Civil Aviation : Importance, Status, Policies & Challenges

Civil Aviation Sector in India

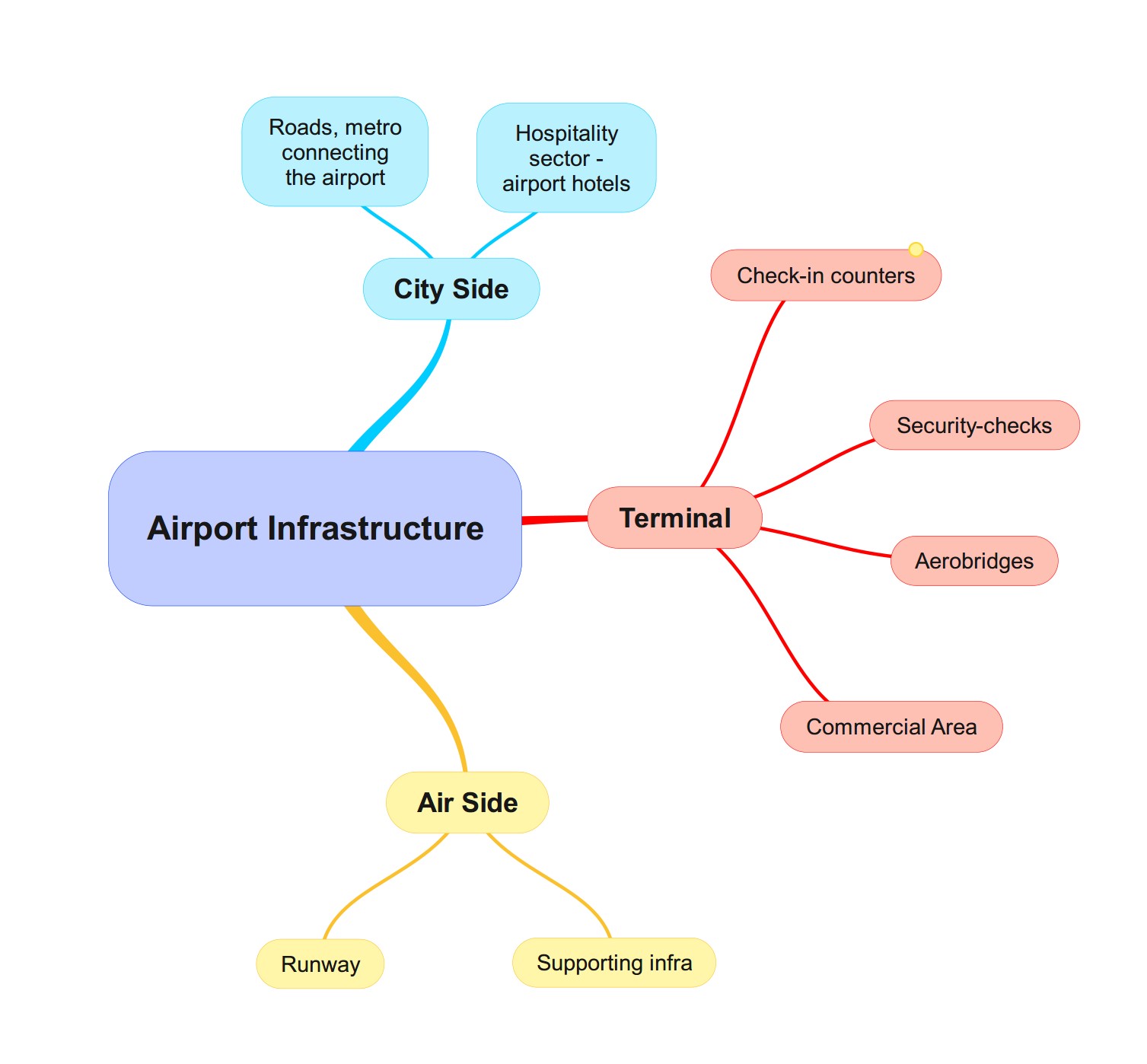

Civil aviation infrastructure is one of the most complex infrastructure systems. It majorly comprises aircraft manufacturing, air traffic control, and airport. But it also includes cargo-handling facilities, telecommunications, navigation and surveillance facilities, tourism, repair and overhaul resources, avionics manufacturing, repair and design capabilities, and flight training facilities.

