Industrial Infrastructure UPSC

Infrastructure is the set of provisions that serve a country, city, or other area. It encompasses the services and facilities necessary for its economy, households, and firms.

In a similar sense, industrial infrastructure is the set of provisions that are needed to serve the needs of the manufacturing sector. These may include public infrastructure, such as dedicated freight corridors or private infrastructure, such as oil refineries.

Special Economic Zone (SEZ)

As per the World Bank, a SEZ generally comprises a “geographically limited area, usually physically secured, single management, separate customs area eligibility for benefits based upon physical location within the zone, and streamlined procedures.”

The World Bank shaped the following table to clarify distinctions between types of SEZs:

| Type | Objective | Size | Typical Location | Typical Activities | Markets |

| EPZ (hybrid) | Export manufacturing | <100 hectares | None | Manufacturing, processing | Export, domestic. |

| EPZ (Single Unit/free enterprise) | Export manufacturing | No minimum | Countrywide | Manufacturing, processing | Mostly export. |

| EPZ (traditional) | Export manufacturing | <100 hectares | None | Manufacturing, processing | Mostly export. |

| Freeport/SEZ | Integrated development | >1000 hectares | None | Multi-use | Internal, domestic, and export. |

| FTZ | Support trade | <50 hectares | Port of entry | Entrepôts and trade-related | Domestic, re-export. |

| Urban enterprise zone | Urban revitalisation | <50 hectares | Urban/rural | Multi-use | Domestic. |

Development of Special Economic Zones (SEZs) Policy

- Special economic zone(SEZs)policy,2000: It promotes SEZs, intending to overcome the shortcomings due to the lack of world-class infrastructure, the multiplicity of clearances and controls, and a volatile fiscal regime to attract more significant foreign investments in India.

- From 2000 to 2006, SEZs operated under the provisions of FTP & fiscal incentives were made effective through the provisions of relevant statutes.

- Special Economic Zones Act, 2005: After consultations with various stakeholders, the SEZ Act, 2005 (supported by SEZ Rules)came into effect in 2006, simplifying procedures and single window clearance on affairs relating to both state and central governments.

- In 2019 Baba Kalyani Committee was established to review the SEZ policy.

The SEZ Rules provide for the following:

- Simplified procedures for the SEZ’s progress, functions and maintenance and for putting units and carrying business in SEZs.

- Single window clearance for establishing SEZ or a unit in an SEZ.

- Simplified compliance procedures and authentication with an emphasis on self-certification.

- Tax exemptions:

- No MAT, CST and so on;

- 100% tax exemption from export income for the first 5 years;

- 50% of the ploughed back export profit for the next 5 years.

Approval mechanism Special Economic Zones:

The developer submits the proposal for establishing SEZ to the concerned State Government. The State Govt has to forward the blueprint to the Board of Approval with its recommendation within 45 days from the date of acquirement of the proposal; the applicant can also directly submit the proposal to the Board of Approval.

Administrative set-up for Special Economic Zones:

A three-tier organisational set-up governs the administration of the SEZs:

- The apex body is the Board of Approval, headed by the Secretary, Department of Commerce, Ministry of Commerce & Industry.

- The Approval Committee approves SEZ units and other associated issues at the Zone level.

- A Development Commissioner, the ex-officio chairperson of the Approval Committee, heads each zone.

- The Approval Committee consists of the following:

- Development Commissioner,

- Customs Authorities and

- representatives of the State Government.

Export Processing Zone (EPZ)

It is defined as an area enjoying exceptional support from the government of India concerning fiscal stimulants, tax rebates and other exclusive benefits for export growth.

Objectives of the Export Processing Zones

Objectives of EPZs Export Processing Zone (EPZ)

Asia’s first EPZ was set up in Kandla in 1965. India was one of the first in Asia to recognise the effectiveness of the EPZ model in promoting exports.

· Export-Oriented Zone (EOU):

The main objectives of the EOUs are to boost exports, earn foreign exchange for the country by stimulating FDI, transfer of latest technologies, and generate additional employment.

· Differences between SEZ and EOU

| Factors | SEZ | Export-Oriented Zone(EOU) |

| Location | Demarcated custom bonded areas notified by Govt. | Any industrial or commercial area. |

| Conversion | Not allowed. | Permissible. |

| Investment criteria | No criterion. | · Minimum investment of 1 Crore in plant and machinery.

