Money and Banking

- Money

- Demand for Money

- Speculative Motive:

- SUPPLY OF MONEY:

- Fiat Money (CU: coins and notes):

- Non-legal tender money:

- Money held by the bank;

- Legal Definitions of Money Supply:

- Money creation by the Banking system

- Reserve money consists of two things:

- High-powered money (or monetary base or H):

- Money multiplier:

- Fractional Reserve Banking

- FAQs related to Money and Banking

The basic assumption about all economic exchanges is that they are done with the objective of making a profit. An exchange takes place when we value the commodity that we hold (i.e. money) less than the commodity that we aim to purchase.

Therefore, understanding money and its flow is vital to understanding the economy.

Money

It is a medium for facilitating economic exchanges. It is an intermediate good which is acceptable to all parties. This makes economic exchanges very fast.

Functions of Money:

Modern-day money serves many purposes.

- Medium of exchange – It is acceptable to all parties for the purchase of goods.

- Unit of account – It acts as a convenient medium of account. The value of all other goods can be expressed in monetary units. It is the unit in which all debts are denominated.

- Standard of deferred payment – It is an acceptable way to settle debt. Even if the value of debt changes due to inflation or devaluation of the currency, it can be easily computed in terms of money

- Store of Value: Money can be reliably, stored and retrieved. Further, it is predictably usable as a medium of exchange when it is retrieved (even if its value is liable to depreciation).

Demand for Money

Demand for money balance is often referred to as liquidity preference. People desire to hold money balance broadly from two motives:

Transaction Motive

The principal motive to hold money is to carry out transactions. Now the question arises, how much money is required in the economy to carry out all transactions?

For this, we must understand that people generally earn money at discrete points in time, but spend it continuously throughout the interval. They hold money to carry out transactions later in the month. For example, if a person’s salary is ₹100 and he spends all by the end of the month. His holding decreases gradually from 100 to 0 throughout the month; It means his average holding is ₹50 in the month.

In general, the transaction demand for money in an economy (M), can be written as:

‘k’ is a positive fraction

T is transactions in the economy over a unit period;

Thus, the money required in an economy is less than the transaction needed to be done by a factor ‘k’.

Velocity of circulation of Money:

It is the number of times a unit of money changes hands during the unit period;

[ v = 1/k ]

The total value of annual transactions in an economy (including transactions in all intermediate goods and services) is clearly much greater than the nominal GDP.

- An increase in nominal GDP implies an increase in the total value of transactions and hence a greater transaction demand for money from the equation. (Why? Because incomes in the economy increase only when there are transactions – more number of transactions indicate a growing economy)

- ‘Y’ is real GDP and P is the general price level or GDP deflator.

- Transaction demand for money is positively related to the real income of an economy and also to its average price level.

Speculative Motive:

People (and Banks) hold money to invest in investment instruments in future.

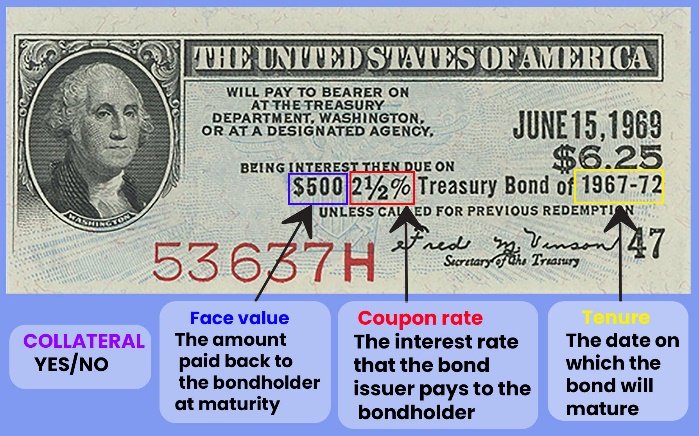

- Bonds: Papers bearing the promise of a future stream of monetary returns over a certain period of time. They can be issued by government or private firms for borrowing money from the public.

- Bond prices fall as interest rises (Quiz: by what logic?).

- But When interest rates are very high people expect a future fall in rates and thus bond prices rise (people convert their money into bonds).

