Payment Systems

India’s Payment system consists of several bank-to-bank transfers of payment technologies as well as payments through mobile banking systems. We shall study these systems in this chapter in detail.

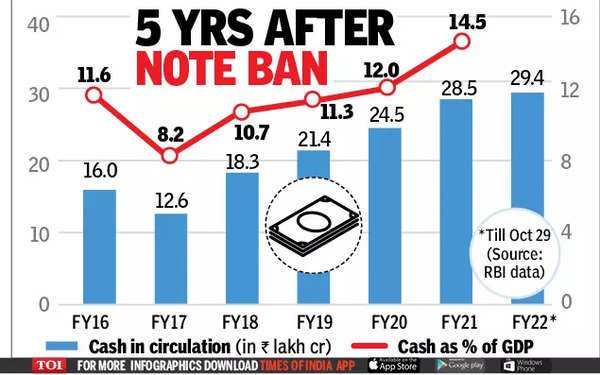

Payment in Cash

Banknotes and coins as a share of GDP in India currently in India is at an all-time high of 14.5%. It is comparable with:

- 20.04% in Japan, 15.67% in Hong Kong, 12.39% in Russia, 10.99% in Switzerland, 10.33% in Euro Zone

- Cash in China has grown fourfold in the last 15 years, yet corruption perception has decreased.

However, in several economies the share of digital transactions is high, making the cash-to-GDP ratio lower. 7.44% in the US, 5.6% in South Korea, 3.8% in Brazil, and 1.7% in Sweden.

Cashless Economy

A cashless economy refers to a monetary system in which the number of transactions in Cash is minimal, and instead, most transactions are digital. A cashless society conducts transactions with banks, buses, and street vendors through virtual payments.

Although a 100% cashless society is not possible, what we aim to achieve is a “less-cash Economy”.

Around 40% of all payments happen electronically in 2024, compared to less than 5% ten years ago. Processed over 16 billion transactions worth ₹23.49 Lakh Crores in October 2024.

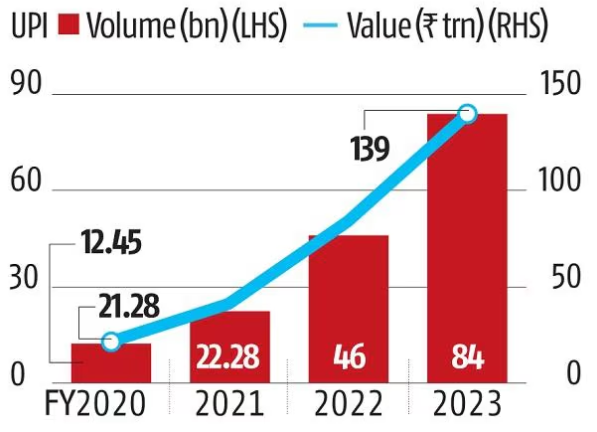

In India, two main methods of digital transaction have become popular over time, i.e. UPI and cards:

- Unified Payments Interface (UPI) transactions are easy and are growing exponentially each month. In 2023, the total number of transactions will be more than 80 billion and more than 140 Trillion rupees.

- The average number of cards an Indian has is 1; About 980 million Debit cards, 100 million Credit cards, and 370 million Prepaid cards in India. Most of the debit cards are used only to withdraw money. There are only 9 million PoS machines.

Advantages of a Cashless economy:

- Convenient mode of payment; Less time-consuming.

- Reduction in cost of printing money; In 2015, printing costs were ₹2,700Cr.

- Decrease in Crime rate and also Bank robberies.

- Good for the banking sector, as digital transactions are cheaper and enable more earnings.

- Transparency and monitoring are easy.

In fact, few economists see Cash as a deterrent to financial inclusion.

International Experience:

Sweden was the first country to promise to go 100% cashless by 2020. However, till now only 70% of the transactions take place digitally. This is still high. They could do this because of:

- 100% literacy.

- Its 85.5% population is Urban.

- Per capita income is 435% of the world average in Sweden but 14% in India.

