National Income Accounting (N.I.A.)

National Income (N.I.) is the aggregate of the year’s income earned by the normal resident of a country in the accounting year. In other words, it is the value of final goods and services produced by the normal residents of a country. It is measured in terms of gross domestic product (G.D.P.), and its variants are N.D.P., G.N.P., N.N.P., etc.

A calculation of the value of the total amount of final goods and services produced by the economy in a year is called G.D.P. Thus, G.D.P. is the sum of gross value added (G.V.A.) of all firms in the economy.

Computation of National Income in India

The first attempt to compute the national income in India was made by Dada bhai Naoroji in 1868. However, this was a very crude method. Dr V.K.R.V. Rao used the 1st scientific method to compute National Income in 1931-32.

After the Indian Independence, the 1st official attempt to compute N.I. was made by P.C. Mahalanobis, the head of the national income committee appointed by the government of India, which also D.R. Gadgil and V.K.R.V.Rao as a member. The first report of the committee was presented in 1951.

Later the task of estimating G.D.P. was transferred to the central statistics office (C.S.O.).

However, in 2019, the central government merged the C.S.O. and the N.S.S.O., establishing a national statistical office (N.S.O.) under the Ministry of Statistics and Program Implementation (MoSPI).

Importance of National Income Accounting

What is GDP

Gross Domestic Product (G.D.P.): The sum of the final goods and services created within the geographical boundary of a state in a specific financial year is known as G.D.P.

Here we should note the following 3 important points:

- Final goods and services: These refer to those goods and services which does not require any further processing.

- Geographical boundary: It is a real or imaginary line that separates two regions. It is generally administered by the Indian government within which all the person, goods, and capital can circulate freely.

- Time period: GDP is generally calculated on a per-annum basis.

What does the term “Goods” mean in the GDP

A “Good” in economics is something worth consuming. It has a value for which it is sold. There are two types of goods:

- Final goods

- Intermediate goods

Final Goods

A Final good is an item intended for final usage and will not pass through further stages of production or transformations. It can be

- Consumption goods: Goods and services consumed when purchased by their ultimate consumers. For example, commodities like television sets, automobiles, or home computers.

- Capital goods: Final goods and services that are not to be ultimately consumed. They are used in the production of other goods. They are Durable in character. For example, tools implement, and machines.

Note: Expenditure on capital goods is known as investment or simply Capital Expenditure (Capex)

Investment Goods

Those goods that generate the capacity to produce more output in the future rise. In total production, there is thus a trade-off between investment goods and consumer goods, i.e. items can either be finally consumed by a consumer or used by a firm.

But, the larger and more sophisticated the capital stock, the more numerous and varied the output of commodities will be. Consequently, more numerous and varied will be the production of consumption goods.

- Gross investment: It is part of our final output that comprises capital goods.For example, machines, tools and implements, office spaces, buildings, storehouses, or infrastructure like bridges, roads, airports, or jetties.

- Fixed Investment: It refers to investment in Fixed capital.

- Depreciation or Consumption of fixed capital: It is an accounting concept of the annual allowance for the wear and tear of a capital good. So, we can say:

| You might hear the terms ‘Gross’ and ‘Net’ in several contexts in Economics. Always remember, ‘Gross’ refers to simple addition and when it is subtracted by a depreciating amount, it becomes a ‘net’ value.

Net ≡ Gross – Depreciation |

Intermediate goods:

- They don’t end up in final Consumption and are not capital goods.

- Used as raw material or inputs for the production of other commodities.

- Goods that a firm buys from another firm are entirely used up in the production process of the firm. For example, steel sheets.

Goods in the definition of GDP

For the computation of the Total production of a country, we use “Final Goods and services produced”. This is because it contains the value of all intermediate goods used in its production.

What does the term ‘Domestic’ in GDP imply?

‘Domestic’ refers to the economic territory for which the total final production is being computed within which the person, goods, and capital can circulate freely.

When computing GDP for India, it includes the geographical territory administered by the Indian government. Apart from the territories of India it also includes the following territories:

- Foreign embassies located in India are not part of the domestic territory, whereas Indian embassies located abroad are part of the domestic territory. So, for example, the Indian Embassy in Washington DC is a part of our domestic territory.

- Ships, including fishing boats and aircraft operated by Indians worldwide, are part of domestic territory. So, for example, if you are inside an Indian aircraft at New York City airport or flying between Tokyo and Paris, you would still be under India’s domestic territory, as the aircraft is a property of India.

