Taxation in India

India’s tax-to-GDP ratio

The Tax-to-GDP ratio measures a country’s total tax revenue as a percentage of its Gross Domestic Product (GDP). It indicates tax collection efficiency, fiscal health, and the government’s ability to fund public services, infrastructure, and welfare programs without excessive borrowing.

India’s poor tax-to-GDP ratio

India’s Tax-to-GDP ratio has shown improvement in recent years, reaching 11.8% in 2024-25, up from 10% in the 2010s. However, this ratio remains lower compared to other major economies. For instance, the United States has a tax-to-GDP ratio of 25.2% as of 2023, while the OECD average stands at 33.9%.

Breaking down India’s tax composition, the Direct Tax-to-GDP ratio reached a 24-year high of 6.64% in the fiscal year 2023-24. The Indirect Tax-to-GDP ratio was 6.86% in 2023-24, indicating a slight increase from the previous year’s 6.72%.

Designing Fiscal Policy

How should we design the Taxation system? Let’s answer this question

Case 1: Is Tax Good?

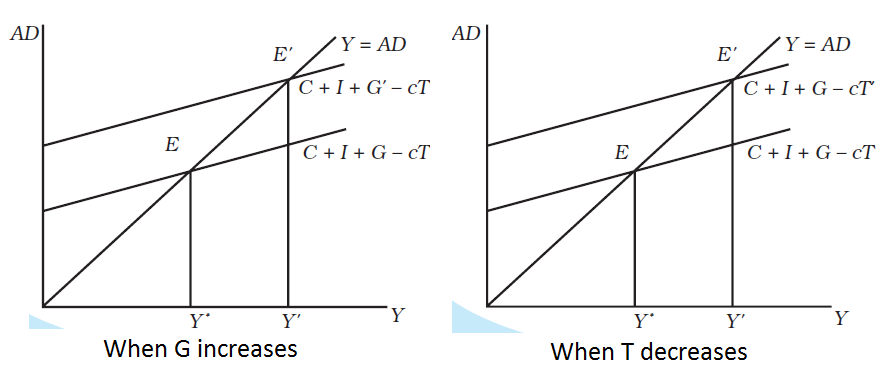

Say a Lump sum tax T is levied on personal income. How does this change the demand in the economy?

- Demand = autonomous consumption and consumption on disposable income.

AD = C + c(Y – T + TR) + I + G

- Here TR is transfer income, I is investment and G is government spending.

- If G induces an extra amount in consumption due to an increase in T. Both enter a multiplier process(in which both affect the next cycle of consumption till equilibrium is eventually reached).

- Net effect of G and T is : ΔY = ΔG + c (ΔY – ΔT);

- If ΔG = ΔT; The taxes were converted to government spending(there is no investment);

- Then ΔY / ΔG = 1;

- [Also ΔY / ΔT = 1]

The amount the government spends by increasing taxes is equal to the increase in the personal incomes of the people.

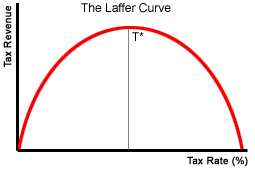

Thus, the government should raise as much tax as it can raise. However, we cannot increase the tax rate for this indiscriminately, as many would then stop paying taxes. We should instead try to levy an optimal tax rate for which the highest amount of tax is collected.

Case 2: How can we get Optimal Tax collection?

Laffer Curve associated with Tax revenue for different tax bases. For zero tax rate, no tax is collected. For a very high tax rate, tax evasion would increase and tax collection would fall to almost zero. The Most optimal rate of taxation is somewhere in between.

Laffer Curve associated with Tax revenue for different tax bases. For zero tax rate, no tax is collected. For a very high tax rate, tax evasion would increase and tax collection would fall to almost zero. The Most optimal rate of taxation is somewhere in between.

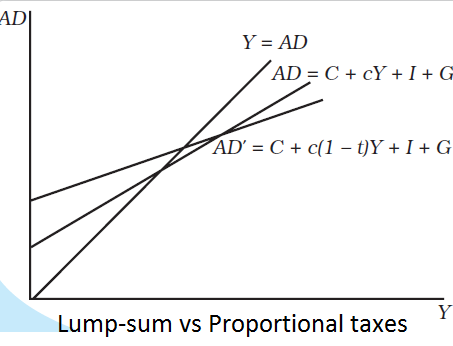

Case 3: Should the tax rate be the same for all?

Such a situation is known as the Proportional tax system.

Suppose the tax amount increases (T) as the income (Y) increases.

Therefore, T = tY; Where, the tax rate is ‘t’ throughout. For example, a 30% tax is levied on everyone.

How would this change the demand in the economy and therefore how the production would be affected?

The Demand AD would become:

AD = A + c(1 – t)Y

The intercept is flatter, i.e. demand decreases slowly, negatively impacting the economy.

Therefore, we need different tax rates for different slabs.

Case 4: Which tax is better indirect or direct?

The reliance on indirect taxes, which are considered regressive, places a greater burden on lower-income groups, as they pay the same tax rate regardless of income.

