8 April 2024 : Daily Current Affairs

Daily Current Affairs

8-April -2024- Top News of the Day

1. Traders rue underpriced onion exports to the UAE

| Topic: GS3 – Indian Economy – Effects of liberalisation on the economy

This topic is significant for UPSC as it addresses agricultural export policies, pricing mechanisms, and international trade dynamics. |

| Context |

| ● The news highlights controversy surrounding Indian onion exports, with allegations of low prices paid to farmers and windfall profits for importers. |

Additional information on this news:

- Indian onion exports have faced controversy as farmers and traders allege that shipments to markets like the UAE have been sold at significantly higher prices, yielding substantial profits for importers.

- Despite concerns over domestic shortage, the government banned onion exports in December and extended the ban indefinitely, allowing exceptions for exports to specific countries based on diplomatic requests.

- On March 1, the Centre permitted the export of 14,400 tonnes of onions to the UAE, with a quarterly cap of 3,600 tonnes, and later approved an additional 10,000 tonnes for the UAE.

- Global onion prices have soared, reaching as high as $1500 a tonne due to export bans imposed by major onion-producing countries like India, Pakistan, and Egypt.

- Indian exports to the UAE, however, have been priced lower at around $500 to $550 a tonne, resulting in significant windfall gains for UAE importers.

- These exports are facilitated through the National Cooperative Exports Limited (NCEL), a government-owned entity, under government-to-government arrangements.

- Exporters have raised concerns over the pricing mechanism and selection process of importers, with allegations of discrepancies in pricing and selection criteria.

- The Horticulture Produce Exporters’ Association has sought clarity on export procedures and pricing from relevant ministries but has received no response.

- Queries to the Ministries of Commerce, Consumer Affairs, and Cooperation regarding export modalities and price determination remain unanswered.

- The situation underscores the need for transparency and accountability in the export process to ensure fair pricing and equitable distribution of profits.

| What are the concerns? |

| ● Price Discrepancies: Indian onion exports face criticism due to allegations of farmers being paid low prices while importers profit from soaring global prices.

● Policy Concerns: The government’s decision to permit limited exports to countries like the UAE amid domestic shortage concerns has sparked controversy. ● Export Bans: Export bans imposed by major onion-producing countries like India, Pakistan, and Egypt have led to price hikes in global markets. ● Windfall Profits: Importers in markets like the UAE allegedly benefit from significantly lower procurement prices compared to international rates. ● Transparency Issues: Export procedures facilitated through government entities like the National Cooperative Exports Limited lack clarity, raising concerns over transparency and accountability. ● Lack of Response: Queries raised by exporters and industry associations regarding export procedures and pricing mechanisms remain unanswered by relevant ministries. ●Impact on Farmers: Farmers face economic hardships as they receive minimal compensation for their produce, exacerbating existing agricultural distress. ● Need for Reform: The situation underscores the need for transparent pricing mechanisms and equitable distribution of profits to ensure fair trade practices and support farmers’ livelihoods. |

| Practice Question: Discuss the implications of pricing disparities and export policies on Indian onion trade, highlighting challenges and possible solutions. (150 Words /10 marks) |

2. Gape limitation: are you a big eater?

| Topic: GS3 – Environment and ecology.

Understanding gape limitation is crucial for UPSC as it illuminates predator-prey dynamics, ecosystem stability, and biodiversity conservation principles. The concept can be specially important from prelims perspective. |

| Context |

| ● The news discusses the ecological concept of “gape limitation,” which highlights how predator mouth size affects prey consumption and ecosystem dynamics. |

Additional information on this news:

- Gape limitation in ecology refers to the concept that predators can only consume prey that fits within their mouth.

- It determines predator-prey interactions, where small predators target small prey and vice versa for larger predators.

- The size of a predator’s mouth influences the evolution of both predators and prey.

- Prey may evolve to be faster or larger to avoid being eaten by predators with smaller mouths.

- Conversely, predators may evolve larger mouths to consume larger prey.

- Understanding gape limitations is crucial for predicting how changes in predator or prey populations, habitats, or environmental disturbances will impact ecosystems.