South Korea: Highest penetration of cards. It gives preferential value-added tax treatment for consumers who pay through the card.

Kenya: Similar to India, has taken measures for online payment for government services. It had relied on mobile technology for this.

Digital Payment Infrastructure

India’s digital payment infrastructure consists of the following:

- The core banking system (CBS) which connects all the banks with their customers

- Standard payment methods such as NEFT, RTGS, IMPS etc. enable interbank transactions.

- UPI which gives every user a virtual payment address, enable instantaneous transactions.

In this chapter, we will study these systems in detail.

Core Banking System (CBS)

Core Banking System (CBS) is the banking solution that enables banks to provide centralized services to their customers from any of their branches. It revolutionized the banking sector in the 1990s by using technology for efficient transaction and customer information management.

- CBS offers real-time access to customer accounts and modern banking services.

- The Reserve Bank of India (RBI) mandates that all commercial banks implement CBS.

- Transactions are processed electronically, and customer data is stored in a centralized database accessible by all branches.

- CBS supports functions like account opening, deposits, withdrawals, fund transfers, and loan processing, and allows customers to access services from any branch location.

| Payment Organisations of India |

| There are only two Authorized organizations permitted to offer payment systems to RBI:

a) National Payment Corporation of India (NPCI): It is a not-for-profit organisation for all retail payment systems in the country and is promoted by RBI. It is an initiative of RBI + IBA (Banks Association) under the provisions of the Payment and Settlement Systems Act, 2007. b) Clearing Corporation of India Limited (CCIL): It was established in 2001 to ensure guaranteed clearing and settlement functions concerning transactions in G-Secs, money market and foreign exchange. |

Standard Bank Payment Methods

For the settlements of the inter-bank account-to-account transfers, several systems were introduced before 2014. These included:

NEFT

NEFT stands for National Electronic Fund Transfer. It was introduced in 2004. In this system, the settlements between banks are done several times a day to enable payments between two accounts belonging to two different banks.

- From Dec 2019, in a single day, 48 settlements run round the clock, except between 12 Midnight and 12:30. Max time taken 2 hours.

- Max limit: 10,00,000;

RTGS

RTGS stands for Real-time gross settlement. It was introduced in 2004 for the settlement of large fund transfers (>2L).

- The payments through RTGS can take place 24X7 (from Dec 2020).

- There is no Maximum limit for the amount transferred through this model.

Both NEFT and RTGS had the limitation that the payments were not instantaneous. To overcome this challenge, NPCI was set up as an independent organisation, which first launched the IMPS method.

IMPS

IMPS stands for Immediate payment service. It was launched in 2010 and is maintained by NPCI.

- However, the transaction charges are higher through IMPS.

- Transaction limit: 2L

Of these NEFT and RTGS are Maintained by RBI but IMPS is maintained by NPCI.

BBPS: Bharat Bill payment system:

It provides multiple payment modes and instant confirmation of payment. Policy guidelines for the BBPS system were issued by RBI in 2014. It operates as a tiered structure with:

- Single Bharat Bill Payment Central Unit (BBPCU): NPCI acts as the BBPCU. It will be an authorized entity under the Payment and Settlement Systems Act, 2007.

- Multiple Bharat Bill Payment Operating Units (BBPOUs): Banks and NBFCs presently engaged in any of the bill payment activities falling under the scope of BBPS and desirous of continuing the activity are mandatorily required to apply for approval/authorisation to RBI under the Payment and Settlement Systems (PSS) Act 2007. The entity should be a company incorporated in India and registered under the Companies Act 1956/Companies Act 2013.

- In case of any FDI in the applicant entity, necessary approval from the competent authority.

Legal Entity Identifier India Ltd. (LEIL)

LEIL is a subsidiary of CCIL.

- In India, entities obtain LEI from LEIL under the PSS Act, 2007.

- RBI has made LEI (a 20-digit Global reference number) mandatory.

- Globally it is maintained by the Global Legal Entity Identification Foundation, 2014: established by the Financial Stability Board.

- It publishes the Global LEI Index.

