18 July 2024 : The Hindu Editorial Analysis

1. Intergenerational equity as tax devolution criterion

(Source – The Hindu, International Edition – Page No. – 8)

| Topic: GS3 – Indian Economy – Issues relating to mobilisation of resources. |

| Context |

|

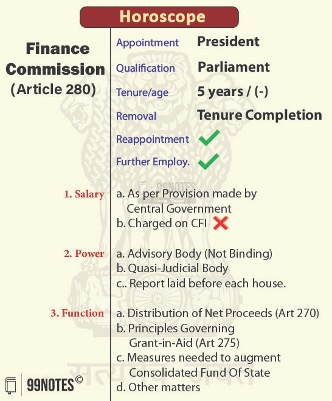

Introduction: Devolution of Union Tax Revenue

- The distribution of Union tax revenue to States is a key topic in both political and economic discussions.

- The Finance Commission (FC) revisits the horizontal distribution formula every five years, prioritising equity over efficiency.

- Equity in this context refers to intragenerational equity, aiming to redistribute tax revenue among States.

- This approach can lead to intergenerational inequity within States.

Intergenerational Fiscal Equity

- Intergenerational equity ensures equal opportunities and outcomes for all generations.

- It implies that current generations should not burden future generations with debt.

- Governments can raise revenue through taxes or borrowing; borrowing to finance current expenditures imposes future tax burdens, leading to intergenerational inequity.

- The Ricardian Equivalence Theory suggests that households save more when the government borrows, but this does not hold true in India’s federal context.

Horizontal Distribution Formula and Intragenerational Equity

- High-income States like Tamil Nadu, Kerala, Karnataka, Maharashtra, Gujarat, and Haryana raise significant tax revenue and finance their expenditures, whereas low-income States like Bihar, Uttar Pradesh, Madhya Pradesh, Rajasthan, Odisha, and Jharkhand rely more on Union transfers.

- During the 14th Financial Commission period (2015-2020), high-income States financed 59.3% of their revenue expenditure through their own tax revenue, compared to 35.9% in low-income States.

- Low-income States received 57.7% of their revenue expenditure from Union transfers, while high-income States received only 27.6%.

Federal Finance Aspects

- Low-income States finance less of their expenditure through their own tax revenue and rely heavily on Union transfers.

- High-income States finance more of their expenditure through their own tax revenue but receive fewer Union transfers.

- High-income States incur higher deficits due to lower Union transfers, while low-income States have lower deficits.

Public Expectations and Fiscal Behavior

- Citizens expect public services to match the taxes they pay, whether through State or Union government services.

- Discrepancies in fiscal behaviour can burden high-income States with higher tax payments for both present and future generations.

- Balancing intragenerational and intergenerational equity is crucial, requiring a balance of equity and efficiency in tax devolution.

Addressing Conflicting Equities

- The Financial Commission typically uses indicators like per capita income, population, and area in the distribution formula, reflecting demand for public services and available public revenue.

- These equity indicators carry more weight than efficiency indicators like tax effort and fiscal discipline.

- Efficiency indicators, based on State budgets, should be given more weight to influence fiscal behaviour positively.

Fiscal Responsibility and Incentivizing Efficiency

- States have Fiscal Responsibility Acts that limit deficits and public debt.

- Reduced Union transfers can compel some States to breach these limits.

- The Financial Commission should assign more weight to fiscal indicators, incentivizing tax effort and expenditure efficiency through larger Union transfers.

- This approach would ensure intergenerational fiscal equity and sustainable debt management by States.

Conclusion: Balancing Equity and Efficiency

- The Financial Commission’s role is to balance equity and efficiency in the distribution formula for tax devolution.

- This balance should address conflicting equity issues and promote fiscal discipline and sustainability.

- Proper implementation of fiscal indicators in the distribution formula can positively influence States’ fiscal behaviour, ensuring both intragenerational and intergenerational equity.

| PYQ: How have the recommendations of the 14th Finance Commission of India enabled the States to improve their fiscal position? (150 words/10m) (UPSC CSE (M) GS-2 2021) |

| Practice Question: Discuss the implications of the Finance Commission’s horizontal distribution of Union tax revenue on intergenerational equity and fiscal sustainability in high-income versus low-income States. (250 Words /15 marks) |