- Research on gape limitations sheds light on the dynamics of animal interactions and their effects on biodiversity.

| Practice Question: Discuss the significance of ‘gape limitation’ in predator-prey dynamics and its implications for ecosystem stability and biodiversity conservation. (150 Words /10 marks) |

3. ‘Unnecessarily complex’ GST needs urgent reform: Kelkar

| Topic: GS2 – Indian Economy – Issues relating to mobilisation of resources.

Understanding GST reforms advocated by Vijay Kelkar is crucial for UPSC, reflecting on fiscal policy and governance challenges in India. |

| Context |

| ● The news revolves around Vijay Kelkar’s advocacy for urgent reforms in India’s Goods and Services Tax (GST) regime, emphasizing simplification and equitable revenue sharing. |

Additional information on this news:

- Vijay Kelkar, key architect of India’s tax reforms, calls for urgent GST reforms, deeming the current regime unnecessarily complex.

- Proposes the creation of an independent secretariat for the GST Council to address concerns of states.

- Advocates for simplifying GST structure with a single rate of 12% shared equally among all tiers of government and Union Territories.

- Highlights high GST rates as a catalyst for fraud, suggests a single rate to optimize revenue and minimize disputes.

- Recommends a single GST rate of 12%, akin to many developed and emerging economies, to simplify structure and boost manufacturing.

- Emphasises the need for additional non-VAT taxes like carbon taxes on demerit goods for a comprehensive reform.

- Urges equitable sharing of GST revenues with the third tier of government for fiscal strengthening and improved governance.

- Calls for Constitutional amendments to establish a consolidated fund for the third tier and ensure equitable GST sharing among all levels of government.

| What are the complexities in GST? |

| Complexities in GST:

● Multi-tiered tax structure with varying rates across goods and services. ● Classification issues leading to confusion and disputes. ● Compliance burden due to frequent changes in tax rates and regulations. ● Inadequate technology infrastructure hindering smooth implementation. ● Lack of clarity on input tax credit and anti-profiteering provisions. ● Interstate transactions facing logistical challenges and administrative hurdles. ● High rates incentivizing tax evasion and fraud. Way forward: ● Simplify the tax structure by moving towards a single or fewer tax rates. ● Address classification issues through clear guidelines and harmonization. ● Provide stable and predictable tax policies to reduce compliance burden. ● Invest in robust technology infrastructure for efficient tax administration. ● Enhance taxpayer education and outreach programs. ● Streamline interstate transactions through better coordination among states. ● Implement anti-evasion measures and strengthen enforcement mechanisms. ● Continuously review and refine GST laws based on feedback and experience. Overall, the way forward involves streamlining the GST regime to promote ease of doing business, enhance compliance, and stimulate economic growth. |

| PYQ: Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. (150 words/10m) (UPSC CSE (M) GS-3 2019) |

| Practice Question: Discuss the complexities and potential reforms needed for India’s GST regime to ensure efficiency and compliance. (250 Words /15 marks) |

4. What is the technology behind manufacturing a semiconductor chip?

| Topic: GS3 – Science and Technology

This topic is crucial for UPSC as it covers India’s semiconductor industry development, addressing supply chain vulnerabilities, and fostering self-reliance. |

| Context |

| ● The news highlights India’s strategic move into semiconductor manufacturing through partnerships with TATA Group and Taiwan’s PSMC, aiming to address supply chain vulnerabilities and foster technological self-reliance. |

Semiconductor Chips:

- Semiconductor chips are crucial components with properties between conductors and insulators.

- They’re crafted by modifying pure semiconductors with dopants, forming complex circuits.

- Analogous to intricate art creation with masks (stencils) and dopants (paint).

The Role of Transistors:

- Transistors, early semiconductor components, act as versatile switches or amplifiers.

- They’re fundamental in modern electronics, with millions/billions integrated into chips.

- Transistor innovation received Nobel recognition in 1956 and 2000.

Fabrication Technology Advances:

- Manufacturing technology evolution drives semiconductor miniaturisation.

- Labels like ’45nm’, ’28nm’, and ’16nm’ denote technology advancements.

- ‘nm’ signifies nano-meter, indicating the scale of miniaturization.

- Researchers explore three-dimensional stacking to enhance chip performance.

