Issues associated with Urban Local Government

Urban governance and management have predominantly been the constitutional domain of state government.

These local institutions of urban government have become weak over the years due to many factors, including encroachment on traditional and legitimate municipal functions by creating parastatals and urban development authorities, a weak executive system, fragile fiscal health, and inadequate staffing and expertise in municipal management.

There are various limitations to urban local governance. It can be categorised in the issues in the function, functionaries and financial as follows:

Issues related to Functions:

Under the 74th Constitutional Amendment Act, states have incorporated provisions in their Municipal Acts for transferring additional functions to the municipal body, but it has several issues:

- Huge variation in powers: The extent of functions transferred differs from state to state and also varies from city to city in the same state.

- Not enough powers: The devolution of the function was not satisfactory, as only 18 subjects were given to local urban bodies. Still, states have not devolved all the functions, as states are reluctant to do this.

- Parallel Bodies: In some states, there is some ambiguity regarding the functional domain of Urban Local Bodies (ULBs) and parastatal bodies, making municipal governance further remote and inaccessible for the citizens. The multiplicity of agencies providing various services in the urban sector has led to overlapping, ambiguity, and resource wastage. Over and above that, the parastatal bodies are not elected Bodies and are not directly answerable to the citizens.

- District Collector: Many functions of the local bodies under the mayor in terms of planning come into conflict with the district collector.

- Transfer of functions in Central schemes: For example, Smart cities mission transfers the functions of planning and management to special purpose vehicles (a corporate entity jointly owned by the central and the state governments)

- Weak constitutional Mandate: The 74th Amendment leaves it to the discretion of state legislatures to devolve finances so that ULBs can fulfil their functions.

Issues related to funds:

There are various constraints on the capacity and resources of the municipal bodies. This is the major reason for this difference in their performance.

- High dependence on external resources: Funds were devolved to ULBs through transfer by the Central and State Governments in the form of grants. The fiscal transfers from the Government in the form of grants formed the major portion, i.e. 50.22% of the total revenue for the period 2015-20. Own and assigned revenue constituted 30.04 and 19.74% of total revenue, respectively, during the period 2015-20.

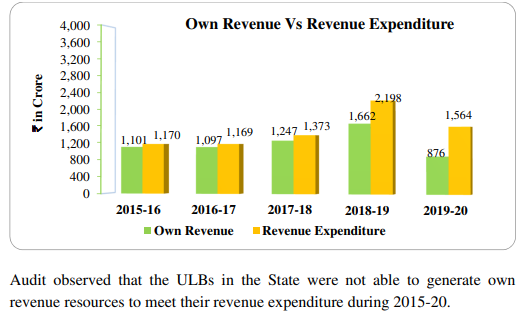

- Resource-expenditure gap: CAG observed that the ULBs in the State were not able to generate their own revenue resources to meet their revenue expenditure during 2015-20. It can be seen in the following chart

- Weak financial powers: There are glaring inter-state disparities in terms of the devolution of financial powers to the ULBs. Some states have not even allowed the municipalities to levy property taxes. There are issues in the levying of property taxes: the tax rate is not being levied periodically, and even the list of taxable properties is not updated periodically; thus, the property tax is not adequately levied.

- Abolition of Octroi: Before GST, the Octroi tax was one of the major sources of income for cities. Pimpri-Chinchwad and Pune are examples of two very high revenue-earning municipalities dependent on octroi. But this is taken away by the State and the central governments.

- Inadequate user charges: While the larger municipal corporations still have access to funds, the smaller municipal councils are financially weak. The provision to levy and collect adequate usercharges is not fully utilised.

- Weak constitutional Mandate: The 74th Amendment leaves it to the discretion of state legislatures to devolve finances so that ULBs can fulfil their functions.

- Delays in issue in grant: State government delays in issuing grants to the ULBs. The delay in the constitution of the SFC and acceptance of its recommendations has a bearing on the assured transfer of funds to ULBs.

- Tied funds: Local authorities have little freedom to use the scheme-related funds independently. Of the total grants recommended by the 15th Finance Commission for Non-Million Plus cities, 40% is a basic (untied) grant, and the remaining 60% is a tied grant.