- It is conceived by G20.

All these systems are connected to the Core Banking Solution (CBS).

All the above systems, including the IMPS system, incurred additional charges, different banks had different systems of maintaining accounts, and the inter-bank settlements were a difficult task. To overcome this difficulty several new payment products were launched by the NPCI after 2014.

Mobile Banking:

Several mobile banking applications have been developed by major banks for their respective customers.

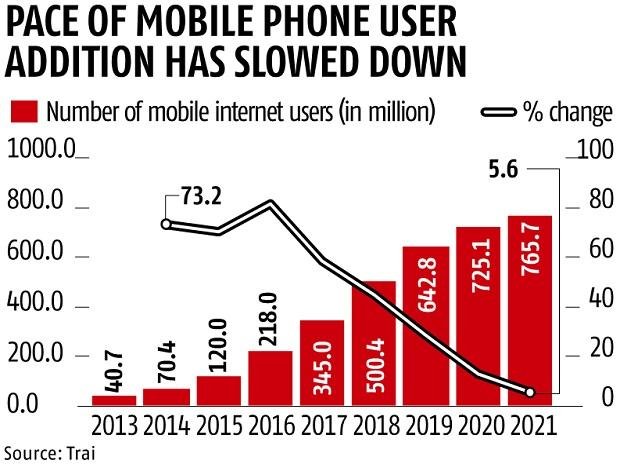

Mobile Penetration in India

There are approximately a billion people; Mobile penetration is still weak in rural India.

- 150 million people above the age of 15 are without cell phones (the digitally excluded); It is about 15% of the adult population.

- 350 million with regular “feature” phones,

- 650 million with smartphones: 70% of the adult population. Overall there are 780 million smartphones in India.

Internet Penetration in India:

- 52.4% of people use the internet in India.

- The global average is more than 60%.

- The internet penetration is deeper in other developing countries like Brazil (85%) and China (75%).

- Developed countries have nearly 100% coverage. For example, South Korea and Sweden (nearly 95%).

Mobile Wallets:

These are applications on a mobile device that act like a physical wallet i.e. store money digitally in the wallet account or the device. For example, SBI Buddy, GPay, Paytm etc.

Advantages of Mobile wallets:

- The liability of the consumer is limited to the amount kept in the wallet (just like physical wallets).

- Earlier Wender and the customer had to be using the same wallet for the transfer to happen. After the introduction of UPI, inter-wallet transfers are facilitated through the UPI Virtual payment address (VPA).

Limitations:

- These are Applications that require the Internet. Secure communication (2G, 3G or Wifi) is used to access and conduct transactions.

- A smartphone is necessary and the encryption level is similar to what we get when using the bank’s web portal.

Unified Payments Interface (UPI):

It is an immediate real-time payment system to instantly transfer funds between multiple bank accounts through a mobile platform. It is developed and maintained by NPCI.

It is a set of standard Application Programming Interface (APIs). It facilitates a ‘virtual address’ as a single payment identifier for sending and collecting money and works on single-click 2-factor authentication. This enables the NPCI to include all account holders across all banks of India into a single system.

Features of UPI 2.0:

- It links overdraft account.

- Pre-authorization of transaction.

- Payment invoices can be sent to the user’s inbox by the merchant.

- QR code Notification can also be sent.

- Transaction limit increased to ₹2 Lakh.

Successes of the UPI system:

- It is one of the most used digital payments platforms in the country with volume reaching ₹76 lakh crore in FY22, compared to ₹41LCr in FY21.

- Replacing cash: The transaction data analysis shows that 50% of transactions through UPI were below Rs 200.

UPI on USSD

A USSD-based *99# mobile application is developed for the basic banking needs by NPCI, to include such customers who do not have smartphones.

- It allows consumers to access their bank accounts using their bank accounts using the regular wireless telephony network(non-data) to communicate with their respective banks and perform transactions.

- They are multi-lingual, hence useful in the Indian context. TRAI is hard at work to make USSD as friendly as the UPI wallets, mainly by reducing the USSD payment gateway charges.