Understanding Wafer Fabrication:

- Wafers, akin to postage stamps, host multiple chips before dicing into individual units.

- Larger wafer sizes (e.g., 300mm) increase production efficiency and reduce costs.

- Efforts are underway to transition to 450mm wafers despite technical and capital challenges.

Assembly and Testing:

- After dicing, chips undergo packaging and wire routing for protection and connectivity.

- Assembly and test plants validate chip functionality and ensure reliability through stress testing.

India’s Semiconductor Ecosystem:

- India boasts a robust chip design industry since the 1990s, driven by computer-aided design.

- Semiconductor design is primarily software-based, facilitating remote collaboration and abstraction.

- Existing chip design ecosystem provides a foundation for semiconductor manufacturing ventures.

- Semiconductor manufacturing opens opportunities for diverse professionals, including engineers and scientists from various disciplines.

India’s Semiconductor Manufacturing Ventures:

- Recognizing the significance of semiconductor infrastructure, India initiates ventures.

- TATA Group partners with Taiwan’s Powerchip Semiconductor for a 300mm wafer fab in Gujarat.

- Approval for assembly and test plants in Gujarat and Assam demonstrates commitment.

- First 28nm chip rollout scheduled for 2026, marking India’s entry into chip manufacturing.

- Leveraging semiconductor design expertise, India aims for a self-sufficient semiconductor ecosystem.

Conclusion:

- Semiconductor chips are integral to modern electronics, crafted through intricate fabrication processes.

- India’s semiconductor ecosystem, bolstered by design expertise, embarks on manufacturing ventures to address supply chain vulnerabilities and enhance technological self-reliance.

| Practice Question: Discuss the significance of India’s recent foray into semiconductor manufacturing and its implications for technological self-reliance and strategic resilience. (250 Words /15 marks) |

5. Supreme Court Expands Constitutional Rights to Include Protection Against Climate Change Effects

| Topic: GS2 – Polity – Indian constitution- Amendments

This topic is relevant for both Prelims and Mains as the analysis delves into the Supreme Court’s interpretation of constitutional provisions, particularly Articles 14 and 21, in the context of environmental rights. |

| Context: |

|

More about the news:

Constitutional Recognition of Environmental Rights:

- The court emphasized that the importance accorded to the environment in these constitutional provisions translates into rights guaranteed elsewhere in the Constitution.

- Articles 21 and 14, which guarantee the right to life, personal liberty, equality before the law, and equal protection of laws, serve as important sources of the right to a clean environment and protection against the adverse effects of climate change.

Impact of Climate Change on Fundamental Rights:

- Highlighting the significance of a clean environment for the realization of fundamental rights, the court underscored the interconnectedness between environmental degradation and violations of the right to life and health.

- Climate change-induced factors such as air pollution, vector-borne diseases, and natural disasters impact vulnerable communities disproportionately, violating their rights to life and equality.

Challenges and Practical Difficulties:

- Despite governmental policies recognizing climate change, the absence of comprehensive legislation addressing climate change and its effects was noted.

- However, the court asserted that the absence of specific legislation does not negate the right of people to protection against the adverse effects of climate change.

Balancing Environmental Conservation and Energy Needs:

- The court addressed the practical challenges in implementing its previous orders related to environmental conservation, particularly regarding power transmission lines.

- Recognizing the technical difficulties and environmental implications of underground power transmission, the court emphasized the need for a balanced approach that considers factors such as terrain, population density, and infrastructure requirements.

Promotion of Renewable Energy:

- Acknowledging India’s commitment to transition to renewable energy sources, the court stressed the importance of harnessing solar power to meet rising energy demands sustainably.

- It highlighted the socio-economic benefits of renewable energy adoption, including poverty alleviation, enhanced quality of life, and inclusive growth.

Conclusion:

- The Supreme Court’s ruling underscores the critical role of environmental conservation in protecting fundamental rights and promoting sustainable development.