2. Choosing the right track to cut post-harvest losses

(Source – The Hindu, International Edition – Page No. – 8)

| Topic: GS3 – Agriculture – Supply chain management. |

| Context |

|

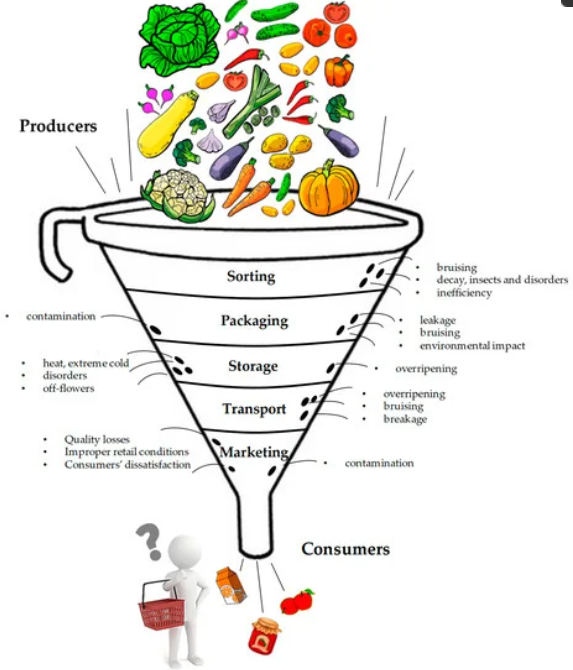

Causes of post harvest losses along the supply chain

India’s Agricultural Production and Export Challenges

- India ranks second in global agriculture production but is eighth in global agricultural exports with only a 2.4% share.

- Low productivity, inability to meet quality standards, and inefficiencies in the supply chain, including inadequate transportation and infrastructure, contribute to this disparity.

- Post-Harvest Losses: Annually, India faces approximately ₹1,52,790 crore in post-harvest losses, highlighting a significant issue in the agricultural supply chain.

The Magnitude of Post-Harvest Losses

- Perishable Commodities: The highest losses are seen in perishable commodities such as livestock produce (22%), fruits (19%), and vegetables (18%).

- Export Losses: During the export process, around 19% of food is lost, particularly at the import-country stage.

- Efficient storage, transportation, and marketing are essential to ensure perishable products reach consumers in time, a priority identified by the Committee on Doubling Farmer’s Income (DFI).

Logistical Challenges in Agriculture

- Complex Supply Chain: Includes first mile transport from farmgate to mandi, long haul transport by various means, and last mile transport to consumers.

- Small and Marginal Farmers (SMF): Constituting 86% of farmers, SMFs struggle with economy of scale and market connectivity, leading to significant post-harvest and income losses.

Food Price Volatility and Railway’s Role

- Price Volatility: Supply constraints affecting perishable produce contribute to food price volatility.

- Railway’s Freight Operations: Indian Railways’ freight transport is crucial, with 75% of its revenue from this sector, including agricultural produce.

- The Food Corporation of India relies on Indian Railways to move 90% of its food grains, while 97% of fruits and vegetables are transported by road.

Indian Railways’ Initiatives

- Truck-on-Train Service: Carries loaded trucks on railway wagons, with successful trial runs involving milk and cattle feed.

- Parcel Special Trains: Introduced during COVID-19 to transport perishables and seeds between markets and producers.

- Kisan Rail: Connects surplus production regions to consumption regions more efficiently, reducing post-harvest losses and enhancing farmer incomes.

Impact of Kisan Rail

- Case Study: Grape growers in Nashik, Maharashtra, saw a net profit of ₹5,000 per quintal using Kisan Rail, transporting about 22,000 quintals of grapes.

- Promising Results: Highlights the advantages of rail-based long-haul transportation of fruits and vegetables.

Challenges and Opportunities

- Farmer Awareness: Need to increase awareness and accessibility of farmers to Railway schemes.

- Logistical Touch Points: Multiple touch points during transport can be a challenge; investment in specialised wagons and rail-side facilities is essential.

- Food Safety: Specialised wagons can minimise spoilage and contamination risks, supporting both domestic and export markets.

- Emphasise streamlining loading and unloading processes and addressing staffing shortages through recruitment and training.

Environmental and Operational Efficiency

- Carbon Emissions: Rail transport generates up to 80% less carbon dioxide than road transport for freight traffic.

- Systems-Based Approach: Integration across modes of transport and geographies is necessary.

- Public-Private Partnerships: Private sector involvement can enhance operational efficiency and strengthen rail infrastructure.

Government Initiatives

- Budgetary Allocation for Agriculture 2024: Aims to bridge the farm-to-market gap with modern infrastructure and value-addition support.

- Complementary Railway Initiatives: Support efficient transportation of perishable goods and minimise post-harvest losses.

Conclusion

- Prioritising rail over road for transporting perishables promises efficiency and reduced losses.

- Efficient rail transport can improve livelihoods and support environmental sustainability, positively impacting future generations.

| Practice Question: Discuss the challenges faced by India in reducing post-harvest losses of perishable agricultural commodities and evaluate the impact of initiatives like Kisan Rail on mitigating these losses. (150 Words /10 marks) |