- Natural gas, Oil and other floating platforms from a resident country operating in foreign water are part of domestic territory.

- Military establishments of India located abroad are part of domestic territory.

Understanding the concept of per annum time

The stock variable vs Flow variable:

- A stock variable is measured at one specific time and represents a quantity.

- The flow variable is extended over an interval of time and is measured per unit of time.

Is GDP a Stock or flow Variable?

GDP is calculated in currency units per annum and is classed as a flow variable.

For example, India’s nominal gross domestic product refers to the total number of dollars spent over a while, such as a year. Therefore, it is a flow variable with units of Rupees/year.

| Important terms concerning GDP |

| In Economics, we hear about various types of prices such as factor price, basic price and market price. These are important in our understanding of GDP, and therefore before checking how GDP is calculated, let’s first understand these terms.

Prices based on Government intervention: ‘Factor’ means pertaining to the factor of production without any government Intervention.

In India, The factor cost does not include indirect taxes like G.S.T., but subsidies received are included in the F.C. as these are direct inputs into the production. |

Calculating National Income

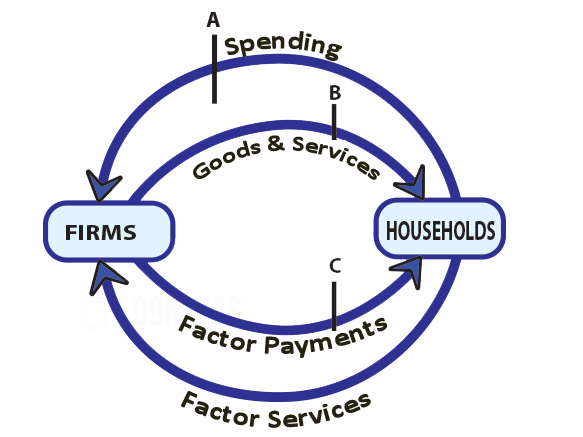

Let’s take a simplified model of an economy for ease of calculation of GDP.

- The top two arrows illustrate the goods and services market – The arrows signify the households that made the payment flow of goods and services to the firms for the goods and services provided to them by the firms.

- The bottom two arrows represent factors of the production market – The arrow signifies the payments made by the firms to the households for the services provided by the households as employees of the firm.

The act of production makes Consumption feasible in two ways:

- Producing consumption goods.

- Creating purchasing power by generating income for those involved in production.

This creates a cycle of economic exchange.

Limitations of the Simple Economic Model

We assume that all the goods produced by a firm are there for purchase by the households. The payments made by the households become earnings made by firms. All the earning made by the firms is distributed amongst the factors of production such as wages, rent, interest and profit.

Therefore, the aggregate Consumption by households is equal to aggregate expenditure. The firms repeatedly use this income to pay for factor services. In this manner, the loop continues.

Thus we can either count the goods and services produced, or the factor incomes or the expenditure in an economy and we will arrive at the same crude estimate of GDP.

At this point, you might be thinking about the obvious limitations of this model:

- No Saving: As per this model, the households dispose of their entire income by spending it on goods and services manufactured by domestic firms, without saving anything. But that is rarely true. People save a proportion of their income.

- There is no export or import in this simple economic model.

- There is no leakage from the system. The whole income of the economy comes back to the manufacturer in the form of sales revenue.

- No Government: Government taxation and subsidies are also ignored in this system.

However, despite these limitations, this is a very good model for understanding the basic production concept of any economy.

If we just assume that this is the structure of our economy at the very basic level, how will we then calculate GDP?

Three Methods of Calculating GDP

In such a system, to estimate the aggregate value of goods and services, we have to measure the flow value at lines A, B and C. Generally, we use 3 methods to calculate these values. They are the Expenditure method, Product Method and Income Method.

- The expenditure method measures the value of spending that firms receive for the goods and services they produce.

- The product or value-added method measures the aggregate value of final goods and services manufactured by all the firms during a financial year.

- The Income Method measures the sum of all factor payments.

Let’s see how we calculate the GDP through each method.

Product or Value-Added Method: (at B)

- The value-added method denotes the net contribution or value addition made by a firm at each stage of production(intermediate goods).

- This method calculates the aggregate value of goods and services produced by all the firms in an economy during a financial year.

- To determine the aggregate value of production, the value of intermediate goods is reduced from the firm’s production value.