Importance of Civil Aviation:

Civil aviation is an important sector well-aligned with the aspirations of India as a developed and prosperous nation.

- Multiplier Effect: Investment in Civil Aviation produces a huge multiplier effect. For every ₹1 spent on air transport, a benefit of ₹3.5 accrues to the economy, and for every direct 100 jobs created in air transport, 610 new economy-wide jobs are generated (ICAO).

- Well-established air connectivity within the country is essential from political, economic, social, and cultural standpoints.

- Employment Generation: The sector catalyses employment generation and boosts the economic growth of a region.

- Regional Development: It is a crucial pillar in balanced regional development. Also, excellent global air connectivity attracts foreign businesses and tourists to India, opens opportunities for Indians in foreign countries, and integrates India into the global village.

- Forward and Backward Linkage: It has linkages with many industries such as tourism, high end manufacturing and even sectors like Agriculture. It has backward linkages with sectors like Petroleum and Maintenance, Repair and overhaul (MRO) sector.

Status of Civil Aviation in India:

- Market Size: India is the 3rd largest domestic aviation market globally, after the US and China.

- Diversification of market: Traditionally, the focus of airport infrastructure has been on the metros, but over the last few years focus has been on the Tier-1 and Tier-2 markets.

- Growth: The growth in the sector has been phenomenal. India’s international airports are not just confined to metros anymore.

Factors pushing growth of Aviation sector in India:

According to the Economic Survey of India 2022-23, India’s aviation sector has a “great potential” driven by the following:

- Growth in population and tourism.

- Rapid urbanization.

- Growing demand from the middle class.

- Higher disposable incomes.

- Favourable demographics.

- Greater penetration of aviation infrastructure.

- The untapped potential of the tourism sector.

- The ideal geographical location between the eastern and western hemispheres.

- Low barrier entry

- Ease of doing business.

Challenges faced by Civil Aviation Sector in India

- Capacity Constraints:

- The lack of airport infrastructure is the weakest link in the growth of the aviation sector. Indian airports find it difficult to face a surge in passenger traffic. Mumbai and Delhi airports are close to saturation with increasing congestion.

- Lack of air traffic infrastructure.

- Low share in the international air traffic:

- A limited number of international airports: Currently, only 34 international airports are operational in India. Smaller international airports face issues starting their international operations.

- Fleet constraints

- Regulatory constraints: Earlier, a carrier could start flying abroad only if it had 20 aircrafts and 5 years’ service experience (The 5/20 rule). Now, an Indian Carrier can start flying immediately – making it 0/20 Rule. Even this is can be relaxed further.

- Foreign airlines are using the 6th freedom of air. Lower utilization of India’s capacity entitlements under bilateral air services agreements.

- The adverse impact of currency volatility.

- Aircraft fleet ‒ small size, old aircraft.

- Maintenance Repair and Overhaul (MRO) – 90% of Indian for maintenance goes outside India to the countries like Singapore, Sri Lanka, Malaysia, UAE. This is because of various factors:

- Lack of skilled workforce

- Lack of latest technologies and spare parts in India.

- Custom Duties discourages MROs from stocking parts on behalf of customers making repairs uncompetitive.

- No Major player: Only MSME sector is involved in the MRO sector in India.

- Bottlenecks to

- High-cost, low-fare operating environment: High cost of operations is mainly due to fuel price hikes, whereas fares are depressed due to intense competition among low-cost and premium airlines. It affects the profitability of the airline.

- Fuel prices have risen drastically in the past 2 years due to high demand from the relaxation of Covid-restrictions and the Russian-Ukraine war.

- Non-viability of smaller airports.

- Ease of Doing business:

- Slow implementation of regional connectivity schemes, expansion, and modernization plans.

- Due to many basic formalities and procedures, the ease of doing business takes a hit.