[Note: We shall study bonds in greater depth in the “Government Borrowing” chapter]

When Money is converted to Bonds: This reduces speculative demand for money. Speculative demand for money is inversely related to the rate of interest.

Where,

r = market rate of interest;

rmax and rmin are the upper and lower limits of r, both positive constants.

As r decreases from rmax to rmin, the value of Msd increases from 0 to ∞.

When r = r min

- Liquidity Trap: If interest rates are low, people hold a lot of money and not bonds; then to inject money further rates are decreased by RBI; But people again hold money with the speculation that interest rates would rise in future.

When r = rmax (i.e. speculative demand for money is 0)

- The rate of interest is so high that everyone expects it to fall in future and hence is sure about a future capital gain. Thus, everyone has converted the speculative money balance into bonds.

SUPPLY OF MONEY:

Fiat Money (CU: coins and notes):

The Fiat money Has little or no intrinsic value. For example, in currency notes; There is no value of the paper of which the currency is actually made up of. However, it still carries some value, being a legal tender.

Legal tender money: It is the money that can’t be refused by any citizen of the country for settlement of any kind of transaction.

- Limited legal tender: can be refused for payment; No legal action would be taken. For example, Coins, which are issued by the Government of India, can be refused by the RBI as legal tenders.

- Unlimited legal tender: It Can’t be refused for payment, otherwise legal action would be taken. For example, Currency notes with the promise of RBI governor. It is recognized in India through the RBI Act, 1934: “Every bank note shall be legal tender at any place in India in payment for the amount expressed therein”.

RBI is the sole issuer of bank notes. Every note bears on its face a promise from the Governor of RBI of ‘pay the bearer’ that if someone produces the note (but not coins) to RBI, or any other commercial bank, RBI will be responsible for giving the person purchasing power equal to the value printed on the note.

Non-legal tender money:

These are the instruments of payment that are generally accepted, but the receiver is legally not bound to accept them. For example, cheques, bank drafts etc. are non-legal tender money. The receiver can refuse to accept payment in such forms.

Bills of exchange:

It is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay on demand or at a fixed or determinable future time a certain sum of money only to, or to the order of, a certain person or to the bearer of the instrument.

- The drawee is the party that pays the sum specified by the bill of exchange.

- The payee is the one who receives that sum.

- The drawer is the party that obliges the drawee to pay the payee. Generally, this party is the Bank that ensures the payment between the two parties.

The period between billing and payment is called the Usanse. If the period between billing and payment is longer, it might accrue interest.

Bill of Exchanges can take many other forms:

- Bank drafts: An instrument of payment whose payment is guaranteed by a bank. Thus, any Bill of Exchange issued by the Bank is known as the Bank Draft.

- Time Draft: If the funds are to be paid at a set date in future, it is known as the Time Draft. They are generally used by importers to pay the sellers for a short period of time after receiving the goods.

- Cheques: a written, dated, and signed instrument of payment that directs a bank to pay a specific sum of money to the bearer. The difference between a cheque and a bill of exchange is that a cheque is always issued by a bank, whereas a bill of exchange can be issued by non-banking authorities too.

- Voucher: the bond of the redeemable transaction type which is worth a certain monetary value and which may be spent only for specific reasons.

- Postal orders

Magnetic ink character recognition code (MICR) is generally put on all kinds of bank drafts, Cheques and Vouchers in order to ensure the authenticity of the bill.

Money held by the bank;

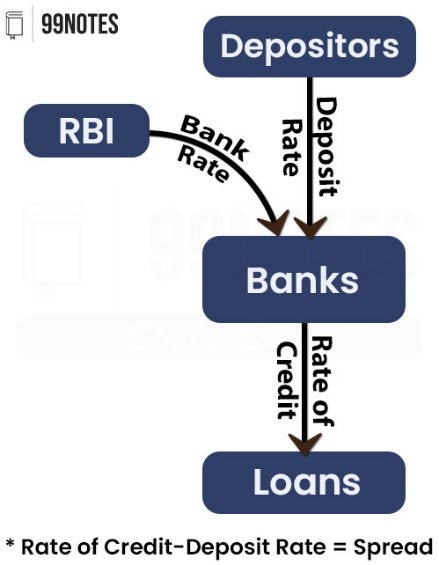

The amount that is held by the bank depends upon:

- Borrowing rate: Rate which ‘commercial’ banks offer to depositors. Deposits are broadly of two types:

- Demand deposits (DD): Money held by the public in commercial banks; payable to the account holder at demand. It is readily available and thus can be used to settle transactions. For example, Current and Saving accounts.