- The rupee value for the goods and services produced in an economy after deducting the cost of inputs (like raw materials) is known as V.A.

- If depreciation is reduced from G.V.A. to account for the normal wear and tear, it is called Net Value Addition(N.V.A.).

For example,

Gross value added of a firm, i (GVAi) ≡ Gross value of the output produced(Qi) – Value of intermediate goods used (Zi)

Net value added of the firm i ≡ GVAi – Depreciation of the firm i (Di);

If we sum the gross value added of all the economy firms in a year, we’ll get the aggregate amount of goods and services produced by the economy in a year, known as Gross Domestic Product(GDP).

- The summation of the net value added of all firms in an economy is Net Domestic Product (NDP).

We have calculated it all at Factor price.

Expenditure method (A):

This method of calculating national income includes all the purchases made by residents, government and business enterprises. Looking at the demand side of the products, firm i can make the final expenditure on the following accounts:

- Final consumption expenditure(Ci) on the goods and services produced by the firm.

- Final investment expenditure(Ii) incurred by other firms on the capital goods produced by firm i.

- Final expenditure incurred by the government(Gi) on the final goods and services produced by firm i. It includes both Consumption and investment expenditure.

- The export revenues(Xi) that firm i earns by selling its goods and services abroad.

The sum of total revenue earned by all such firms is given by:

- If C is the final Consumption, Cm is the expenditure on imports. C-Cm is the aggregate final Consumption spent on domestic firms.

- Similarly, I – Im is the aggregate final investment expenditure spent on domestic firms.

- G – Gm is part of domestic firms’ aggregate final government expenditure.

Note: Here, X is total exports, M is total imports, C is Consumption, I is investment and G is government expenditure on all firms in an economy.

As we know, G.D.P. is the sum of all final Expenditures received by the firms in the economy so that we can write :

Limitation of Expenditure Method:

It excludes expenditure on second-hand goods and the purchase of shares and bonds.

Income Method(C):

This method focuses on the production perspective. The sum of final expenditure (only on final goods) is equal to incomes received by all factors of production taken together. Let us consider that the revenues earned by all the firms put together must be distributed among the factors of production, such as salaries, wages, profits, interest earnings, and rents. Let us consider,

- Wi = Wage of a person/household;

- Pi, Ini, Ri = gross profits, interest payments and rents received by the ith household in a particular year.

Since: G.D.P. ≡ sum of all G.V.A., and

GDP ≡ C + I + G + X – M ≡ W + P + In + R

What’s the best method for finding a country’s GDP?

We can measure GDP using any of the above three methods, and we should Ideally get the same result. The Government uses each of these methods to calculate India’s GDP and cross-verifies each for errors.

Concept of Savings

Till now, we have not introduced to concept of saving into this equation. In the calculations that we have addressed above, we have assumed that all that is earned is spent. However, this is not accurate.

There are three ways in which people spend their earnings (assuming there is no aid or donation, ‘transfer payment’ in general, or something sent abroad:

- Consume (C)

- Save (S)

- Pay taxes (T)

Therefore, we can arrive at the following identity:

Thus, C + I + G + X – M ≡ C + S + T

Thus, C + I + G + X – M ≡ C + S + T

Thus, I + G + X – M ≡ S + T

It means: (I – S) + (G – T) ≡ M – X

Here, a few interesting economic identities can be seen:

- Out of G.D.P., a part is consumed, and a part is saved. On the other hand, from the side of the firms, the final aggregate expenditure received by them must be equal to consumption expenditure and investment expenditure. The aggregate income received by the households is equal to the expenditure received.

- Since consumption expenditure cancels out from both sides, we are left with aggregate savings equal to the aggregate gross investment expenditure.

| Transfer Payments |

| A payment made or income received in which no goods or services are being paid, such as a benefit payment or subsidy. These are unilateral payments that are not included in N.I. However, transfer payments are included in personal income and are taxable. |

Limitations of GDP in computing national income:

- It does not include the income of all Indian nationals, as it excludes non-resident Indians.

- Residents’ income made abroad: It even excludes the income made by the residents of a country if it is earned abroad. For example, often people store their earnings in a different country from where they live. But GDP counts this income where the production took place.

- It excludes transfer payments sent back home from abroad. This money is often earned by Indians and used in India and therefore should be a part of India’s national Income. For example, remittances sent from the Gulf countries.