· Not applied in agriculture, handicraft, handmade jewellery and so on. |

| Period of utilisation | Duty-free goods for 5 years. | Duty-free goods for 3 years. |

| Trading Units | Allowed within SEZ. | Discontinued. |

| Foreign investment | 100% FDI allowed. | FIPB approval. |

| Infrastructure | Much better | They are not as good as SEZs. |

| Income Tax | 100% deduction on export income for 5 yrs + 50 for the next 5 yrs. | Relief for 10 straight years. |

National Investment and Manufacturing Zones (NIMZs):

It is an essential instrumentality of the National manufacturing policy. In addition, NIMZs aim to provide a productive environment for persons transitioning from the primary to the secondary and tertiary sectors.

Differences between NIMZ and SEZ

| Factors | NIMZ | SEZ |

| Origin | Under national manufacturing policy. | Under SEZ act. |

| Minimum Area | 5000 ht. | 10-1000 ht depending on the sector. Smaller for gems/jewellery/IT. |

| Maximum Area | Not specific. | 5000 ht. |

| EIA | State government. | The project developer. |

| Energy | Part of the electricity must be procured from

Renewable sources. The state government will give subsidies. | No such requirement. |

| Does the government give special preference to these units in procurements | Yes. | Not Clearly specified. |

| Innovation/ | The state government will pay 50 %fees for international patent applications.

Tax exemption on money spent on various certificates. | Not Clearly specified. |

| Single window clearance to file | Yes. | Yes. |

Industrial corridors

An Industrial corridor is an infrastructure facility allocated to a geographical area intending to stimulate industrial development.

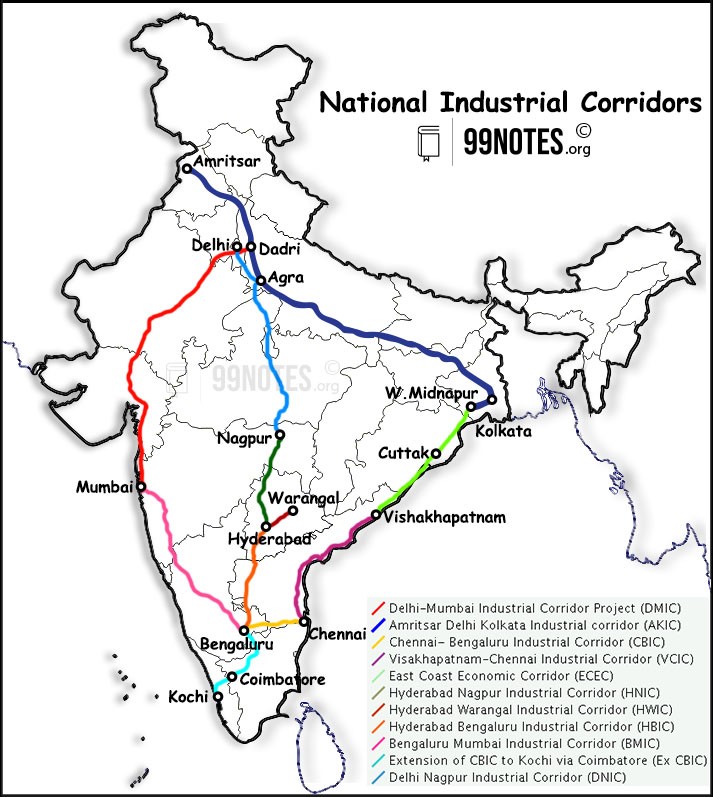

National Industrial corridor programme:

- The Government of India thrives in different industrial corridors nationwide to boost the National Industrial Corridor Programm This project will be implemented by the National Industrial Corridor Development Corporation Limited (NICDC).

- It will function under DIPP, Ministry of Commerce & Industry and consist of members from:

- M/o Railways, M/o Road Transport & Highways, M/o Shipping,

- Vice-Chairman of NITI Aayog and

- CMs of states concerned.

- Function: Apex body to oversee integrated development of all industrial corridors nationwide.

- Features of NICP:

- Cluster-based approach.

- Often created in areas that have pre-existing infrastructure, such as ports, highways and railroads.

- Easy supply chain linkage.

- Multi-model transport; Ex: DMIC – connects via rail & Roads.

- Promoting Labour incentive sectors.

- Inviting Private investment in construction.

- Cooperative federalism: partnership with respective State Governments for boosting industrial development.