- Time deposits: Money held by the public in commercial banks with a fixed maturity period. For example, Fixed Deposits.

- Together they form Net Demand and time liabilities (NDTL).

- Lending rate: Rate at which banks lend to investors. Creditworthiness is judged by Collateral (security pledged for the repayment/current asset). Lending consists of:

-

- Cash Credit

- Demand

- Short-term loans to private investors and bank’s investment in government securities and other approved bonds.

Spread: There is a Difference between borrowing and lending rates; i.e. the profit that is appropriated by the banks. This is discussed in greater detail in the next chapter.

Legal Definitions of Money Supply:

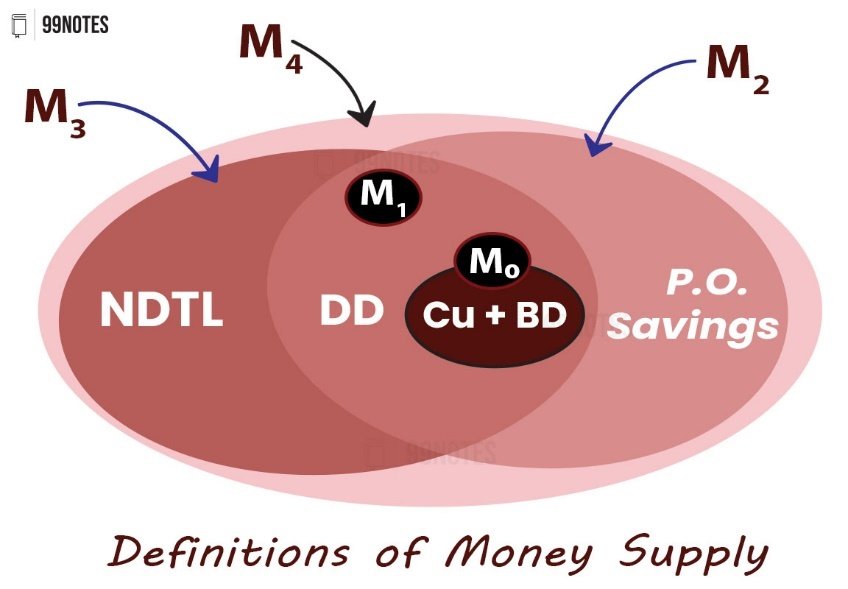

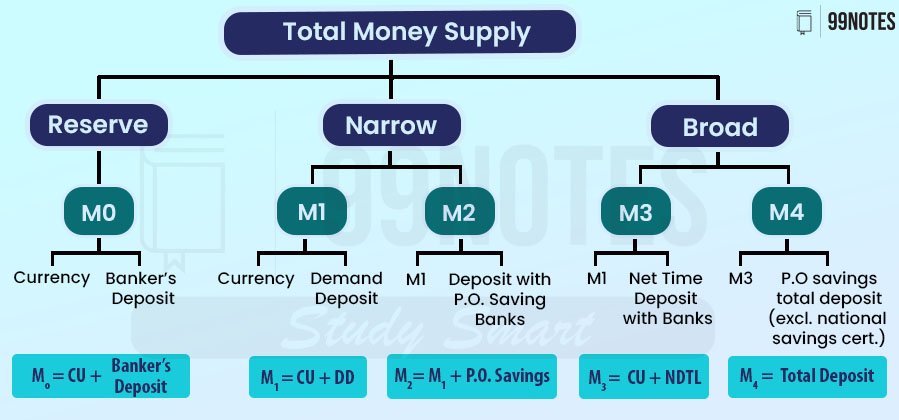

The total amount of money in circulation among the public at a particular point in time is classified into five categories: viz. M0, M1, M2, M3 and M4; The Reserve Bank of India defines these terms in India.