In contrast, progressive taxes, such as income tax, are linked to the taxpayer’s ability to pay, with the average tax rate increasing as taxable income rises.

Proportional taxes apply the same rate throughout, maintaining neutrality across income levels.

Taxation in India

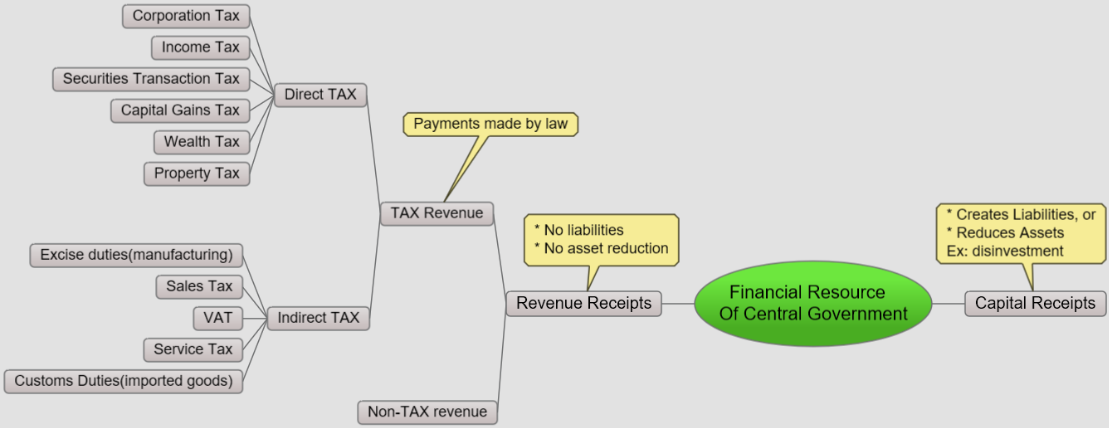

India’s tax system is broadly classified into Direct Taxes and Indirect Taxes, levied by the Central and State governments to generate revenue for governance and development.

- Direct Taxes (Levied on income & wealth)

- Income Tax – Paid by individuals and businesses based on earnings.

- Corporate Tax – Levied on profits of companies.

- Wealth Tax (Abolished in 2016) – Previously charged on net wealth above a threshold.

- Indirect Taxes (Levied on goods & services)

- Goods and Services Tax (GST) – Unified tax on goods and services.

- Customs Duty – Charged on imports and exports.

- Excise Duty – Levied on manufacturing (now merged into GST).

| Tax Category | Amount (₹ crore) | Percentage of Gross Tax Revenue |

| Income Tax | 14,38,000 | 33.70% |

| GST (CGST + IGST) | 12,00,000 | 28.10% |

| Corporation Tax | 10,82,000 | 25.30% |

| Union Excise Duties | 3,17,000 | 7.40% |

| Other Taxes | 93,233 | 2.20% |

| Customs Duties | 2,40,000 | 5.60% |

| Total | 42,70,233 | 100% |

Direct taxes

Direct Taxes are those taxes for which the burden of tax falls on the entity that is being taxed. The entity that directly pays this kind of tax to the government Directly bears the tax burden and this burden cannot be shifted. Central government Collects ₹8 Lakh Crore worth of direct tax revenue.

Corporation Tax:

It is levied on the incomes of registered companies/corporations in the country(whether national or multinational/foreign). Taxed on the basis of aggregate income, irrespective of its source and origin.

Note: Foreign companies are taxed on incomes that arise from operations in India.

At this point, Corporation tax is just 3rd biggest source of revenue for the central government. Once it used to be the most important source.

Income Tax

The Tax on personal income is known as the Income tax. More particularly it is levied on Individual income as well as on the incomes of those firms that are not companies. These entities are covered under the Income Tax Act, 1961.

About 34% of the direct tax revenue of GoI.

Problem of Low tax base: As of March 31, 2024, India has issued approximately 74.67 crore Permanent Account Numbers (PANs), covering nearly half of the population.

- However, the number of individuals filing Income Tax Returns (ITRs) remains significantly lower.

- In the fiscal year 2023-24, over 09 crore ITRs were filed, accounting for about 6.68% of India’s population.

- This disparity between PAN holders and ITR filers suggests that a substantial portion of PAN holders are either not earning taxable income or are not compliant with tax filing requirements.Efforts to bridge this gap are essential for enhancing tax compliance and broadening the tax base.

Other direct Taxes:

Securities Transaction tax:

- For transactions in listed securities undertaken on stock exchanges and in units of mutual funds.

- Currently, it stands at 0.1% of the value of Equity traded, and 0.025% STT on Intraday (on selling only).

Capital Gains Tax:

It is levied on Profits generated from the sale of a capital asset (physical and financial), such as, any kind of property held by an assessee, paintings, jewellery/ornaments, business stocks, mutual funds, etc. are taxable as capital gains, either short-term or long-term. It is applicable in the year in which the sale of capital assets takes place.

- Long-term capital gain (sale & purchase are at least a year apart): 10% [from 2018]

- Short-term capital gains (sale and purchase is within months): 15%.