Problem with USSD payments: It is a bit cumbersome.

Similar USSD or SMS-based systems in other countries

- One of the major mobile payment systems globally was introduced by Vodafone’s Kenyan associate, Safaricom in 2007.

- M-PESA, which is Africa’s leading mobile money service, operates across the Democratic Republic of Congo, Egypt, Ghana, Kenya, Lesotho, Mozambique and Tanzania, with 51 million customers making over $314 billion in transactions per year through the service, according to Vodafone.

| USSD: Unstructured supplementary service data |

| USSD is a GSM-based technology i.e. used to send text between a mobile phone and an application program in the network. You can identify such payment systems with messages starting with * and ending with #. Example of USSD mobile code: *99#, *123# etc.

USSD messages create a real-time connection during a USSD session. So, they are more responsive than SMS services. It can be used even without any internet connection. |

‘UPI 123PAY’ –

- Launched by RBI in 2022 – a UPI for feature phones

- In India, there are roughly 1.18 billion mobile phone users, of which 780 million use smartphones, and the rest of almost 400 million use feature phones.

- Aims of NPCI and RBI: Enabling UPI for feature phone users will help NPCI realise its target of processing 1 billion transactions a day.

- It doesn’t need an internet connection for transactions. Customers have to link their bank account set or change UPI PINs with feature phones to use this facility.

- It will have almost all the features of UPI that are there on smartphones. It will fill in the gap and take the adoption of digital payments.

- It is a three-step method to initiate and execute services for users.

- It will allow a host of transactions based on four technology alternatives:

- Calling an IVR (interactive voice response) number,

- App functionality in feature phones,

- Missed call-based approach,

- Proximity sound-based payments.

- Feature phone users will now be able to perform various financial and non-financial transactions, such as peer-to-peer payments, utility bill payments, national electronic toll collection (NETC) FASTag recharge, mobile bills, direct-to-home, and mobile recharge, along with linking a bank account.

Bharat Interface for Money (BHIM)

The BHIM application has been developed by the NPCI to allow any customer of a UPI to conduct certain basic transactions such as sending/receiving money.

- It includes 47 banks that have registered with the NPCI to conduct immediate payments over the UPI network.

- It can be used on Smartphones as well as a feature phone.

- They don’t store any bank-related information on the phone, but connect directly to the consumer’s bank account;

DigiSaathi –

Launched by RBI

- A round-the-clock helpline set up by NPCI — that will assist callers with all their queries on digital payments via the website and chatbot facility.

- Its automated response system will help customers address their queries related to multiple products and services under the payment system umbrella, including cards, UPI, NEFT, RTGS, IMPS, AEPA, NETC, BBPS, USSD, prepaid payment instrument wallets, national automated clearing house (NACH), trade receivables discounting system, cheque truncation system, money transfer service scheme, mobile and internet banking.

Payment through Cards

RuPay Cards:

RuPay was launched in 2012 by the NPCI. It is an Indian version of a debit/credit card; similar to Visa and MasterCard. Its primary focus is Financial inclusion.

It was created to fulfil the RBI’s desire to have a domestic, open-loop, and multilateral system of payments in India. It is the 7th such Payment system in the world.

RuPay cards got a major boost through the Jan Dhan Yojana (PMJDY) as RuPay cards were issued to all Jan Dhan accounts. Despite the critics saying most accounts are dormant, RuPay cards are now widely used by Jan Dhan Card holders.

- Banks provide every account holder with a RuPay debit card with ₹1L accident insurance.

- RuPay works on three channels (ATMs, Point of Sale, and Online sales).

- Currently, it is acceptable in several countries such as Singapore, Bhutan, Maldives and several Gulf countries including UAE, Bahrain and Saudi Arabia.

- Several other countries like France, the UK, and Russia have signed agreements to enable it.

30 Crore Rupay Debit cards have been issued till now.

| EMV Payment systems |

| EMV stands for Europay, MasterCard, and Visa. These three companies originally created the EMV standard. The standard is now managed by EMVCo, a consortium with control split equally among Visa, MasterCard, JCB, American Express, China UnionPay, and Discover.