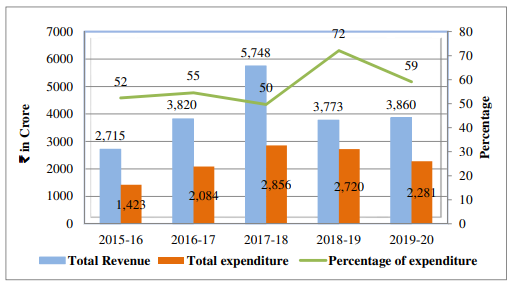

- The low extent of utilisation of Funds: A comparison of the total expenditure with total revenue for the period 2015-16 to 2019-20 showed that ULBs were able to utilise, on average, about 57% of the available funds each year.

Issues related to Functionaries:

There are following issues related to the Human resources working in the ULBs:

- Shortage of personnel: ULBs in India often need more skilled and qualified personnel, affecting their ability to carry out their duties and functions effectively. The root cause of the problem of inefficient service delivery is the capacity constraints of ULBs.

- Delays in Election: There have been delays in the election in the urban local bodies. A study from the data of 679 municipal corporation elections between 1994 and May 2023 shows that 58.8% of municipal corporation elections in India were found to be delayed.

- Lack of capacity and skills: Human resources in the urban local bodies do not have the institutional, operational, educational, and legal capability to develop commercially viable infrastructure projects, mobilise resources for the projects, and implement them. Inadequate training is one of the main impediments to introducing new technologies and management styles in the working of municipal corporations.

- Inability to pay the employees: There has been a shortage of funds and no payment of salaries in some urban local bodies.In such a situation, it is difficult for the towns to sustain their ability to perform their bare minimum functions, especially with the latest Pay Commission recommendations.

- Political interference: ULBs in India are often subject to political interference, affecting their independence and neutrality in decision-making.

- Corruption: Urban local bodies have faced corruption complaints or concerns about irregularities in various departments.

- Inadequate tenure of the Mayor: In some cities, the term of the mayor is for a year.

Other issues related to the Urban local bodies:

- Insufficient public participation: While there is little effort on the part of the municipal bodies to include people in the process, the problem is compounded by the fact that there is very little awareness among citizens of their role in the governance process.

- Issues in transparency and accountability: The main impediment towards achieving transparency and accountability is not the lack of understanding of the need for the same but the lack of means to achieve the same. As most ULBs are severely capacity-constrained both in terms of funds and manpower, it becomes hard to put in place systems that would enhance accountability in such a scenario.

Way forward:

The Planning Commission of India constituted a Working Group on Urban Governance to formulate the 12th Five-Year Plan. Some of the recommendations of the committee for strengthening urban governance are as follows:

Standardising the classification of ULBs:

The states should adopt standard norms for the classification of ULBs. It would be advisable that all the municipalities be reclassified into three categories, viz;

- Municipal Corporation for large urban areas of 5 lakhs and more population;

- Municipal Council for urban areas of 1 lakh to 5 lakh population;

- Nagar Panchayat is for towns below 1 lakh in population.

Strengthening Ward Committees:

- There is wide variation in the functioning of ward committees across the state. Although the legal provisions for the constitution of a Wards Committee have been made in most states, the actual spirit of the amendment is diffused.

- Hence, ward committees’ constitution and functioning need to be incentivised.

- Further, there is a need to establish area sabhas and to link area sabhas and ward committees to ensure that accountability and participatory processes become a reality.

Strengthening Metropolitan Planning Committees:

- MPCs have yet to evolve in accordance with the spirit of the constitutional amendment. Every state should form the MPCs. The central government needs to support the state government in this regard.

Improved financial management:

- Urban local bodies should be provided with adequate resources and financial support to deliver essential services to their citizens. This could include grants, loans, and other forms of financial assistance.

Convergence of functions of parastatals/state bodies with Local Bodies:

- Historically, due to poor staffing and technical capabilities of the Local Bodies, a number of Parastatal Bodies were created to provide services listed in the 12th Schedule. Thus, capacity building is needed for the urban local bodies.

- The multiplicity of agencies providing various services in the urban sector has led to overlapping, ambiguity, and resource wastage. There is a need for activity mapping for these bodies.

