Financial Inclusion

Financial inclusion has been defined as “the process of ensuring access to financial services, timely and adequate credit for vulnerable groups such as weaker sections and low-income groups at an affordable cost”. – Dr. Rangarajan (Chairman: committee on financial inclusion).

Elements of Financial Inclusion

Financial inclusion essentially means access to the Banking system. This includes the THREE elements:

- Opening Bank Account: Ensuring that every individual has access to a basic savings or checking account.

- Branch and ATM Access: Increasing the number of bank branches, ATMs, and micro ATMs in rural and remote areas.

- Digital Financial Services: Promoting mobile banking, online payment systems, and digital wallets to facilitate financial transactions.

- Financial Literacy: Educating individuals on managing money, budgeting, and making informed financial decisions.

- Affordable Financial Products: Providing low-cost, easy-to-understand financial services like savings, credit, insurance, and pension products.

- Credit Access: Offering loans and credit to underserved populations, including microloans and small business loans.

- Insurance and Pension Schemes: Enabling access to affordable health insurance, life insurance, and pension schemes.

- Access to Account Linked Government Schemes: Expanding the reach of government-backed direct benefit transfers (DBT) schemes such as PM KISAN, Ujjwala Yojana etc.

National Strategy for Financial Inclusion |

| RBI’s National Strategy for Financial Inclusion (NSFI) for the period 2019–2024 set forth the vision of expanding and sustaining the financial inclusion process at the national level through a broad convergence of action.

Key Recommendations include: 1. Universal Access to Financial Services: By March 2020.

2. Providing Basic Bouquet of Financial Services: It includes a Basic Savings Bank Deposit Account, credit, a micro life and non-life insurance product, a pension product and a suitable investment product.

3. Access to Livelihood and Skill Development: by March 2020.

4. Financial Literacy and Education

5. Customer Protection and Grievance Redressal: Customers shall be made aware of the recourses available for resolution of their grievances. 6. About storing and sharing of customer’s biometric and demographic data, adequate safeguards need to be ensured to protect the customer’s Right to Privacy. 7. Effective Co-ordination:

|

Benefits of Financial Inclusion

- Poverty Reduction and Promotion of Entrepreneurship: by providing people with the tools to save, access credit, and grow their income.

- Empowerment of Women: It encourages women’s participation in the economy empowering them to manage their accounts and make independent financial decisions.

- Improved Financial Stability: It builds a wider account base and diversification of credit in the banking system building resilience against economic shocks and emergencies.

- Social Protection: It improves access to government welfare programs, ensuring timely delivery of benefits such as subsidies, pensions, and direct cash transfers.

- Reduction in Inequality: Financial inclusion helps bridge the wealth gap by offering financial services to underserved populations, including rural and low-income communities.

- Better Financial Management: Access to banking and financial services helps individuals manage their money more effectively, reducing reliance on informal, often exploitative, lending sources.

- Digital Empowerment: Digital financial services open up access to banking for those in remote areas, overcoming geographical barriers and making financial systems more efficient.

- Sustainable Development: By offering credit for sustainable projects and investments, financial inclusion contributes to broader environmental and societal development goals.

Therefore, Inclusive financial systems stimulate economic growth by expanding access to credit for businesses, enabling investment and job creation.

Strategies to expand financial services in India

- Expanding the penetration of Banking institutions in underserved areas, by opening bank branches.

- Lead Bank Scheme: Each district is assigned to one bank which acts as a “pace setter” in providing integrated banking facilities.

- Rural Banking: Through Regional Rural Banks, Urban and Rural Cooperative Banks etc.

- Simplifying the account opening: Direct Schemes for opening Banking and Insurance Accounts. For example, the Jan Dhan Yojana (PMJDY), Jivan Bima Yojana (PMJJBY), and Suraksha Bima Yojana (PMSBY).

ATMs (Automatic Teller machines) in underserved areas |

||||||||||||

There are 3 Types of ATMS broadly:

White and Brown label ATMs enable us to expand the banking services in rural areas.

Note: Confederation of ATM Industry (CATMi): Group of Brown and White label ATM operators. |

Pradhan Mantri Jan Dhan Yojana (PMJDY)

Slogans: “Every tear from Every eye”, “Mera khata mera Vidhata”.

Pradhan Mantri Jan Dhan Yojana (PMJDY), is a financial inclusion program of GoI, that aims to expand and make affordable access to financial services such as bank accounts, remittances, credit, insurance and pensions. This campaign was launched by PM on 15 August 2014.

Benefits of PMJDY:

- Opening of no-frills accounts:The Bank account open under PMJDY does not require a minimum balance. An overdraft facility (-ve balance) up to ₹5000 is also available after six months. Interest is on deposit. Free RuPay debit card for account.