EMV cards are smart cards (also called chip cards or IC cards) that store their data on integrated circuits in addition to magnetic stripes (for backward compatibility).

|

Point of Sale Devices (PoS) Machines:

For payments at the merchant’s point. However, it is an expensive method of payment.

Merchant Discount Rate (MDR):

- 1 to 2.5% of the transaction amount charged to the customer.

- Imposed directly on the merchant by the bank, which is, in turn, passed on to all customers through increased Selling price of goods and services.

- Reason: Credit cost due to blocked account + service cost.

Government Initiatives:

- The government has exempted such devices from Central Excise duty and additional customs duty.

- Budget-2019-20: No MDR on specified digital mode of payments (on payment via RuPay and UPI). Cross-subsidy is provided by the government to the banks for credit loss.

Watal Committee on Roadmap for digital payments;

- MDR must be low enough to ensure that merchants adopt the payment methods;

- However, it must be high enough to cover the costs and incentivise issuers and acquirers to keep acquiring a greater number of merchants.

- Caps placed on MDR may ultimately hamper the growth of the payments industry.

Payment methods for Welfare Schemes

Direct benefit transfer of the benefits of the welfare schemes to the accounts of the beneficiaries has long been seen as the more transparent and leakproof way of executing such schemes. India has reached at a crucial junction in its digital history when we can reach every individual digitally without any bureaucratic hurdle.

99% of adults already are covered by any one of the three in the JAM trifecta i.e. Jan Dhan-Aadhaar-Mobile. We can use these methods to transfer any benefit to the population of India.

Aadhaar-Enabled Payments System (AEPS)

AEPS is a biometric payment system app using the Aadhar platform. This enables anyone with just an Aadhaar number and a bank account to make a merchant payment using his biometric identification.

- Payment can be made by a thumb impression after a bank account is linked with the Aadhar gateway. Therefore, Payment could be made without a phone.

- It is based on UPI to facilitate e-payments directly through banks.

- It has been integrated into BHIM and the necessary POS devices have been rolled out.

AEPS is aimed at covering those 350 million people who do not have phones.

Problems with AEPS

- Biometric Issues: Inaccurate or outdated fingerprints/iris data can cause authentication failures. This has created several exclusion errors. For example, a girl died of starvation in Jharkhand after an Aadhar-enabled authentication failure deprived the family of a PDS ration.

- Inadequate Infrastructure: Insufficient access to micro-ATMs or PoS devices in remote locations. Banks have limited coverage across regions.

- Technical Challenges: Poor internet or network connectivity in rural areas hampers transaction success. Similarly, Device malfunctions or software issues in micro-ATMs affect transaction processing.

- Privacy Concerns: Unauthorized access to Aadhaar data could lead to security risks or misuse.

e-RUPI

A cashless and contactless instrument for digital payment for welfare schemes. It is a QR code or SMS string-based e-voucher, which is delivered to the mobile of the beneficiaries.

- It allows users to redeem the voucher without a card, digital payments app or internet banking access, at the service provider.

- It has been developed by the NPCI on its UPI platform, in collaboration with the Department of Financial Services, the Ministry of Health and Family Welfare and the National Health Authority.

- NPCI has partnered with 11 banks for e-RUPI transactions: Axis Bank, Bank of Baroda, Canara Bank, HDFC, ICICI, Indian Bank, IndusInd Bank, Kotak Mahindra Bank, PNB, SBI and UBI.

- The acquiring Apps are Bharat Pe, BHIM Baroda Merchant Pay, Pine Labs, PNB Merchant Pay and YoNo SBI Merchant Pay.

- More banks and acquiring Apps are expected to join the e-RUPI initiative soon.

Mechanism of e-RUPI:

- Creating a voucher: It is pre-paid in nature, where the user issues a voucher in favour of someone and for a specific purpose. For example, the voucher can be to do a charity or donation. It cannot be used for any other purpose.

- Sending a voucher: This voucher can be QR code-based or SMS string-based e-voucher, thus assuring timely payment to the service provider without the involvement of any intermediary.

