Finance Commission of India – UPSC Exam Notes

Finance Commission of India

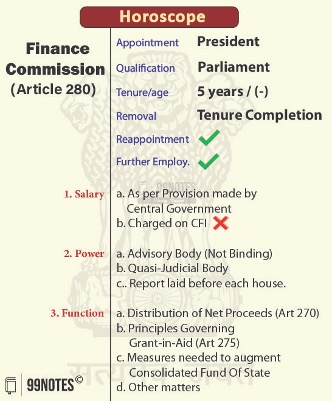

Article 280 of the Constitution of India provides for a Finance Commission, a quasi-judicial body that recommends principles by which fiscal horizontal and vertical balance can be maintained in the India’s Fiscal Federal Structure.

Article 270 makes provision for sharing of a share of central taxes with the states. Article 275 provides for statutory grants in Aid and Article 282 provides for discretionary grants for the states. In order to formulate fair principles based on which these grants can be provided to the state, role of finance commission becomes vital in the Indian polity.

Why is there a need for centre to share taxes with the States?

1. Need for Vertical balance in federalism:

In the Federal political structure of the Indian Constitution, there is a tendency in favour of the Centre. In fiscal matters, the Centre is much stronger than the states as the revenue-generating taxes, such as Income tax, corporate tax, and half of GST go to the Union.

| Some taxes levied by the Centre, State and Local bodies | ||

| Centre | States | Local bodies |

| Income Tax | State GST | Tax on Land and Building |

| Corporation Tax | Tax on Electricity | Vehicle Tax |

| Central GST | Excise Duty on Alcohol | Tolls |

| Customs | Stamp Duty | Entertainment Tax |

Thus, the constitution makers felt a need to make a constitutional provision to mandate the Union to share a portion of its tax revenue with the states under Article 270.

In this context, the Finance Commission has been created under article 280. The Finance Commission devises a formula to distribute the net tax proceeds between the Centre and states collectively; that is called vertical balance.

2. Need for Horizontal balance in federalism:

- The Finance Commission also tells how the taxes are to be distributed between different states to maintain the horizontal balance.

- Due to vast regional disparities (e.g. Himalayan States), some states are not able to raise adequate resources as compared to other better-positioned states. To maintain equity, the Finance Commission recommends special funds that can be shared with comparatively disadvantaged states from the Centre’s pool of taxes.

Composition of Finance Commission in India:

Article 280 mentions that a Finance commission should be established at every five year or earlier by the President through an order.

- Appointment and Removal: Since, the President can appoint the Finance commission at any time before five year, its appointment and removal is at the discretion of the President (i.e. the government).

- The Finance Commission comprises the Chairman and four other members.

- The tenure and the salary are decided by the order of the President.

The government generally appoints the Finance commission and provides it with a term of reference document, to serve as guiding principles in order to make its recommendations. The commission then studies the fiscal balance of the country and submits its recommendations via a report, which is then laid before the Parliament.

| Terms of Reference |

| Terms of reference (ToR) are the guidelines by the Central Government to the Finance Commission on the basis of which the Finance Commission has to frame a report. |

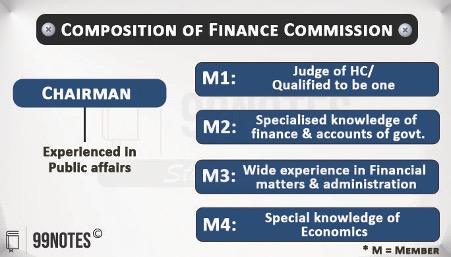

Qualification of Members of Finance Commission

Article 280, leaves it upon the Parliament to decide on the selection process and qualification of the members. Thus, the Finance Commission (Miscellaneous Provisions) Act, 1951 was passed by the Parliament, which mentions the following qualification:

- Chairman: Experienced in public affairs

- Member 1: Judge of high court or qualified to be appointed as one.