- While affirming the constitutional recognition of environmental rights, the court also recognizes the need for pragmatic solutions that balance environmental conservation with socio-economic development goals, particularly in the context of India’s energy transition and climate change mitigation efforts.

| Right to a Healthy Environment |

|

| PYQ: The most significant achievement of modern law in India is the constitutionalization of environmental problems by the Supreme Court. Discuss this statement with the help of relevant case laws. (UPSC CSE (M) GS-2 2022) |

| Practice Question: Discuss the recent Supreme Court ruling expanding the scope of Articles 14 and 21 to include the right against the adverse effects of climate change. Analyze the implications of this ruling on environmental conservation, fundamental rights, and policymaking in India. (250 words/15 m) |

6. Rare Total Solar Eclipse to Grace North America: Insights into Astronomical Rarity and Occurrence

| Topic: Important Topic for Prelims |

| Context: |

|

More about the news:

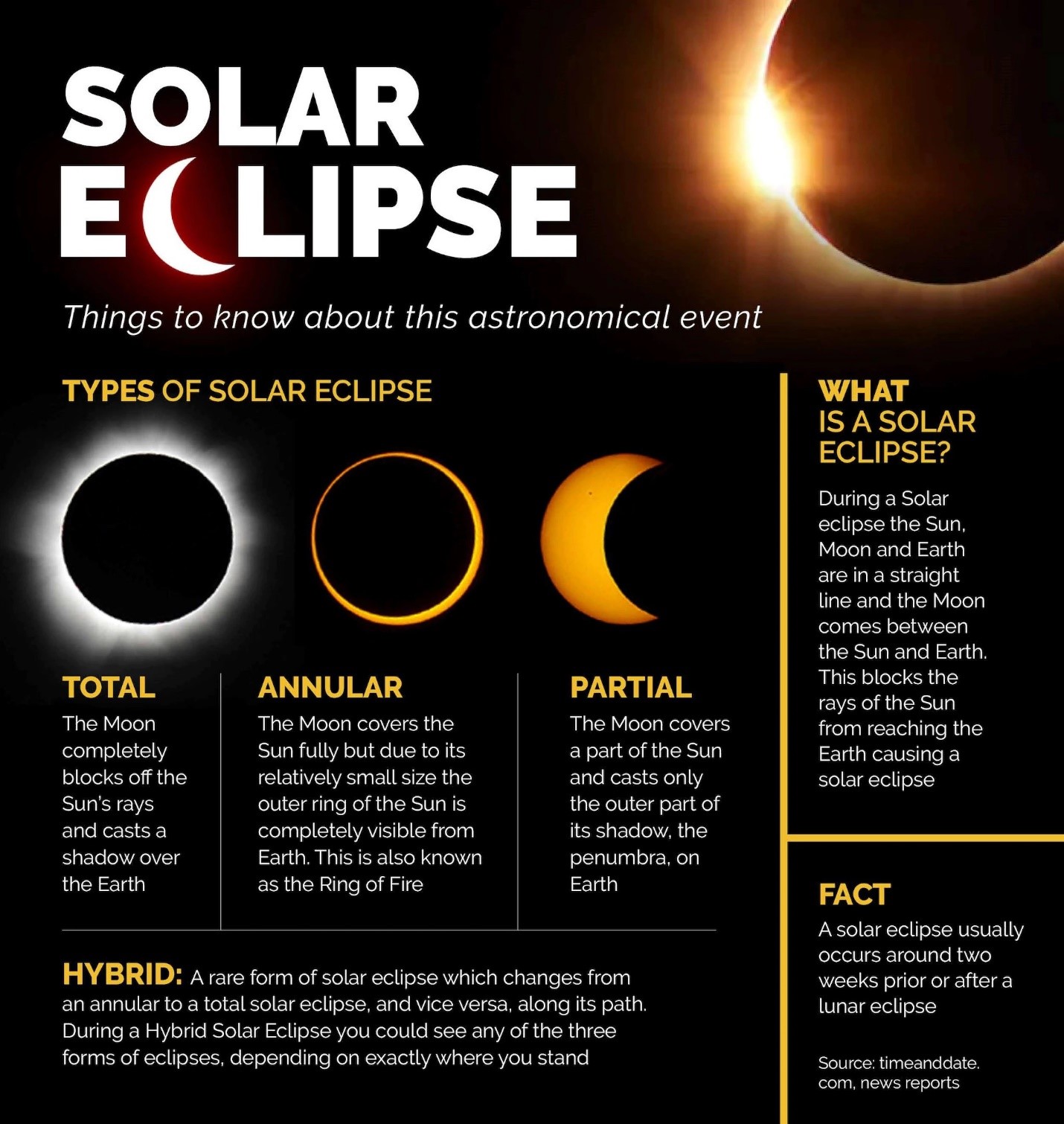

Types of Solar Eclipses:

- Total Solar Eclipse: This occurs when the Moon completely blocks the Sun’s light, casting a shadow on the Earth. Observers within the path of totality experience complete darkness.