- Air safety and security – mainly due to the old fleet, lack of upgraded technology and skilful workforce.

- Poor domestic Manufacturing of Aircraft and spares

Initiatives taken by the government in the Civil Aviation Sector:

1. Investments taken to boost investment:

100% FDI is allowed under automatic route for ‘Greenfield Projects’ and ‘Brownfield Projects’.

-

- Greenfield Airports (GFA) Policy – 2008 provides guidelines, procedure and conditions for establishment of new Greenfield Airports in the country.

- Government of India has so far accorded ‘In-Principle’ approval for setting up of 21 Greenfield Airports across the country.

National Infrastructure Pipeline (NIP) – Under this scheme a CAPEX of more than Rs.98000 crore has been allotted to increase the number of airports to 220 by 2024-25 from current 147 airports.

National Monetisation Pipeline

-

- Under this, 25 airports of the Airport Authority of India are set for asset monetization between 2022-2025.

- It will boost private investments in aviation infrastructure.

- A component of this is the bundling model, where smaller airports with low traffic are bundled with larger (and relatively more attractive) airports to channel private investments in smaller airports.

2. National Civil Aviation Policy 2016 (NCAP 2016)

| National Civil Aviation Policy (NCAP) 2016 |

| • Main aim: To make regional air connectivity a reality by establishing an integrated ecosystem and enhancing the ease of doing business through deregulation, simplified procedures, and e-governance.

• Features: • It laid the foundations for regional air connectivity. • Relaxed the 5/20 rule – making it 0/20 Rule. • Provides an incentive for boosting Maintenance Repair and Overhaul (MRO) business. • Focus on the development of airports in the PPP model. • Separate regulations for helicopters and charter planes and aviation education and skill building. Helicopters are free to fly between two points below 5000 feet without requiring the clearance of ATC (Air Traffic Control). • Promotes ‘open sky’ policy whereby the government is to enter into an air services agreement with the SAARC countries and the countries beyond a radius of 5000 km from New Delhi. • It adopts a hybrid-till model for the privatization of airports. |

3. Regional Connectivity Scheme RCS – UDAN policy – under NCAP 2016

Regional Connectivity Scheme (RCS) – Ude Desh Ka Aam Nagrik (UDAN) |

||||||||||

| • Aim: To increase regional connectivity and penetration by reviving unserved and underserved airports in Tier II, III and IV cities. It is a mission to make flights accessible to the common person. It is a market-driven scheme.

• The Airport Authority of India is the implementing agency and provides Viability Gap Funding (VGF) to the selected airline operators (SAO). SAOs will get the exclusive rights to operate the UDAN flights for three years on the awarded route under the UDAN scheme. • The scheme has provisions for concessions like: o Rebate on levies or charges imposed by the airport operators. o Excise duty at 2%. o VAT at 1% o Subsidized parking charges at airports. o Exemption from the GST net. • RCS is available only for states and airports willing to provide concessions required under the scheme. • A Regional Connectivity Fund will subsidize the operations under the RCS. • Airfares have been capped at ₹2500 for a 1-hour journey of approximately 500 km on an aircraft or a half-hour journey on a helicopter. • The SAO will have to commit 50% of the seats on RCS flights and up to 13 passengers on helicopters as RCS seats. • The central government will cover 80% of the losses in subsidy, and the states will cover the rest. For the north-eastern states and the union territories, the ratio is 90:10. • The benefits under the scheme are available for 10 years from the date of its notification.

• Recent steps: o 220 new airports have been announced to be built by 2025, and 15 new flight training schools. o 400+ routes have been identified under the scheme. o 100+ aircraft will be added every year. o RCS-Small Aircraft Sub-Scheme: It intends to facilitate the creation of an ecosystem for small aircraft operations in the country. It will focus on sub-20-seater aircraft to provide last-mile connectivity. Such planes would be manufactured domestically, boosting Make In India. Significance of UDAN Scheme: • Boost to One District One Product Scheme. • Boost growth in the domestic civil aviation market. • Enhanced regional connectivity and balanced regional development. Stimulate rural development. • A great leap towards ‘One Nation One Market’. • Development of allied sectors Ex: MRO sector. • Promotes tourism. • Makes flying affordable for the masses. • Boost to One District One Product Scheme.

|

Other initiatives in Civil Aviation

- International UDAN: An extension of the domestic UDAN scheme, it aims to connect India’s smaller cities directly to some key foreign destinations in the neighbourhood. It aims to make use of the open skies agreement that India has with other Asian countries. Only the state government is mandated to provide financial support for flights under the international UDAN.

