Money and Credit

Terms of Credit:

Every credit in the market is governed by the “four terms of credit”, which are:

- Interest rate – The borrower has to pay a sum of money as interest along with the principal amount.

- Collateral – An asset that the borrower owns (land, building, vehicle, livestock, deposits with bank) and uses as a guarantee to the lender until the loan is paid

- Documentation – Proper documents of borrowing with all the terms and conditions must be submitted.

- Mode of repayment – The mode through which the borrower will repay the loan must be mentioned.

How do banks function?

Banks are financial institutions that act as intermediaries between savers and borrowers, facilitating the flow of money in the economy. Their primary functions include:

- Accepting Deposits: Banks provide a safe place for individuals and businesses to deposit their money, offering different types of accounts like savings, checking, and fixed deposits. In return, depositors may earn interest on their funds.

- Providing Loans: Banks lend money to individuals, businesses, and governments for various purposes. Banks charge interest on these loans, which is a key source of their revenue.

Spread is the difference between borrowing and lending rates. It is the profit that is appropriated by the banks.

Any bank which accepts deposits from the public and provides loans is known as the Commercial Bank.

Money creation by the Banking system

Through a process known as fractional reserve banking, banks only need to keep a fraction of deposits as reserves and can lend out the rest. This process increases the money supply in the economy, stimulating growth.

Allied services provided by banks

- Payment Services: Banks facilitate payments through checks, electronic transfers, debit/credit cards, and online banking, making it easy for customers to send and receive money.

Some banks which specialise only in the Payment systems are known as the Payment Banks. - Investment and Asset Management: Many banks offer investment products, such as mutual funds and wealth management services, helping customers grow their savings.

Growth of Banking in India

At the time of independence, India’s credit market was mainly composed of irregularised local money lenders. In 1951, 93% of outstanding debt came from such “non-institutional investors”, and less than 1% of rural credit came from commercial banks. The regularised banking system was virtually non-existent. This created several problems.

- Money lenders charged very high rates of interest, which could be as high as 200% in a year. This pushed the farmers and peasants into high levels of indebtedness.

- Private banks were small and regularly failed. A decade before the nationalization of banks in 1969, there was an average of more than 35 private bank failures every year.

- The deposit rate was very low as the public did not trust the formal banking system.

In all, the lending activity had a bad name in India.

India’s Banking Policy after 1969:

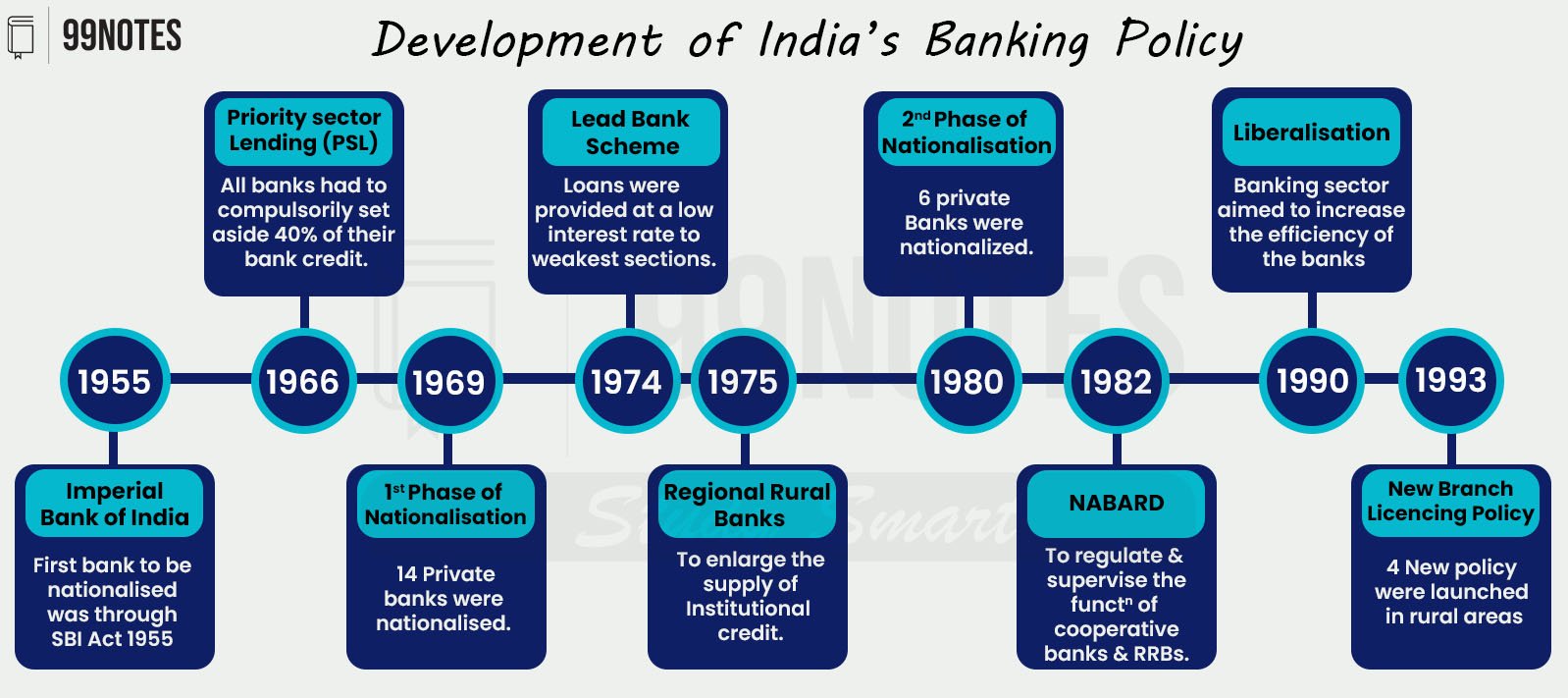

After such a poor performance, it was decided that Indian banks needed reforms; Thus, the newly elected Indira Gandhi Government introduced the following Banking Policy in 1969.

- New Branch Licensing Policy: For each new branch in the metropolitan area 4 new were opened in rural areas.

- Lead Bank Scheme, 1969: Each district was assigned to one bank where they acted as “pace settlers” in providing integrated banking facilities.

- Priority sector Lending (PSL): All banks had to compulsorily set aside 40% of their bank credit for the ‘priority’ sectors, which mainly included agriculture.

- Differential interest rate scheme, 1974: Loans were provided at a low interest rate to the weakest sections.

- Regional Rural Banks (RRB), 1975: to enlarge the supply of institutional credit.

- NABARD, 1982: to regulate and supervise the functions of corporative banks and RRBs.

Above all, it was decided that several private banks would be nationalised.

Nationalization of Banks:

In 1969, as per the basic tenets of the new banking Policy, the government started nationalising private banks, i.e. their ownership was transferred to the government through forced purchases. As a result, more than 80% of the banking sector was under government ownership by 1969, and more than 91% by the 1980s.

The Process of Nationalisation had 2 aspects:

- Opening of banks in every corner of the nation.

- Government takeover of the bank, which is unable to follow the New Banking Policy.

- The first bank to be nationalized was the Imperial Bank of India through the SBI Act of 1955. It started acting as the principal agent of RBI.

- In 1969, the First Phase of Nationalization started in which 14 private banks were nationalized.

- In 1980, in the second phase, 6 private Banks were nationalized.

Advantages of Nationalisation

This led to an impressive growth of financial intermediation.

- Growth in Deposits: The share of bank deposits to GDP rose from 13% in 1969 to 38% in 1991.

- Growth in Savings: The gross savings rate rose from 12.8% in 1969 to 21.7% in 1990.

- Growth in Advances: The share of advances to GDP rose from 10% in 1969 to 25% in 1991.

- Growth in Investments: The Gross Investment rate rose from 13.9% in 1969 to 24.1% in 1990.