- Annular Solar Eclipse: During an annular eclipse, the Moon covers the central portion of the Sun, leaving a ring or annulus of sunlight visible around the edges.

- Partial Solar Eclipse: In a partial eclipse, the Moon covers only a portion of the Sun, resulting in a crescent-shaped Sun.

- Hybrid Solar Eclipse: A hybrid eclipse is a rare phenomenon where the eclipse shifts between total and annular as the Moon’s shadow moves across the Earth’s surface.

Frequency of Solar Eclipses:

- Solar eclipses occur during a new Moon, when the Moon and the Sun are aligned on the same side of the Earth.

- Despite a new Moon happening approximately every 29.5 days, solar eclipses are less frequent, typically occurring between two to five times a year.

- This rarity is due to the inclination of the Moon’s orbit, which is tilted about five degrees relative to the Earth’s orbit around the Sun.

- As a result, the Moon’s shadow often misses the Earth.

Rareness of Total Solar Eclipses:

- Total solar eclipses are exceptionally rare events for any given location on Earth, happening approximately once every 400 years.

- This rarity is because witnessing a total eclipse requires being within the umbra, the darkest part of the Moon’s shadow.

- The umbra is quite small, covering less than 1% of the Earth’s surface during an eclipse, making the chance of experiencing totality infrequent for most places.

| Solar Eclipse |

|

7. Congress Manifesto Pledges to Reform Bail Laws and End Arbitrary Arrests, Critiques BJP’s Handling of PMLA

| Topic: GS2 – Governance – Government policies – Interventions for development in various sectors

This topic is relevant for both Prelims and Mains in the context of understanding the role of laws like the PMLA in India’s legal system, including their enactment, evolution, and constitutional validity. |

| Context: |

|

More about the news:

Context and Opposition’s Stance on PMLA:

- The CPI(M), Congress’s ally, echoed similar sentiments, advocating for the repeal of stringent laws like the PMLA and the Unlawful Activities (Prevention) Act (UAPA).

- However, it’s noteworthy that some of the most stringent provisions of the PMLA, now criticized by opposition leaders, were introduced during the Congress-led UPA regime.

- Despite this, successive governments, including the BJP-led one since 2014, have made significant changes to the PMLA, amplifying concerns over its misuse.

Legal Backing and Supreme Court’s Verdict:

- The constitutional validity of the PMLA was upheld by the Supreme Court in 2021, validating its provisions and enforcement mechanisms.

- A pivotal aspect of the PMLA is its divergence from the usual criminal procedure code, granting sweeping powers to agencies like the ED.

- This includes not adhering to standard protocols for searches, seizures, and arrests.

- The Supreme Court’s verdict in 2021 solidified these powers, affirming the legality of the PMLA’s operational framework.

Evolution and Amendments of the PMLA:

- The genesis of the PMLA dates back to global efforts in the 1990s to combat terrorism financing and money laundering.

- India’s enactment of the PMLA was in response to international mandates, with the law coming into force in 2005.

- Subsequent amendments in 2009 and 2012 expanded the scope of the PMLA, empowering agencies like the ED to take coercive actions against politicians accused of corruption.

Impact and Criticisms:

- The amendments, particularly those in 2012, significantly enhanced the PMLA’s reach, incorporating offenses like corruption under its purview.

- This broadening of the law’s application has led to prolonged incarcerations of individuals without trial, sparking criticism from various quarters.

- Critics argue that stringent bail conditions and expansive definitions of money laundering have resulted in prolonged pre-trial detentions, raising concerns about fairness and due process.

Conclusion:

- The evolution of the PMLA, its legal backing, and the Supreme Court’s validation underscore its significance in India’s legal landscape.