- Reserve Money(M0): It is the amount of money printed and circulated by RBI; It is defined by RBI as the money in circulation and the bankers’ deposit in the RBI (For example, Indian banks are mandated to store some cash as Cash reserve ratio(CRR) with RBI).

- M0 = CU + Bankers’ Deposit

- Narrow money: It is highly liquid, and readily serves as a Medium of exchange; it does not lose its nominal value – such as currency and transferable deposits.

- M1 = CU + DD (Currency + demand deposits): It is the most liquid and easiest for transactions,

- M2 = M1 + Saving deposits with Post Office savings banks

- Broad Money: More than just physical money. Apart from the narrow money, it also includes other financial instruments that can serve as a store of value and can be converted into cash without much difficulty.

- M3 = M1 + Net time deposits with commercial banks. (‘net’: deposits of public held by bank).

- In other words, M3 = CU + NDTL

- It is the most commonly used measure of money supply Aggregate monetary resources

- M4 = M3 + Total deposits with the Post Office savings organizations (excl. National Savings Certificates);

- the least liquid of all

- M3 = M1 + Net time deposits with commercial banks. (‘net’: deposits of public held by bank).

The interbank deposits, which commercial banks hold in other commercial banks, are not to be regarded as part of the money supply.

Money creation by the Banking system

The money supply would change if the value of any of its components such as CU, DD or Time deposits changed.

M1: The money supply changes with various actions of the monetary authority, RBI, and commercial banks; The preference of holding cash balances vis-a-vis deposits in banks also affects the money supply

Currency deposit Ratio (cdr): CU/DD

- cdr is a purely behavioural parameter: It is the money held by the public in currency to Bank deposits. It reflects the liquidity preference of the public. It depends on the season etc. too; For example, during the festive season or the sowing season cdr increases.

Cu + DD = 1

- If a person gets ₹1, she will put ₹ 1/(1 + cdr) in her bank account and keep ₹ cdr/(1 + cdr).

Reserve deposit ratio (rdr):

- Money (as part of deposits in banks) that banks hold as reserve money; [Rest money is given as loans]; Or R / DD (Reserve kept by bank/DD)

- rdr is the proportion of total deposits commercial banks, but always <1, as reserves can’t be more than deposits; Banks use this money to meet the demand for cash by account holders.

- Reserve money is regulated by RBI, which ensures that banks have a safe cushion of assets to draw when account holders need it.

Reserve money consists of two things:

- Vault Cash:

- Policy instrument: Statutory liquidity ratio SLR: fraction of total demand and time deposits that banks maintain with themselves in the form of specified liquid assets; Commercial banks have to hold only some specified part of the total deposits as reserves. This is called fractional reserve banking. For example, Government securities.

- Deposits of commercial banks with RBI:

- Policy instrument: Cash reserve ratio CRR: fraction of deposits that banks must keep with RBI. The CRR is the Reserve requirement. It is now 4% from an all-time high in 2004 of 15%.

SLR/CRR/Bank rate etc. can be varied to change rdr. Their actual functioning is explained in this book.

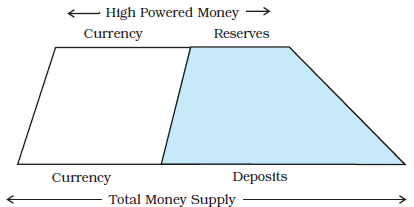

High-powered money (or monetary base or H):

It is the total liability of the monetary authority, i.e. the RBI; If someone (individual, commercial banks or Government) comes to RBI to redeem this cash, RBI has to pay the value back; this is the liability of RBI. It consists of:

- Currency (notes, coins, Vault cash) and

- Deposits held by GoI and commercial banks with RBI.

RBI acquires debt bonds or securities issued by the government and pays the government by issuing currency in return. It issues loans to commercial banks in a similar fashion. RBI buys government bonds or gold to push money into the market.

