What is vertical fiscal imbalance?

(Source – The Hindu, International Edition – Page No. – 10)

| Topic: GS2 – Indian Polity – Federal Structure |

| Context |

| ● The news addresses India’s Vertical Fiscal Imbalance (VFI), where States handle most expenditure but collect less revenue, relying on Union transfers.

● The 15th Finance Commission highlighted this issue, suggesting that increasing tax devolution to States could balance finances, enhance spending efficiency, and support equitable fiscal federalism. |

Introduction to Vertical Fiscal Imbalance (VFI)

- The 15th Finance Commission highlighted that States in India face a significant Vertical Fiscal Imbalance (VFI).

- States incur 61% of the revenue expenditure but collect only 38% of the revenue receipts.

- This imbalance means that States rely heavily on transfers from the Union government for their expenditures.

Why VFI Needs Attention

- Constitutional Division of Duties: The Union and State governments have constitutionally defined financial responsibilities. The Union government collects major taxes like Personal Income Tax and Corporation Tax, while States handle expenditures on publicly provided goods and services.

- Efficiency Considerations: To maximise efficiency, it’s ideal for the government closest to the service users to manage expenditures. However, States struggle due to the revenue gap.

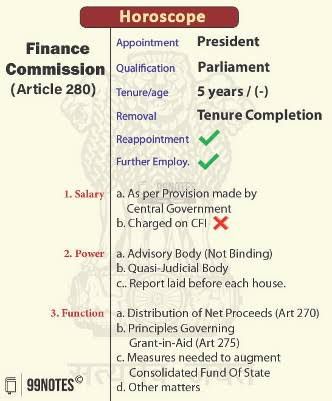

Finance Commission’s Role

- The Finance Commission addresses VFI by deciding on two key areas:

- How to distribute the Union government’s tax revenue to States.

- How to allocate these resources among individual States.

- VFI is related to the first area, focusing on how much tax revenue from the Union is devolved to States.

Current Financial Transfers

- Grants and Transfers: Besides tax devolution, Finance Commissions recommend grants under Article 275 of the Constitution for specific needs. Other transfers occur under Article 282 through centrally sponsored and central sector schemes, but these are conditional.

- Untied Transfers: Tax devolution is the only transfer that is unconditional and untied.

Estimating VFI in India

- There is a need to outline a method to estimate VFI at the aggregate level for all States, using a ratio of total own revenue receipts plus tax devolution to own revenue expenditure.

- If this ratio is less than 1, it indicates a VFI, with the deficit being used as a proxy for the imbalance.

- To eliminate VFI, the share of tax devolution needs to rise to about 48.94%, but the 14th and 15th Finance Commissions recommended only 42% and 41% respectively.

Call for Increased Tax Devolution

- Many States advocate for the 16th Finance Commission to fix the share of tax devolution at 50% of the net proceeds.

- Benefits: Higher devolution would provide States with more untied resources, align expenditures with local needs, and enhance the efficiency of spending, contributing to a more balanced fiscal federalism.

Conclusion

- Addressing VFI through increased tax devolution would support a more equitable distribution of fiscal resources and improve the efficiency of State expenditures, fostering a healthier system of cooperative fiscal federalism.

| PYQ: Though the federal principle is dominant in our Constitution and that principle is one of its basic features, it is equally true that federalism under the Indian Constitution leans in favour of a strong Centre, a feature that militates against the concept of strong federalism. Discuss. (200 words/12.5m) (UPSC CSE (M) GS-2 2014) |

| Practice Question: How does Vertical Fiscal Imbalance impact the financial autonomy of States, and what measures could be taken to address this imbalance? Evaluate the proposal for increasing tax devolution to States. (250 Words /15 marks) |