- Urban local bodies should be given greater autonomy and decision-making powers to effectively address their citizens’ needs. This can include powers related to planning, financing, and delivering services.

Empowerment of political office bearers:

- The Mayors or Chairpersons of the ULBs should be accountable to the people and have power and tenure commensurate with this objective.

- In addition, there is a critical need to build the capacity of the political executive, specifically in areas such as sensitisation vis-a-vis the need for reforms, service level benchmarks, etc.

Strengthening the Organisational Capacities:

- There is an urgent need for increased investment, financial management and audits in local bodies. Thus, the creation of a municipal cadre is essential.

- Urban local bodies should be supported in building the necessary skills and knowledge to manage their affairs effectively. This could include training in financial management, planning, and service delivery.

Regulatory mechanisms for delivery of basic urban services:

- An Independent Urban Service Regulator is needed as the current paradigm of service providers deciding service levels and tariffs is outdated. The regulator would monitor the provision of service and the tariff regime and ensure transparency and efficiency.

Improved infrastructure and services:

- Investments in public transportation, water and sanitation, infrastructure, and other essential services by providing ULBs with the resources and support can help address some of the challenges faced by citizens and make urban areas more livable and attractive.

Public-Private Partnership (PPP):

- PPPs, structured around a robust revenue model (including user charges, targeted subsidies, and viability gap funding) and offer a good prospect of return on investment, can contribute to systemic gains and better management of urban services.

- The State governments should bring out a legislative framework to address the entire gamut of issues in the implementation of PPP Projects and develop clear policies about the identification of projects that can be developed and implemented on a PPP basis, delivery processes, project development, approval and implementation process, guiding principles of contract management etc.

Accountability and Citizen Participation:

- A more interactive and participative framework (like open data initiatives or citizen engagement platforms) should be followed by ULBs to ensure greater accountability to the citizens.

- This can be achieved through citizen advisory boards, town hall meetings, and other mechanisms for public input.

- Citizen Report cards, like the one prepared by the Public Affairs Centre in Bengaluru, need to be replicated across all cities.

Use of E-Governance and Technology for better service delivery:

- With municipal administration becoming increasingly complex, the benefits of Information Technology (IT) adoption are becoming more and more visible across several municipalities.

- Database management can improve basic functions such as property tax management, birth and death registration etc.

- The IT and E-Governance tools should be strengthened and adopted in all the ULBs; for this, whatever skill upgrade is required should be done.

Enhanced collaboration:

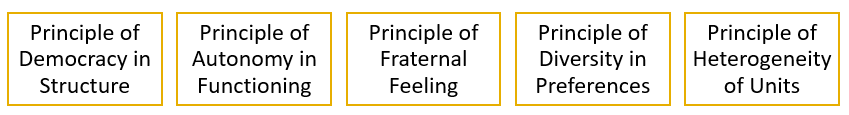

- Urban local bodies should work closely with other levels of government, as well as with civil society and the private sector, to effectively address the challenges facing their communities. The Principle of PANCHASHEELAS can be a unique solution in this regard.

Conclusion

Good Urban governance demands that Local Self-government be a vibrant entity with sufficient autonomy to respond to the resident’s needs and aspirations. However, reluctance to share power stifled their growth during the post-independence era.

The 74th CAA attempted to correct the situation, but the real power transfer has not occurred despite being passed more than three decades back. As urbanisation is increasing and cities are experiencing widening gaps in infrastructure and services, the government, especially the Central Government, has created conditions for the State governments to undertake reforms to strengthen the ULBs.

It is high time necessary steps are taken at the earliest, as cities are the engines of economic growth. Smart Cities Mission and Atal Mission for Rejuvenation and Urban Transformation (AMRUT) are important programmes of the government of India that emphasise the central role of the ULBs in planning for the vision of the cities, with particular emphasis on citizen participation.

![Centre State Relations- Legislative, Administrative, And Financial [Upsc Notes] | Updated February 21, 2026 Centre State Relations- Legislative, Administrative, And Financial [Upsc Notes]](https://99notes.in/wp-content/uploads/2023/10/central-state-relation-featured-768x500.webp)