- It does not account for the depreciation of the existing stock of capital in the economy. For example, old bridges do need maintenance, it is not a new production but is counted in the GDP.

- Production for Charity: It does not include that production which is not meant for sale or purchase. What about food produced in Gurudwara or measures taken for social welfare? These might not have a purchase price but do add value to the economy.

To solve these limitations, economists often use other economic identities instead of GDP to represent the national income.

National Income

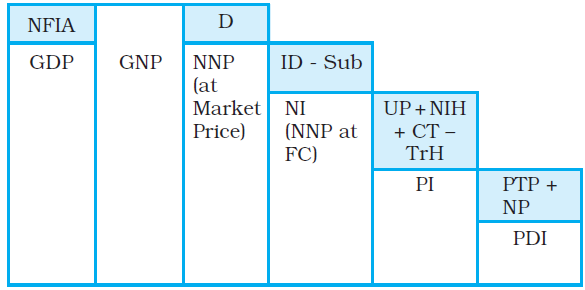

National income can be represented by the following parameters:

Net Domestic Product (NDP):

Net Domestic Product (NDP) is determined by deducting the depreciation of plant and Machinery from GDP. This solves the issue of Depreciation.

Gross National Product (GNP)

Gross National Product (GNP) is the monetary value of all the final goods and services produced by normal residents of a state in a financial year.

![]() Note: X = income by Indians made abroad; M = income of the foreigners in a country.

Note: X = income by Indians made abroad; M = income of the foreigners in a country.

Thus, it includes the income made anywhere in the world by all residents of a country (citizens as well as foreigners).

- This neutralises the impact of profit shifting (a practice in which the profit is reported in a different country by registering the business abroad).

- This is the actual income of the country which can be taxed by the government.

The GNP is referred to as the Gross National Income (GNI) in recent times. This way of measuring is so advantageous that the World Bank takes GNI as the criteria to classify countries based on high or low income.

It is different from GDP as it is not limited by the geographical location of production done by the residents of a country. Many countries such as Ireland have given up the GDP-based accounting in favour of GNI/GNP.

Net National Product (NNP)

Net National Product (N.N.P.) is G.N.P. with depreciation factored in.

National Income

Net National Product (N.N.P.) at factor cost is also referred to as the National Income (N.I.). When the production cost is the basis of the value of goods and services, we get N.N.P. at factor cost.

National Income can be subdivided into the following:

- Personal Income (P.I.): Part of National income received by households.

- Undistributed Profits (U.P.): Earned by firms and government Enterprises and are not distributed among factors of production.

Limitations of National Income

It doesn’t include the following:

- Intermediate goods.

- Transfer payments like scholarships, gifts, etc.

- Sales of second-hand goods.

- Lottery and prize money.

- Services are done by homemakers.

NNP at market price

Net National Product (N.N.P.) at Market Price is the value of the net national product at a consumer price.

Personal Income (PI)

Personal income is the income that persons get in return for their provision of labour, land, and capital used in current production and the net current transfer payments they receive from businesses and the government.

But P.I. is not the income over which households have a complete say. They have to pay taxes like personal tax payments and Non-tax payments (fines), etc.

Personal disposable income (PDI):

It is that part of personal income available to the households for disposal (or spending) as they like.

- National disposable income impliesN.P. (at market prices) + Other current transfers.

Private Income

Private income refers to Factor income from net domestic product accruing to the private sector + National debt interest + Net factor income from abroad + Current transfers from the government (Subsidies) + Other net transfers from the rest of the world (such as Charity).

Problem of Inflation

Problem 1: Impact of inflation on GDP

How to say that the Volume of production has doubled or just the prices have doubled?

The formula for the calculation of GDP does not consider the amount of goods but considers only the value of goods.

Problem 2: Price disparity

Suppose India produces a kilogram of Apple for ₹100 and the same kilogram is produced and sold by a farmer in Europe for ₹200. In this scenario, a production of ₹100 would be counted in India’s GDP and a production of ₹200 would be counted in Europe’s GDP.

But this is unfair to India. If the same quantity of item is produced, then the same amount should be added to the calculation of GDP.

The problem of price disparity in different economies creates difficulties in comparing different economies.

Three Definitions of GDP

Thus, we compute GDP for three types of prices.

Nominal GDP:

The term nominal means “existing in name only”. When GDP is calculated in the domestic currency at the current prevailing price of Goods and services, it is called Nominal GDP.