- Five industrial corridors were proposed, which will cover 15 States; they are:

- Delhi Mumbai Industrial Corridor (DMIC): it spans the States of UP, Haryana, Rajasthan, MP, Maharashtra and Gujarat. It runs along the Western Dedicated Freight Corridor of the railways. Initially, 8 nodes/cities in the six DMIC states have been taken up for development.

- Bengaluru-Mumbai Economic corridor (BMEC): Dharwad (Karnataka) is an Industrial node with the UK’s help.

- Chennai Bengaluru Industrial Corridor (CBIC): Funded by Japan International Cooperation Agency (JICA). Three industrial nodes have been completed so far:

- Ponneri (Tamil Nadu),

- Tumkur (Karnataka),

- Krishnapatnam (Andhra Pradesh).

- Vishakhapatnam Chennai Industrial Corridor (VCIC): It is a part of the Eastern Coastal Economic Corridor (EEC), which runs along Kolkata to Tuticorin. It is being funded by Asian Development Bank (ADB). The following two nodes for master planning have been identified:

- Visakhapatnam (Andhra Pradesh),

- Srikalahasti-Yerpedu (Andhra Pradesh).

- Amritsar Kolkata Industrial Corridor (AKIC): It covers Punjab, Haryana, UP, Uttarakhand, Bihar, Jharkhand and West Bengal. It runs along the Eastern DFC of railways.

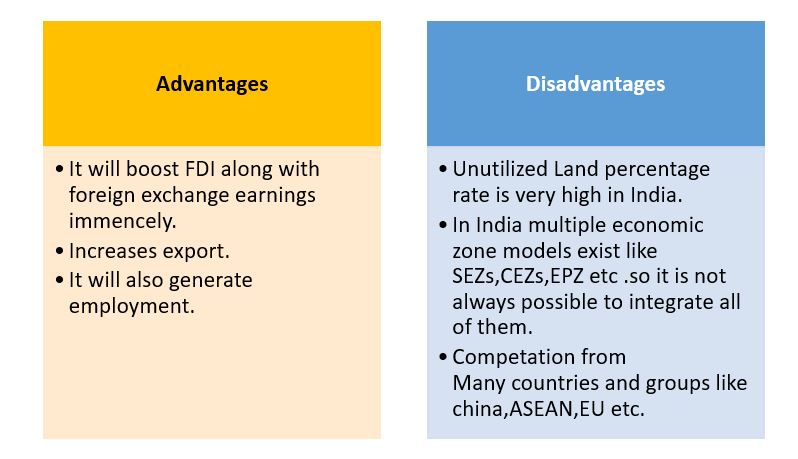

Significance of Industrial corridors:

- Economic Significance:

- Avenues for Exports.

- Lowers Logistic costs.

- It will create further Job Opportunities.

- It will mitigate migration.

- Enhance the Opportunities for private sector investmentin the infrastructure projects associated with the exploitation of industrial opportunity.

- Import substitution.

- Environmental Significance:It will confine the concentration of industries in one particular location, which exploits the environment beyond its carrying capacity and causes environmental degradation.

- Socio-Economic Significance:

- Setting up industrial townships, educational institutions, and hospitals.

- Further, raise the standards of human development.

- Preserving family as an institution by preventing migration.

- Regional equality/social integrationin the country.

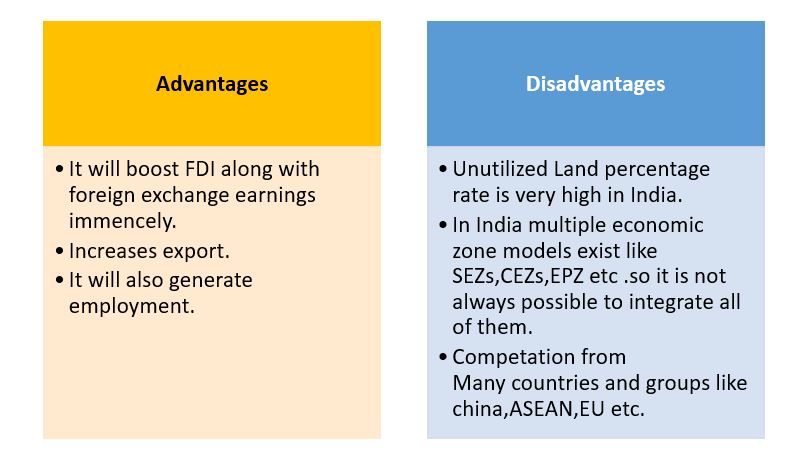

Challenges Associated with Industrial Corridors:

- Land Acquisition: It has been slow because of legal hurdles and the amount of compensation.