- Member 2: Specialised knowledge of finance and accounts of the government.

- Member 3: Wide experience in financial matters and administration.

- Member 4: Special knowledge of economics

They are eligible for reappointment.

Functions of the Finance Commission

The constitution mandates the Finance Commission to make the following recommendations to the President of India:

- The division of the net proceeds of taxes to be shared between the states and the Centre and its allocation between the states.

- The principles under which the grants-in-aid to the states should be given by the Centre (i.e. out of the Consolidated fund of India).

- Measures to increase the consolidated fund of a state to supplement the panchayats and the municipalities’ resources in the state based on the recommendations issued by the State Finance Commission (SFC).

- Any other issue that the President refers to in the interest of sound finance.

| Grants |

We have already seen in the Centre state relations article that the taxation powers in India are skewed towards the Centre. In order to financially assist the states, the constitution of India makes a mechanism of ‘Grants’ which the Union can utilise. The constitution provides two types of grants:

|

Powers of Finance Commission:

On the basis of the functions, as mentioned above, through the Finance commission act, 1951, various powers have been given to the Finance commission:

- It is Advisory Body: the recommendations of the finance commission have neither been made binding as per the constitution nor through the act.

- Quasi-Judicial power: Finance commission has the power of the civil court as per Code of civil procedure, and thus, it can:

- Summon and enforcing the attendance of witnesses;

- Require the production of any document;

- Requisite any public record from any court or office.

Note: These powers are vital, since in order to make recommendations, it may require to investigate into financial position of the states and the Union.

- The Report of the finance commission has a constitutional mandate –

-

- The President receives the Commission’s report, and presents it to both the Houses of Parliament together with an explanatory memorandum as to the action taken on its recommendations.

- Therefore, the recommendations of the Finance commission cannot be turned down, unless compelling reasons are given.

Major recommendations of 15th Finance commission

N.K. Singh chaired the 15th Finance Commission. The Commission was required to submit its report by October 2019, but the deadline was missed, and therefore it submitted two reports based on the terms of reference provided by the government:

- The first report was an interim report tabled in Parliament on February 2020, which consisted of recommendations for the financial year 2020-21.

- The final report was tabled in Parliament on February 1, 2021, with recommendations for the 2021-26 periods.

The recommendations reported were:

- The share of states in the central taxes for the period 2021-26 is recommended to be 41%, which is same as that for 2020-21, on the basis of following criterion:

| Criteria | 14th FC

2015-20 |

15th FC

2020-21 |

15th FC

2021-26 |

| Income Distance | 50 | 45 | 45 |

| Area | 15 | 15 | 15 |

| Population (1971) | 17.5 | – | – |

| Population (2011) | 10 | 15 | 15 |

| Demographic Performance | – | 12.5 | 12.5 |

| Forest Cover | 7.5 | – | – |

| Forest and Ecology | – | 10 | 10 |

| Tax and Fiscal efforts | – | 2.5 | 2.5 |

| Total | 100 | 100 | 100 |

Note: According to the terms of reference, the Commission was required to use the population data of 2011 Census (instead of 1971) for its recommendations. Therefore, the states which had controlled their population growth since then were at disadvantage. Thus, demographic performance has been introduced as a new criterion, which awards states with lower fertility rates.

- Fiscal deficit: The Commission advised that the Centre should reduce the fiscal deficit to 4% of GDP by 2025-26. For states, it advised the fiscal deficit limit (as % of GSDP) of:

- 4% in 2021-22,

- 5% in 2022-23, and

- 3% during 2023-26

- Reduction in total liabilities: The liability of the Centre will decline from 9% of Gross domestic Product (GDP) in 2020-21 to 56.6% in 2025-26The liability of states collectively will decline from 33.1% of GDP in 2020-21 to 32.5% by 2025-26.

- Evaluate the Fiscal Responsibility and Budget Management Act (FRBM), and advise a new FRBM framework for Centre as well as states and oversee its implementation.