The problem with the nominal GDP is that it captures only the value of production and not the actual amount of production.

It is represented as ‘GDP’ (in capital letters).

Real GDP

When GDP is calculated at ‘constant prices’, i.e. it is adjusted for inflation, it is known as the Real GDP. “problem 1”, i.e. the problem of inflation is solved by the Real GDP.

How to calculate Real GDP?

In order to calculate Real GDP following process is adopted:

Step 1: Select a Base year

The base year is the year whose prices are being used to calculate real GDP in the current year. It should have the following characteristics.

- It should be a normal year (stable economy)

- Latest year (Not a long time ago)

- Relevant data must be available.

The Government currently takes 2012 as the base year for the computation of GDP.

Step 2: Now count all the services produced this year. And then Calculate the value of goods and services produced this year in the prices that were prevailing in the Base year.

For example, say in an economy we produced only a kilogram of apple which costs ₹100 today. We will count only a kilogram of Apple and will take its value as the one that prevailed in the base year, i.e. 2012. Say in 2012 it cost just ₹50.

So the real GDP is ₹50.

GDP deflator

The GDP deflator is the ratio of nominal to real GDP.

The GDP deflator is different from the Consumer Price Index (CPI). CPI is the index of prices of a given basket of commodities that are bought by the representative consumer.

GDP at Purchase Power Parity

GDP at Purchasing Power Parity (PPP) is a way of measuring the economic output of a country by comparing the value of goods and services produced across different countries, taking into account the relative cost of living and inflation rates.

Unlike the nominal GDP or the real GDP, which is measured using market exchange rates, GDP at PPP adjusts for the differences in price levels between countries, allowing for a more accurate comparison of living standards and economic productivity.

The problem of price disparity between countries is solved by this method.

Significance of GDP

- D.P. growth rate: It indicates the performance of the country compared to the previous years.

- D.P. per capita indicates the level of economic development compared to other countries.

GDP Vs welfare:

GDP is the total product produced which gets distributed as income. Thus, there is a temptation to consider it as an index of the greater well-being of the people of a country.

Now we will discuss a few drawbacks of using GDP as a parameter of the welfare of any country:

- Non-uniform distribution of GDP: We can also find big inequality in purchasing power in the economy (rural vs urban). Also, in the same area, incomes are non-uniform. If the income levels are skewed. Welfare is not possible even in high-income level countries.

- Non-monetary exchanges: Many activities are not evaluated in monetary terms. For example, Barter exchanges in the informal economy. These are not registered as a part of economic activity. This is a case of underestimation of GDP. It doesn’t give a clear indication of productive activity and well well-being of the country.

- Does not cover the Care economy: It does not measure unpaid services like household work and social services.

- Growth at the cost of Environment: It does not consider the negative externalities of economic growth, where there is the usual trade-off between economic growth and environmental degradation.

- Effect of Externalities: Harms or benefits an association, company, or an individual causes to another for which they are not paid(or penalised). For example, Pollution in production may kill fish in a nearby river. Which is a loss to the economy. Thus GDP overestimates the actual welfare.

- Production of negative goods: For example, the production of goods like drugs, guns etc., increases the monetary value of production, but they do not contribute to any social welfare.

There is a need to effectively collect statistical information to measure national income accurately. We should work on Eliminating the risk of double counting.

Economic Growth vs Economic Development?

| Economic Growth | Economic Development |

| It is unidimensional. | It covers multidimensional aspects. |

| It is a quantitative concept. | It is a qualitative concept. |

| It is just a mean, not the end, so it is a narrow concept. | It is a broader concept as It ends in itself. |

| It can be achieved without the development | It is required for the development |

| Indicators are GDP and per capita income. | Net economic welfare, Physical quality life index (PQLI), HDI, Gross Happiness Index, and MPI (Multidimensional poverty index). |

New Ways of Measuring Development

- New Economic Welfare (NEW): GNP + Value of non-monetary work + Value of Leisure – Environmental cost – Expenditure on Defence.

- Physical Quality of Life Index (PQLI): It is prepared by MD Morris with 3 indicators:

- Life expectancy after the age of one year.

- Infant mortality rate.

- Basic literacy at the age of 15 and above.

- HDI -based on 4 factors that UNDP publishes.

Thus, Production and Consumption are intrinsically linked; the economic cycle rolls on, making a continuous process of Consumption and production possible.