the introduction of the bill is based on the ground that the subject in the bill is beyond the legislative competence of the House, then the Speaker may allow a full discussion.

- Publication in the Official Gazette: After the bill is introduced, it is published in the Official Gazette.

- The bill can be published in the official Gazette even before its introduction in the House if the Presiding officer permits. In such a case, the leave of the House to introduce the bill is not necessary.

- Reference to Standing Committee: At this stage, the presiding officer may refer the bill to a departmentally related standing committee for further examination.

2. Second Reading

- General discussion: At this stage, the general discussion on the bill takes place in which the principles of the bill are discussed. After general discussion, the House may take any of the following actions:

- May consider the bill immediately or on a fixed date;

- Or refer the bill to a select committee;

- Or a joint committee of both houses;

- Or circulate in the public to elicit popular opinion.

- Committee stage: The committee undertakes a thorough examination of the bill clause by clause. It may also suggest amendments but without affecting the underlying principles of the bill. After examining, the bill is sent back to the House.

- Consideration stage: At this stage, the House considers the bill clause by clause and every clause is voted upon. The members may propose amendments to the bill, which, if accepted, becomes part of the bill.

3. Third Reading

At this stage, the bill is finally moved to be passed. This stage does not involve any discussion or amendments. If the majority of the members present and voting approve it, it is considered passed.

After authentication by the presiding officer, the bill is referred to the second House.

4. Bill in the Second House

In the second House, the bill goes through the same process except the introduction stage. When the bill is referred to the second House, it has the following alternatives:

- It may pass the bill without amendments;

- It may pass the bill with amendments and send back the bill for reconsideration;

- It may reject the bill by not passing it;

- It may keep the bill pending by not taking action.

In case of a deadlock, the President may summon a joint sitting of both the Houses. If the majority of members of both Houses present and voting approve the bill it is considered passed.

5. Assent of the President

Every passed bill is presented to the President for his/her assent. The President has the following alternatives:

- S/he may grant the assent;

- S/he may withhold the assent (Absolute Veto).

- S/he may send the bill for reconsideration of the House (Suspensive Veto).

- S/he may take no action (Pocket Veto).

If the President grants the assent, the bill becomes an act, and it is placed in the statute books.

Financial Bills

Such bills deal with financial matters such as appropriation and expenditure of funds. The Constitution has categorised financial bills into 3 types:

- Money bill [Article 110]

- Financial Bill (I) [Article 117 (1)]

- Financial Bill (II) [Article 117 (3)]

1. Money Bill

Article 110 of the Constitution defines a Money bill. According to it, a bill that contains any or all of the following matters only:

- The imposition, abolition, alteration, remission or regulation of any tax;

- The regulation of the borrowing of funds or giving of any guarantee by the government of India or amendment of any law regarding the financial obligation of the government of India;

- Custody of, and payment and withdrawal from, the Consolidated fund of India or the Contingency fund of India;

- Appropriation of funds out of the consolidated fund of India;

- The receipt of funds on account of the Consolidated Fund of India or the public account of India or the custody or issue of such funds or the audit of the accounts of the Union or of a State;

- Declaring of any expenditure charged on the consolidated fund of India or increasing the amount of any such expenditure.

- Any matter incidental to any of the matters specified above.

Legislative Procedure for a Money Bill:

- Certification of Money Bill: It is the Speaker who certifies if a bill is a money bill or not, and his/her decision is final.

-

- S/he also authenticates the bill when it is sent to the Rajya Sabha and when it is presented before the President.

- Their decision cannot be questioned in the Parliament, in a Court of law or even by the President. However, the certification of the Aadhar Act 2016 as a money bill was challenged (as judicial review is a basic feature of the Constitution).

- Introduction of the bill: A money bill can only be introduced with the prior recommendation of the President. Further, a money bill can be introduced only in the Lok Sabha. Such bills are government bills; hence, they can only be introduced by a minister.

- After the bill is passed in the Lok Sabha, it is transferred to the Rajya Sabha for consideration, which has restricted power with regard to money bills.

- It cannot reject or amend the money.

- It has to send back the bill within 14 days, with or without recommendation. If the bill is not sent back within the stipulated time, it is deemed to have been passed in its original form.

- The Lok Sabha can either reject or amend the bill.

- President’s Assent: When the bill is sent to the President for his assent, s/he can either give his/her assent or withhold assent but cannot return the bill for reconsideration. Usually, the President gives assent as the bill is introduced with his/her consideration.