- Krishi UDAN: It aims to increase farmer income by helping them realize remunerative prices on their produce in an larger market unlocked by transporting their produce by air. Krishi UDAN 2.0 emphasizes the food products from remote locations like the hilly areas, north-eastern States and tribal areas.

- NABH NIRMAN – aims to increase the number of airports and the traffic handling capacity of airports by more than five times the capacity to handle a billion trips a year. It has 3 aspects for building airport capacity:

- Fair and equitable land acquisition.

- Long-term master plan for airport and regional development.

- Balanced economics for all stakeholders.

- Flexible Use of Airspace (FUA)

- Indian Air Force (IAF) controls 30% of national airspace out of which 30% has been released as upper airspace under Flexible Use of Airspace.

- Rationalization of tax on ATF have been undertaken by several states.

- Safety:

- GAGAN (GPS-Aided Geo Augmented Navigation) System – An air traffic control (ATC) system for safety and reducing congestion.

- The Aircraft (Investigation of Accidents and Incidents) Rules 2017 lays down the procedure for speedy and accurate investigation of accidents.

- A new policy for MROs has been announced.

- It reduces the regulatory burden inherent in the previous policy. Royalty has been completely done away with; rents have been normalized.

- With many aircraft planned, there is a push towards setting up MROs in India; specifically, the OEMs (Airbus, Boeing, etc.) are being encouraged to set up MROs in India. It can make India a base for reverse engineering.

- Given its geographical location, India can become an MRO hub for the rest of Asia.

- More Flying Training Organisations (FTO) are being added.

- 34 DGCA-approved FTOs are operating at 52 bases in the country.

- Drone policy

- PLI Scheme has been announced for Drone.

- Liberalised Drone Rules, 2021 has been notified.

- DigitalSky Platform launched.

- Bharat Drone Mahotsav 2022 was organised.

- Improving Domestic Manufacturing:

- C-295 aircraft manufacturing facility in Gujarat

- A new helicopter policy has also been announced.

- Improving User experience:

- DigiYatra – To bring together the entire aviation industry to develop a digital ecosystem to provide travellers with a seamless, paperless, consistent service experience.

- AirSewa 2.0 – provides information on flight delays, refund issues, easy check-ins, complaints, etc.

Way Forward

- Concept of airport hubs: An airport hub is a common point that connects several source-destination pairs with non-stop flights and serves several airlines. India is advantageously positioned geographically like Singapore. Its benefits are:

- Choice and flexibility: Airport hubs allow for a maximum combination of source-destination flight pairs. As a result, the users get a larger number of flights and destination choices and higher service frequencies.

- It creates an economy of scale for the airport and the airlines.

- Increased viability of city pairs.

- Lower ancillary costs.

- Future airport master plans need to integrate aspects of inter-modal connectivity, and logistics support infrastructure (warehousing)

- Rationalizing duties and taxes.

- Ex: Bringing ATF (aviation turbine fuel) under GST will enable airlines to reduce costs.

- Pass on the increase in fuel costs in a calibrated manner rather than artificially keeping the fares low.

- The 0/20 rule should be further diluted to the 0/0 rule.

References: It is time India plans a hub airport flight path – The Hindu

![What Is Social Infrastructure: Meaning, Importance &Amp; Challenges [Upsc Notes] | Updated July 27, 2024 What Is Social Infrastructure: Meaning, Importance & Challenges [Upsc Notes]](https://99notes.in/wp-content/uploads/2023/05/social-infrastructure-99notes-upsc-1-768x512.webp)