Infrastructure Financing- Complete UPSC notes

Infrastructure Financing

Infrastructure Financing refers to the set of mechanisms devised to Fund Infrastructure projects. Financing is the most critical aspect of infrastructure creation.

Mechanisms of Infrastructure Financing

There are various mechanisms used to finance Infrastructure:

- Government funding – Government often makes budgetary provisions for Infrastructure funding. The Department of Economic Affairs (DEA), under the Ministry of Finance, overlooks the public financing of Infrastructure in India

- These are generally a part of Capital Budget allocation.

- However, sometimes allocations can be made through the central sector schemes or centrally sponsored schemes which form a part of the Revenue budget, for example, in the case of Swachh Bharat Abhiyan, which funds the creation of toilets.

- Private funding – Investment funds

- Bonds: For example, Masala Bonds, Green Bonds etc., are used to raise funds from international markets.

- Disinvestment & Privatisation: Government has found it easier to encourage private players to invest in India through privatisation. For example, Tatas bought Air India.

- Raising funds from the International market in the form of Foreign Direct Investment (FDI) or Foreign Portfolio Investment (FPI).

- Raising funds from the Domestic market: Domestic private investors often invest in financial instruments like Infrastructure Investment Trusts (InvITs), Real Estate Investment Trusts (REITs) etc., which invest in Infrastructure.

- Public Private Partnership Models – It is an arrangement between the government and private sector for the provision of public assets and/or public services.

-

- It is a means to distribute the risk between the government and the private players.

- These are discussed in the article related to PPP investment models in greater detail. Here is the gist of these models:

| Finance

(Investment) |

Revenue

(Toll) |

Operation and Management | |

| Build Operate Transfer (BOT) | Private | Private | Private |

| Build Operate Transfer (BOT) – Annuity | Private | Govt. | Private |

| Viability Gap Funding (VGF) | Govt + Private | Private | Private |

| Engineering procurement and Construction (EPC) model | Govt | Govt | Govt; Only Plan is Private. |

| Hybrid Annuity Model (HAM) | Govt. & Private | Govt | Private |

| Transfer of Technology (TOT) | Govt. or Private | Private | Private |

Challenges in Infrastructure Financing:

- Government Capacity is limited – especially when compared to the pressing infrastructure needs of the country. India also lacks large banks with great financing capabilities.

- Indian market is too small: the DIIs and general public do not have enough financial capability to invest in Infrastructure related bonds/securities.

- Currency fluctuation risks: Foreign investors lose money whenever the rupee depreciates, which makes Indian bonds unattractive for foreign players.

- The poor rating of Indian bonds: Indian bonds are often poorly rated when compared to their foreign counterparts.

- Investment Climate: Investors look at the ease of doing business as the most important condition before investing in an economy. The investment climate has improved significantly over the years. But challenges of law and order or red-tapism still remain.

Government Initiatives

The government has taken various initiatives in the past few years to gather the financial resources to fund infrastructure projects in India:

1. The National Infrastructure Pipeline (NIP) for FY 2019-25: It is a ₹102-lakh-crore first-of-its-kind

-

- National Infrastructure Pipeline (NIP) is a whole-of-government exercise to provide world-class Infrastructure to citizens and improve their quality of life.

- Aim: to improve project preparation and attract investments into Infrastructure.

- The Department of Economic Affairs (DEA) (Ministry of Finance) had set up a High-Level Task Force under the chairmanship of its Secretary to formulate the NIP plan.

- All projects (Greenfield or Brownfield) (both economic and social infrastructure projects) with a project cost greater than Rs. 100 crores under DEA are sought to be included in this plan.

- If implemented successfully, it will boost the infrastructure investment over the next five years (2019-25) by 2%-2.5% of the GDP annually.

- In the 2021 Budget, NIPwas expanded to 7,400 projects, out of which around 217 projects worth 1.10 lakh crore were already completed.

2. PM Gati-Shakti plan is a ‘national masterplan’ for multi-modal connectivity.

-

- It subsumes the Rs 110 lakh crore National Infrastructure Pipelinethat was launched in 2019.

- It was launched by the Prime Minister in October 2021.

- It is essentially a digital platform that brings 16 Ministries, such as Railways and Roadways, together for integrated planning and coordinated implementation of infrastructure connectivity projects. Most central government departments have already started using it.

- The multi-modal connectivity will provide seamless-integrated connectivity for the people, goods and services from one mode of transport to another and will facilitate the last mile connectivity.

- The Centre is also coordinating with state governments, hand-holding them to integrate state-wise data.

- It will create “an integrated framework” for infrastructure development. It will ensure that various economic hubs better utilise the investments being made by the government and private players.