- Technological Know-how:India lacks technological know-how in certain sectors.

- Taxation regime:Needs to fairly identify the tax liabilities of foreign firms functioning in India as permanent establishments.

- Macroeconomic stability: A stable exchange rate is necessary for foreign players with investments in India can avoid currency risks.

- Massive investment is required.

- Fear of broadening the Urban-Rural gapin terms of HDI.

Way Forward

It would be prescient to raise FDI caps to accommodate foreign players to fetch the requisite technical know-how and foster Indian investment in setting up accessary and auxiliary industries in that sector.

DONE IN ROADWAYS

Coastal Economic Zone (CEZ)

- It has been envisaged to facilitate port-led industrialisation and/or Export-Import (EXIM) / coastal trade of goods & commodities.

- CEZ is a spatial economic region comprising a large area in a single district or a group of coastal districts or district(s) with strong linkage to ports in that region/vicinity with an intent to reduce the logistics costs from demand/supply centre to port and vice versa.

- It has a dual focus – direct contribution of port traffic coupled with employment generation and reduction of logistics costs.

- Such a zone is envisaged to comprise industrial areas/estates, housing & urban infrastructure, and logistics/transport infrastructure to be a self-contained region with a direct or a strong port linkage.

Objectives:

- Creating large-scale employment opportunities in the coastal regions across identified sectors to promote development in the coastal areas.

- Increasing India’s EXIM trade competitiveness by reducing logistics costs through proximity and port connectivity.

- Increasing freight traffic through the ports near the industries on account of trade generated by these manufacturing capacities.

- Provide an impetus to coastal shipping by creating supply and demand centres close to the coastline for the domestic movement of goods and passengers.

DONE IN WATER TRANSPORTATION

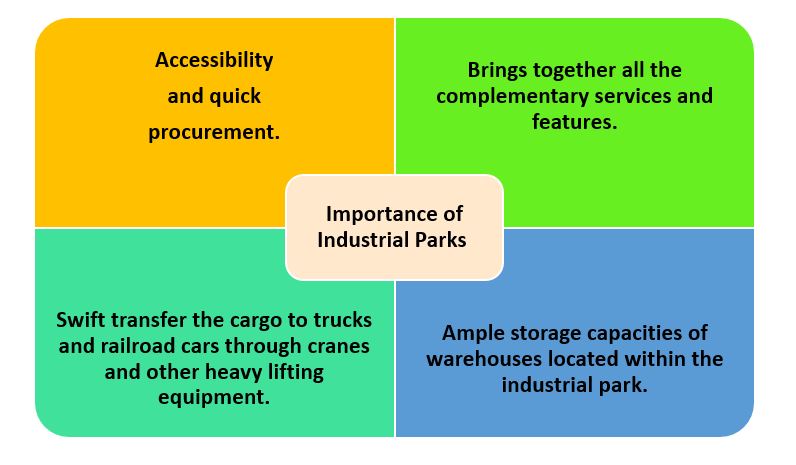

Industrial park:

- It is an area zonedand planned for industrial development. Industrial parks are notable for being relatively simple to build; they often feature speedily erected single-space steel sheds, occasionally in bright colour.

- The Industrial Park Scheme, 2008, was announced by the CBDT, which is under the Ministry of Finance.

- Since 2014, the central government has not maintained industrial parks. However, the Department for Promotion of Industry and Internal Trade (DPIIT) has built one centralised system of industrial park updates available at the Industrial Information System (IIS). The concerned States are updating the details at regular intervals.

- The Department for Promotion of Industry and Internal Trade (DPIIT) recently released the Industrial Park Rating System (IPRS).

- IPRS was organised as a pilot-level exercise in2018 with support from Asian Development Bank and its knowledge partner PwC.

- The Industrial Parks in India often lack professional management and maintenance, so all stakeholder-based management is the need of the hour.

Challenges Associated with Industrial park:

- Gathering heavy industry in one place, like industrial parks, can raise environmental hazards in the long run.

- The ceaseless movement of cargo can lead to traffic congestion in the area.

- The occurrence of excess noise, metallic and non-metallic pollution can lead to serious health hazards for the residents.

Way forward:

Industrial parks will boost India’s efforts to lead the world in the 4 th Industrial Revolution(IR). Effective execution and implementation of all the government programmes could help India take a significant leap in the USD 5 trillion economy target by 2025-26.