Notes

| Ordinary Bill | Money Bill | |

| Introduction | Can be either in the Lok Sabha or the Rajya Sabha | Can be introduced only in the Lok Sabha but not Rajya Sabha. |

| Can be introduced either by a minister or by a private member. | It can be introduced only by a minister. | |

| Recommendation of President | Can be introduced without the prior recommendation of the President. | Prior recommendation of the President is required before introduction. |

| Power of Rajya Sabha | It can be amended or rejected by the Rajya Sabha. | Rajya Sabha can neither amend nor reject it. It should return the bill with or without recommendations, which may or may not be accepted by the Lok Sabha. |

| Maximum holding period of Rajya Sabha | Maximum period of six months. | Has to return it within 14 days. |

| Certification by the Speaker | It does not require any certification by the Speaker. | It needs the certification of the Speaker when transmitted to the Rajya Sabha (if it has originated in the Lok Sabha). |

| Case of Deadlock | If there is a disagreement between the two houses, a joint sitting of both houses can be summoned by the President to resolve the deadlock. | There is no provision for a joint sitting of both houses in this regard. |

| President’s assent | It is sent for the President’s assent only after being approved by both houses. | It is sent for the President’s assent even if it is approved by only Lok Sabha. |

| Presidential Veto | It can be rejected, approved, or returned for reconsideration by the President. | It can be rejected or approved but cannot be returned for reconsideration by the President. |

2. Financial Bill (I)

Financial Bills (I) are bills that contain provisions of Article 110 along with other matters of ordinary legislation.

- Introduction of Finance Bill (I): Like the Money bill, the finance bill also cannot be introduced in Rajya Sabha, and its introduction requires the prior recommendation of the President.

- Except for the introduction, all other provisions are similar to those of an ordinary bill. Hence, it can be rejected or amended by the Rajya Sabha. The only exception is that any amendment except for abolition or reduction of tax cannot be moved in either of the Houses without the recommendation of the President.

- In case of disagreement, the President can convene a joint session of both the Houses to resolve the deadlock.

- After the passing of the bill, it is presented to the President for assent. S/he can either give assent, withhold the assent or return the bill for reconsideration.

3. Financial Bill (II)

Financial Bills (II) are those bills that contain provisions involving expenditure from the consolidated fund of India but do not contain any matter mentioned in Article 110.

- It is treated as an ordinary bill and goes through the same process as other ordinary bills.

- The *only special feature of this type of bill is that it cannot be passed in either of the Houses unless the President has recommended to that House the consideration of the bill.

| Introduction | Life | |

| Finance Bill (I) | Like Money Bill | Like Ordinary Bill |

| Finance Bill (II) | Like *Ordinary Bill | Like Ordinary Bill |

Joint Sitting of the two Houses

It is a parliamentary mechanism provided in the Constitution to resolve a deadlock between the Lok Sabha and Rajya Sabha over the passage of a bill. This provision in the Constitution has been borrowed from the Australian Constitution.

A deadlock over the passage of the bill happens in the following conditions:

- If the bill is passed in one House but is rejected by the other House;

- If the two houses disagree over amendments to the bill;

- If after being approved by one House and sent to the other, the bill is still pending in the other House for six months. [In the calculation of 6 months, no account will be taken of during which the House (in which the bill is pending) is adjourned or prorogued for more than four consecutive days].

In such cases of deadlock, the President can summon both Houses for a joint sitting for the purpose of deliberating and voting on the legislation.

- Applicability: This mechanism is not applicable in the case of Money Bill or Constitutional Amendment Bill.

- In case of Dissolution of LS: If the bill has already lapsed due to the dissolution of the Lok Sabha, then a joint sitting cannot take place. However, if the Lok Sabha is dissolved after the President has notified the convening of the joint sitting, the bill does not lapse, and joint sitting can be held.

- If the President has notified the joint sitting, the Houses cannot move further on the given bill.

- Procedure: The joint sitting of both Houses is governed by the Rules of Procedure of Lok Sabha, and the meeting is presided over by the Speaker of Lok Sabha; and in his/her absence deputy Speaker presides over. If s/he is also absent, then the deputy chairperson of Rajya Sabha presides over; in his/her absence, a person determined by the joint sitting presides over.

- Quorum of the sitting: At least 1/10th of the members of both Houses must be present in the meeting.

- Amendments: The Constitution provides that new amendments cannot be proposed except in a few conditions, such as:

-

- Those amendments that have caused final disagreements between the Houses;

- Those amendments have become necessary due to the delay in passing the bill.

- Passage of the Bill: if the majority of the members of both Houses present and voting approves the bill, it is considered passed by both Houses.

- Instances: The mechanism of joint sitting has been resorted to only three times since the commencement of the Constitution in the following cases:

-

- Dowry Prohibitions Bill, 1960

- Banking Service Commission (Repeal) Bill, 1977

- Prevention of Terrorism Bill, 2002