- GST: The rate structure should be simplified by merging the rates of 12% and 18%. States should make efforts to expand the GST base and ensure compliance.

Major recommendations of 14th Finance Commission |

| a. Distribution of Divisible pool of Central taxes: Share of states in the net proceeds of the shareable Central taxes should be 42% from 32%.

b. Horizontal Criterion: It has used following broad parameters – Weightage also given to 2011 population along with 1971 population. b. Fiscal Related recommendation: a. Revenue deficit to be progressively reduced and eliminated. b. Fiscal deficit to be reduced to 3% of the GDP by 2017–18. c. A target of 62% of GDP for the combined debt of centre and states. |

16th Finance Commission – Term of Reference |

| The government has indicated that it will not delay the constitution of the 16th Finance Commission. The government has approved the terms of reference for the commission.

The 16th FC shall make its report available by the 31st of October 2025, covering 5 years commencing on the 1st of April 2026. |

Challenges for Finance Commission

- Issue with the Appointment: The selection of the members of the Finance Commission by the Centre has been criticised by the States as against the principle of federalism.

- Little Consultation with states: The terms of reference are generally framed without the consultation of the states. E.g.- 14th FC had used the 1971 Census formula for the horizontal distribution of taxes among states. However, the 15th FC was ordered to use the 2011 Census data, to which the Southern States objected.

- Operational Issues:

- Quality of data – The Finance Commission depends on the data provided by the Government to frame its recommendations. Many times, these data are outdated, inconsistent, and incomplete, causing serious quality issues.

- Competing Demands – It is a challenge to comprehensively balance the interests and adjust the demands of all three tiers of Government.

- Issues with the Implementation:

- No control over implementation – The Finance Commission has no direct control over how its recommendations are executed or monitored. They also face problems such as non-compliance, misuse or deviation of funds.

- Non-Acceptance of Recommendations – The Finance Commission is an advisory body. The Central Government and the state government may choose not to accept the important recommendations of the Commission.

- Poor Coordination – Lack of coordination or disagreements between the Union and the States can influence the implementation of reforms.

- Grants based on Conditions – Some grants will be provided based on the conditions fulfilled by the states. To fulfil those conditions and receive grants, the state government may end up spending more reckless money or less money than adequately required, creating obstacles in the implementation of policies/schemes.

- Increasing Central Government’s Debt – Mounting debt in the backdrop of global recession causes serious concern as to the acceptance of the Commission’s recommendation for devolution of taxes to the States.

- Increasing indivisible pool of taxes – There is a growing concern among States as the Central Government is increasing Cess and Surcharges, which is not shared with the States, thereby impacting their revenues.

- GST Council Functioning – The decisions taken by the GST Council can impact the revenue projections and computations made by the Finance Commission which in turn can affect the financial resources available for sharing to States.

- Insufficiency of Funds – There is a possibility that the funds allocated for specific reforms may not be sufficient, resulting in poor implementation since financial constraints can limit the availability of resources.

- The Chairman of the Fourth Finance Commission, Dr. P.V. Rajamannar, highlighted how the Finance Commission and the former Planning Commission had similar but overlapping functions and responsibilities.

Way Forward

- Use of the Inter-state Council for the determining of the term of reference of the finance commission

- Selection of the Chairman and members of the Finance Commission should be based on a selection committee to reduce the discretion of the Centre.

- Recommendations should be binding on the Government. Otherwise, it has to submit reasons in Parliament for non-acceptance of the Finance Commission’s recommendations.

- Increasing the power of the Financial Commission to increase the divisible pool by including cess, surcharge, etc.

- Capacity building of the Finance Commission to have a research wing for independent data collection and research.

The Finance Commission is an essential organisation for fiscal federalism. It has to be working on the principle of cooperative federalism to promote the state’s interest. Centre and state coordination are needed to achieve fiscal federalism through the Finance Commission.