- However, criticisms over its implementation, especially regarding bail conditions and prolonged detentions, highlight the delicate balance between law enforcement and individual rights.

- As political parties navigate these issues, the debate over the PMLA’s efficacy and fairness continues to shape public discourse and legal reforms.

| What is Money Laundering? |

|

About:

|

| PYQ: Money laundering poses a serious threat to country’s economic sovereignty. What is its significance for India and what steps are required to be taken to control this menace? (200 words/10m) (UPSC CSE (M) GS-3 2013) |

| Practice Question: Explain the significance of the Prevention of Money Laundering Act (PMLA) and discuss any recent developments related to its enforcement in India. (150 words/10 m) |

8. Bose, Barkatullah, a history of Indian governments before freedom

| Topic: GS1 – History – Modern Indian history – Personalities

This topic is relevant for both Prelims and Mains as the analysis delves into a significant aspect of India’s struggle for independence during the World War II era, shedding light on Subhas Chandra Bose’s contributions and the formation of the Azad Hind government. |

| Context: |

|

More about the news:

Formation of Azad Hind Government:

- Subhas Chandra Bose traveled to Germany and Japan seeking support to overthrow British rule in India.

- In Singapore on October 21, 1943, he proclaimed the Provisional Government of Azad Hind (Free India), claiming authority over Indian territories under Japanese occupation.

Structure and Recognition of Azad Hind Government:

- Bose headed the Azad Hind government and held key portfolios, with AC Chatterjee, SAA Ayer, and Lakshmi Swaminathan in ministerial roles.

- The government received recognition from Axis powers and their allies but lacked widespread international acknowledgment.

Comparison with Kabul Provisional Government:

- The Kabul Provisional Government formed in 1915 by the Indian Independence Committee (IIC) under Raja Mahendra Pratap and Maulana Barkatullah served as another symbolic act of defiance against British rule, though lacking territorial control and broad international recognition.

Symbolism vs. Substance:

- While both the Azad Hind and Kabul Provisional Governments symbolized resistance against British rule, they lacked substantial control over Indian territories and failed to gain significant international recognition beyond certain alliances during wartime.

Conclusion:

- The claims of Subhas Chandra Bose as India’s first Prime Minister based on the establishment of the Azad Hind government and comparisons with earlier symbolic acts of resistance highlight the complex dynamics of Indian independence movements and their symbolic versus substantive impacts on the struggle for freedom.

| About Netaji Subhas Chandra Bose |

|

| Practice Question: Explain the significance of the Provisional Government of Azad Hind led by Subhas Chandra Bose during World War II in India’s struggle for independence. How did this government contribute to the freedom movement, and what challenges did it face? (250 words/15 m) |

9. India’s Rapidly Growing Russian Oil Imports Face Headwinds in 2024

| Topic: GS2 – International Relations – Bilateral Relations

GS3 – Indian Economy This topic is relevant for both Prelims and Mains in the context of understanding India’s energy security, geopolitical implications of oil imports, and international relations with countries like Russia and the US. |

| Context: |

|

More about the news:

Rising Russian Oil Imports:

- Indian refiners escalated their purchases of Russian oil following the invasion of Ukraine in 2022, driven by deep discounts offered by Moscow.

- Russia, previously a marginal player, now stands as New Delhi’s primary crude source, surpassing Iraq and Saudi Arabia.

Current Import Status:

- March 2024 data from Kpler indicates that Indian imports of Russian oil reached around 1.7 million barrels per day (bpd), representing a third of total imports for the month.

- Despite this, the volumes were lower compared to highs seen in mid-2023, though it’s forecasted to remain above 1.5 million bpd in 2024.

Challenges to Sustained Growth:

- Reduced Discounts and Competition: The discount for Indian refiners on Russian Urals crude compared to Brent crude decreased from $15 to $4 per barrel between 2023 and 2024. Additionally, West Asian oil companies are expected to adjust pricing, potentially increasing competitiveness against Russian oil.

- Logistical Considerations: The Middle East enjoys a logistical advantage due to shorter shipping routes compared to Russia, making their oil more attractive to Indian refiners. Kpler suggests that Russian oil’s upper pricing limit remains around a $4/bbl discount to Brent, beyond which Middle Eastern substitution may be considered.