- Redeeming: The users of this seamless one-time payment mechanism will be able to redeem the voucher without a card, digital payments app or internet banking access, at the service provider.

Schemes to promote Digital Payments

Vittiya Saksharta Abhiyan

It is launched by the Ministry of Education (MHRD) to create awareness and encourage people to go digital.

- It also ‘appealed’ to private and government institutions of higher studies to receive and pay nothing in cash, and develop a cashless campus.

- Many people have enrolled on the webpage launched by the Ministry;

Other Recent Policy Changes

- Charges for payments via NEFT and RTGS removed. RBI has asked banks to pass on the benefits to customers.

- The merchant discount rate charges applicable on payment via RuPay and UPI have been removed.

- Also, all business companies with an annual turnover of ₹50 crore or more have been mandated to offer RuPay and UPI modes of payment to customers.

- Announcements in the budget speech of 2019-20: Business establishments with an annual turnover of more than Rs. 50 crore shall offer low-cost digital modes of payment such as BHIM UPI, UPI QR Code, Aadhaar Pay etc.

2020: NITI Aayog recently pointed out that the digital payments market in India is set to become a trillion-dollar industry in the next five years, led by growth in mobile payments which are slated to rise to $190 billion by 2023 from $10 billion in 2017- 18.

SWIFT system

SWIFT refers to the Society for Worldwide Interbank Financial Telecommunication. It is a secure financial message carrier between banks internationally.

- It is the biggest international transaction system in the world currently. It carries about 26 million financial messages each day. It was formed in 1973 by a group of 239 banks from 15 countries.

- Vulnerability: Full security requires that best practices are applied not only to SWIFT infrastructure within banks but the full end-to-end transaction ecosystem within their firms, including payments, securities trade and treasury.

- In the PNB case missing link between the bank’s CBS and SWIFT was the cause of failure.

- It has now been corrected; a separate unit to re-authorise most messages sent over SWIFT.

System for Transfer of Financial Messages (or SPFS)

- Russia has already built a new system for payment messaging as an alternative toCalled System for Transfer of Financial Messages (or SPFS), it is the Russian analogue to SWIFT developed by the Bank of Russia.

- Three times cheaper than SWIFT, the system has been in development since 2014, when the US government threatened to disconnect Russia from SWIFT.

Nirav Modi Scam:

PNB officials used the SWIFT system to verify the fraudulently issued Letters of Understanding (LoUs). Whenever a LoU is issued, it is entered into the Bank’s CBS (Core Banking Software). PNB uses Finacle Software which is developed by Infosys. PNB employees did not enter these LoU details in the CBS. So, these LoUs were fraudulent.

- Normally the bank undertakes transactions against LoUs issued by other banks through its overseas branches. The transaction amount is then credited to the LoU issuing bank’s Nostro account

| Letter of Understanding (LoU): |

| Bank Guarantee generated on behalf of importers for payments abroad. The issuing bank agrees to unconditionally repay the principal amount and interest thereupon. It remains valid for 3 months. |

- Affect on PNB: ₹5,473Cr was injected into PNB for recapitalization. Even if half the actual loss is recovered, its capital adequacy ratio will be back to the same level as before the recapitalization was announced.

- Solution:

- RBI has set a deadline of April 30 as an “outer limit” for all PSBs to integrate SWIFT with CBS.

- RBI has banned such instruments issued by banks to businesses for international transactions. However, It is estimated that overall, bank finance for imports into India is around $140bn, of which over 60% ($85bn) is funded through such buyers’ credit.

- RBI has asked for power over PSBs to be ‘Ownership neutral‘;

- Since PSBs are owned by the Government, is RBI does not feel free to act?

- The government regulates the PSBs in India.

- Better management and operational efficiencies,

- Privatization: Lowering of government shareholdings in the Banks.

- Consolidation of overseas branches by the government – without affecting the presence.

Technological overhaul: Such as block-chain (distributed digital ledger) and Big data analytics.

FAQs related to Payment Systems