- Relaxation on know-your-customer (KYC) norms:A person don’t have a valid identification document can also open a bank account. This type of account called a “Small Account”, can regularised within one year.

- Engaging business correspondents (BCs):Account opening and bank translations are through business correspondents. Usually, business correspondents are appointed in remote rural areas where bank branches are not present.

- Use of technology:Bio-metric-based account opening and transactions must be available through business correspondent. This helps illiterate people also do banking.

- Direct Benefit Transfer:The government subsidies are directly transferred to the beneficiary. This reduces delay, and leakage to get service.

- Insurance:Accidental insurance cover of ₹00 lac. Provide life cover of ₹30,000/- payable on the death of the beneficiary.

2024 PMJDY Progress Report

PMJDY has been a huge success in terms of opening around 54 Crore no-frills accounts in India. Given India’s population, this number seems too low. However, it has been widely assumed that there are only a few families now with no bank account in India.

| Bank Type | Number of Rural/Semi-urban beneficiaries | Number of Urban Beneficiaries | No. of Rural-Urban Female Beneficiaries | Number of Total Beneficiaries | Deposits in Accounts (In Crore) | RuPay Debit Cards Issued |

| PSBs | 26.37 | 15.66 | 23.16 | 42.02 | ₹185,431.77 | 31.82 |

| RRBs | 8.63 | 1.45 | 5.86 | 10.08 | ₹46,018.38 | 3.65 |

| Private Banks | 0.74 | 0.93 | 0.90 | 1.66 | ₹7,012.78 | 1.38 |

| Rural Cooperative Banks | 0.19 | 0.00 | 0.10 | 0.19 | ₹0.01 | 0.00 |

| Grand Total | 35.92 | 18.03 | 30.03 | 53.95 | ₹238,462.94 | 36.85 |

*We will read about the Regional Rural Banks (RRBs) and Rural Cooperative Banks later in this chapter.

Limitation:

- Credit-to-Deposit Ratio is low: Our main aim of PMJDY is to reduce the dependence of the people on informal creditors. However, people still find it difficult to take loans from the formal sector. Therefore the PMJDY accounts are being used solely for saving, but it is not being used for the actual credit uptake.

- Over-reliance on PSBs for the implementation of the scheme can be a long-term challenge. The participation of the private banks is too low in PMJDY, which instead focuses on more profitable sectors of the economy.

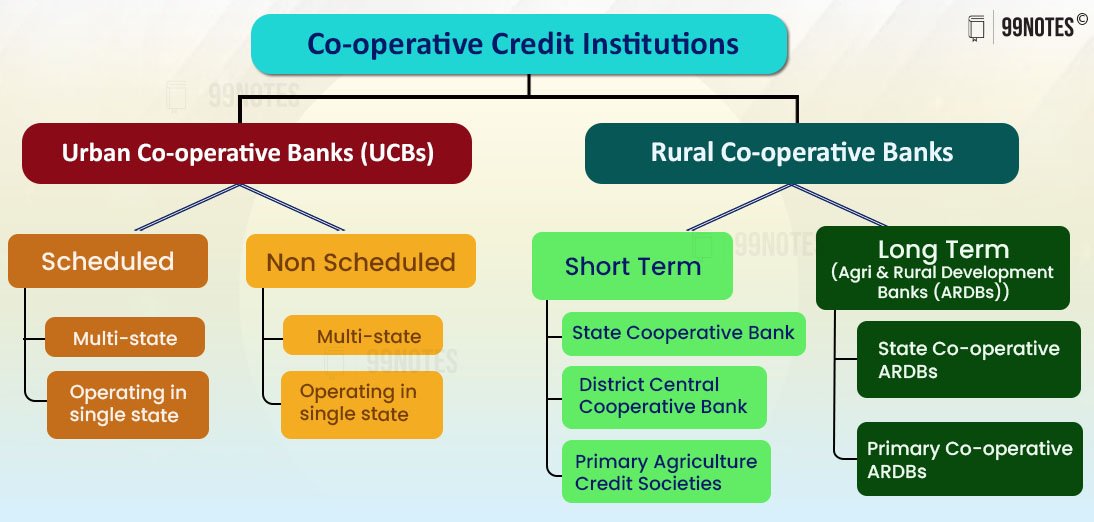

Cooperative banks

Urban Cooperative Banks (UCBs):

UCBs are not formally defined. However, it refers to primary cooperative banks located in urban and semi-urban areas.

- They function under the Cooperative Credit Societies Act, 1904

- These banks, till 1996, were allowed to lend money only for non-agricultural purposes. This distinction does not hold today. These banks were traditionally centred around communities, localities workplace groups.