- Above all, the government ownership of the banks created trust in the system. People now stopped imagining that banks could ever fail and instead started seeing bank deposits as a sure-shot means of preserving and growing their wealth.

This stabilised India’s banking system. However, it also created a host of new problems.

Problems of Nationalisation and Banking Policy of 1969:

- Lending in the Priority sectors still remained low, as the farmers and SMEs were afraid of taking loans from the banks due to strict collateral requirements.

- Lazy banking: The banks were not interested in lending to the entrepreneurial sectors. There was virtually no diversification in the banking sector.

- Interest rates still remained very high in comparison to the developed world.

- The government could not fulfil the need for money: There was a huge demand for money, which was still being fulfilled by the local money lenders.

- No competition remained in the banking market; Almost all of the banking system was owned by the government.

- A high degree of corruption in the disbursement of loans.

- The government started using the banking system to finance its own debts. The banks were forced to buy government bonds by propping up the SLR requirements. (SLR is discussed in the next chapter)

- Competition from foreign Banks and Non-Banking Financial Companies (NBFCs): The Government banks were gradually losing competition to foreign banks.

Thus, Nationalisation helped the Indian banking system to gain public trust. However, it was still unable to fulfil the financial needs of the country. A need was felt to allow Indian domestic private players to enter the banking market. In 1991, when India liberalised its economy, the banking sector too was freed from the shackles of the government. As a result, many reforms were introduced.

| Priority Sector Lending (PSL) |

| Various sectors in India do not get timely and adequate credit from the bank. Sectors like Agriculture and small industries are considered risky and have low repayment capability. However, these are the sectors that employ most Indians and are not growing due to a lack of capital. Thus, in 1966 RBI created a mechanism of mandatory lending by Indian banks for certain sectors.

Mandatory Lending: In the PSL system, banks are currently required to about 40% of their total advances/loans to these priority sectors. Within this 40% too banks have to allocate a certain percentage to certain sectors:

Applicability of PSL targets:

Penalties

Priority sector lending certificates (PSLC):

Is PSL Good for the Economy? There has been no consensus on how effective PSL has been in actually expanding credit growth in high-priority areas. However, there have been various concerns:

Thus, there has been a general consensus that PSL requirements should be gradually tapered down (as per the Economic survey of 2014-15). This can be done in two ways:

|

Banking in the Age of Liberalism:

In 1991 various reforms took place:

- RBI allowed banks to open and close branches at will.

- PSL guidelines were diluted, and SIDBI was formed in 1990; Now, PSL target shortfall funds are shared by both NABARD (for agricultural credit) and SIDBI (for small industries).

- Widening of Priority sector definition: Banks were allowed to lend to activities that were remotely connected with agriculture or agri-business, yet classified them as agricultural loans.

The problem of Liberalisation:

- More than 900 rural bank branches closed down across the country. The rate of agricultural credit growth fell sharply from around 7% per annum in the 1980s to about 2% per annum in the 1990s.

- By 2002 Institutional credit fell from 64% to 57.1%.

In this context, new measures were needed to be taken.

New Branch Authorization Policy (2005):

A Policy to double the flow of agricultural credit within 3 years was announced.

- Permission to set up new branches was given only if RBI was satisfied that the banks had a plan to adequately serve under-banked areas to ensure actual credit flow to agriculture.

- 25% of new branches were to be opened in rural areas.

As a result, more than 10,000 new branches opened in rural India. However, it largely served the agribusiness sector instead of farmers.