- Payment Issues and Sanctions: Payment currency discrepancies between Russian sellers and Indian buyers, as well as recurrent sanctions from G7 nations, pose significant challenges. G7-imposed price caps and subsequent measures, such as restrictions on maritime service providers, impact Russia’s ability to export oil.

G7 Imposed Price Cap:

- In December 2022, G7 nations imposed a price cap of $60 per barrel on Russian seaborne crude, aiming to limit Kremlin’s revenue for funding the war in Ukraine while ensuring global oil market stability.

- Russia responded by developing its own tanker fleet to bypass Western restrictions.

Ensuring Compliance and Impact on India:

- The US and its allies are vigilant in enforcing the price cap and countering evasion attempts.

- Recent sanctions on shipping firms and tankers aim to deter non-compliance.

- While India is not a signatory to the price cap or sanctions, it seeks to avoid accepting oil delivered on sanctioned tankers to prevent potential secondary sanctions.

Conclusion:

- While India’s Russian oil imports have seen significant growth, maintaining this momentum faces obstacles ranging from pricing dynamics and competition to geopolitical tensions and sanctions regimes imposed by the G7 nations.

- These factors will likely influence India’s energy sourcing strategies in the foreseeable future.

| Who are the Top Crude-Oil Suppliers for India? |

|

Status of Oil Imports:

|

| PYQ: The term ‘West Texas Intermediate’, sometimes found in news, refers to a grade of (2020)

(a) Crude oil (b) Bullion (c) Rare earth elements (d) Uranium Ans: (a) |

| Practice Question: India’s burgeoning reliance on Russian oil imports presents a complex array of challenges and opportunities. Discuss the factors contributing to the surge in Indian-Russian oil trade since 2022. (250 words/15 m) |

For Enquiry

8 April 2024 : Daily Current Affairs

8 April 2024 : The Hindu Editorial Notes PDF

8 April 2024 : PIB Summary for UPSC

8 April 2024 : Indian Express Editorial Analysis

6 April 2024 : Daily Current Affairs Quiz

6 April 2024 : Daily Answer Writing

6 April 2024 : Daily Current Affairs

6 April 2024 : PIB Summary for UPSC

6 April 2024 : The Hindu Editorial Notes PDF

6 April 2024 : Indian Express Editorial Analysis

April 2024 Daily Current Affairs 8 April 2024 : Daily Current Affairs Daily Current Affairs

6-April -2024- Top News of the Day

1. India abstains from UNHRC vote that called…

April 2024 The Hindu Editorial 8 April 2024 : The Hindu Editorial Notes PDF The Hindu EDITORIAL

8-April-2024

1. Shaping India’s path to inclusive health care

Topic: GS2 – Social…

April 2024 PIB 8 April 2024 : PIB Summary for UPSC PIB Summary for UPSC

6-April-2024

1. Over 73,000 applications received on Suvidha Portal since the announcement…

April 2024 Indian Express 8 April 2024 : Indian Express Editorial Analysis Indian Express Editorial Analysis

8-April-2024

1. Getting around a boycott

Topic: GS2 – International…

Daily Quiz 6 April 2024 : Daily Current Affairs Quiz 6- April 2024 : Daily Quiz…

mains answer writing 6 April 2024 : Daily Answer Writing Mains Answer Writing

6-April-2024

Q1) What makes the India-USA relationship unique is the presence of…

April 2024 Daily Current Affairs 6 April 2024 : Daily Current Affairs Daily Current Affairs

6-April -2024- Top News of the Day

1. India abstains from UNHRC vote that called…

April 2024 PIB 6 April 2024 : PIB Summary for UPSC PIB Summary for UPSC

6-April-2024

1. Hydroelectric power projects with aggregate capacity of 15 GW under…

April 2024 The Hindu Editorial 6 April 2024 : The Hindu Editorial Notes PDF The Hindu EDITORIAL

6-April-2024

1. Parliaments past, a mirror to changing dynamics

Topic: GS2 –…

April 2024 Indian Express 6 April 2024 : Indian Express Editorial Analysis Indian Express Editorial Analysis

6-April-2024

1. Waiting for summer

Topic: GS3 – Indian Economy…