- Currently, there are 1600+ UCBs

Problem with UCBs:

- Many banks failed: Punjab and Maharashtra Cooperative (PMC) Bank and Indian Cooperative Bank.

- Dual Control: RBI and Registrar of Cooperative Societies.

Reforms for Urban Co-operative Banks (UCBs)

- RBI has revised the Supervisory Action Framework (SAF) on UCBs due to the deterioration of its financial position. Under this, UCBs will face restrictions on worsening of 3 parameters:

- Net NPA exceeds 6% of net advances.

- CAR falls below 9%.

- Losses for two consecutive financial years or have accumulated losses on their balance sheets.

[Same for PCA Framework for Scheduled Commercial Banks]

- RBI has directed large UCBs (with assets of ₹500 crores and above) to report all exposures of ₹5 crores and above to the CRILC.

- Central Repository of Information on Large Credits (CRILC): It was set up by RBI in 2014-15 for early recognition of financial distress, enabling prompt action for resolution and fair recovery for lenders and as part of a framework for revitalizing distressed assets in the economy.

- All Scheduled Commercial banks, all Indian financial institutions and certain NBFCs report to CRILC having aggregate fund-based and non-fund-based exposure of Rs 5 Crore and above.

- In the event UCBs fail, deposits with them are covered by the Deposit Insurance and Credit Guarantee Corporation of India up to a sum of ₹5 lakh per depositor (raised from ₹1 Lakh in Union budget 2020-21), the same as for a commercial bank.

- Deposit covered: All bank deposits, such as savings, fixed, current and recurring.

- Bank covered: All banks operating in India including private sector, co-operative and even branches of foreign banks in India.

- Exemptions: deposits of foreign governments, deposits of central/state governments and inter-bank deposits.

- June 2020: Urban and multi-state cooperative banks brought under the supervision of the RBI by GoI.

- They have been brought under the RBI supervision process, which applies to scheduled banks.

- An Ordinance is approved to this effect.

- They are 1,540 in number and have a depositor base of 8.6 crore, who have saved ₹4.84 lakh crore. Thus, Depositors will get more security.

- RBI sets up panel for strengthening UCBs – It is an eight-member expert committee on UCBs to examine their issues and provide a roadmap for strengthening the sector.

- Headed by: former RBI Deputy Governor NS Vishwanathan, will take stock of regulatory measures taken by the central bank and other authorities in respect of UCBs and assess their impact over the last five years to identify key constraints and enablers, if any, in fulfilment of their socio-economic objective.

Rural cooperative banks (RCBs)

RCBs in India are primarily responsible for ensuring credit flow to the agriculture sector. There are about 1Lakh RCBs.

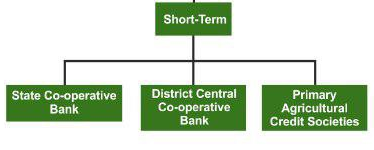

There are 3 types of RCBs for Short-term loans, i.e. for crop loans.

1 and 2: StCBs/DCCBs are registered under the provisions of the state’s State Cooperative Societies Act and are regulated by RBI.

- Under Section 35 (6) of the Banking Regulation Act, the NABARDhas been given authority to inspect State and Central Cooperative Banks.

- There are about 35 State cooperative banks (All except Lakshadweep, Ladakh and Dadar) and 350 DCCBs in India.

3: Primary Agricultural Credit societies (PACS) are not regulated by the RBI because they are not covered by the Banking Regulation Act of 1949.

- Around 94,000 such banks in India.

- It is the most basic unit and smallest cooperative credit institution in India and works at the Gram Panchayat level.

Problems of PACS

- Low coverage – In the Northeast and marginalized groups.

- Defaults of members in loan repayment and the inability of societies to raise resources,

- The inability of the members to provide the prescribed security

- Lack of up-to-date land records or inalienable rights to land or inability to produce sureties,

- Lack of awareness: Studies have shown that almost 90-92% of members of PACS in Uttar Pradesh have never seen copies of the bylaws of their own co-operatives.

- Lack of diversification of portfolio.

Central Funding:

- A new Central Sector Scheme of financing facility under the Agriculture Infrastructure Fund of Rs. 1 Lakh Crore. The scheme will support farmers, PACS, Agri-entrepreneurs, etc. in building community farming assets and post-harvest agriculture infrastructure.

NABARD has envisaged the transformation of 35,000 PACS in three years commencing with the transformation of 5,000 PACS in FY21 and for subsequent years 15,000 PACS each during FY22 and FY23. Rs.5000 crore have been earmarked under this special dispensation for the year 2020-21.