Banking in India Today

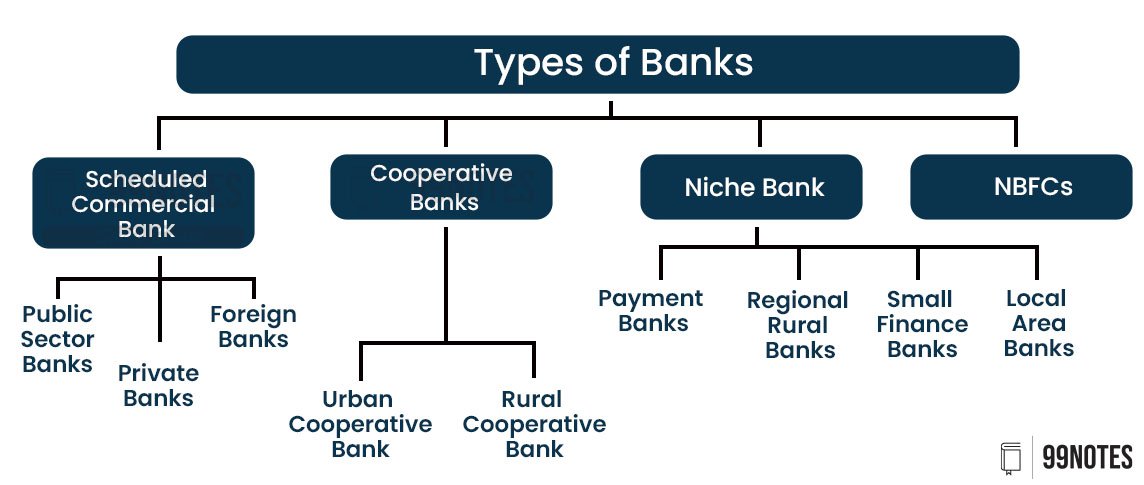

A Scheduled Commercial Bank (SCB) is a bank listed under the 2nd Schedule of the RBI Act, 1934. These banks must meet specific criteria set by the RBI, including minimum capital requirements. They are eligible for borrowing from the RBI and are regulated by it.

Public Sector Banks

Public Sector Banks

Most of the banking in India is done by the Public Sector Banks, i.e. those which are owned by the government. Currently, there are 12 Public sector banks in India. In fact, the State Bank of India is the largest in India both in terms of assets and number of branches.

They perform a very important task.

- The government runs schemes with their help: For example, between 2010 and 2016, it bore the key responsibility of opening a no-frills account for the unbanked. It opened 90% of such accounts.

- Provides stability: During the 2007 GFC when most markets in the developed world dominated by private banks collapsed, PSBs stayed put, as they had lesser risk in the urban market.

However, there are certain disadvantages to such banking:

- RBI regulation is not effective, as they are owned and regulated by the Government

- They are too small and too many, Thus unstable. In banks, the bigger, the better.

- Lack of Customer friendliness.

- Due to government Ownership. – No incentive to grow and Bad governance.

Therefore, every few years, the banking sector, especially the PSBs, faces the NPA and profitability problem.

Private Banks in India

In India, RBI ensures that there is a diversification of ownership of the banks to ensure that the control of the financial institutions of the country is not concentrated in a few hands. Therefore, the following guidelines have been put in place for private banks:

- At least 26% of the ownership of any bank should be placed in the hands of resident Indians.

- Not more than 74% of FDI is allowed in any private sector bank.

- No single entity or group of related entities should have a shareholding or control, directly or indirectly, in any Private sector bank above 10% of the paid-up capital.

- Any group or individual owning more than 5% shareholding in a bank would have to face additional regulatory guidelines.

Further, for those banks which have been only recently listed publically:

- Private players can hold any percentage in the bank for the first 5 years.

- Shareholding must be reduced to below 40% after 5 years, below 20% in 10 years, less than 15% in 15 years, and eventually to less than 10%.

There are 22 Private sector banks in India. HDFC Bank is the largest bank in India in terms of market capitalisation (valuation).

Other Banks

Any foreign bank is allowed in India only after it fulfills its regulatory compliance. RBI has allowed only 44 Foreign banks to operate in India till now.

We will study Cooperative banks, niche banks, and non-banking financial companies (NBFCs) in the later chapters.

Internal Working Group (IWG) of RBI to review Ownership guidelines |

The IWG of RBI aimed to review the extant ownership guidelines and corporate structure for private sector banks in India, eligibility criteria for individuals/ entities to apply for banking licenses; an examination of preferred corporate structure for banks and harmonisation of norms, and other shareholding related issues.

|