Problem: India has a low investment-to-GDP Ratio. The Capital gains tax discourages investments.

There are four types of taxes on investment: LTCG, STCG, Securities transaction tax, and Dividend income tax above 10L (since 2017).

Wealth Tax:

It is levied on specified assets of specific persons including individuals and companies, under the Wealth Tax Act, 1957.

- It is not levied on productive assets (only on wealth not in circulation). Thus, shares, debentures, UTI mutual funds etc. not taxed.

- Abolished in 2015-16 & replaced by an additional surcharge to be paid by the super-rich (>50Lakh).

Property Tax:

Property Tax is generally levied by the local bodies (municipalities and Panchayats) on the income from property. Usually include buildings, flats, shops & land etc.

| Central Board of Direct Taxes (CBDT) |

CBDT is a statutory authority functioning under the Central Board of Revenue Act, 1963. Department of Revenue, Ministry of Finance.

|

Indirect Tax:

The tax burden can be shifted or passed on to other persons later through business transactions of goods/services. The agent who bears the burden of the tax is not the one on whom it is normally levied.

Excise Duties:

Excise duty is levied on the goods that are manufactured in the country and meant for domestic consumption.

Sales Tax:

It is charged on the point of purchase or exchange of certain taxable goods, charged as a percentage of the total value of the product. After the introduction of GST, it has been removed from all types of articles.

Problem of Cascading of taxes:

Service tax suffered from a cascading effect, leading to tax on tax, encouraging tax evasion and black money generation.

For example, if a restaurant charges ₹1,000 for a meal and levies 15% service tax, the customer pays ₹1,150. If the restaurant later purchases cleaning services for ₹500, the provider also levies a 15% tax, increasing costs.

Since input tax credit was not allowed, businesses passed on these costs to consumers, inflating prices. This encouraged cash transactions to evade taxes, fostering black money circulation. The GST system replaced service tax, eliminating cascading effects and improving transparency.

Value Added Tax (VAT):

It is a multi-stage tax. Levied only on ‘Value added’ at each stage of a supply chain & not on the entire value of sales. In VAT, taxpayers receive credit for tax already paid on inputs in earlier stages of the supply chain.

Problems with the VAT system

- Tax on electricity fuel, other tax on sales not included.

- It has only one problem, i.e. no Input Credit for inter-state purchases.

- Input Credit system of CenVAT (central VAt) & State VAT couldn’t offset each other.

- Different rates for different items. Surcharge & different tax on sales & manufacture by other states. Thus business decisions are more influenced by tax considerations rather than efficiency.

- Services not fully covered.

After the implementation of the Goods and Services Tax (GST) on 1 July 2017, most goods and services in India transitioned to this unified tax system. However, certain items remain outside the GST framework and continue to be subject to Value Added Tax (VAT):

- Alcoholic beverages for human consumption:

- Petroleum products

| Input Credit |

| Suppose I am a merchant & I collected VAT from a customer on a material I sold. Now it’s my responsibility to give this collected tax to the government. But I can tell the government that I paid some taxes on the raw material that I purchased to make this good.

On this, I’ll claim the tax already paid to the merchant. This would be added to my input credit account. Advantage: If such a system is not in place then the value addition in a complex product with several specialised companies in the value addition chain would become difficult. For example, in mobile phone manufacturing. This would discourage long chain value addition products. |

Service Tax:

Levied on services provided by an entity & the responsibility of payment of the tax lies on the service provider.

Customs duties:

Tax levied on goods imported into the country as well as on goods exported from the country.

We shall study the GST in the next chapter.

Division of Taxation powers in India

India has a Three-tier federal structure with the taxation powers distributed as follows:

- Central Government:

- Direct taxes: Corporations & personal income(except agricultural income; it’s for state government)

- Indirect taxes: Customs, Excise, Sales Tax and Service Tax.

- State Government:

- Direct Tax: Land Revenue, Professional Tax, Entertainment Tax(doubt).

- Indirect tax: Sales tax(replaced by VAT), Stamp Duties, state excise.

- Local Bodies Tax:

- Direct: on properties(buildings etc.), Octroi(tax on entry of goods for use/consumption within areas of the Local bodies; abolished in various areas), Tax on markets & Tax/User Charges for utilities such as water supply, drainage etc.

We have studied the division of financial powers between different levels of the government in our Polity-I book.

Tax Policy

A tax policy is a framework that guides how taxes are levied, collected, and managed to support economic growth, equity, and revenue generation. An effective tax policy should be competitive, predictable, and transparent, ensuring fair taxation while promoting investment and compliance. It must focus on reducing tax evasion and ensuring fiscal discipline without being adversarial.

- Competitive & Predictable: Encourages businesses and individuals to comply voluntarily.

- Equitable Taxation: Ensures fair distribution between direct and indirect taxes.

RAPID Approach:

- Revenue: Maximizing government income efficiently.

- Accountability: Transparent tax administration.

- Probity: Ethical tax collection and enforcement.

- Information: Data-driven tax policymaking.

Digitalization: Technology-driven compliance and monitoring.