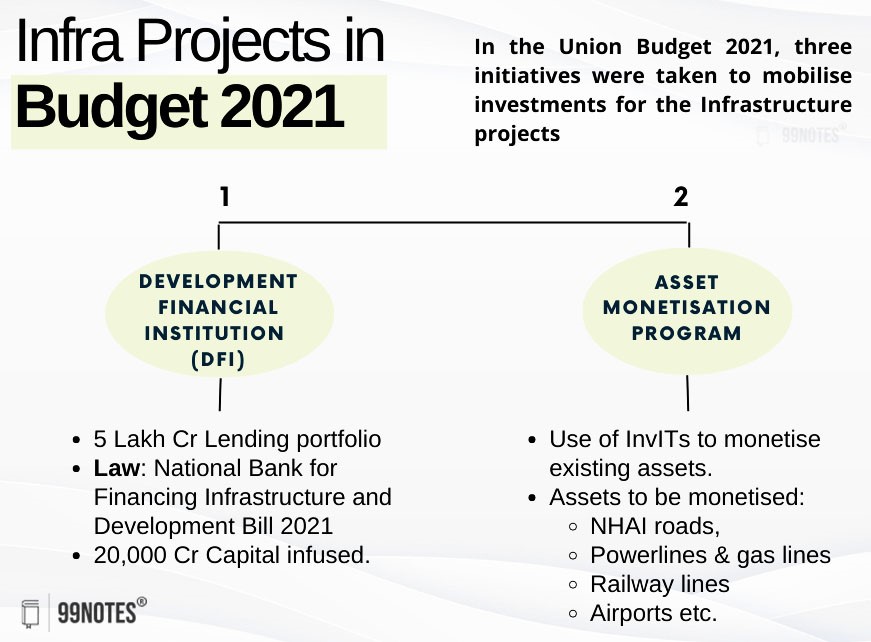

3. Development Financial Institution (DFI)– was created in the 2021 Union Budget to act as a provider, enabler and catalyst for infrastructure financing.

-

-

- The government created a lending portfolio of Rs. 5 lakh crore under the DFI, which was to be operationalised in 3 years.

- The government amended the InvITs’ and REITs’ legislations to enable Debt Financingby Foreign Portfolio.

- To enable the government’s guaranteed support and direct access to liquidity from the RBI, the National Bank for Financing Infrastructure and Development Act 2021 was passed.

- The government capitalised on DFI with 20,000 crores.

-

4. Asset Monetization Programme was launched in the 2021 Union Budget to facilitate private investment in government assets.

-

- 5 operational toll roads worth 5,000 croreswere transferred to the NHAI-InvIT

- Transmission assets worth 7,000 croresare transferred to the PGCIL-InvIT

- Dedicated Freight Corridor assets to be monetised by Railways, for operations and maintenance, after commissioning

- Airportsare being monetised for operations and management, including AAI Airports in Tier II and III cities

- Othercore infrastructure assets:

-

-

- Oil and Gas Pipelinesof GAIL, IOCL and HPCL

- Other Railway InfrastructureAssets

- Warehousing Assetsof CPSEs such as Central Warehousing Corporation and NAFED

-

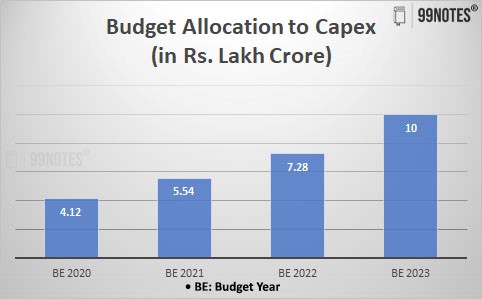

5.Budget Allocation: Over the years, there has been a sharp increase in Capital Budget.

5.Budget Allocation: Over the years, there has been a sharp increase in Capital Budget.

-

-

-

- In the Union budget of 2023, the government has allocated Rs. 10 Lakh crores to Capital Expenditure (Capex) (BE 2023-24).

- Since 2020, the government has enhanced capex to about 250%, as shown in the chart below, with an increase of 33% annually.

-

-

6. Infrastructure Finance Secretariat:

- In the 2014-15 Budget, Finance minister Arun Jaitley created an institute named P3 India (for the promotion of Public-Private Partnerships). Till 2022, not much progress happened in this regard.

- In 2022, P3 India was renamed as Infrastructure Finance Secretariat and was given a new office in Janpath. The 2023-24 budget now provides a greater role to this newly formed institution.

- It will support all stakeholders in attracting more private investment in Infrastructure, such as roads, railways, urban Infrastructure, and power, which are primarily reliant on public funds.

7. Harmonized Master List of Infrastructure:

- In Budget 2023, an expert committee has been proposed to review the list recommending the classification and financing framework suitable for Amrit Kaal.