Some of the supplied money is kept in accounts and some is spent(behaviour is explained by cdr). The money in accounts is further injected as loans(after confirming to rdr behaviours of the bank);

Money supply (M) after each set of loans is increased but in a ‘convergent’ process.

- M = CU + DD = (1 + cdr)DD

Where cdr = CU / DD

- H = CU + R = cdr.DD + rdr.DD = (cdr + rdr) DD

Where R = reserve kept by banks.

Therefore, M is essentially nothing but M3, and H is essentially M0.

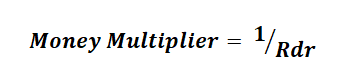

Money multiplier:

The ratio of Total Money Supply to high-powered money is known as the money multiplier. It is computed as the following.

It is always greater than 1; i.e. in any economy, the money is multiplied. Money Supply in the economy is greater than the amount of money actually infused by the central bank.

This happens because the currency deposit ratio (cdr) is always greater than 1.

Example of Money Multiplication

Suppose the RBI releases ₹100 in the Economy to the people.

Suppose it is a general behaviour of the public that 50% of this is deposited into their bank accounts and the rest 50% of it is kept as currency/cash (i.e. the currency-deposit ratio becomes 1). Therefore, ₹50 would be deposited into the banking system by the public and the rest ₹50 would remain as cash with people.

Further, whatever banks receive as deposits, suppose only 80% of it is advanced as credit by the banking system to the people, the rest is kept by the banks as reserves (as shown in the table below). Thus, our reserve-deposit ratio becomes 0.2. It means that ₹40 would be pushed by the banks in the economy as loans.

Here, we must realise that only ₹100 was released by the RBI in the economy but now, 40 more rupees are made available for expenditure to the public by the banking system.

| Additional Money Supply | Currency | Deposits | Money available for lending | |

| Round 1 | 100 | 50 | 50 | 40 |

| Round 2 | 40 | 20 | 20 | 16 |

| Round 3 | 16 | 8 | 8 | 6.4 |

| Round 4 | 6.4 | 3.2 | 3.2 | . |

| … | … | … | ||

| … | … | … | ||

| Total | 166.67 |

Isn’t it amazing, that after just one round of lending, we find ₹140 in total in the pockets of the people?

If the same behaviour of the banks is repeated for several rounds of lending, we will find about ₹167 in the pockets of the people. This additional ₹67 is the product of the money multiplier effect.

Money Multiplier formula

Taking cdr as 1 and rdr as 0.2 as taken in the above example, our money multiplier becomes:

Thus, if ₹100 is the money pushed into the economy (H), ₹167 is the total money supply (M).

Although the cdr cannot be changed as it is the natural behaviour of the public, Instruments of Monetary policy can be utilised to shape the rdr. We will study these instruments of monetary policy in the coming chapters.

Here, it is interesting to note that if the cash-to-deposit ratio is zero, i.e. people do not keep any significant amount as cash in hand, and instead keep everything in as a deposit in the bank, then the Money multiplier changes as follows.

Thus, in an economy where digital payments are the norm, the Money multiplier formula becomes:

This is the exact situation that the Indian economy is going through today. People are not keeping cash and instead using digital payment methods. Further, the reserve deposit ratio has consistently remained below 20%. Therefore, the money multiplier has remained above 5 for the last many years.

In recent years, the Money Multiplier (M/H) has remained in the range of 5.5-5.8, i.e. the money in the economy is 5.5 times more than actually issued by the RBI! [Economic Survey data]

Fractional Reserve Banking

It is a system in which banks in an economy keep only a fraction of deposits as reserves and lend out the rest. This creates the money multiplier effect as discussed above.

As a result, the total amount of deposits held by all commercial banks in the country is much larger than the total size of their reserves.

This obviously creates a risk for the economy. What if all the depositors come to withdraw their deposits at the same instance (a situation known as the bank run)? The banking system just has ₹100, the additional ₹67 is created only by the circulation of money in the banking system.

Thus, it is theoretically impossible to return all the money to the depositors. The system does not have enough money. Therefore, the failure of the banking system is the biggest threat to any economy. It’s the central bank’s job to ensure that the people’s trust in the banking system remains intact and such a failure never occurs.